Nigerians are slowly changing from cash dependency to digital forms of transactions. According to the Nigeria Interbank Settlement System (NIBSS), the adoption of digital payment options, especially mobile, has been growing exponentially.

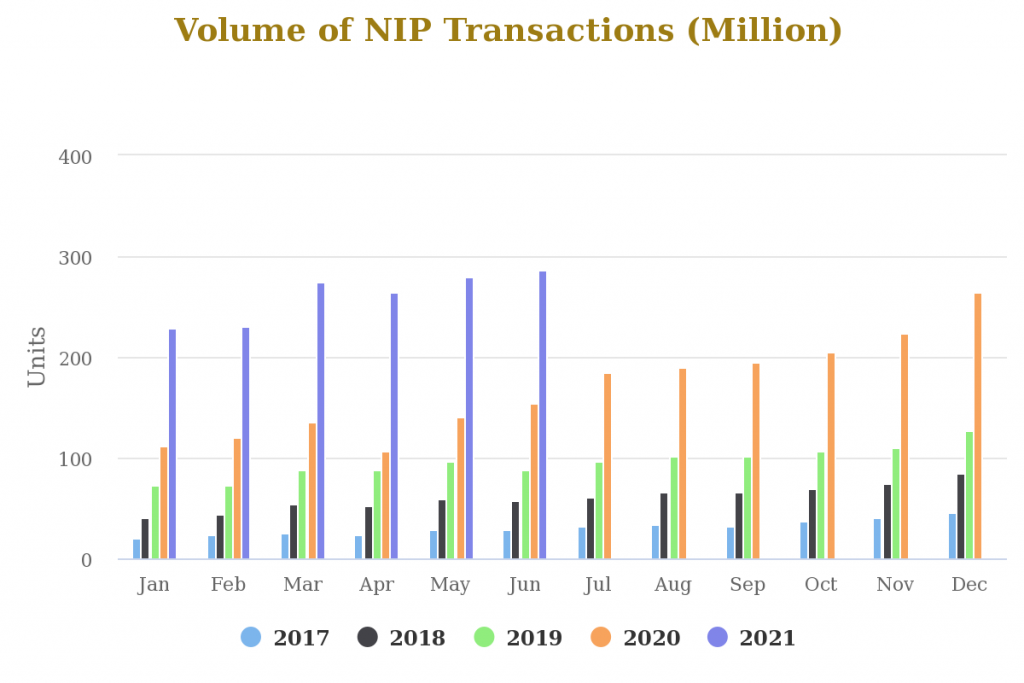

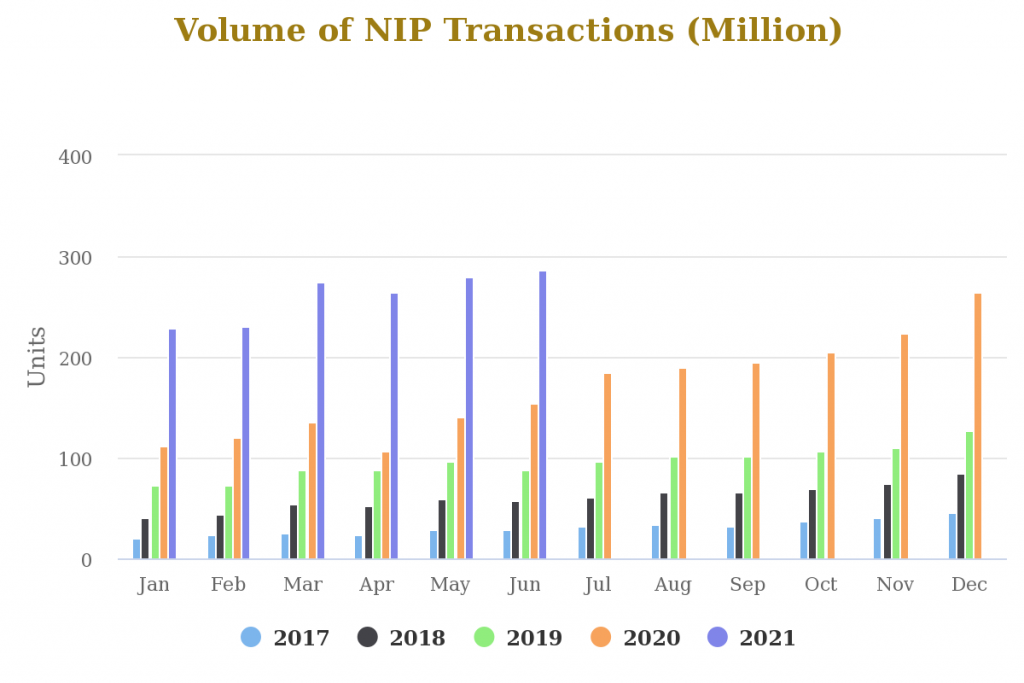

The total volume of transactions through NIBSS instant payment (NIP) rose to a record 287 million in the month of June.

This represents a 2.7% growth from the previous month and a 25% growth from the 228 million recorded at the beginning of the year.

NIP is an account-based, online real-time Electronic Funds Transfer (EFT) through all available electronic channels including Mobile, USSD & Internet Banking, POS, ATM, Web and internet platforms.

A breakdown shows that mobile saw the highest growth rate of adoption, rising 15.8% in the last month to hit an all-time high of 22 million transactions.

PoS transactions, on the other hand, grew by just 3.75% in the last month. However, compared to the same period in 2020, its volume rose by an outstanding 65.8%.

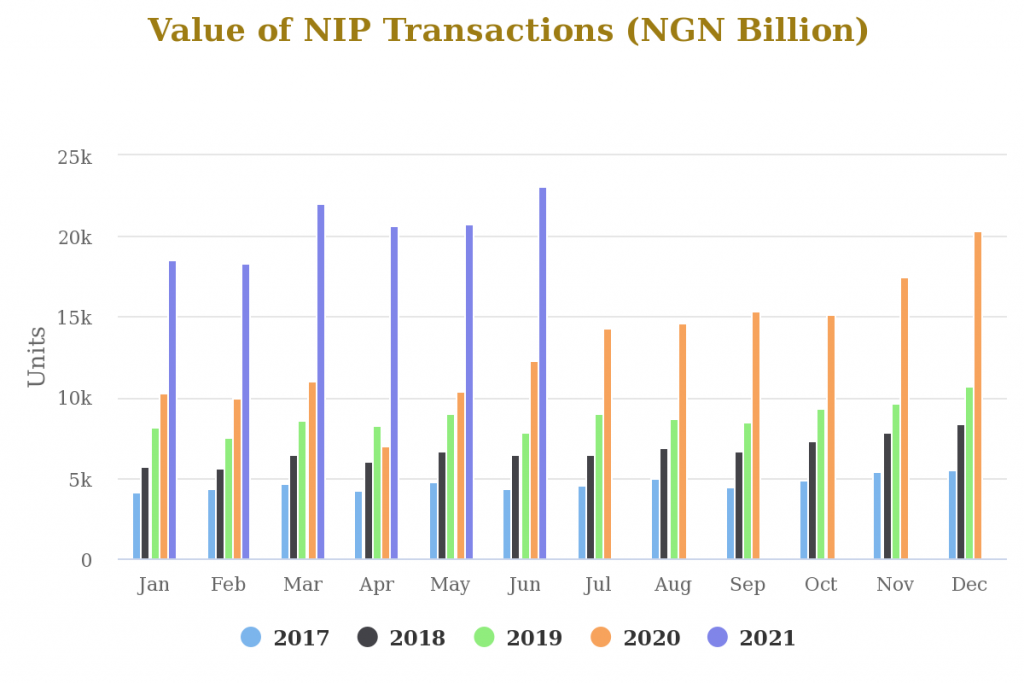

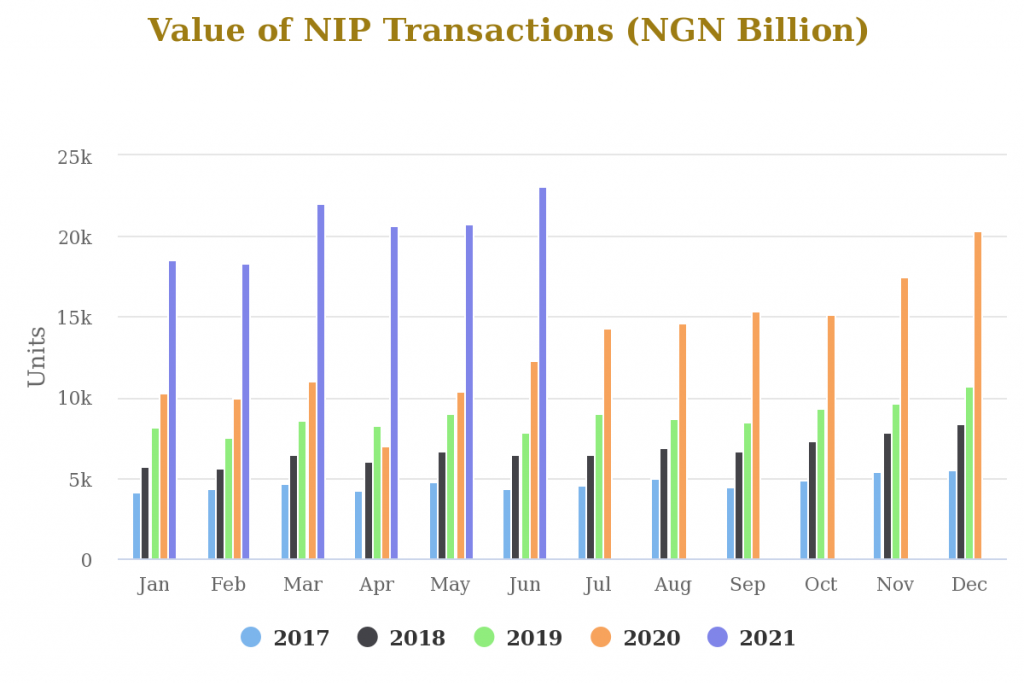

Over N23 trillion transacted in June

Similar to the volume, the value of transactions also grew significantly, benefiting from the increase in numbers across channels.

The NIBBS report shows that instant payments recorded a yearly high of over N23 trillion, up 11.6% from the N20.71 trillion in May and a whooping 88.5% compared to the same period in 2020.

A breakdown shows that the value of mobile transactions rose 14.5% in the month to hit 603 billion while the value of PoS remained relatively unchanged at 503 billion after dropping 4.5 million during the month.

Mobile payment use hits all-time high after over 22 million transactions in June

Analysing the numbers

The growth seen across the digital channels further highlights global reports that Africa and Nigeria in particular, has one of the fastest digital adoption rates in the world.

This adoption is driven by the country’s young and mobile-first population in addition to the tailwind effects of digitalisation brought by the COVID-19 pandemic.

Now, more businesses are going digital or digitalising an aspect of their business to meet the new global trend. This, in turn, has influenced how people make payments as businesses are now receiving payments through cards via mobile or PoS.

For example, apps like Jumia Food and Bolt often incentivise users to pay directly on the app by giving discounts.

Similarly, the provision of cheaper and faster ways to get online for small and medium scale entrepreneurs by startups like Flutterwave and Paysack through their online storefronts has had a notable effect.

Now, businesses on social apps like WhatsApp and Instagram have storefronts they can easily share links to and get paid electronically without the use of cash.

According to Paystack, it has over 40,000 businesses using its platform and it pays out over $20 million to them monthly.

Another factor driving the adoption rate is the move by banks to get users to use its self banking platforms like USSD and Mobile apps. For example, GT Bank now educates users on how to use mobile apps for payments, request cards and other services instead of visiting their physical branches.

Going forward

The narrative of Nigeria being a solely cash-based economy is changing. The growth in digital payment adoption over the last five years has been massive.

According to NIBSS, monthly use of digital channels rose from just 45 million transactions valued at N5.4 trillion at the end of 2017 to over 287 million valued at N23tr in June 2021. This represents a growth of over 530% in the last 5 years.

A breakdown shows that in 2018, the volume of transactions rose by 104.6% between January and December. In 2019, the growth was still strong but it dropped to 75%. However, last year, the numbers skyrocketed, hitting a record yearly increase of 137%.

Looking at the current growth rate, digital transactions are on track to hit 450 million monthly transactions at the end of the year.

In Summary

Mobile still remains one of the largest contributors to electronic payments in Nigeria. This isn’t surprising as smartphone penetration keeps increasing exponentially.

According to the NIBSS, mobile phones and tablets were responsible for 78 per cent of total transfer transactions in 2020.

The success of fintechs like Paystack, Kuda and Flutterwave have also contributed to the adoption of digital payments.