The Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele has announced that the apex bank will definitely launch its own digital currency in the country.

Nairametrics reports that Emefiele disclosed this during the 279th monetary policy rate (MPR) meeting held today in Abuja.

We are committed in the CBN and I can assure everybody that digital currency will come to life even in Nigeria.

Godwin Emefiele, CBN Governor

This follows concerted efforts by the CBN to crack down on cryptocurrency operations in Nigeria. The regulator had in February ordered banks to shut down any accounts linked to crypto transactions.

Emefiele’s draconian clampdown on crypto startups and investors is still fresh in memory, and perhaps one of the underlying motives for the CBN ban was to pave the way for the launch of its own Naira-pegged digital currency.

After all, the regulator introduced its Naira4Dollar scheme after banning mobile money operators, payment service providers and online wallets from processing diaspora remittances, effectively forcing many to resort to traditional banks.

Recall that Technext had reported that the Founder of Bitcoin Nigeria User Group, Chimezie Chuta had predicted that the CBN was already planning to introduce its own digital currency. Chimezie was also a member of the committee that drafted the SEC regulations on cryptocurrencies.

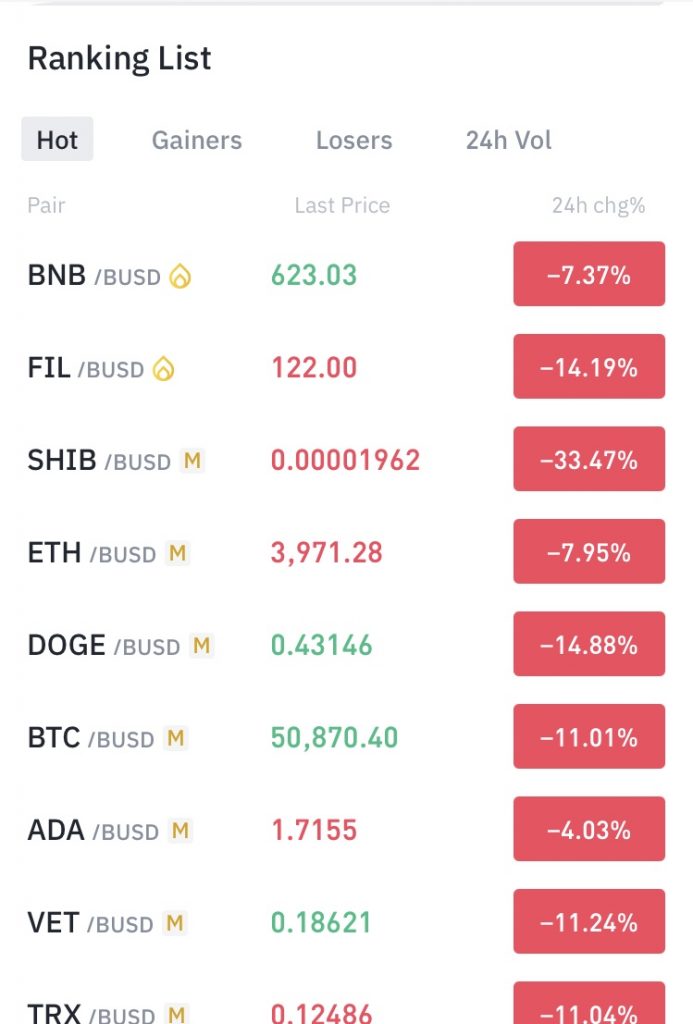

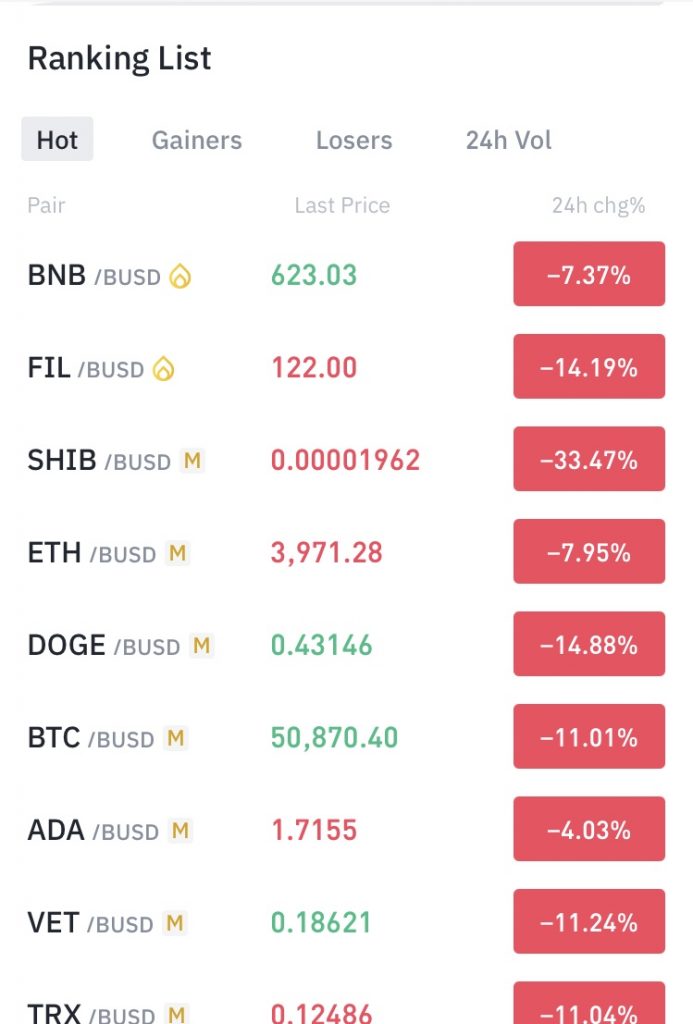

Crypto prices have crashed in recent weeks due to a combination of Elon Musk-led Tesla’s Bitcoin U-turn and China’s reinforced ban on mining and trading.

While the crypto ban still fully remains in effect, Emefiele maintains that the CBN is still carrying out its investigations regarding the activities surrounding the digital assets class.

We have carried out our investigation and we found out that a substantial percentage of our people are getting involved in cryptocurrency which is not the best. Don’t get me wrong, some may be legitimate but most are illegitimate.”

Godwin Emefiele

“Under cryptocurrency and Bitcoin, Nigeria comes 2nd while in the global side of the economy, Nigeria comes 27th. We are still conducting our investigation and we will make our data available,” he said.

Many Nigerian crypto proponents will, however, be paying lip service to these investigation claims based on the precedent set by the regulator.

Like Nigeria, South Africa is also working to launch a wholesale central bank-issued digital currency.