Electronic payments in Nigeria recovered from a decline in April to reach a record 279.4 million in transaction volume in May. This is the highest ever figure posted by the sector.

The e-transaction volume in May surpassed the previous all-time high of 275 million recorded in March 2021.

Data from the Nigeria Interbank Settlement System (NIBSS) shows that the volume of NIBSS Instant Payments (NIP) transactions rose by 5.4% from 265 million in April to 279.4 million in May.

Compared to the same period in 2020, e-payments grew by a massive 100%.

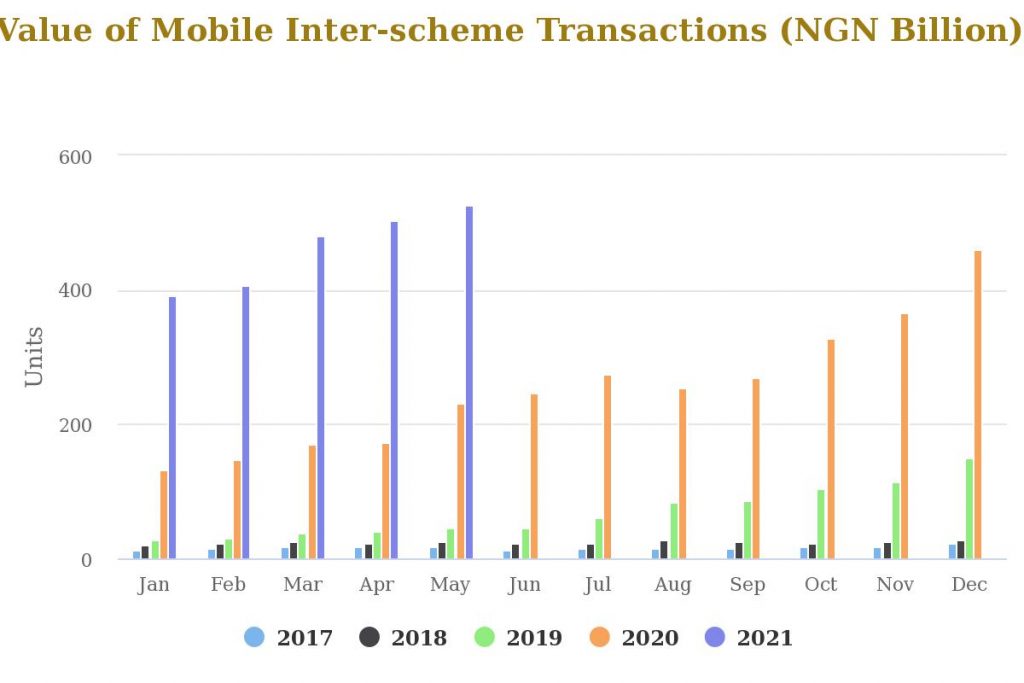

Peak mobile payments growth fuels recovery

Mobile payments hit peak numbers in May, both in terms of transaction volume and value. Mobile transactions increased by 1.5 million to 19.7 million during the month. This triggered the growth in online payments volumes after falling for the first time in April.

Total mobile-based transactions were valued at a record N527 billion, up by 4.8% from N502.7 billion posted in April.

The strong performance in mobile payments may be attributed to the resumption of SIM sales and registration by telecom operators in May. After the 4-month SIM ban was lifted, subscribers were able to buy and register SIMs.

Mobile payments via USSD, internet banking or fintech apps can only be carried out using registered SIM cards. It is safe to say that telcos might have regained some subscribers in May, hence, more people could complete mobile transactions.

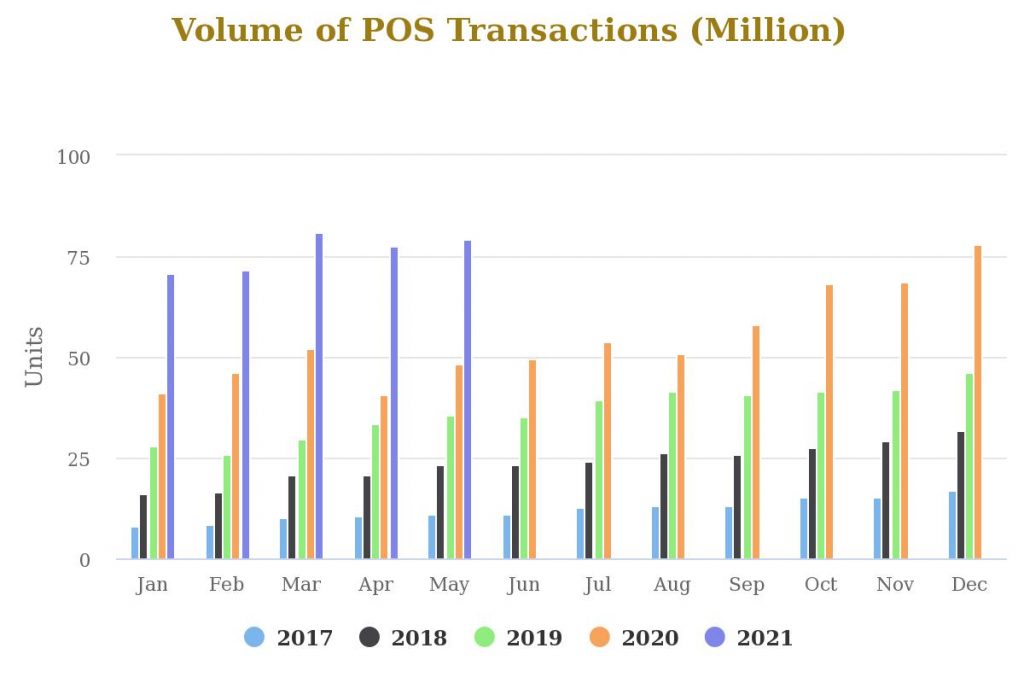

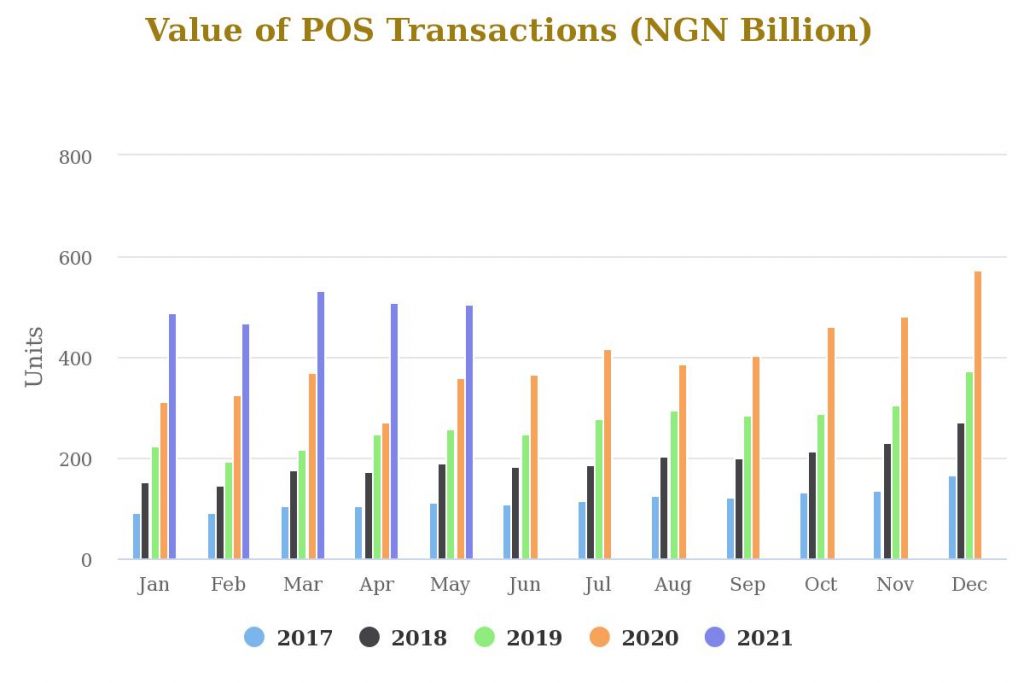

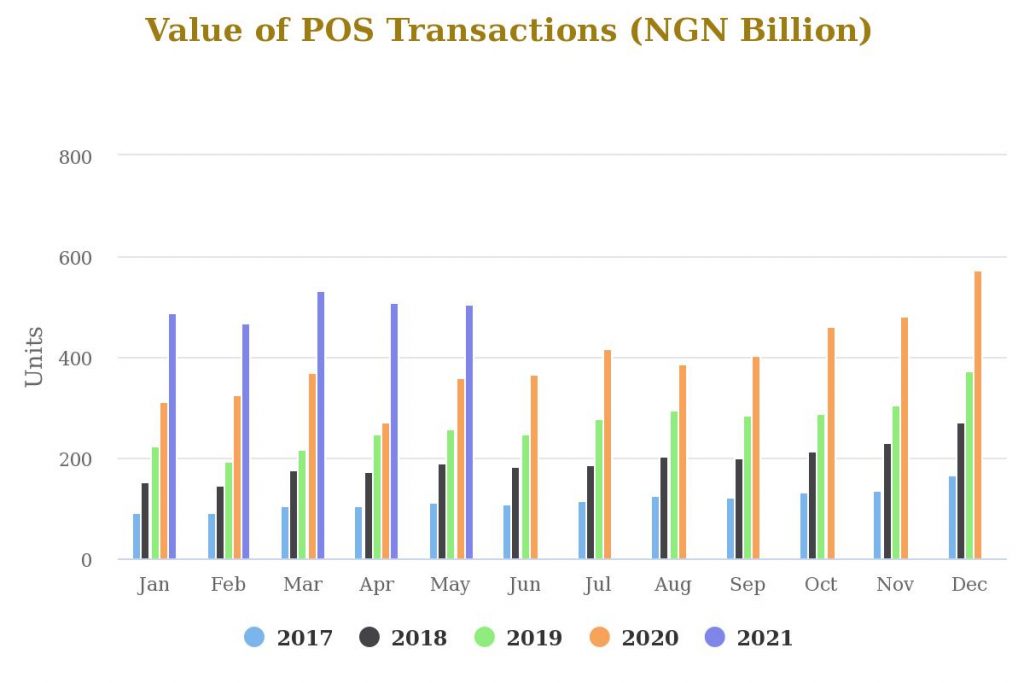

POS payments value drops despite higher volume

An increase in POS transactions in the past month failed to reflect in the total value of payments. Although the volume of POS payments rose to 79 million, the worth of these transactions fell by N4 billion.

POS transfers were valued at N504 billion in May, a 0.79% drop from the N508 billion posted in April.

This is the second consecutive time that the value of POS payments has declined in 2021. A possible reason is the harsh economic reality faced by many Nigerians amid rising inflation rates. Essentially, POS users are paying less more frequently.

Prices of consumer goods have continued to increase after annual inflation in the country surged to a four-year high of 18.17% in March.

In May, the overall value of e-payments was N20.7 trillion, the same amount recorded in April.

Going forward, the new N6.98 charge for USSD bank transfers may dissuade several bank customers from using the service henceforth. With over 40 million Nigerians using USSD services, this could lower the volume of mobile transactions in the coming months.