The venture capital space in Africa has seen significant growth in recent years. The total funding raised by African startups rose from $400 million in 2015 to about $2 billion in 2019, according to Partech Africa.

Similarly, Weetracker reported that Africa’s Startup funding rose from under $200 million in 2015 to over $1.3 billion invested in African tech companies in 2019.

Although the VC numbers vary across several data agencies, all of them agree that Africa’s VC numbers have consistently grown over the last five years.

To understand the growth, between 2015 and 2019 the startup scene raised record-breaking numbers with the only drop happening last year during the pandemic.

The impressive growth underscores the rapid emergence and growth of technology ecosystems which has led to an unprecedented influx of capital from local and international investors across the continent.

In a chat with Technext, Lauren Cochran, Managing Director at Blue Haven Initiative, a VC that has invested in several African startups including Twiga Foods, M-Kopa and the now acquired Paystack, speaks on how the African VC ecosystem has changed over the years.

Africa is the new VC magnet

Iterating the visible influx of VC investors into the African startup space, Lauren revealed that in 2015 there were only few seed investors on the continent.

“At that time there were almost no funds besides some seed managers like us and Savannah funds. There were a few in South Africa and I think Microtraction was just starting.”

However, over the years investments from indigenes and foreign investments from people based in silicon valley have significantly increased funding in Africa.

More funding = more startups

Lauren also revealed that the uptick in funding has led to an increase in startups on the continent. “Before, there weren’t lots of companies because there wasn’t much funding. Now, there are more investors, but I also think there are more companies and there’s a bit more infrastructure.”

According to Partech, just 55 startups raised funds in 2015 compared to the 347 startups that completed 359 deals in 2020. This shows just how much the ecosystem has risen over the years. Recent data shows that Africa now has over 2,000 startups, with Nigeria having highest volume —over 750.

This increase in the number of startups, according to Lauren, has also led to an increase in competition in the tech space. There are now several startups jostling for the same market compared to earlier years when the few startups in existence were mostly pioneers in the space.

More people are now interested in building startups

Asides funding, the interest of young graduates and experts in entrepreneurship and the startup ecosystem has grown over the years.

The Blue Haven Managing Director narrated that entrepreneurship was not a thing that people aspire to do in the past. She added that success stories across the tech ecosystem have changed that.

“Because there hadn’t really been as many success stories as there are now, entrepreneurship was not a thing that people aspire to do. I spent a lot of time in the early days trying to convince people to leave their jobs at KPMG or some other big accounting firm and join one of the startups we invested in. And, I think that has obviously changed now that people have actually made real money and, seen exits.”

Effects of Covid-19 – What happened in 2020

The Covid-19 pandemic that plagued 2020 had one of the biggest impacts on the African VC scene over the last 5 years. There was a significant impact on foreign direct investment (FDI) in Africa as flows declined by 16% to $40 billion, from $47 billion in 2019.

The report showed that the economic decline and health challenges caused by the pandemic weighed heavily on foreign investments into the continent, according to UNCTAD’s World Investment Report 2021.

Lauren confirmed the UNCTAD reports, saying that investments certainly slowed during the previous year.

“There was certainly a slowdown of investment, we made one investment in a company that we’d met before and we did just a couple of follow on rounds,”

Lauren Cochran, Managing Director at Blue Haven Initiative

According to her, VCs were not necessarily ready to work with companies that they are not able to interact with physically.

“The idea of working with a company remotely was still pretty new and, to not be able to go into someone’s office and meet the team and really go out in whatever markets they were working in is something that we weren’t necessarily ready to do.”

Remote funding is possible but it won’t take over physical investment process anytime soon

Lauren, however, revealed that while it is still tough for VCs like hers to do an entirely remote process, they became more open to remote due diligence.

She narrated that they have done an almost entirely remote funding and a similar one is in the works.

“We did seed investment in Kenya, almost entirely remotely. We actually met the team right before were about to fund, but that was on the smaller side. It was less than a million-dollar cheque. we’re also working on a transaction in Tunisia that might have to be an all remote process the way its going.”

However, she added that if it was a huge funding round like a series A, it will be hard not to do some physical interaction with the business.

“If it’s a Series A investment we’re doing, where we’re going to sit on the board and it’s over a million dollars that we’re going to invest, it’s still going to be hard for us not to meet them in person and really spend time with the business,” she said.

How the pandemic affected companies – an investors perspective

Aside from deciding which new startup to invest in, VCs also had to worry about the effect of the pandemic on startups that they had already invested in.

Speaking from her experience with Blue Haven’s portfolio companies, Lauren revealed that the pandemic forced companies to take a really hard look at how they were spending money.

She added that they had to figure out what was really critical and kind of skinny down in a way that they wouldn’t have had the need to if things were going as they were before COVID.

“Before COVID, startups knew where their next funding round was coming from. They could travel and meet new investors. They weren’t as focused on making sure that costs were super lean.”

Looking back, she thinks that those decisions made during the pandemic made businesses better off in regular times.

“I think it was a bit scary. We really didn’t know how the lockdowns would impact the business models, but people made pretty hard decisions that I think now have made these businesses better off in regular times,” she said.

Remote working and hiring

Talking about the major changes the pandemic caused for businesses, the Blue Haven MD explained that startups are now re-evaluating the need for huge office or infrastructure that they used before the pandemic.

She also added that startups are now hiring people remotely with the whole idea that talent can be found globally, no matter where the business is actually operating.

“We’ve got one team that now has an entirely remote tech team. So you’ve got some people in Nairobi. They’ve got a bunch in Eastern Europe, they got, I think, one in Australia and maybe even one in Latin America.”

Has the 2020 health investment boom slowed down?

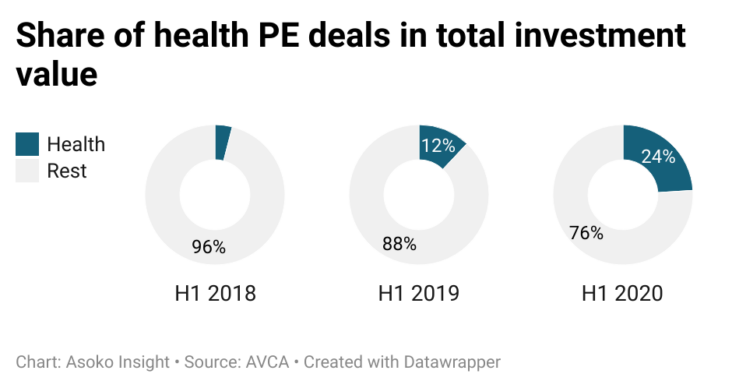

One of the biggest industries that gained from last year’s pandemic was the health industry. Partech and Weetracker reports show health tech was among the top five sectors to raise funds during the year.

Similarly, data from Africa Venture Capital Association, shows that the sector saw 24% in the first half of 2020, the largest VC funding by any sector during the period. This is up from 4% in 2018 and 12% in 2019 recorded during the same period.

Speaking on the 2020 health tech boom, Lauran believes the boom is still underway. “I mean, we started investing in health before COVID, and I think there’s a couple of trends from COVID that created helpful tailwinds.

“People are willing to spend more on their health and, there’s obviously, a recognized need of how to do that. But also people want more technical technological solutions.”

She added that the fact that people are more open to remote solutions has allowed the health systems to expand their ability to care for people as well.

“The health systems were already stressed before COVID, it was already difficult to get timely care. So, this comfort with remote has allowed the health systems to expand their ability to care for people as well.”

In summary

For investors, every market has unique challenges. In Africa, it could be the the rainy season, or the delay of the government cooperative payment to cocoa farmers in Cote d’Ivoire and the ripple effects that it can cause.

Lauren says despite the challenges, the ecosystem has grown and is much healthier than it was when she first entered into the space in 2015.