Nigeria Interbank Settlement System plc (NIBSS), in partnership with all Financial Service Providers, has launched a new Nigeria Quick Response (NQR) Payment Solution to make payment more convenient for all merchants, businesses and customers in the country.

The launch was hosted by Frank Edoho and attended by Managing Directors of deposit mobile banks like Ecobank, First Bank amongst others.

(NIBSS); Christabel Onyejekwe, Executive Director, Business Development, NIBSS; Premier Oiwoh, Managing Director/CEO, NIBSS and Niyi Ajao, Deputy Managing Director, NIBSS at the official launch of the Nigeria Quick Response (NQR) payment solution powered by NIBSS

NQR powered by NIBSS

The new Payment Solution is an innovative payment platform that delivers instant value for P2B (Payer to Business) and P2P (Peer to Peer) transactions by simply scanning to pay.

This is done by providing a “low-cost” method for merchants to generate a QR code that shoppers can scan to pay for an item.

“If you have a phone with you all you have to do is just scan the QR code and you automatically make payment.”

Each code will have unique details containing the information relating to the transaction and would link with a customer’s Banking App, already enabled on their smartphone.

According to the Managing Director NIBSS, Premier Oiwoh, the NQR is a new dawn for innovation in the Nigerian financial services industry.

“With more people being able to pay for goods and services with just their smartphones, the ‘NQR Payment is about re-creating the Nigerian payment experience whilst deepening financial inclusion in the country”,

Mr. Premier Oiwoh, CEO of NIBSS

He added that Digital transactions supported through the NQR code payments will promote and enhance the consumer payment experience while driving growth for business owners.

One of the Bank MD in attendance, similarly expressed that the digital payment landscape is evolving very rapidly and that NPR code has the operating capability to improve payment solution in Nigeria.

He added that the innovation creates a straight-through process via point of collection from banks to bank.

“It’s very easy to leave your card at home but very few people forget their telephones. It’s the one thing we check when we wake up in the morning or we use to stay in touch with our friends, Families and conduct business throughout the day”

Benefits of NQR

Faster

NQR provides several advantages some of which are over existing e-payment solution to both merchants and buyers.

According to banking experts, the new NQR is faster in terms of processor and when compared to conventional card payment systems. The NQR code also has the capability for instant payment received by the merchant irrespective of where the consumer and merchant operate from.

The high speed of transaction also means that merchants can get instant notification and value for all transactions. Similarly, buyers will get instant notification on payment made.

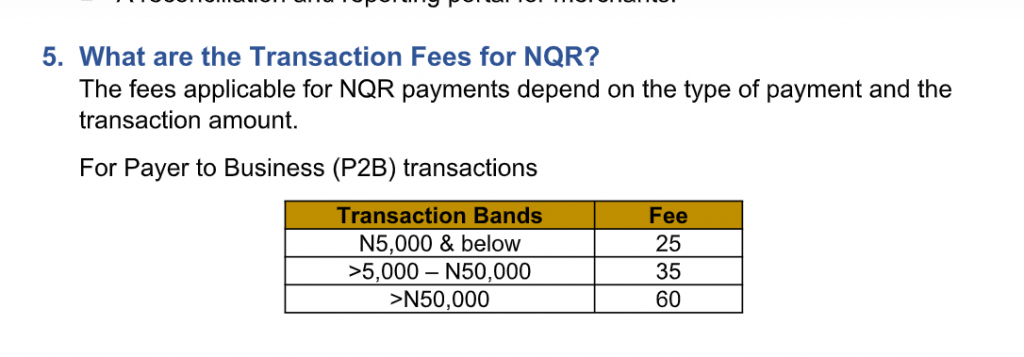

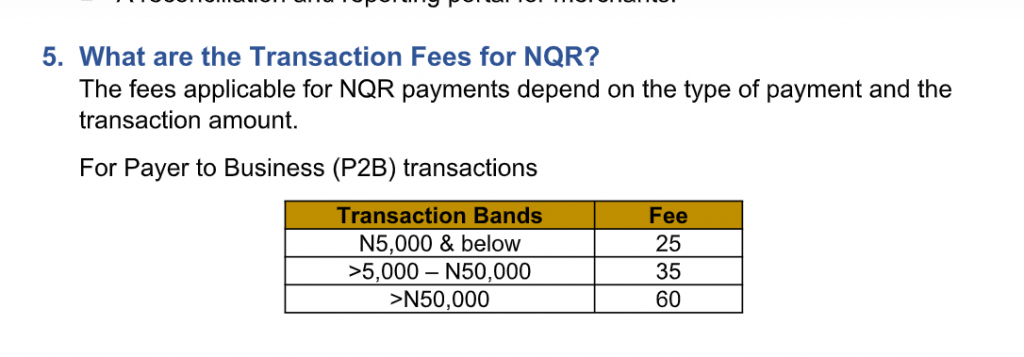

is NQR really cheaper??

Asides from being fast, NQR is also touted by the NIBSS as the cheapest form of payment in the country. It has a zero onboarding cost, little or no chargeback and lower transaction fees across various price band.

The fees are determined by the type of payments and the transaction amount. for the common P2B transaction, a fee of N25 is charged for payments below N5000, N35 for payments between N5,000 and N50,000 and N60 for payments above N50,000.

Surprisingly, the fees charged for P2B is higher than the current fee for bank to bank transactions. A fee of N10 is paid for transactions below N5,000; N25 for a transaction between N5000 and N50,000 and N60 for transactions above N50,000.

Contactless payment

With the COVID-19 pandemic still very much around, social distancing is still important. NQR technology deals with contactless payments. Instead of using a card platform, this solution provides an alternative that is truly contactless.

According to a banking expert, small traders, tailors, and even musicians can leverage the opportunity to collect money using an NQR code by putting their QR code on a card or equipment for people to scan.

Reduce Foreign remittance

PoS is one of the major means of payment in the country. A speaker at the launch expressed that POS is not produced in the country and the cost associated with it will require foreign expenditure.

He added that if this new technology is adopted we can reduce the demand which means that we will no longer need foreign exchanges to onboard devices.

Another speaker pointed out that the fact that NQR is making the payment system more indispensable which means putting customers in a place to better spend money.

He also says that NQR also have use cases in education, crowd management and several others

Start scanning to pay

Getting on-boarded on NQR is easy and fast. According to NIBSS, you can visit your bank to be on the platform or visit the android Playstore to download the NQR Merchant app.

You can then register by submitting your last name, BVN and account name. NQR also has integration with the website and on-site scanning options.

As a buyer or customer you can access the NQR using the mobile banking app of your bank.

After getting on-board, the NQR platform displays the QR codes generated to receive payment at their locations while payers select their bank’s mobile application and scan the displayed NQR codes to make payments to the merchant.

The NQR payment is completed by providing identification through your pin or biometrics to protect your account.

The MD of both Keystone bank and Ecobank both confirmed that the new technology has already been included on its platform and customers are already enjoying it.

Summary

NQR will further accelerate the customer journey. According to Oiwoh, the payment solution will unify the available closed QR code schemes in the country for consistent user experience and acceleration of digital adoption.

He added that consumers and merchants alike move towards technology-driven solutions, QR Codes are growing increasingly important.