Getting access to money is a constant need for many people and fintech startups that provide solutions for this need are in much demand. In the space, the likes of Carbon, Evolve Credit, Branch, Kiakia and Renmoney have already created services that provide micro-credit to individuals and businesses that need it.

Changes in the interest rates on loans as well as in the terms and conditions from one fintech to another provides an array of options for people to choose from. Fewchorefinance is another fintech company that is providing a solution to the problem of “I need a loan”.

While it may take longer than hours to apply for loans and get a response from banks and some fintechs, this startup is making it simpler to borrow money online within an hour.

Also read: Credit and Loans Company Renmoney Sacks 391 Employees as it Leans More Towards Technology

How to get a loan from Fewchorefinance

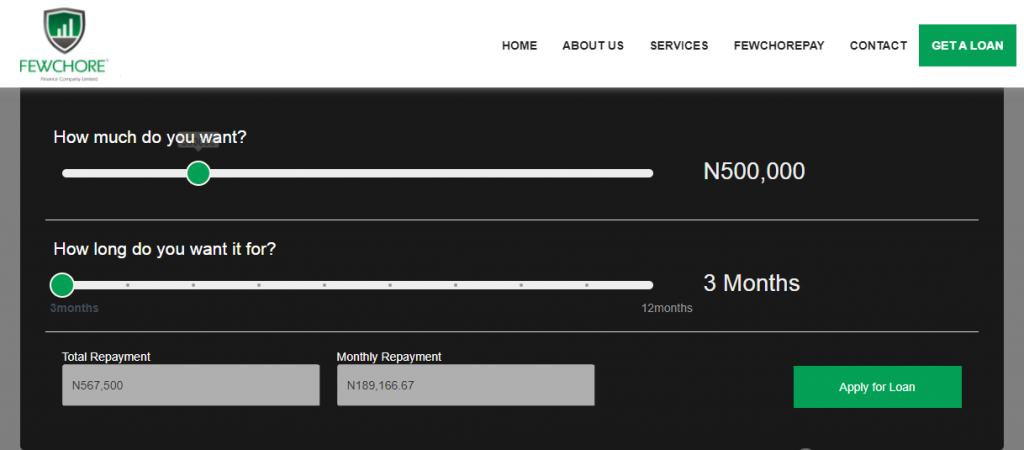

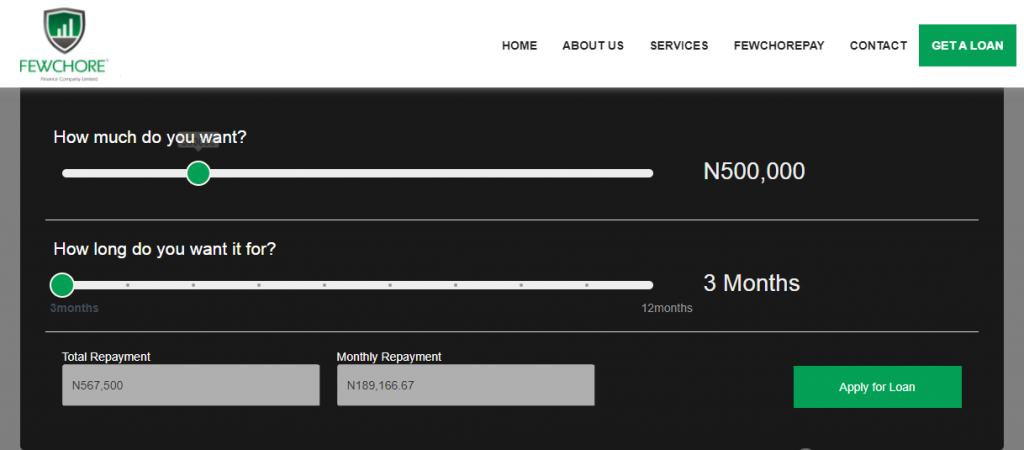

To get a business or personal loan from the startup, there are three steps to follow. The first is to indicate the amount of money that is to be borrowed as well as when it will be fully repaid. The least amount that can be borrowed is N50,000 and the minimum repayment time is 3 months, according to information from its website.

You may like: Nigerian Fintechs are Battling With Increasing Number of Loan Defaults Due to Job Loss and Economic Woes

Based on the amount and the duration, Fewchorefinance calculates the interest that is to be repaid. The interest is bigger when the loan is bigger or the repayment time is longer. If, for instance, one borrows N500,000 for a period of 3 months, the sum that will be repaid is N567,500 at NN189,166.67 monthly. If it is repaid over 5 months, the loan + interest becomes N612,500.

Before a loan is approved, the startup collects Know Your Customer (KYC) information from the user. This includes official email, salary account statement for the last 3-6 months as well as details of ATM card. Only salary earners can obtain loans from the startup and applications will be rejected from those who are not.

The fintech company has an app, Fewchorepay, which lets users invest money in credible ventures as well as access its loan service. Fewchorefinance also provides services ranging from asset financing and fund management to local and international trade financing.

‘Loan process is seamless’ – User reviews

On its Playstore account, the reviews of other people who have used its app are mixed but mostly positive. Bolaji Olusanjo said, “Simple, fast and reliable. I was able to get my loan in few minutes.”

Another user, Lawrence Uzochukwu, said, “Wonderful experience. Accessing the loan was seamless. Customer service is exceptional, responds on time to your complaints. I would never have asked for more. Fewchore Finance you have my 5 stars. Wish I could give you more.”

Some of the negative feedbacks are about incessant bank charges while trying to use the app. Rotimi Oluwatobi said, “I sent mail, no response from you guys. I applied for a loan, my account was debited twice for a statement of account, yet I didn’t get any loan disburse into my account. This is unfair.”

Ikeh David also said, “It keeps debiting me each time I try to add a card yet it doesn’t add. It’s very annoying. Please fix your app or take it off completely because you are scamming people of their N40 each time they try to add a card and it doesn’t add.”

Fewchorefinance responded to the negative feedback with suggestions on fixing it for the persons concerned.

The loan service works and the customer service is great. For salary earners, it is another addition to the pool of loan providers in Nigeria.