Loan default rates in Nigeria is on the increase due to growing economic uncertainty in the country. According to reports, fintech startups in Nigeria are the most hit as they are struggling to keep loan default rates at tolerable levels.

The fintech model of providing a convenient and easy way to access loans has been growing the sector at breakneck speed for the past year. However, the economic effects of the pandemic which has led to increasing loan defaults is compelling startups to reconsider their business models.

Job loss and economic woes

According to findings, the major cause of the uptick in loan defaults is the high amount of job losses during the pandemic. The loss of jobs made it impossible for many to meet their payment deadlines.

Before COVID-19, Nigeria’s unemployment rate was already sky-high at 23.1% while underemployment stood at 16%, according to the National Bureau of Statistics (NBS).

The outbreak made situations worse as at least 42% of Nigerians surveyed reported to have lost their jobs, while 79% reported a loss in income, according to the World Bank.

Similarly, businesses and entrepreneurs have been finding it difficult during this period. The snowballing effects of the COVID-19 pandemic on the country’s economy have made it difficult for them to get funds or pay back loans.

The total GDP of the country fell by 14.27% in the first quarter of 2020 to stand at N16.74 trillion. In Q2 the GDP fell further by 7.97 % to N15.89 Trillion with only 13 out of 46 Sectors recorded positive real growth.

The general decline has made lenders more cautious in their lending campaign while stepping up their loan recovery campaign. However, the current situation significantly affected fintech more than other players in the sector.

Fintechs Vs Microfinance

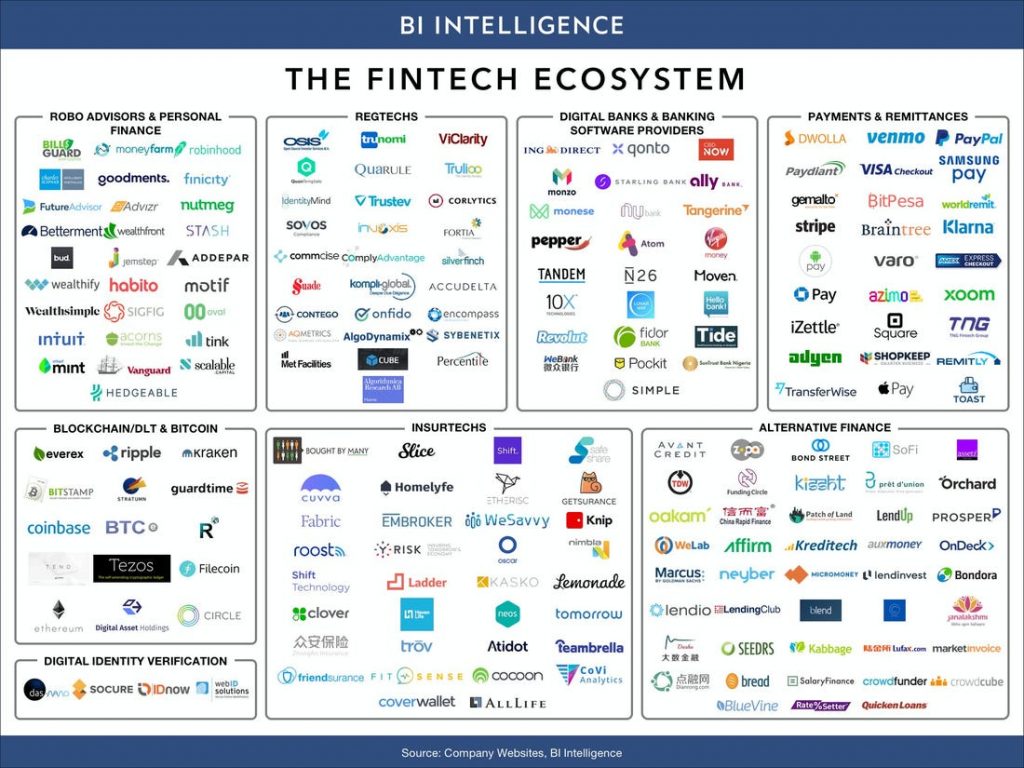

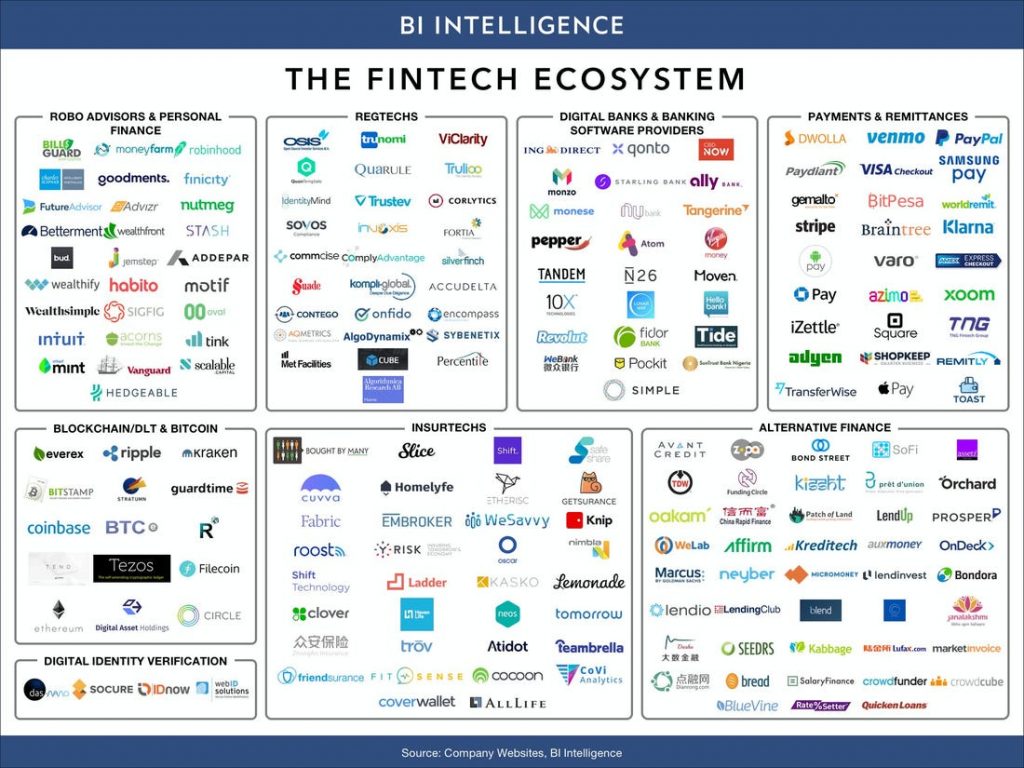

Comparing lending models, fintechs generally have flexible conditions and processes of loan applications that allows for easy access to loans. Most applicants can go through the process in the comfort of their homes.

Fintechs, mostly require a few documents such as passports, utility bills, account statements, and identity cards. Often, borrowers are credited without address (residential or official) confirmed.

Favour, a business owner explained that getting loans for microfinance banks is tedious and time-consuming. He said that he had to provide the purpose of his loan, collateral and also had to open a bank account with the bank.

However, while the fintech mode of assessing loans is easier, it makes it difficult for them to recover loans from defaulters. The usual reminders and account freezing tactics employed are often insufficient.

Microfinance on the other hand has a loan recovery system that leverages on both “technology and diabolical” means. An eye witness shared with TechNext that a microfinance bank once used policemen to arrest a defaulting borrower who was on the run in church. The fact that Church address isn’t information put in loan applications shows just how crude loan recovery models for microfinance banks can get.

“Nigerians have a bad attitude to debt” Emmanuel, a financial expert speaking on the increase in loan defaults said. He explained that many Nigerians find it difficult to pay back loans promptly. He added that many take loans to survive without any concrete plans on how to pay it back.

Fintechs Vs Banks

Similar to Microfinance, money deposit banks (MDBs) subject loan applications to rigorous and irritating scrutiny. But they also have options for fast loans.

Although these fast loans often don’t have guarantors and need just minimum documentation, it requires the borrower to have his salary account in the bank. This makes it easier for the bank to recover the loan in case of default.

Also the CBN has a regulation that allows a bank to connect a loan to BVN. This makes it possible for any Bank to recover loans from any bank account under the BVN

Fintechs don’t have this leverage. A borrower can keep collecting his salary in the banks and decide to put money in the mobile wallet of the fintech. This makes it difficult for fintechs to recovery loans unlike the case of banks who can just deduct it directly from any account attached to the borrower’s BVN.

Finding a New Lending Model

While the fintech’s current model isn’t bad, it may not have the success rate it desires for profitability due to the economic environment in Nigeria. According to experts, the casual approach to loan facilitation exposes them to more risk, especially in countries like Nigeria where identification is a challenge.

The added effects of the pandemic and increase in job losses making it harder for borrowers to repay their loans calls for fintechs to find a way around to survive.

Some lenders seem to have started employing new processes. A marketer for a loan app revealed that the fintech now collects physical collaterals like the papers of cars, that are easily collectable in a case of loan default.

In summary, the loan default rate is growing faster than the companies initially expected and fintechs need to customise their solution to the current situations in the country if they want to survive.