Kiakia is a moneylending fintech startup that was founded by Chiemeziem Anyadike, and Olajide Abiola in 2015. The company was launched to promote financial inclusion in Nigeria and make loans accessible to people who may be considered ineligible by traditional banking sources.

Through its web platform, Kiakia offers quick loans to people and businesses. First-time borrowers are given a maximum repayment time of a month. Subsequently, the repayment time is extended as the user builds credit-worthiness. The loans are between #10,000 and #200,000 and are perfect for people who need to access loans fast and return it in a short period.

People who are ineligible to access loans from banks, co-operatives can obtain loans quickly with Kiakia.

KiaKia is also a peer-to-peer lending platform. People and businesses who wish to lend money as an investment are paired with the best match from the pool of people who want to borrow money. The startup uses a credit scoring algorithm to evaluate people’s track records and determine their credit-worthiness.

Getting loans on Kiakia

For starters, KiaKia caps its loans awarded to individuals at N200,000. Loans above N200,000 are only provided to responsible borrowers. These are people who have obtained a significant amount of loans and paid back in good time.

For loans above #200,000, the startup repayment period and interest rates are more flexible.

There are other startups that provide the same service in the Nigerian fintech sector. Fairmoney, Aella Credit, Carbon, Renmoney, and Branch are some of the startups offering similar services in Nigeria.

A difference between Kiakia and other lending platforms is the time granted for loan repayment. As earlier stated, KiaKia gives first-time borrowers a maximum of 30 days to repay their debt, but other loan providers like Renmoney and Carbon lend money within the same range to users and give a repayment time of more than 30 days to borrowers.

Thus, if you want more time to repay a loan, KiaKia may not be the best for you as other platforms give more time for repayment.

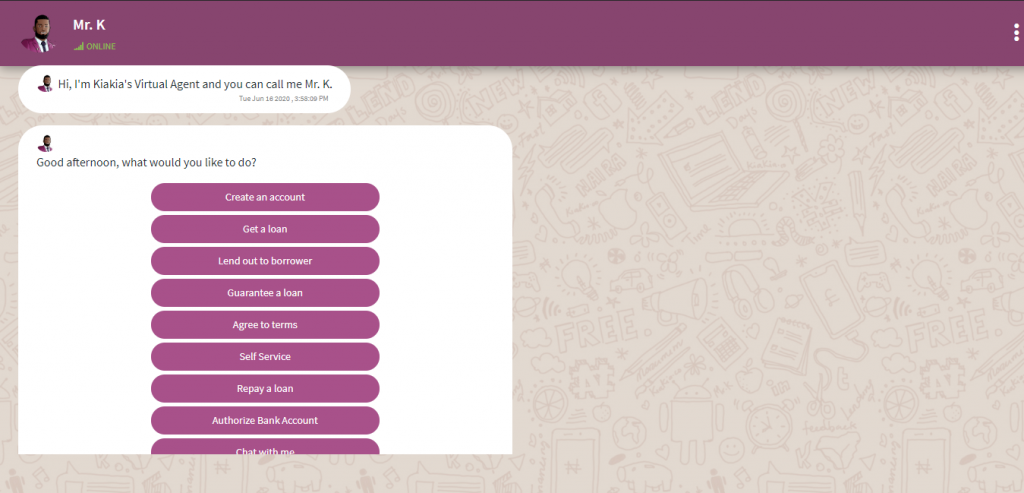

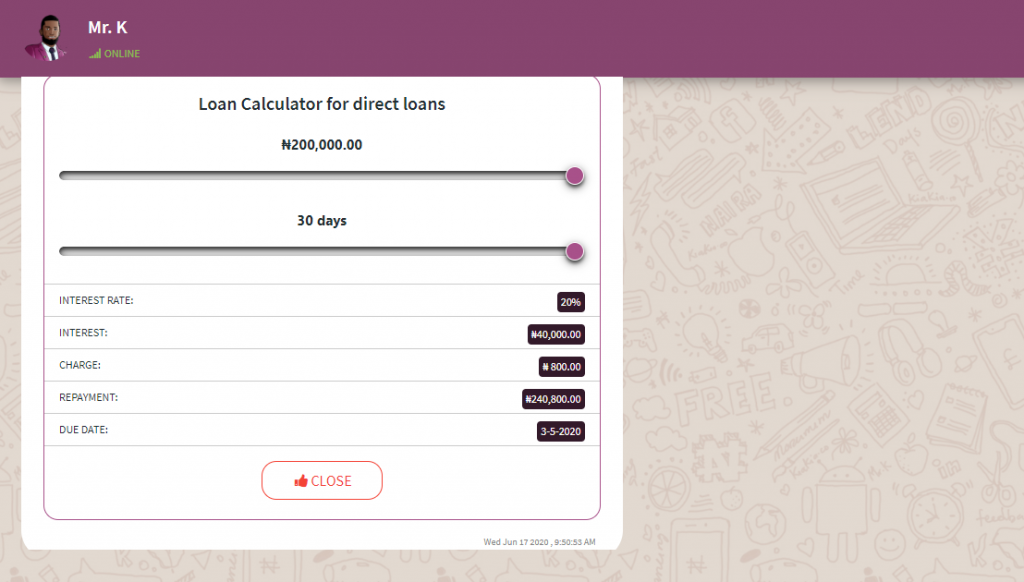

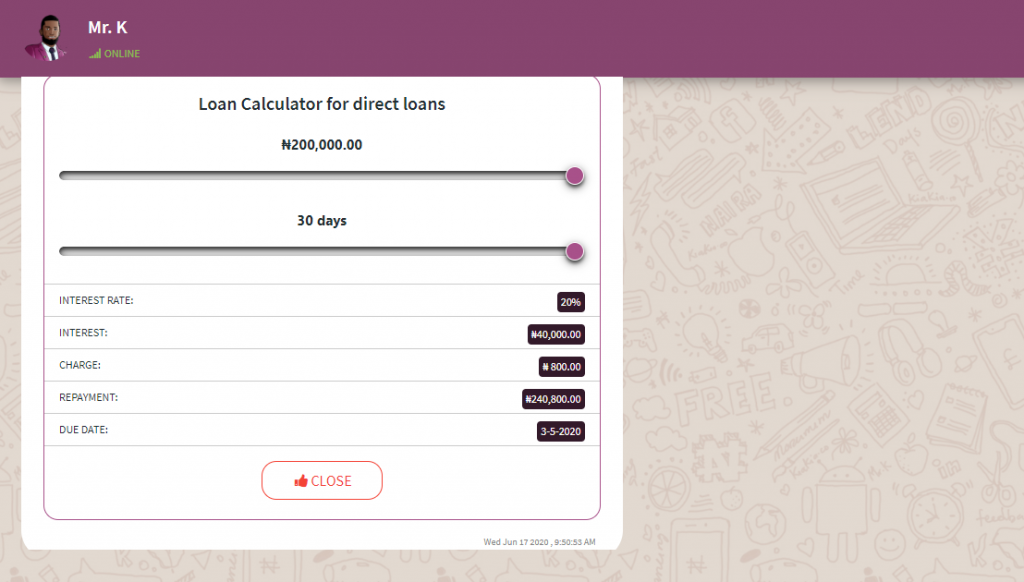

Chatting with KiaKia’s chatbot, ‘Mr K’ provides help to access Kiakia’s services in a friendly, and humane manner, unlike the standard robotic demeanour of most AI bots. The bot allows a user to create an account, register as a borrower or a lender, and stand as guarantor for another borrower, among other things.

Kiakia does not have an app for borrowers at the moment, and loans can only be applied for through the chatbot.

Processing and Interest

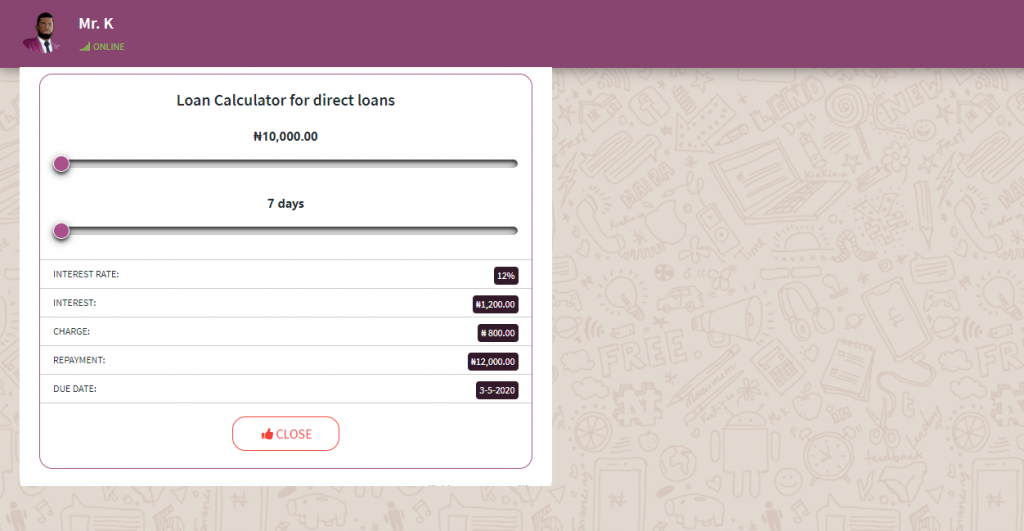

The processing fee for each loan is set at N800, while the interest rate is 15% for loans that will be paid back before 14 days, and 20% for the ones that will be paid back within 30 days.

Carbon charges as low as 5% on the first loan, while subsequent loans attract interest rates from 1.75% to 30% depending on the risk associated with the loan. Renmoney charges an interest of 4% to 5% on loans.

Aella Credit charges between 4% to 29% interest on loans obtained from it. Compared to what banks charge on loans, the interest rates obtainable from Kiakia, and other fintech borrowing platforms are still relatively high. Guaranty Trust Bank, for instance, offers quick credits to customers at a monthly interest rate of 1.33% and allows a repayment time of 6 months, or 12 months.

Before the CBN announced a reduction of the MPR (Monetary Policy Rate) in May, the bank lending rate in Nigeria was put at 14.92% per annum. The MPR was reduced with the intention to have the bank’s lending rate consequently reduced. While there are other economic factors that might defeat the purpose of the MPR reduction, the interest rates charged by Kiakia and most lending platforms are relatively high.

Like other moneylending platforms, users have to submit identification documents before accessing services on the platform. The required documents include a work ID, BVN, screenshots of up to 3 months of work income, as well as a passport photograph of the individual. The borrower has to be above 21 years of age.

Obtaining loans is straightforward with the assistance of the bot, and loans are processed within minutes once the appropriate documents and answers are provided. The loan processing attracts a fee, while the loan attracts an interest.

Investment loans for people and businesses

On the startup’s mobile app, people can fund loans with their money and earn interest. Kiakia’s investment plan ranges from N50,000 to N10,000,000. The funding can be done through a bank transfer or a debit card, and for as many times as the investor is able to.

The maximum loan amount is N10,000,000 and it can only be invested singly for a maximum tenure of 18 months. After the maturation date, the funds are paid back into the investor’s designated bank account.

Suggested read: Cowrywise vs PiggyVest: What You Need to Know Before Making a Choice Between Them

Kiakia’s focus on borrowing and investing makes its app user-centric and effective. According to a user, Babatunde Akin-Moses, he likes ” that it is strictly for lending and so it keeps the user-focused. The interface is beautiful, simple and intuitive: it requires no handholding whatsoever.

“I was particularly impressed with how quick and easy it was to fund a loan. Along with multiple options for payment too. As someone who operates in the Fintech lending space, I can confidently say that this is an app that gets the job done excellently!” he said.

Another user, Endurance Joseph, said Kiakia provides “a perfect alternative to just letting your money lie wasting in the bank with little to no interest being remitted. This app helps me plan my finances a great deal, the remittance is timely. It (remittance) has never been delayed even once, and the customer service is top-notch.”