Branch Personal Finance App is one of the many apps providing access to loans for people and businesses in Nigeria. The app is developed by Branch International and has only the android version.

Overview

With the predominant of means of accessing funds being through the traditional banking system, applying for a loan paints the picture of getting into traffic, walking into a bank, speaking to a customer care agent and filling some paperwork. Then there’s the waiting for approval or rejection as determined by the bank based on your creditworthiness.

All these processes take time, and time is money. Hence the need for a means to access loans without having to physically march into a banking hall, meet the high credit requirements and fill some paperwork.

Besides the ease of access, being able to apply for a loan and get it almost immediately can make or break deals whether in business or personal ventures.

Providing that access is what Branch does through its app and in this review, I will examine the app based on simplicity, user experience, functionality and visual appeal.

Functionality – How Branch provides the access

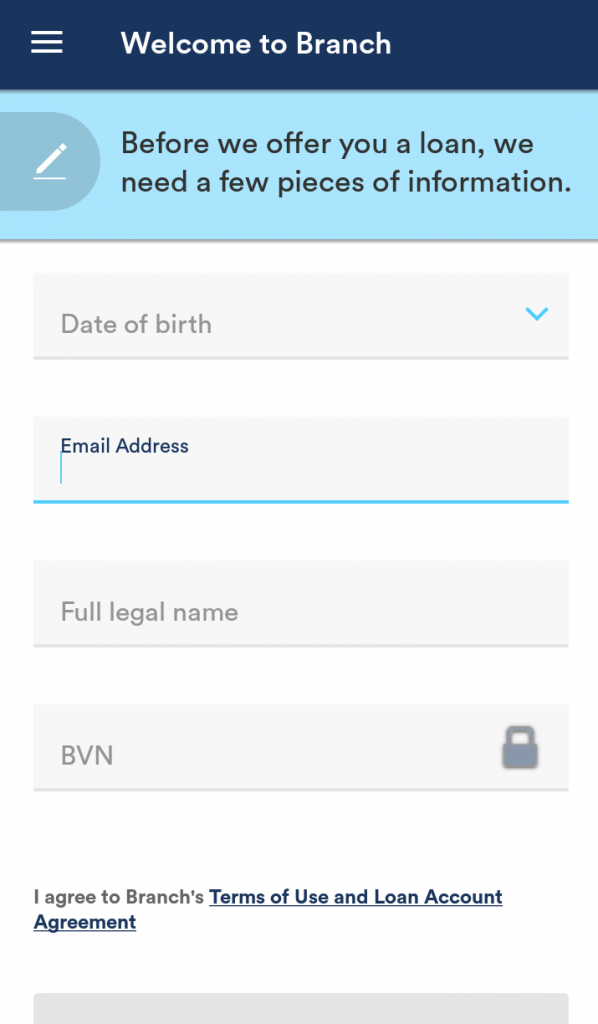

I installed version 2.3.1 of Branch from the Playstore, chose English as my preferred language and proceeded to setup an account for myself. The details required to register are basic and therefore made that process easy.

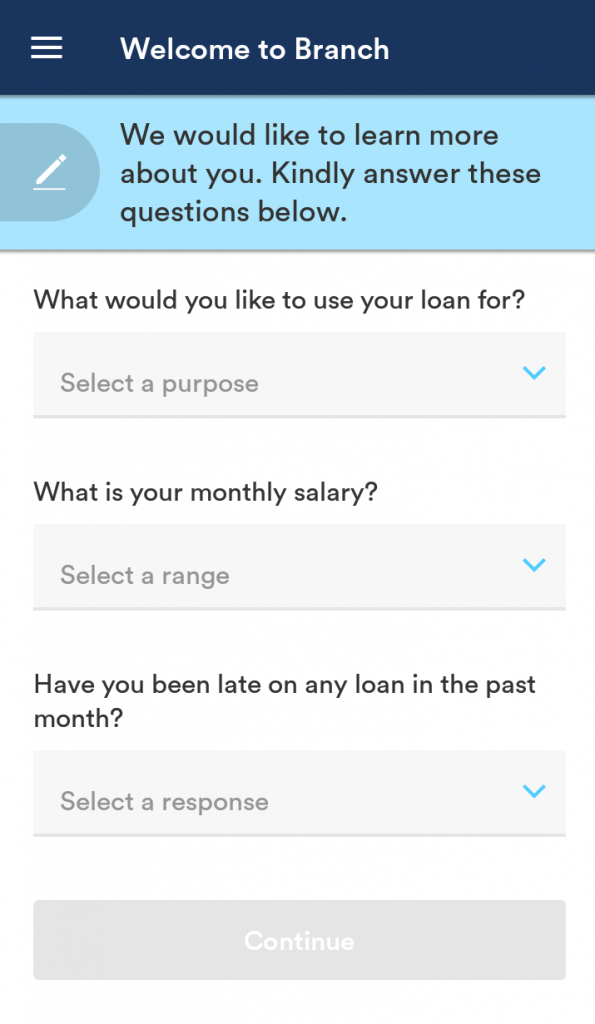

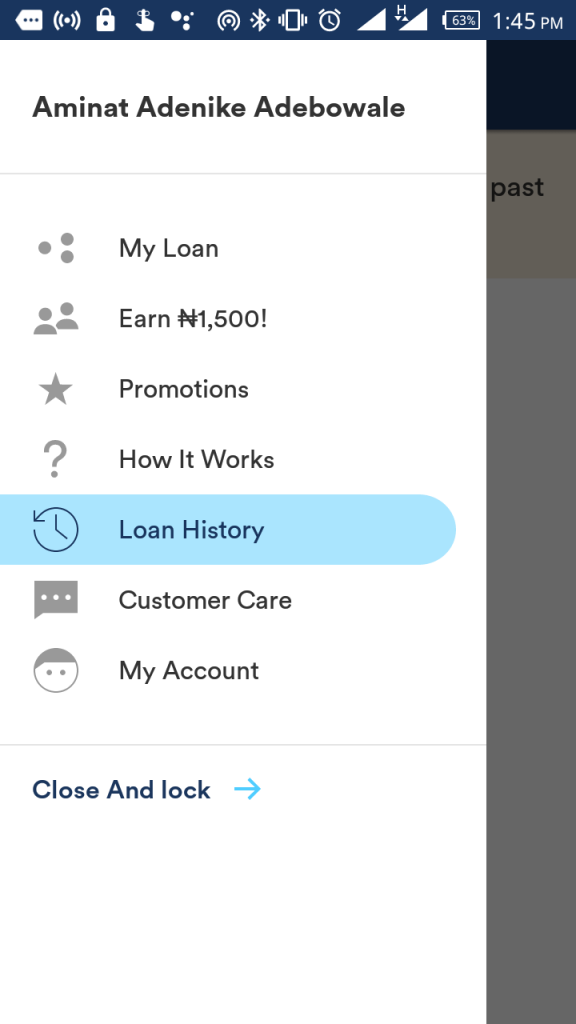

The app provides a colourful interface that calls attention to the business at hand – loans. The user can either peruse the sidebar or go through the option called ‘My offers’. By selecting the offers option, you can start applying for a loan directly.

The presence of the two other options besides the loan provides the most important thing needed besides the loan – help. This makes the user experience smoother for anyone who has a question or needs to reach out for external help.

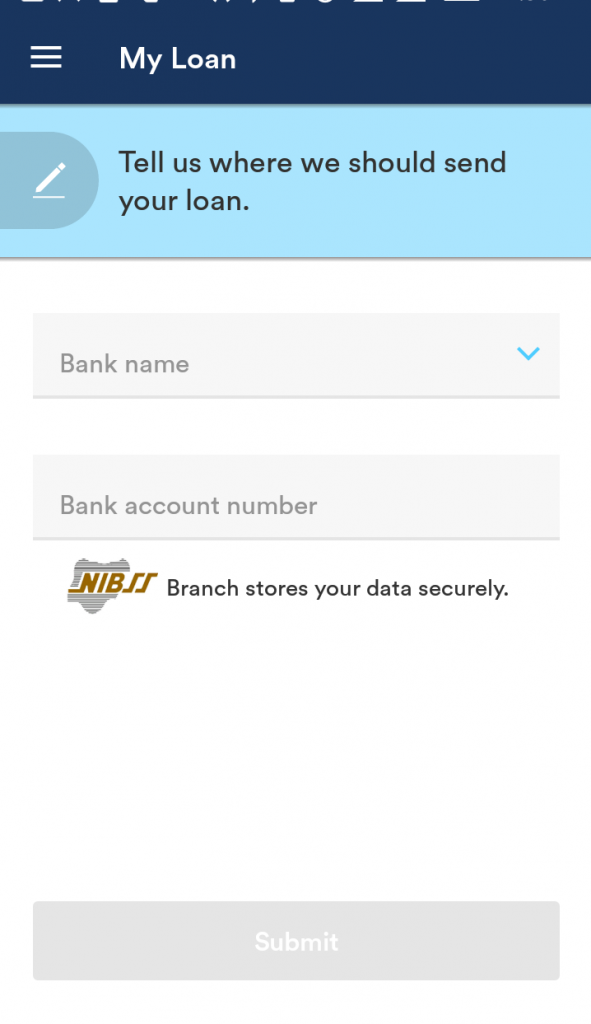

To get the loan, you have to enter your BVN and give the app permission to crawl through your SMS history as well as the data on your phone in order to determine your credit history. The messages it will look through include those from your bank. Once it determines your creditworthiness, Branch will let you know the amount you can borrow from the platform.

Ease of use and simplicity

As earlier established, the app provides a simple interface that makes it easy to navigate pages within it. As a result, a millennial, youth, middle-aged or older person can launch the app and figure out how to use it within minutes, as long as there is no visual impairment.

Visually, it is colourful in an understated way with blue, green, white and red appearing at different times. Once the app is open, the logo is visible only on the sidebar and is not particularly distinctive, adding to the understated design of the app.

Comparison with other related apps

In comparing Branch with other related apps, I will use the interest rate at which loans are given for each platform.

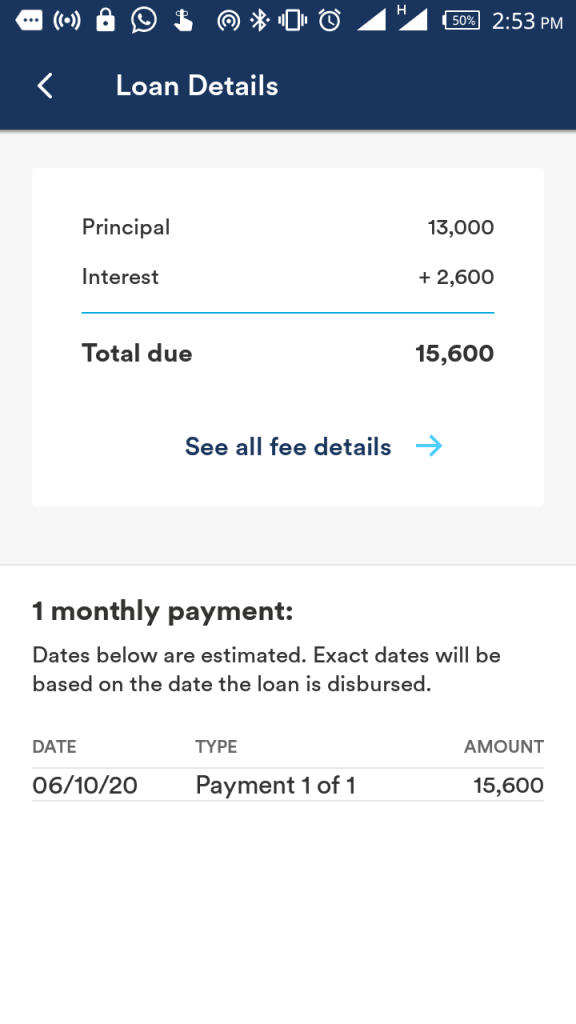

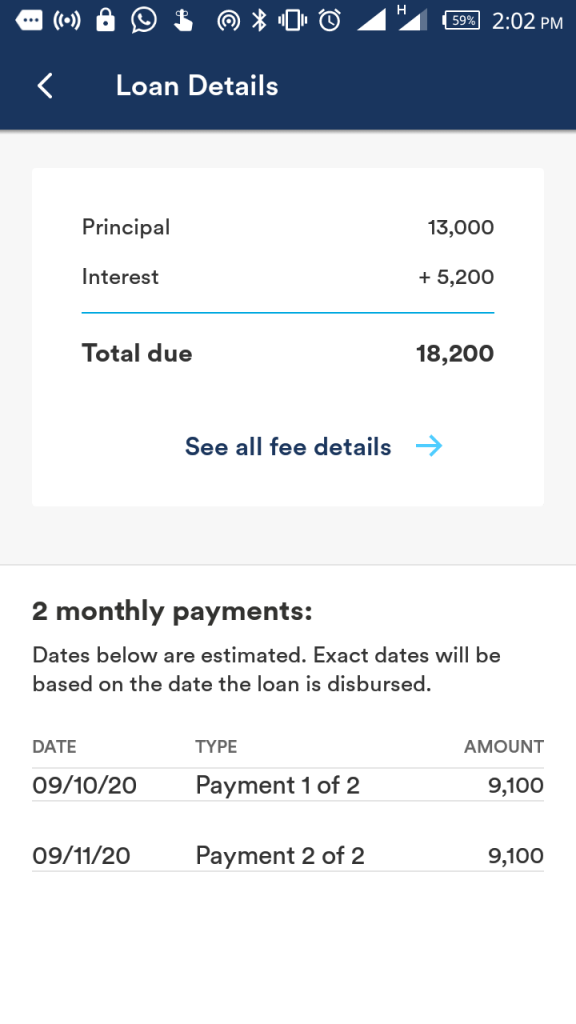

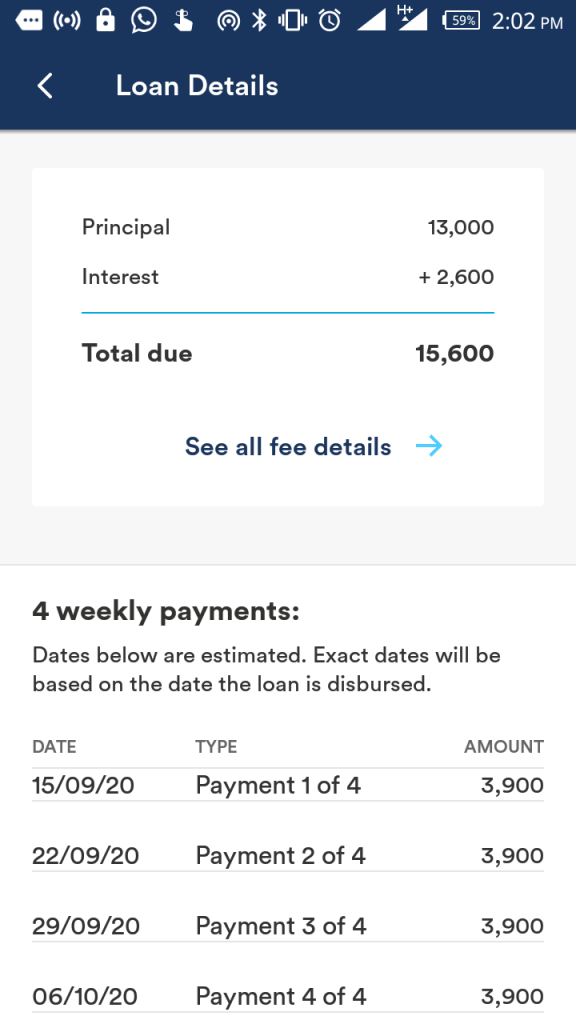

As a first-timer, I attempted to borrow N13,000 on the app. I found out that I can pay back in a one-time monthly payment, in four instalments spanning 4 weeks, or in two instalments over a period of 2 months. The interest rate is 20% for the first 2 options (interest of N2,600) while it increased to 40% (interest of N5,200) if the payback period is for 2 months.

Depending on how fast you repay the loans and your creditworthiness, the interest rate charged on your future loans will reduce to between 14-28% while the amount you can borrow will increase.

Other related apps include FairMoney, Xcredit, and Carbon.

FairMoney gives loans between N1,500 and N500,000 for an interest rate between 10 and 28%. It has a repayment time of 2 weeks to 3 months depending on the amount borrowed. Carbon gives loans from N1,500 to N1 million and charges an interest rate from 1 to 21% also to be repaid from 2 weeks to 3 months.

Xcredit gives loans but with a catch. You can borrow N5,000 to N500,000 using the app, however, be prepared to be bothered until you pay back fully. While there is no service fee, there is a 1% late payment fee that keeps adding to the capital for each day you refuse or are unable to pay up.

In addition, the interest rate for Xcredit loans is high and the repayment period is from 10 days to 6 months with an average interest rate of 12%.

Comparing Branch’s interest rate to what is charged on loans obtained through related apps, it is average. Carbon and Fairmoney are better choices compared to it while Xcredit is not.

In summary

Reviewing the Branch app based on its interest rate as well as factors mentioned earlier, it delivers an average experience to the Nigerian who needs to use it to borrow a loan immediately. However, it delivers on the core function, which is to give loans.