Nigerian digital financial platform, Carbon has revealed that it disbursed loans worth over N23.1 billion in its recently released 2019 financial overview. This is a 76.9% increase from the N13 billion disbursed in 2018, indicating high growth in the company’s key offering.

The increase in loans disbursed translated to over N6.3 billion generated in revenue. This is a 68.8% year-on-year (YOY) growth compared to the $3.73 billion made in 2018.

Carbon’s high growth was driven by its expansion into Kenya as the added exposure gave it access to more Africans.

In 2019, Cabon disbursed over 975 thousand loans

The company also introduced some features during the year that had a significant impact on the revenue, as users quickly adopted it. Here are some of them.

Loans Top-ups

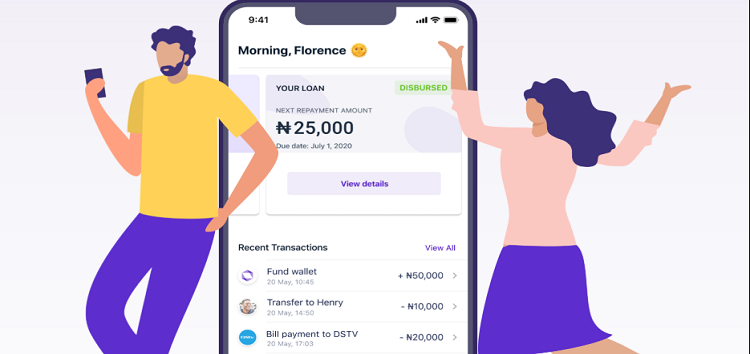

In 2019, the company launched a loan top-up feature that allowed customers with active loans to access additional credit when needed. At the end of the full-year Carbon had recorded over 25 thousand loans top-up.

Savings on Carbon

To help their customer make money, Carbon introduced a one-time investment feature that allowed them to create an investment plan with as low as N100. At the end of 2019, Carbon users had invested a total of N2.8 billion.

Free Bill Payments

By giving customers free bill payments along with cheaper transfers and fast transaction, more customers used the Carbon app for their payment services. This resulted in the number of transaction on the app increasing 23 times more than that of 2018.

In total, 5.5 million bill payments worth about N51 billion were processed using Carbon

Cash Rewards

Apart from its cheaper transfer rates, Carbon’s cash reward feature attracted more users to the platform. The feature rewards customers who repaid loans on time with cash.

The feature was so huge a success that more than N130 million was returned within the first 3 months of its launch.

Over 60% Increase in Expenses

For all of Carbon’s incredible growth, its expenses also grew exponentially. Its expenses rose from N3.457 billion in 2018 to over N5.56 billion in 2019. This is a 60.9% increase in cost.

The company’s huge expenses resulted in just about N112.6 million in profit after tax. This was 23.47% lower than the 147.2 million generated in 2018.

COVID-19 and 2020 Update

So far this year, Carbon introduced its iOS app and USSD (*1303#) service. It also launched Carbon Express – a keyboard allowing users to make payments from social apps like WhatsApp.

Following the COVID-19 Pandemic, Cabon revealed that it has been rescheduling loans for customers who have problems with repayments due to financial difficulties. It also added that it has been helping customers with about N20,000 in health benefits.

Carbon has rescheduled over 9,016 loans for customers affected by COVID-19

Carbon has also announced its Disrupt Fund, a $100,000 Pan-African fund to address the lack of capital for African tech startups. This year it’s also making plans to introduce virtual and physical debit cards as well as a reward program for loyal customers and SME accounts for entrepreneurs.

Summary

2019 was generally a good year for Carbon despite the drop in profit after tax. From its successful expansion to the increase in loan disbursed and revenue, the payments company has a lot of positives to take away.

However, with the current pandemic poised to create a good and bad scenario for the company, we just have to wait and see if Carbon can recreate last year’s success this year!