Nigerian digital financial platform, Carbon (formerly Paylater) launched its mobile app 4 years ago. Since then, the startup has disbursed a significant amount of loans as well as other financial services.

To celebrate the feats achieved by the company since the launch of its app, we have decided to take you down memory lane and bring you a few landmarks by the startup since then.

Carbon Disrupted the Quick Loan Space

Initially launched as Paylater, the startup disbursed loans of between N7,500 to N200,000 to its online users within minutes of request. And about a year after the rollout of its mobile app, the startup reportedly began to disburse over 1,000 loans daily. By the end of the year 2017, Paylater had disbursed 3bn in loans to its users.

By the end of 2018, the startup had disbursed loans worth over N13 billion to users. This was about 400% increase from the figure it did in 2017, sealing its position as one of the country’s biggest fintech operations. It has since increased its loan cap to N500,000 for individuals and N20 million for SMEs.

Beyond Lending

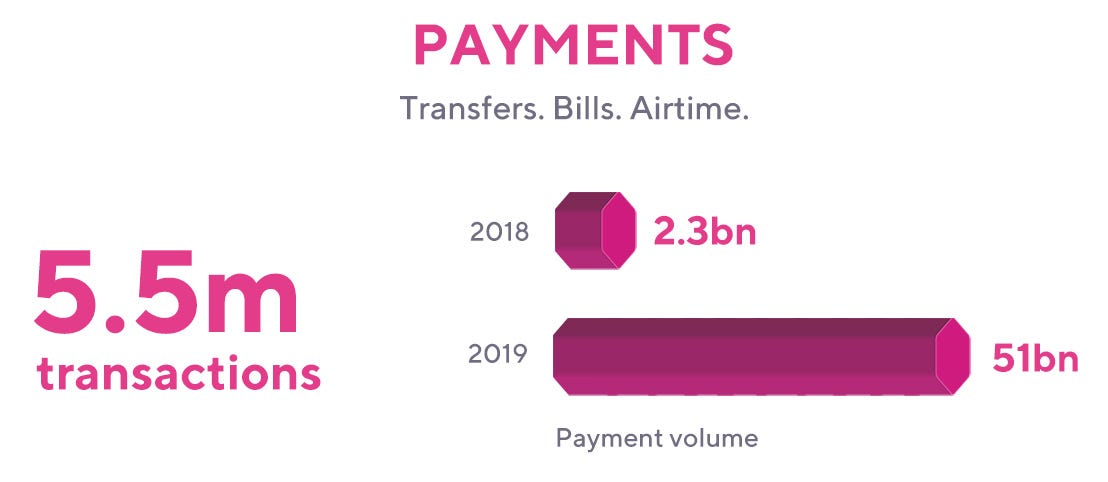

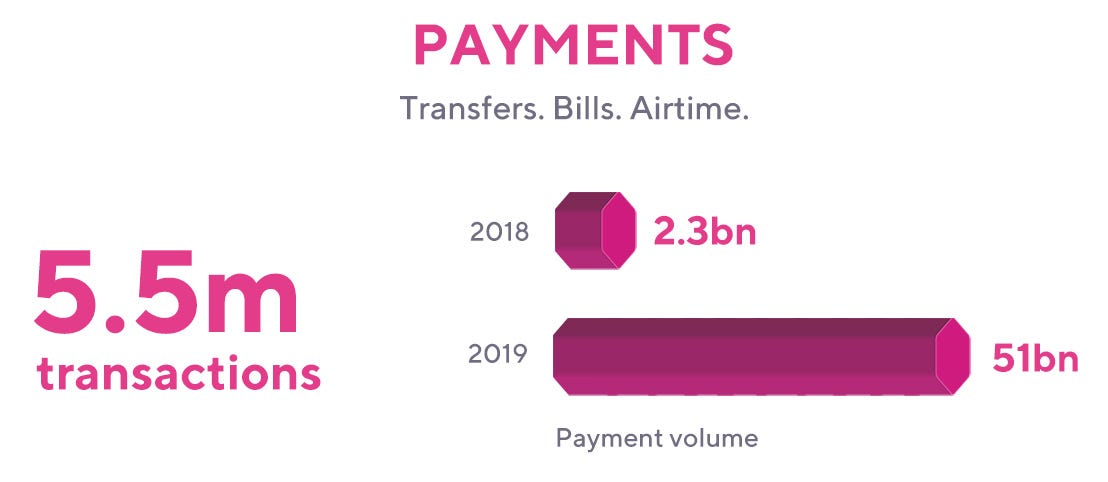

In 2018, Carbon (formerly Paylater) introduced a payments feature into its app. This allowed users to buy recharge cards, pay bills and even transfer funds. It also introduced an investment option for users. By the end of 2018, the startup had recorded over 500,000 transactions worth N2.3 billion from the payments space alone and N800 million from investments.

By the end of 2019, the platform had done over N51 billion in the bills and payments space, a whopping 23x growth from 2018. While the investments feature also grew to N2.8 billion.

Paylater, No; Carbon Yes

In March 2019, the platform’s parent company One Finance (OneFi) secured a $5 million loan from Lendable, an international lending platform. Following this, the startup made known its ambitions to fully transition into a full-fledged digital bank. This of course was expected as the startup has been adding other features beyond lending to its app.

A month later, Paylater broke the news – a name change to Carbon, which it says reflects its growing digital offerings.

Following the name change and revamp, the platform rolled out free credit reports and a wallet for its customers in addition to its lending, investment and payments options. It also began to offer in-app credit reports and finance management.

And the impact of these revamps could be seen in its end of the year report where over 408,000 wallets had been opened on its app, with over N22 billion naira stored in them. It also disbursed over N23 billion in loans.

Expansion, Achievements and Awards

Since 2016, Carbon has expanded into new countries beyond Nigeria where it initially launched. The Startup has expanded to Ghana and recently Kenya. It also rolled out an iOS app, becoming the first digital lender in Africa to do so, as well as a USSD feature for its users without smartphones.

The startup also acquired AmplifyPay, another payments startup, which allowed it to introduce some new banking features on its platform.

Carbon was awarded the Best Fintech Solution in Africa at the 2019 AppsAward Africa. This recognition came just months after its co-founders joined the 91st cohort of Endeavor Entrepreneurs.

Recently, the startup launched a new $100,000 Pan-African fund targeted at insurance, health and education tech startups on the continent. The startup will be offering up to $10,000 in each of the selected startups in return for 5% equity. This is to fill in the fund gap on African startups.

Congrats to the Carbon team and cheers to more.