Paylater, one of Nigeria’s biggest fintech operations had an impressive 2018. According to its annual review published on its blog, Paylater disbursed loans worth over N13 billion to users last year. That’s an unbelievable 300% increase from 2017 when it distributed N3 billion worth of loans.

According to the company, repeat customers also grew in 2018. Over 80% of eligible Paylater borrowers returned for loans in 2018.

One important reason for this has been the close knit community Paylater has created for itself. One such community is its members-only Facebook page. With users sharing their different experiences and financial goals, the Paylater Facebook community helps to reinforce users’ understanding and trust in the product.

Another important community enabler has been its email subscription service ran by a man named Henry. With his witty mails and information updates, Henry certainly has his ways of making customers return back to the platform.

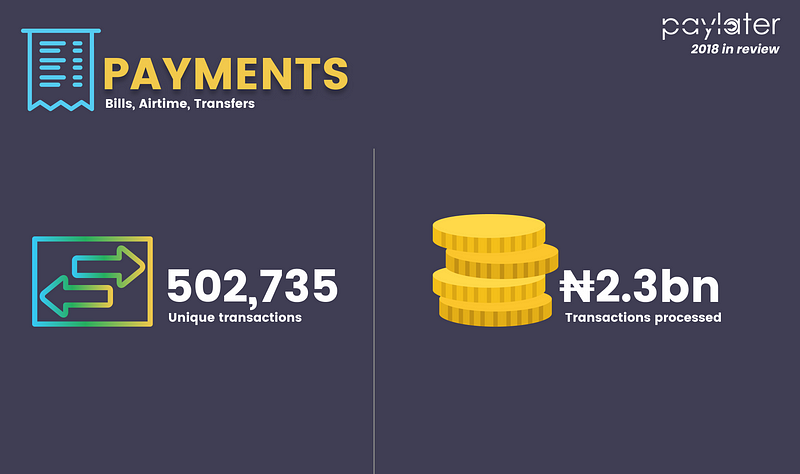

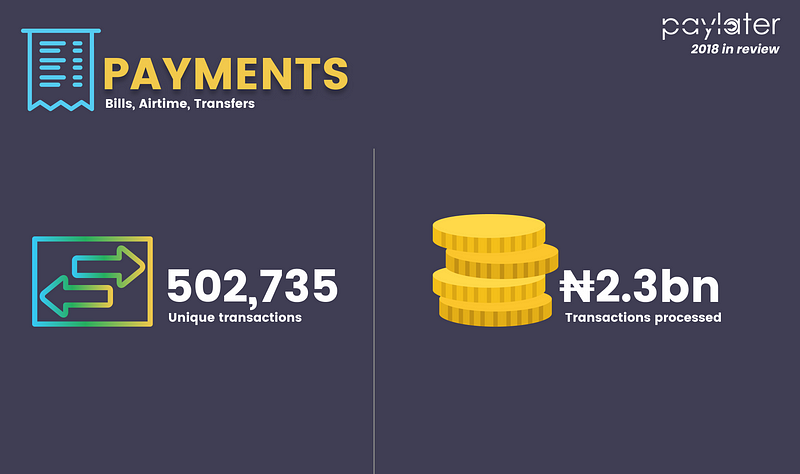

Interestingly, aside from lending, Paylater also recorded impressive growth in another product: Payments. The app introduced a payments feature, allowing users buy recharge cards, pay bills and even transfer funds. And at year’s end, this segment recorded 500,000 transactions worth N2.3 billion.

Another stunning growth recorded by Paylater is actually internal; its employees. Over the last 12 months, the startup added 26 new players into its Customer Success workforce. Meanwhile at the start of 2018, that division had just four members.

The growth is attributed to rising customer enquiries and sundry issues. And according to the team, 4,000 support tickets were received daily.

What Has Paylater Planned for 2019?

In 2019 however, PayLater aims to push further into the financial space by, initially, offering two new products.

First, Paylater will launch a business account for female entreprenuers. With more and more women increasing working in the informal markets, providing them with digital banking facilities is one way to help improve their businesses.

And the foray is also interesting as it sees Paylater make a first move to become a full-fledge digital bank, like ALAT, Revolut and ATOM. It certainly has the competency and frankly, it’s about time it did.

The second new feature for 2019 is the distribution of Debit cards to customers. The debit cards will work as part of the newly launched Paylater Wallets. It will allows users make transactions and withdrawals from anywhere across the world.

Now that completely captures its goal to become a full-fledge bank. With its architecture already robust and trusted, Paylater is probably the best fintech that will provide all round banking services.

We've just updated the app, with our fantastic new investment feature called PayVest! 🚀

— Carbon (@get_carbon) July 4, 2018

Here's what's on offer:

– Earn great investment returns, up to 15.5% annually 📈

– Create up to 5 investment plans 🔀

– Zero fees/hidden charges ⛔️

Available now. https://t.co/gJkK4wOwBf pic.twitter.com/c6ILzAd1It

Importantly, it has already, quietly, launched different bank-like services. For instance, it launched PayVest, an investment package for users, which promises 15.5% returns for users.

It also launched the Payments, allowing users transfer money anywhere. It has launched Paylater Wallets, which holds cash for users, like a regular bank, and gives them rewards.

Let’s not also forget that it has its own credit rating. Like regular banks, the app owners, One Financial, now has its operations checked and validated for success or regression. This helps to put it somewhat on par with regular banks.

So in 2019, Paylater could well and truly become Nigeria’s most robust digital bank!