Startup founders usually have some of the most brilliant ideas. Especially founders in the tech space where business is based on their ability to provide innovative solutions. Sadly, these ideas, however impressive, do not always end up as successful businesses with many of them crashing and burning in their infancy.

According to a 2020 Businessday report, the startup failure rate in Nigeria stood at 61%. In essence, only 39% of startups in Nigeria survive. Across Africa, startup failure rates range from 75% in Ethiopia and 74% in Ghana to 58.3% in Senegal and 60% in Somalia. Kenya has one of the lowest startup failure rates with 58.7%.

While many of these startup founders had brilliant innovative solutions to problems as well as what must seem like a good market for their solutions, they nonetheless found themselves failing. And this could be a very painful and regretful experience for founders, especially those who had invested so much time, effort and personal finance into the business.

There are several factors responsible for the failure of tech startups in Africa. While some of them are beyond the control of the founders and the team members, some of them are. CB Insights has revealed some of these reasons based on their dissection and analysis of hundreds of failed startups and this report is based on their findings.

Poor funding and failure to raise new capital (38%)

Well, we have heard about this quite a lot, haven’t we? But the truth remains, finance will always be the backbone of every endeavour.

This is because, without proper funding, the task of working on an idea until it materializes as a concrete business ready to take on the market becomes very tough. And this had a hand in the ultimate demise of 38% of the startups studied.

Even after producing a minimum viable product that is ready for the market, keeping it there and scaling it would require more funding. While many tech founders bootstrap their operations from the idea stage to the early stage, there almost always comes a time when external funding becomes a necessity. But many startups do not even make it to that time.

According to a WeForum report, only 8% of African startups make it to the Series B stage of funding as of 2019. This is a huge drop from 17% in 2014.

“Money and time are finite and need to be allocated judiciously. For the startups on our list, running out of cash — tied with the inability to secure financing/investor interest — was the top reason startups cited for their failure”

CB Insights

Thankfully, Africa-focused VC companies like Microtraction and Future Africa that understand the African funding landscape are leading the charge to provide financial expertise to African startups in order to help them survive the problem of funding.

Absence of market need (35%)

As shocking as this may sound because of course, you expect people going into business to be certain about their market, the lack of a market is the second-highest reason for startup failures here.

Better put, the market doesn’t think it needs the solution.

Many tech innovators have a notorious penchant for building solutions to the problems they see as pressing, not necessarily the ones the market considers so. It is not surprising to hear stories of founders who had tried their hands on several other solutions before finally arriving at the one which works.

“Don’t build what you care about, you will lose money that way. Build what the market cares about and you will make money. Customers don’t want your product or what it does; they just want to make their lives better.”

According to CB Insights, tackling problems that are interesting to solve rather than those that serve a market need was cited as the No. 2 reason for failure, noted in 35% of cases.

Instead of spending too much time coding and developing algorithms for perceived problems, founders should endeavour to invest more time, effort and some of that money in market research and analysis. Lots of legal apps are languishing in Playstores because their owners built what they thought were solutions to real problems while the market disagrees.

There are several market research companies in Africa that could help startups decide what the market wants and advise what to build. They include Metrix Digital Agency, Bufiredd, Market Trends International, the MRC Group etc.

Outcompeted (20%)

To be outcompeted simply means to be overwhelmed and run out of business by the competition. While it is a healthy business practice not be obsessed by the competition, it is equally a bad business habit to ignore them.

This is because once the market loves a tech product or service, there’s nothing stopping other innovators from jumping into the space it has created. Many times these newcomers enter with better and more unique ways of doing the old stuff, and many times with a lot of money such that it would only be a matter of time before they take over the space.

Ample examples of this exist in Nigeria. Econet which was a pioneer in the mobile communications space in Nigeria was overrun by competition from MTN and Globacom (Glo).

Similarly, Max.NG which is one of the first bike-hailing startups in the country was quickly maxed out by Gokada which entered with better technology and Opay’s ubiquitous Oride which invaded the space with a great deal of money.

Nigerian-born Founder of American robotics startup, Reach Robotics, Silas Adekunle learned about this the hard way. After six years of doing business, raising at least $7.5 million, and building what was described as ‘the world’s first gaming robot, MekaMon, the startup would eventually close shop in 2019.

Adekunle explained that the reason was due to “tough business circumstances.”

“The consumer robotics sector is an inherently challenging space – especially for a start-up. Over the past six years, we have taken on this challenge with consistent passion and ingenuity. Unfortunately, for Reach Robotics, in its current form at least, today marks the end of that journey,” he said.

The lesson here is to keep an eye on the competition while trying not to get too obsessed with them.

Flawed business model (19%)

A business model is basically a roadmap that will ensure the successful operation of a business. It identifies the customer base and how products or services can be tailored to provide value to these customers to ensure maximum revenue. Unfortunately, many startups with wonderful solutions and value propositions still fail on this leg.

“One of the world’s largest photographic film makers, Kodak officially went bankrupt in 2012 after helping to invent the digital camera which ultimately killed its business model.”

There are many ways a business model can be flawed. If a business model’s value propositions, for instance, generate more costs than revenue from customers then it is flawed. Basically, if a startup is spending more money to deliver value than it’s getting as revenue, it is running itself into extinction.

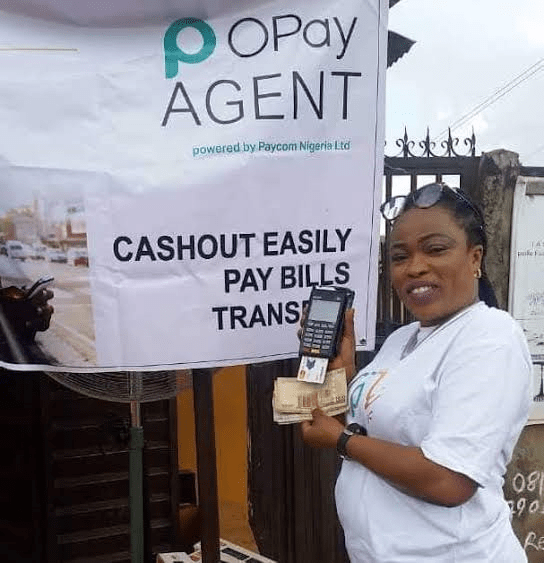

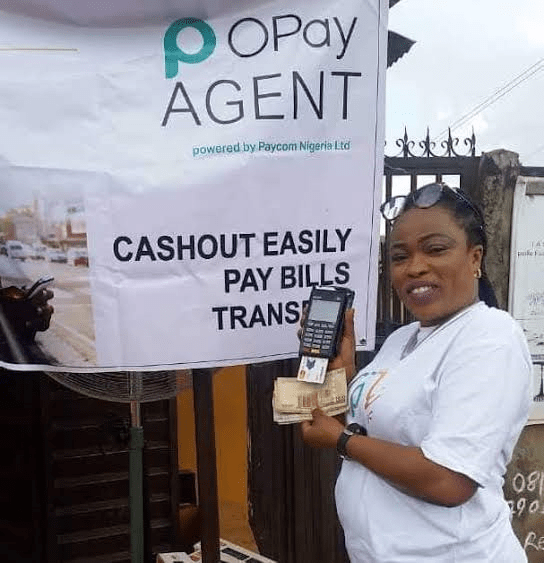

A very famous example of this is Opay which spent a lot of money to provide cheaper products and services for several of its businesses including ride-hailing, food delivery and its fintech services. For a very long time the super app was spending a lot more to deliver value. Most of the business verticals were unable to hold after the ban on motorcycles by the Lagos State Government.

A business model can also be flawed if it doesn’t establish proper channels to reach and deliver value to the customer base. No matter how brilliant a solution is, if people don’t know about it and can’t access it, it is useless to them.

There are several business analysis consultants out there that could develop very workable models for businesses out there. Founders would do well to use their services.

Regulatory/legal troubles (18%)

A regulatory problem is probably the fastest way to die for startups in Africa. While other startup killers mentioned before are killing startups slowly by making them struggle for years before finally giving up, a regulatory problem hits once, hits hard, and can be very fatal, especially for startups in countries like Nigeria.

“The absence of regulation is a risk and startups who have good structure and who have good advice will be wary because of reputation to brand. Because government can just slam a new policy and new law that wasn’t there at the time and you can get bankrupted just overnight.”

The bike-hailing startups previously mentioned suffered a sudden demise in Lagos when the state government, in February 2020, declared a blanket ban on bikes in the state.

Just like that, hundreds of millions of dollars in investment were reduced to almost nothing. Another Lagos regulation in the taxi-hailing space could also see smaller hailing companies disappearing from the space.

In February 2021, the Central Bank of Nigeria (CBN) ordered banks and other financial institutions to shut down accounts of organisations and individuals using them to transact cryptos. This came as a huge blow to crypto startups in Nigeria as they found themselves unable to carry out their core business of facilitating crypto to cash transactions.

Most of them had to resort to facilitating P2P transactions.

Salient Advisory’s Remi Adeseun told Technext that the best way for startups to deal with the regulatory problem is not to venture into a space that is not regulated. Therefore, if a startup must go into a space and there’s no regulation, they should make the authorities put one place.

In all

So there you have it, the top 5 reasons why tech startups fail.

Other reasons on the CB Insights list include pricing and cost issues, picking the wrong team, mistimed product, disharmony among teams and investors, burning out and lack of passion etc. But the top 5 trumps them all.