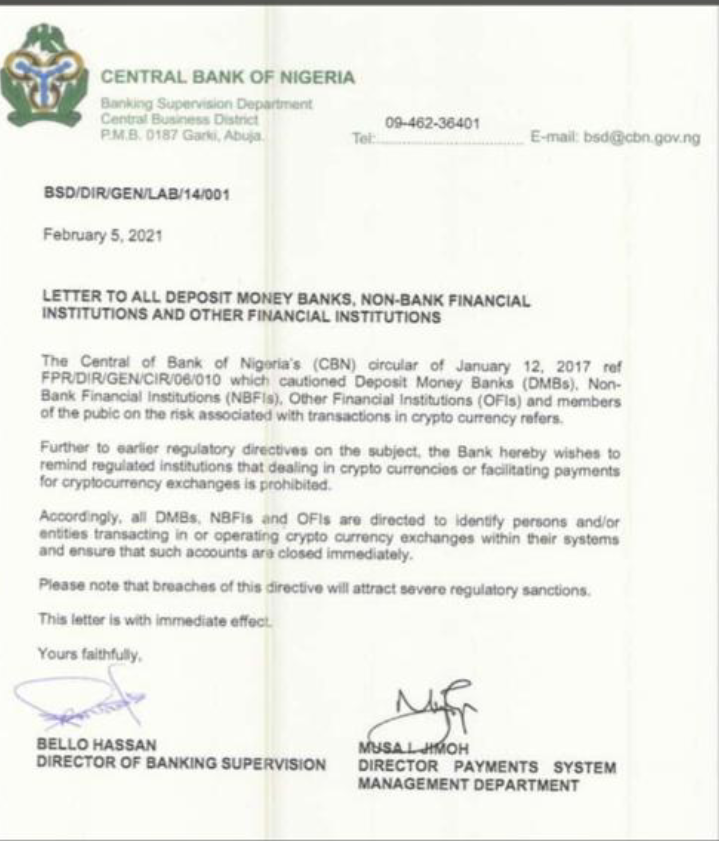

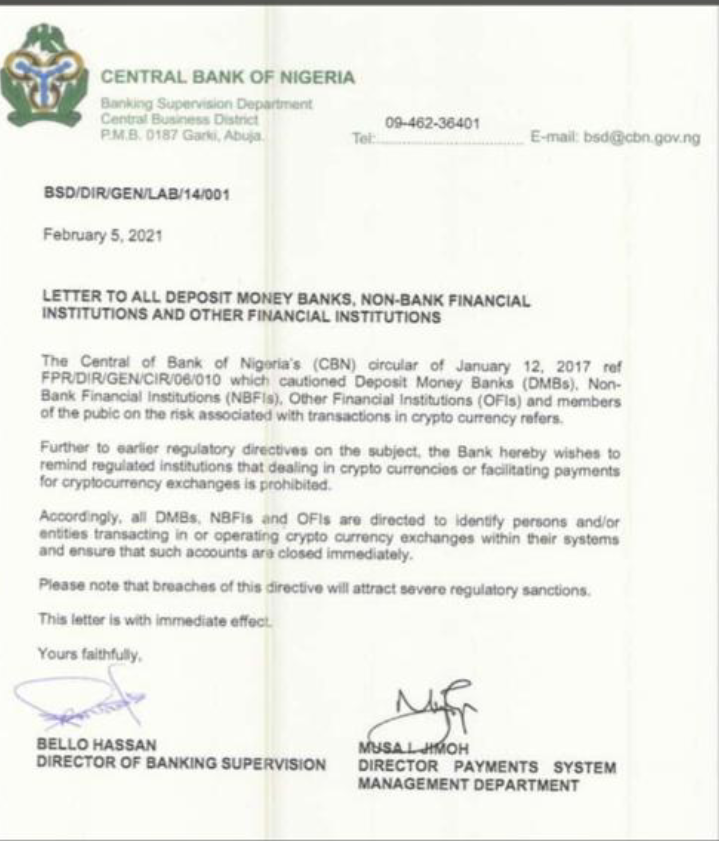

The crypto industry in Nigeria has been hit with a major setback. According to a recently released circular by the Central Bank of Nigeria (CBN), all banks, non-bank financial institutions (NBFI) and other financial institutions in the country have been directed to identify and shut down accounts of persons or companies transacting or operating cryptocurrency exchanges within their system.

The new directive means that any Nigerian’s account can be shut down for transacting or operating cryptocurrency in the country.

The regulator added that any breach to the directive will attract severe sanctions.

Crypto boom in Nigeria

This development comes at a time when Cryptocurrency adoption is on the rise in the country. Now, more and more people are making transactions, investing and transferring funds with it.

Last year, Arcade Research ranked Nigeria fifth globally with about 11% of its internet subscribers owning or using cryptocurrencies.

Despite the country’s crypto boom, the Nigerian government has refused to recognize cryptocurrencies as a valid form of money. As early as 2017, the regulator sent a warning to banks and Nigerians at large that cryptocurrencies like Bitcoin are not licensed or regulated.

It further warned that they may lose their money without any legal security as it was not protected by the Nigerian law.

However, the continuous growth and trust in cryptocurrencies have only increased adoption in the country and forced people to turn deaf ears to the CBN warnings.

Coinmarketcap ranked Nigeria among the top 9 in crypto growth in the world.

CBN strikes against Crypto

Last year, there was a semblance of hope that Nigeria would follow South Africa’s steps to regulate cryptocurrency when the Nigerian Securities and Exchange Commission set up a committee to create a framework for the regulation of digital assets and local crypto exchanges in Nigeria.

However, it appears that the government has changed its mind. The latest directive to shut down all accounts dealing in cryptocurrency is an obvious attempt to stop Nigerians from dealing in cryptocurrency. This is a complete opposite from what was expected.

What happens next?

With the new directive, Nigerian cryptocurrency platforms like Bundle and Yellow Card may be in a blind as to how the new laws affect them.

However, the obvious deduction is that they might no longer be able to process crypto transactions in the country.

Notwithstanding, Nigerians still have options of foreign crypto exchanges to avoid any foreseeable negative impact of the CBN law.

In Summary

Despite the CBN circular being somewhat ambiguous and open to many interpretations, the new order shows that the regulatory body is no longer taking a hands off approach to the cryptocurrency question.

However, instead of the regulation people were clamouring for, the CBN has opted for a shutdown approach.