Opay has raised $120 million funding from Chinese investors to scale its services in Nigeria and expand into Kenya, Ghana and South Africa.

The investors in this Series B funding include Softbank Asia, Meituan-Dianping, GaoRong, Source Code Capital, BAI, Redpoint, IDG Capital, Sequoia China and GSR Ventures.

Opera founded Opay in 2018. The platform started operations in Nigeria with a $50 million funding that was raised in June 2019.

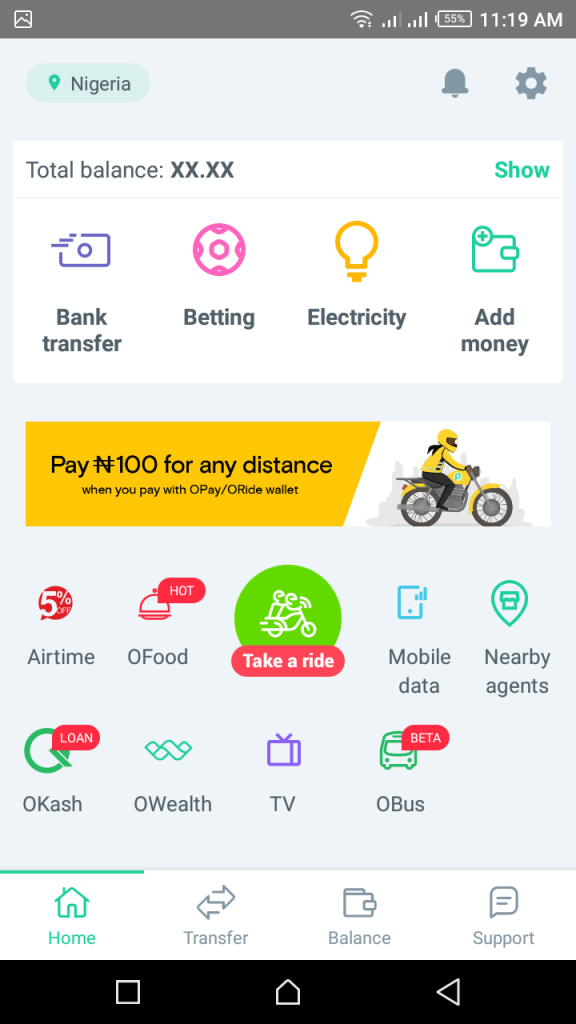

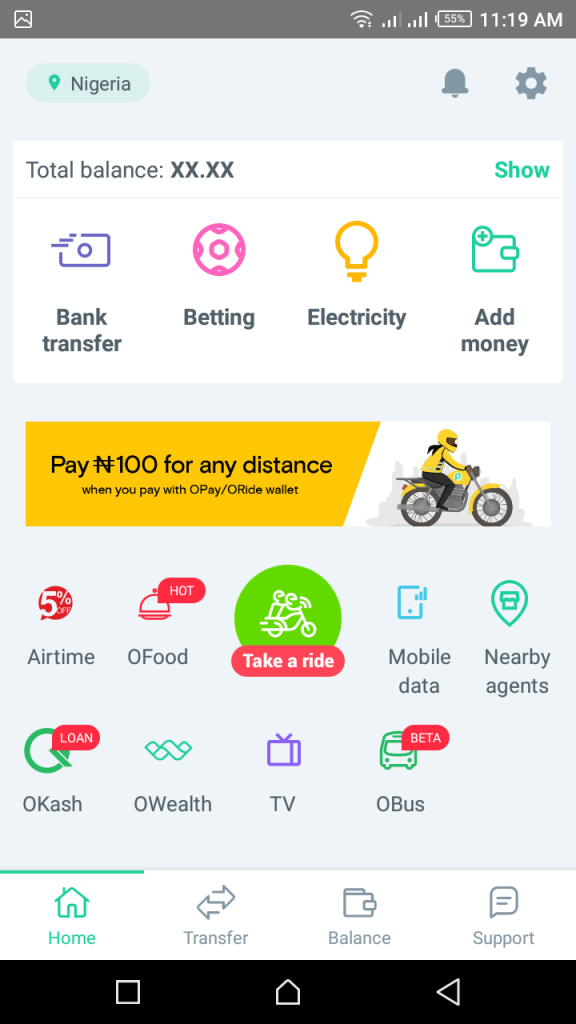

With its Series A funding, Opay has gone on to launch impressive verticals in Nigeria. Its services now include Oride, Obus, Oleads, Otrike and Ofoods.

Impact of the mammoth $120 million series B funding

According to Opera CEO and OPay Chairman Yahui Zhou, with the funding raised, the current services being offered by Opay will be scaled up in Nigeria. This implies that more Nigerians will be targeted to either increase their use of Opay’s services or start using the services.

“Opay will facilitate the people in Nigeria, Ghana, South Africa, Kenya and other African countries with the best fintech ecosystem. We see ourselves as a key contributor to…helping local businesses…thrive from…digital business models,”

Yahui Zhou, Opera CEO and Opay Chairman

The plan for the big funding involves the key expansion into Kenya, Ghana and South Africa. However, those are not the only countries in the expansion plan. There are other undisclosed countries in Africa on Opay’s radar.

If Opay follows its modus operandi in Nigeria, that means that inhabitants of these African countries are about to be treated to heavily discounted rides and services for a couple of months.

Opay, Jumia, Palmpay and other African fintech operators

Fintech businesses essentially need people to pay for products through them.

Konga knows this, so does Jumia, Renmoney, MTN and the rest of the fintech family.

With a population of approximately 1.2 billion, Africa has a ready market and Nigeria appears to be the center of this market.

Apparently, Chinese businessmen know this too and are investing more in Africa’s digital finance. Over the last months, Techcrunch reports that about 15 Chinese businessmen have made notable investments in African tech.

MTN recently obtained a license for its fintech subsidiary and Jumia is working towards transitioning to digital finance. With the launch of Whatsapp Business, Whatsapp may also be considering Whatsapp Pay while Palmpay just raised an investment round of $40 million led by China’s Transsion.

With Opay’s latest funding announcement, fierce and innovative cross-competition is to be expected from other fintech companies not only in Nigeria, but also in Ghana, Kenya and South Africa because these countries are Opay’s next target markets.