South African fintech, Stitch has announced a seed extension of $2m to expand into Nigeria. The startup raised $4m during its initial seed round, thereby bringing the total seed investment to $6m.

The round saw participation from repeat investors such as Raba, Firstminute Capital, CRE, Village Global, 500 Fintech, Future Africa, and Norrsken.

Individual investors such as Tom Blomfield, co-founder of Monzo and GoCardless; Matt Robinson, co-founder of GoCardless; Emilie Choi, president and COO of Coinbase; and Charlie Delingpole, founder of ComplyAdvantage contributed to the round.

Founded by Kiaan Pillay, Natalie Cuthbert and Priyen Pillay, Stitch aims to provide full Application Programming Interface (API) access to financial accounts across Africa. They started their operations in South Africa.

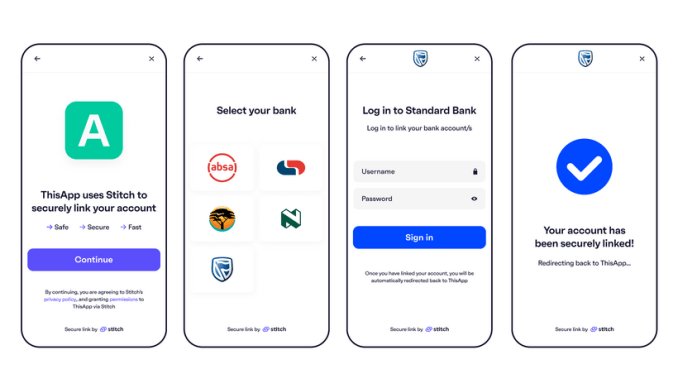

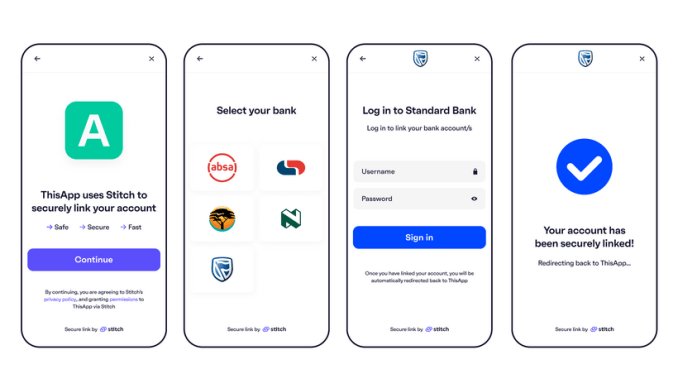

With its API, developers can connect apps to financial accounts. This allows users to consensually share their transaction history and balances, confirm their identities and initiate payments.

Co-founder of Monzo and GoCardless, Tom Blomfield said in a statement that he invested in Stitch because of the company’s role in growing digital finance companies in Africa.

“I see a lot of potential in African markets, where the wave of digital finance innovation is really beginning to gain momentum, and the Stitch team is getting in at precisely the right time. The team is one of the best I’ve seen globally, and I’m excited to see them continue to grow in Nigeria and beyond.”

Tom Blomfield, co-founder of Monzo and GoCardless

Payments and identity all in one

As of now, Stitch has a data and identity API product and a new payment product. Like most API fintech startups, Stitch charges developers and companies per API call. However, for some products like budgeting or personal finance management apps, it also charges a fixed fee.

According to the startup, within six months of its soft launch in South Africa, the company has seen more than 50% month-on-month growth in customer and payments volume across all solutions.

In Nigeria, Stitch has also been testing its payments product instead of its primary data product. According to the CEO, the company had a more compelling use case of the payments product in Nigeria after speaking to over 40 fintechs.

Stitch says it is on track to facilitate $10 million in monthly payments by the end of the year. Some of its clients include Chipper Cash, Paystack, Franc, Sanlam, Yoco and Flexclub.

Expansion into Africa’s largest market

Africa already has a lot of players involved in the API space, with most of them being Nigerian startups. Mono, Okra and OnePipe are some of them. However, they mostly operate in Nigeria and maybe one other country.

It is clear how important Nigeria is as a market for these startups. To gain a head-start in the market, Stitch is offering Nigerian businesses that intend to use Stitch free access to the product until the end of 2021.

This is according to Benjamin Dada, the country manager of Stitch Nigeria. Dada also believes the market is big enough to accommodate multiple players so the Stitch team will try to edge others by developing “inclusive and sustainable” pricing for its customers.

“They will not only be achieving cost savings by accepting account payments, but they can now earn a little more for each payment they accept via Stitch”

Benjamin Dada, country manager, Stitch Nigeria