From Paystack to Rave, GTPay, VoguePay and Remita, there has been a rise in the provision of payment gateways and fintech services for Nigerian businesses. These companies provide APIs that businesses can use to offer financial products and services to customers.

10 years ago, fintech was a very obscure notion at best and the concept of businesses receiving payments directly on their websites or rendering financial services like banks was almost non-existent. Now, with fintech companies like Cowrywise, Piggyvest, Paystack and the likes, more innovative solutions are springing up every day.

Suggested Read: Ghanaian Fintech OZÉ Raises $700k Seed Capital to Fuel Expansion into Nigeria

Because of these solutions, saving digitally, borrowing money without applying for bank loans and investing without involving banks are now possible. One of the greatest strengths fintech has given to entrepreneurs is the opportunity to manage payment for goods and services right from a web page.

The multitude of payment gateway options means that different gateways come with different peculiarities and price points. This also means that if you need more than one gateway option, you need to individually integrate each one of them.

Or not.

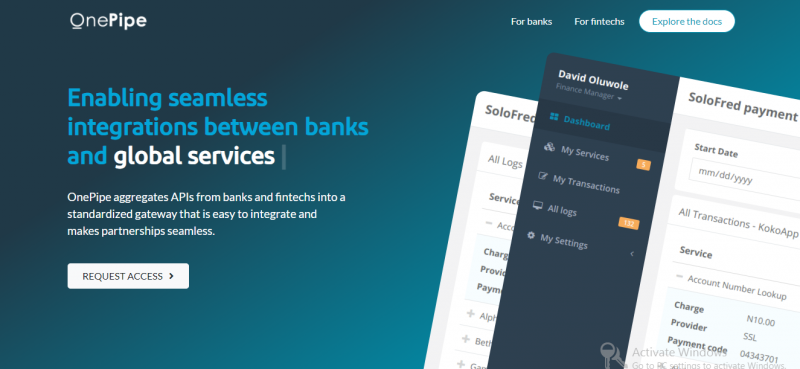

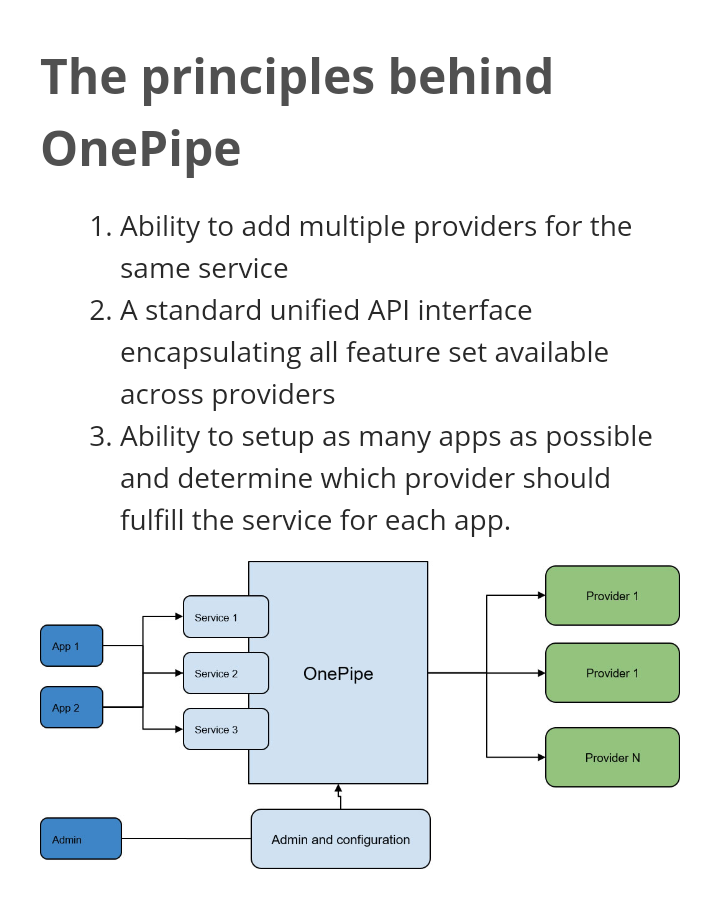

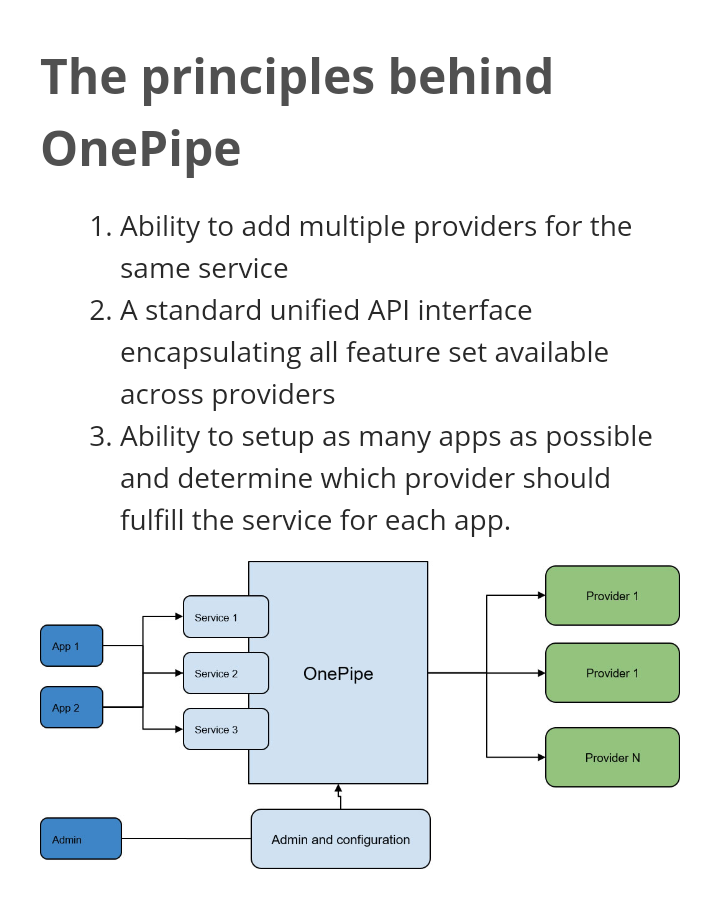

Onepipe is a Nigerian fintech company that aggregates financial services in the form of APIs from banks and fintechs into a standardised gateway for other service providers to use. In simple terms, it allows businesses to have access to different payment gateways at once without the need to integrate each separately. Onepipe was founded by Opeyemi Adeoye in November 2018.

Multiple integrations in one pipe

Similar to the way different wires can be passed into a pipe and then accessed from one opening, Onepipe removes the need to manage multiple integration processes when adding payment gateways to a site. The startup helps businesses to embed financial services, process payment from bank accounts, and provide banking services to underbanked Nigerians.

Also Read: From Paystack to Bamboo, Here are Technext’s Top 5 Fintech Players of 2020

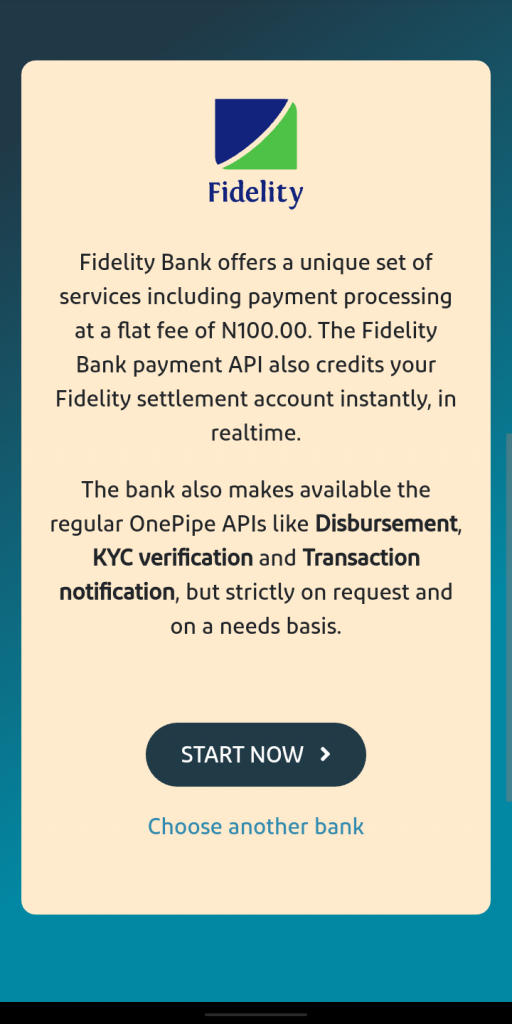

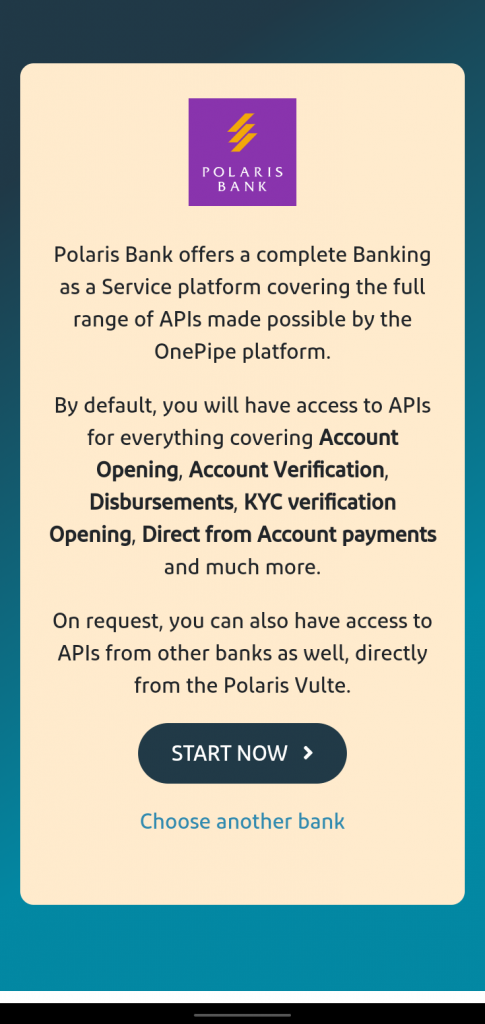

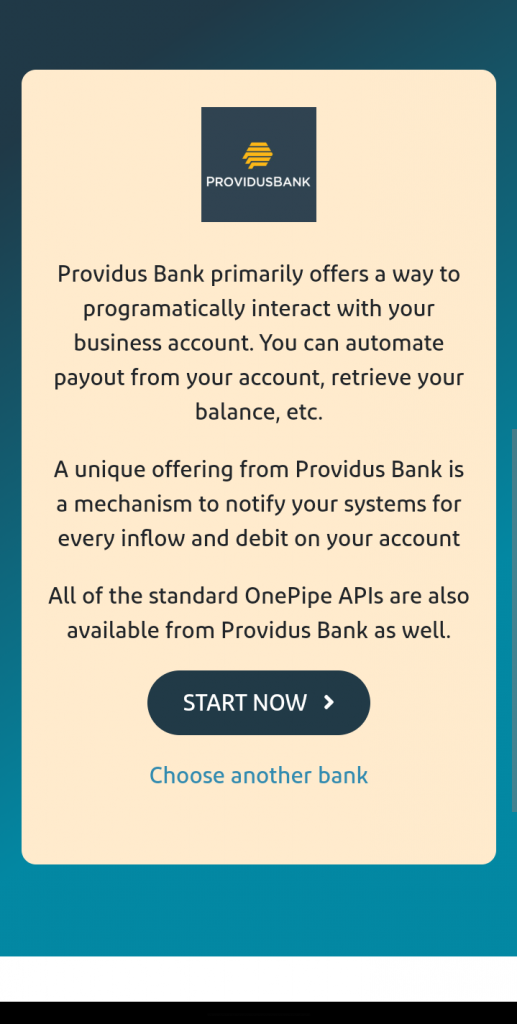

All of this is done without going through different contracts with different providers. Setting up the software starts with a signup process that collects personal details as well as BVN. Once the details have been submitted and approved, the user can set up the password and generate the API and secret key. A business account will be opened for the user with any of four partner banks; Fidelity, Polaris, Providus and SunTrust.

The bank will reach out to the user to obtain KYC information as mandated by the CBN before the service will be allowed to go live. It is this account that all charges for API access will be deducted from and all income paid into.

Through the platform, entrepreneurs can add multiple payment service providers for the same business app (web or mobile), or do the same for multiple apps. Services such as card-charging, statement lookup, account debit, bill payment, airtime purchase, instant loans and KYC lookup services can be accessed through the API whether as a business, bank or fintech.

In the case that a payment gateway is experiencing downtime, Onepipe users can switch between different providers to continue with operations.

Some of the services listed above are provided by different financial operators but all of them can be used from Onepipe’s API without integrating each one. Based on the quality of service, cost and other business considerations, you can switch from one provider to the other. The providers available on the startup’s channel include QuickTeller, Rave, Paystack, Interswitch lending services and Secondscore.

The cost of using Onepipe

Using the software incurs different charges based on the bank host that the user selects. SunTrust Bank charges N52.50 flat rate for payment processing and instantly credits the bank account while Fidelity Bank charges N100 for payment processing. The API functionalities of Onepipe are also available with whichever bank is hosting the user. From the bank charges, Onepipe takes a percentage cut as its own payment.

Funding

OnePipe raised $950,000 in a pre-seed round from investors in 2020. Investors that participated in the round include Atlantica Ventures, DFS Lab, Future Perfect Ventures, Ingressive Capital, P1 Ventures, Raba Capital, Sherpa Africa, Techstars, and Zedcrest Capital. OnePipe is also one of 10 startups that joined Techstars New York Accelerator summer programme in July 2020.

In summary, there are tons of payment gateways available today. But access to more than one has always been a tad more complicated and time-consuming. Onepipe makes it easy to access as many as are available without extra complications.