Ghana-based fintech startup, OZÉ has closed a $700,000 seed funding round to drive growth for African businesses and fuel its expansion into Nigeria.

The seed round was led by Venture capitalists Anorak Ventures and Matuca Sarl together with Ingressive Capital, MEST and Nigeria’s Rising Tide Africa. This follows undisclosed funding raised from Anorak Ventures in December last year.

Speaking on the latest funding, OZÉ co-founder and COO, Dave Emnett revealed that the fintech startup is working with Paystack as part of its expansion plans to Nigeria.

I couldn’t be more excited about what’s next for OZÉ. We’re integrating with Paystack and other PSPs to allow our SMEs to accept and send payments through the app and partnering with more financial institutions to expand on the success of OZÉ’s approach to lending.

Dave Emnett, OZÉ co-founder and COO

Having raised up to $565,000 in pre-seed and seed capital over 7 rounds since 2017, the latest seed round brings OZÉ’s overall funding to $1.27 million.

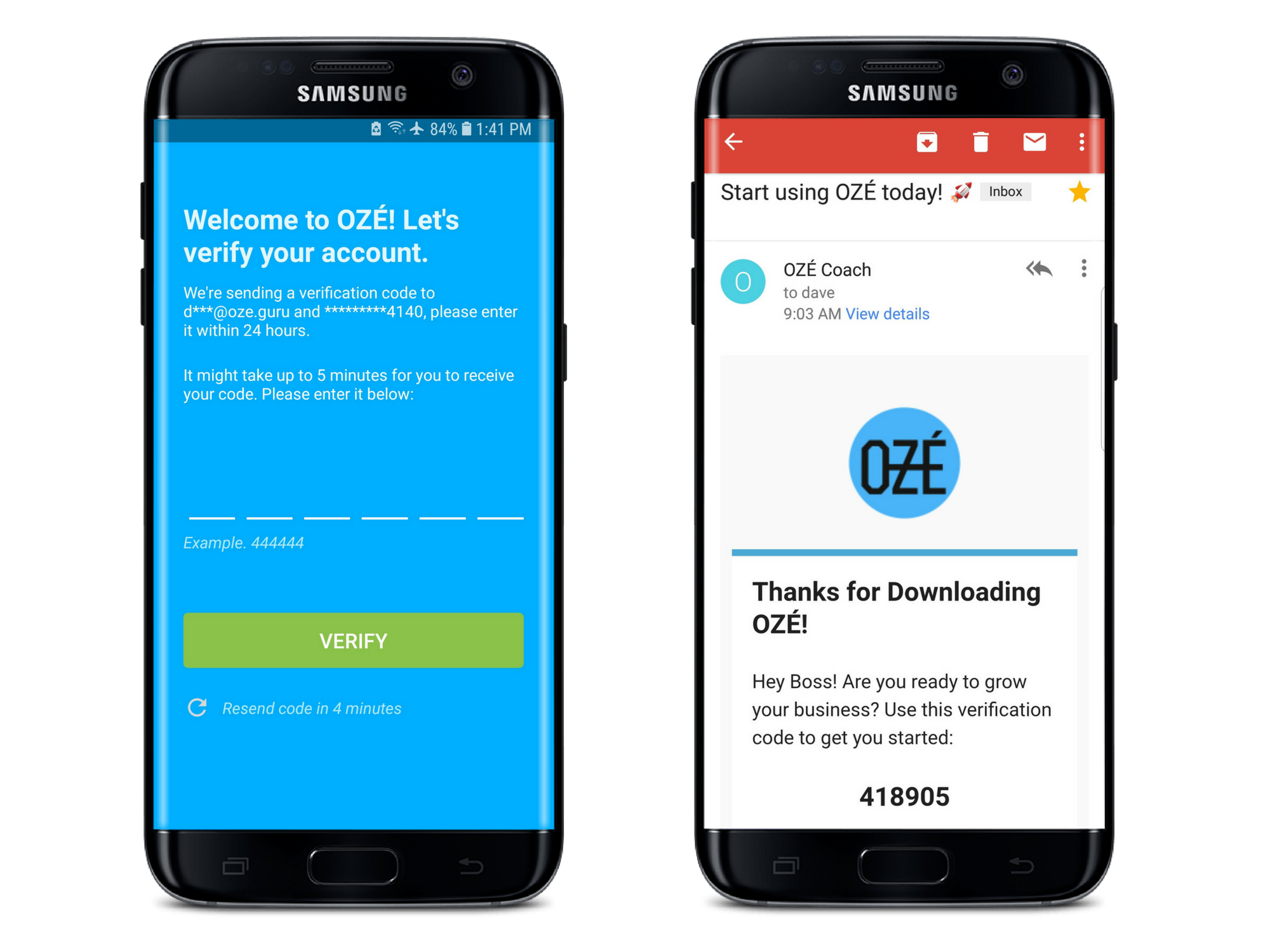

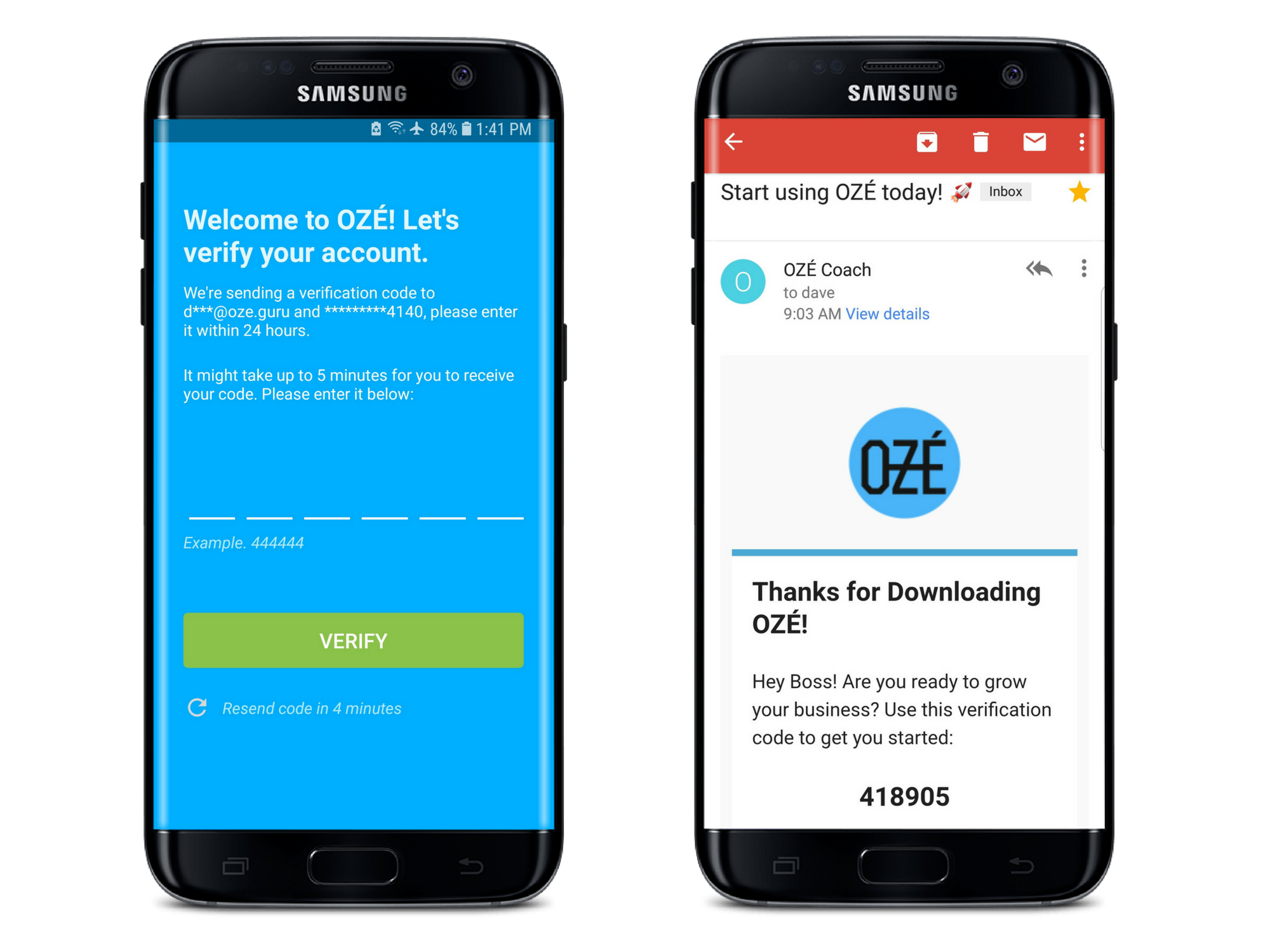

Founded in 2016 by Meghan McCormick and Dave Emnett, OZÉ provides a platform to help drive growth for micro, small and medium-sized enterprises (MSMEs) in Africa. Using the OZÉ mobile/web app, businesses are able to manage tasks and operations including tracking sales and expenses, sending digital receipts and invoices as well as accessing credit loans.

OZÉ aims to leverage the latest seed funding to expand into Nigeria and promote the newly released iOS version of its business app. Since launching its beta app in 2018, the fintech company has gained more than 25,000 users and processed up to 250,000 transactions worth over $50 million.

With the MSME credit gap in Sub-Saharan Africa estimated at $331 billion, OZÉ aggregates data using a unique machine learning algorithm and partners with banks to provide MSMEs with no-collateral loans via its platform.

Armed with $700K in added capital, the Ghanaian fintech is planning to venture into Nigeria’s fast-growing mobile lending space dominated by the likes of Carbon, Branch and Fairmoney.