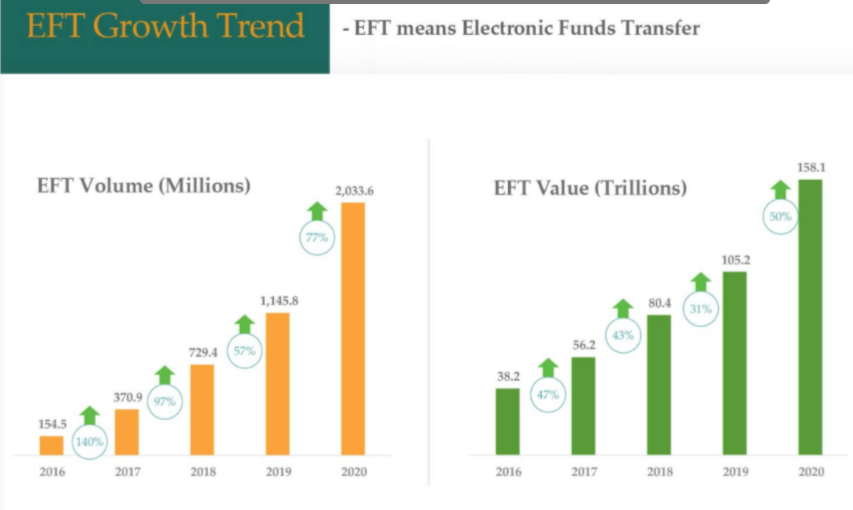

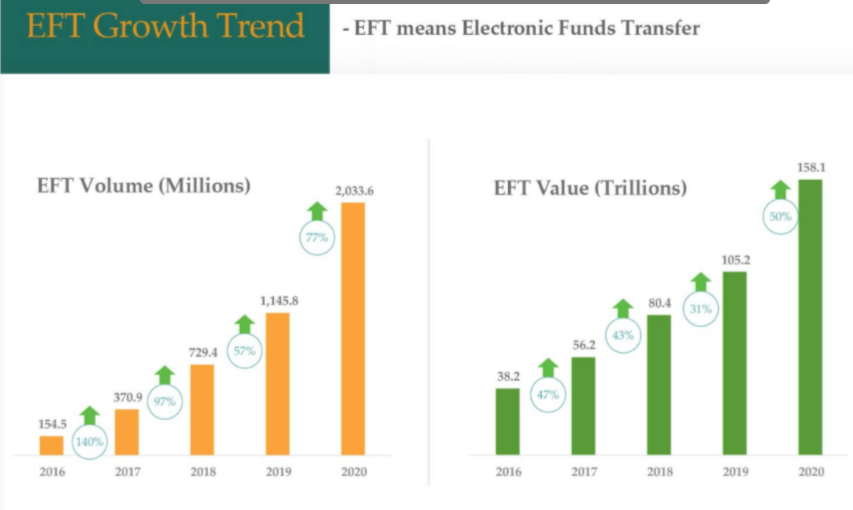

The adoption of e-payments in Nigeria has been significantly accelerated by the COVID-19 pandemic. In 2020, over 2.03 billion electronic transactions were performed, according to Nigeria Interbank Settlement System plc (NIBSS) Insights on Instant Payments.

This is a whopping 77% increase from 1.14 billion transacted in 2019. Similarly, the value of the electronic transaction rose significantly, recording a 50% rise from N105.2 Trillion in 2019 to N158.1 Trillion in 2020.

In addition to that, the number of banked Nigerians increased during the course of the year. The NIBSS revealed that the number of unique accounts that carried out an instant payment transaction rose from 29.4 million to 35.4 million in 2020.

The report attributed the boom to the transition of people to electronic channels for funds exchange following the government imposed lockdowns.

USSD grows by 80% in 2020

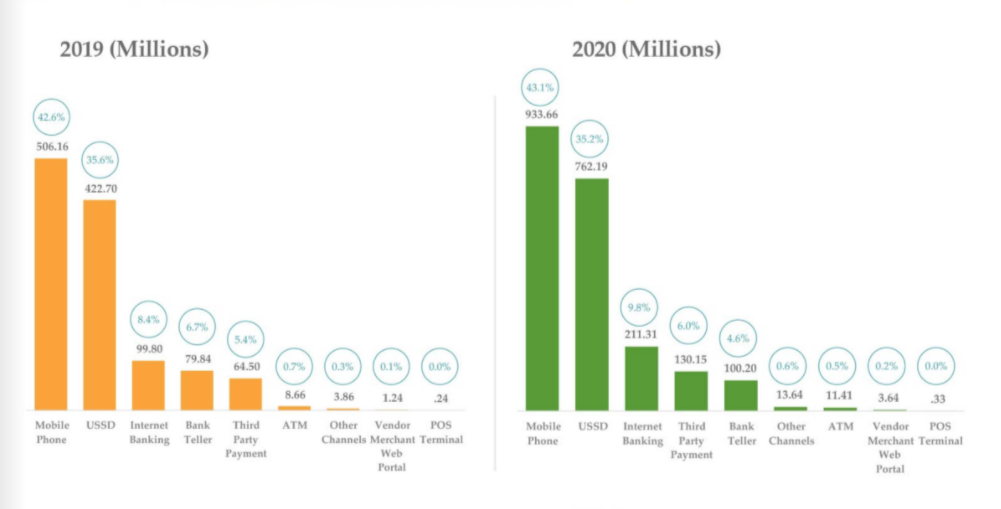

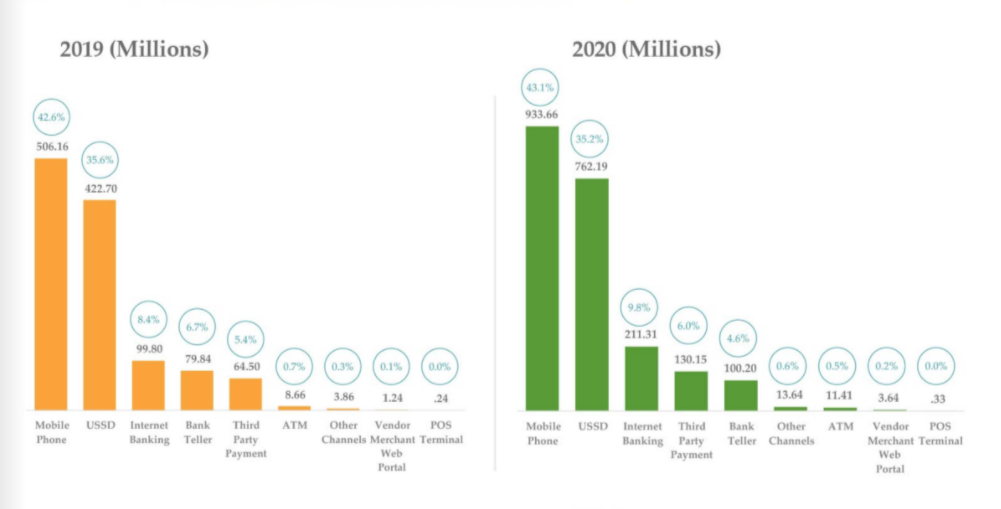

In terms of transaction channels, Mobile remains the most preferred channel, rising by a remarkable 84% to contribute 43% of total transactions during the year.

USSD comes second with a growth of 80% to secure 35% of the total Instant Payment (NIP) transactions. This means that the total number of USSD transactions in Nigeria rose from 422 million in 2019 to 762 million in 2020.

At number 3, Internet Banking transactions also showed incredible growth rising from 99.8 million in 2019 to 211.3 million in 2020. This represented about 10% of the total transactions.

Other channels like Third-party payment operators (6.0%), Bank Teller (4.6%), ATM 0.5% and POS Terminals contributed the remaining instant payment transfers in the country.

Generally, the numbers indicate that a whopping 78% of total transfer transactions were carried out using a mobile device. This can be attributed to the move away from physical channels during the lockdown.

Also, the use of ATM for transfers is dropping. Its contribution to the total NIP transaction during the year fell from 0.7% in 2019 to 0.5% in 2020. Similarly, the use of POS for transfer was less than 1% of the total NIP for the year.

All this points to the fact that the ATM and POS channels are more used for withdrawal and transactions and not transfers.

Youth Boost Adoption of Electronic Payment

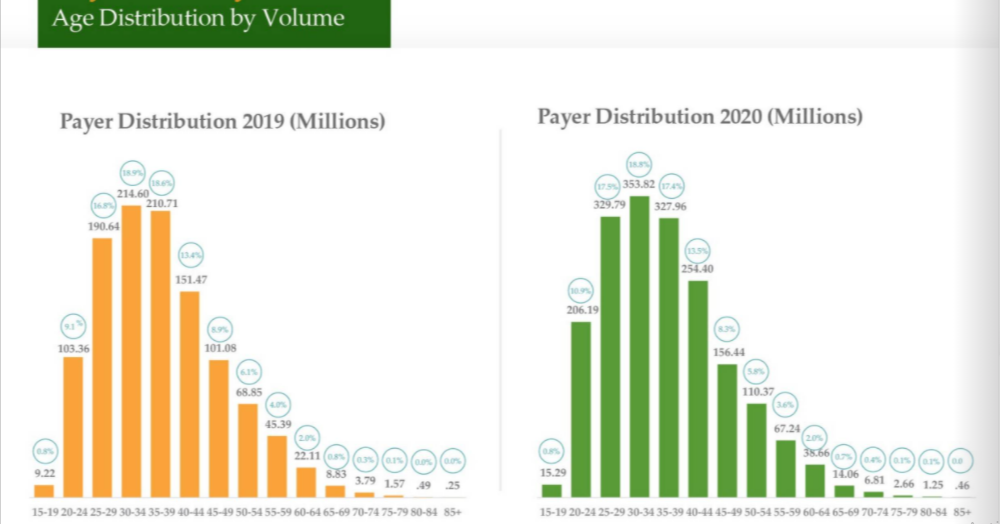

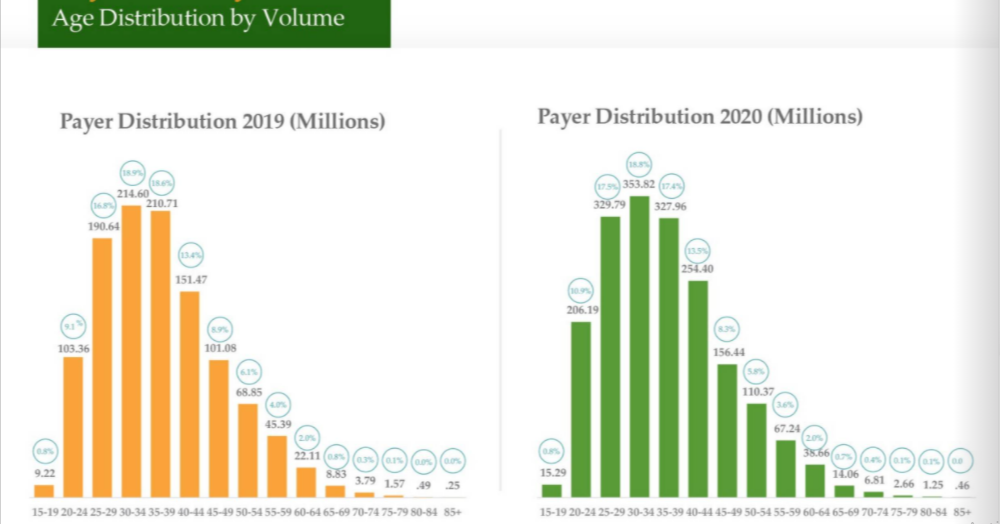

In terms of age distribution, the youths are leading the adoption of instant payments in the country. According to the report, Nigerians between the ages of 25- 34 years carried out about 36% of all the interbank NIP transactions in 2020.

Similarly, adolescents and youths between the ages of 15 and 24 saw a spike in adoption. Their age group saw an incredible growth of 97% to contribute about 12% of the total NIP.

The growth can be traced to the increasing mobile and internet inclusion especially within the youth population. This is because they are more likely to adopt electronic payments.

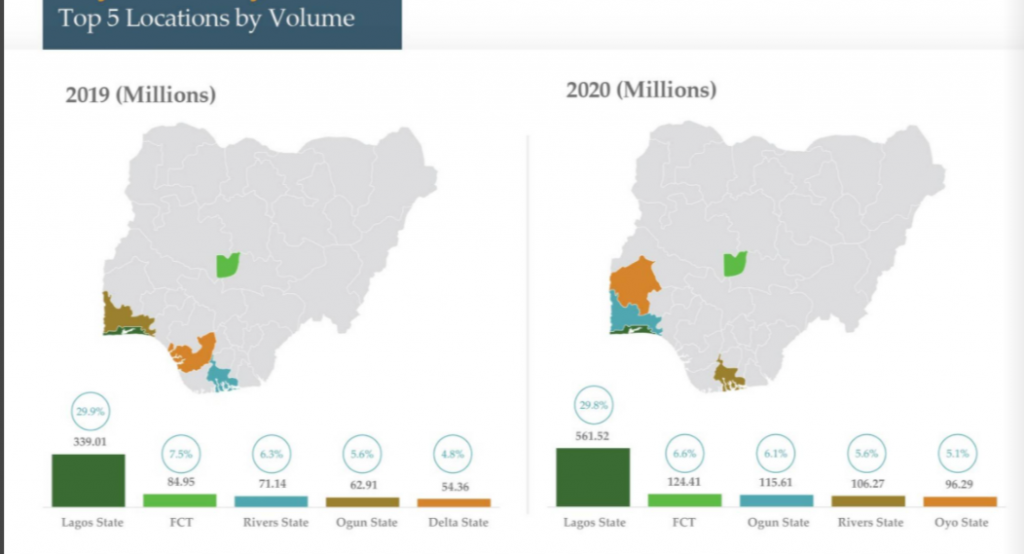

Lagos Remains the Hub for Electronic payments

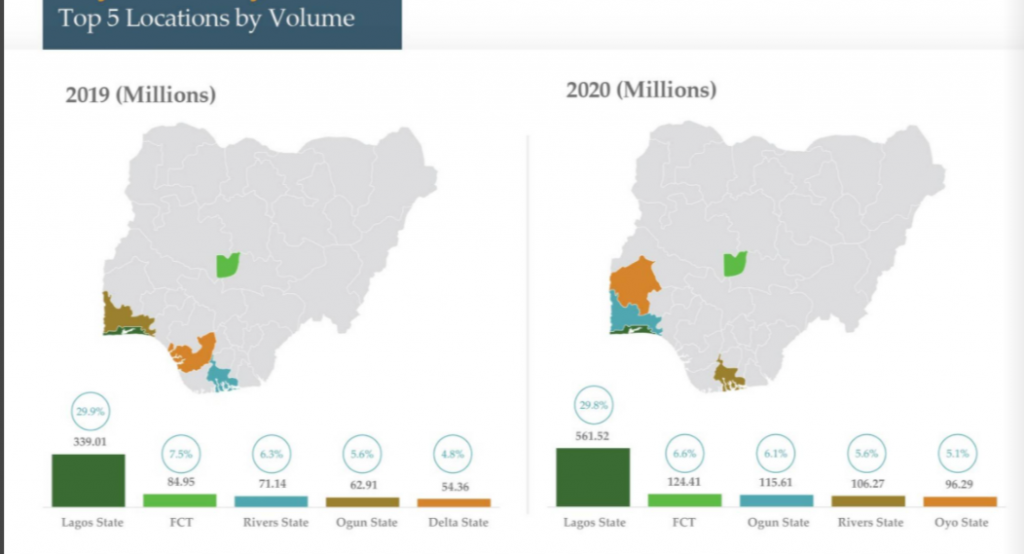

According to the report, Lagos remains the biggest hub for electronic payments in the country.

Residents of the country’s economic hub were responsible for more than 30% of the total NIP transactions initiated by Nigerians.

While this is not unsurprising the gap between the contribution of Lagos and the next state on the chart – FCT (7%) is too large. This shows that the spread of the growing adoption of electronic payment is not even across states.

The stats of the remaining states in the top 5 – Ogun (6%), Rivers (6%) and Oyo (5%) confirms the gap.

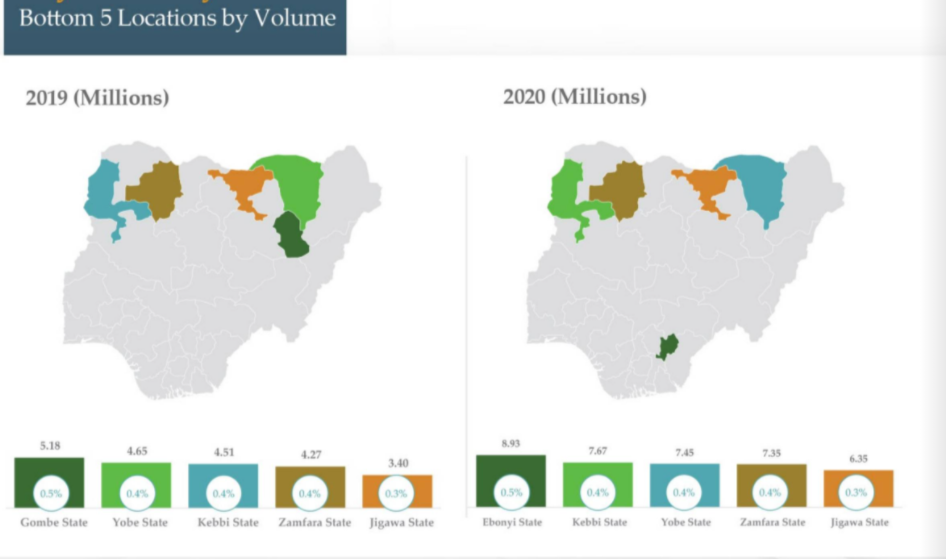

On the bottom end, Yobe (0.4%), Zamfara (0.4%), and Jigawa State (0.3%) lead the charts. Their poor level of electronic payment adoption can be attributed to several things including the low financial, mobile and internet inclusion in the region

In Summary

Nigeria has the fourth-largest unconnected population in the world – 58% just below China and India.

However, with over 49.5% smartphone ownership and an estimated 97 million already mobile internet users, there is a strong prospect for continuous growth in the coming years.

NIBSS agrees, forecasting significant growth for NIP in the short-medium term due to the strong indicators from mobile and USSD payments.