More Nigerians are opting to use Mobile Money and Electronic Banking for transactions following the lockdown imposed by the government.

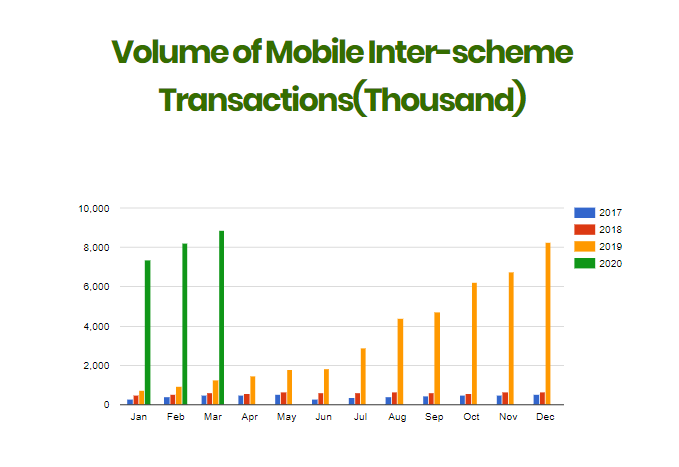

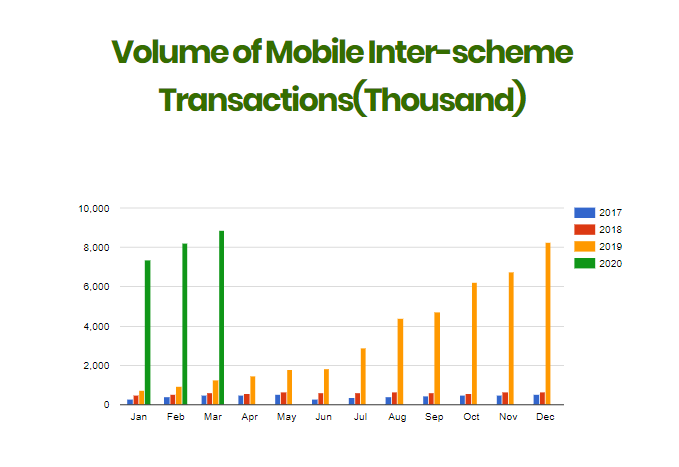

The volume of transaction performed using mobile (Inter-scheme Transactions) increased from 8.2 million in February to 8.8 million in March, according to the Nigerian Inter-Bank Settlement System (NIBSS) report.

The total amount of transactions performed using electronic payment like Point of Sale (POS), internet banking, USSD and web payment using cards also increased significantly.

14.5% increase in the value of Mobile transactions

Following the restriction of movement caused by the lockdown, many Nigerians who normally would have gone to banks to get cash opted to use their mobile for transactions.

The total value of transactions performed using mobile increased by 14.5% in March. The value rose from N148.3 billion in February to N169.8 billion in March.

Over 52 million POS transactions

Apart from Mobile, POS also recorded a significant double-digit growth of 13.4% in usage. The use of POS increased to 52.2 million from 46 million that was recorded the previous month.

Similarly, the value of transactions performed using POS also increased by about N42.8 billion to record a total of about N368.8 billion in March.

Increasing use of card payment and internet banking

With the lockdown in place, the physical purchase of food and other basic items became difficult and inconvenient. E-commerce is an alternative that provides Nigerians a mode of ordering groceries and other necessities.

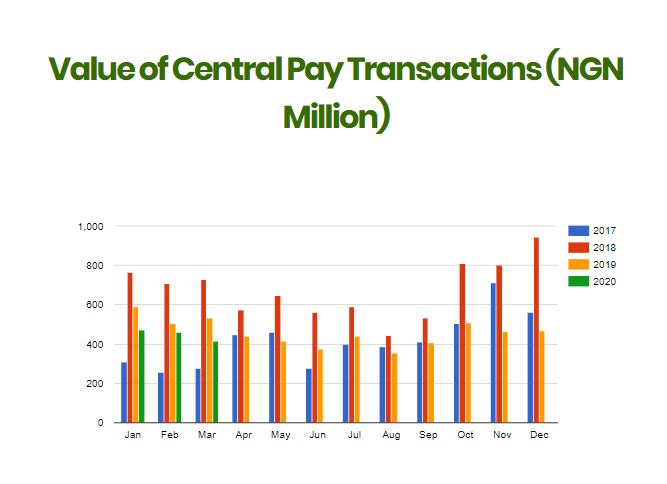

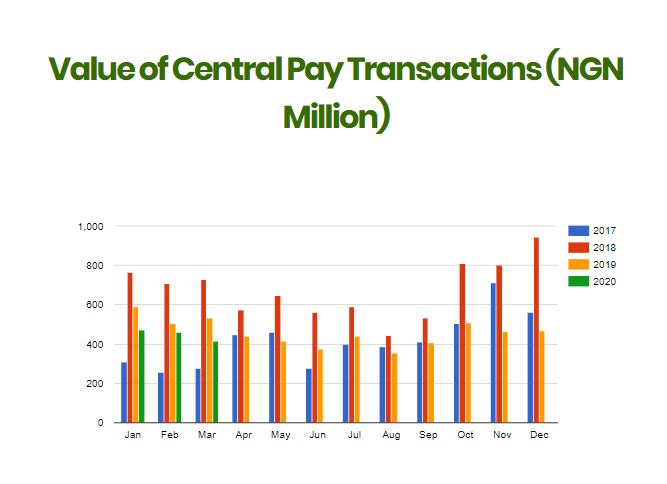

The volume of payment performed using Central Pay increased to 48.5 thousand from the 47 thousand recorded in the previous month.

Central Pay is a payment gateway solution that enables online payment through web pages of e-commerce and online merchant enterprises.

However, the value of transaction performed using Central Pay decreased by 9.2% to N416.4 million.

Cental Pay uses web payments through ATM cards and Internet Banking

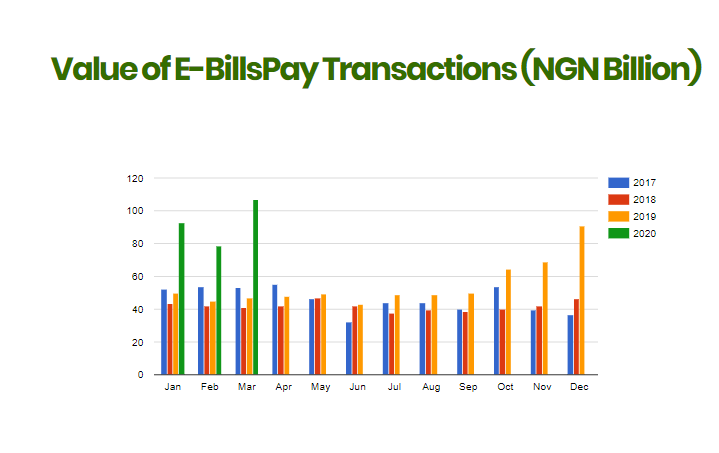

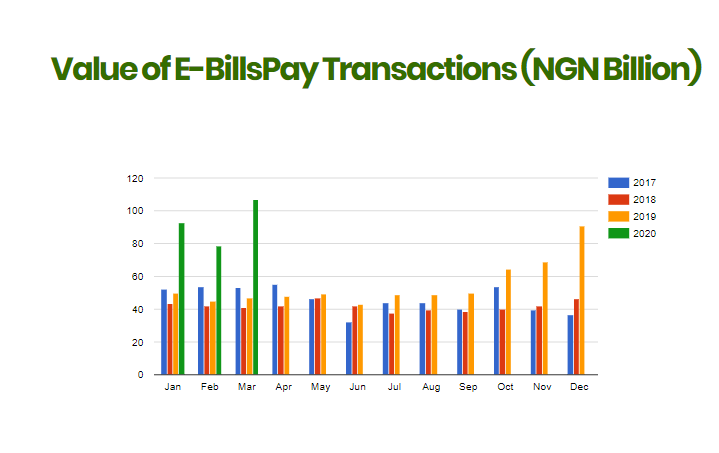

More Nigerians paid their bills electronically

Physical payment of bills and services like power is almost impossible as the doors of most organisations like Eko electric are shut. Electronic bill payment provides a system that can allow easy payment and services even while at home.

E-bill pay allows payment of bills and services like airtime, power, water, DSTV subscription among others. According to the report, the value of transaction performed using e-bills pay increased by 36.6% to N107.06 billion.

However, the volume of transaction performed using e-bills reduced to 80.4 thousand from the 85 thousand registered in the previous month.

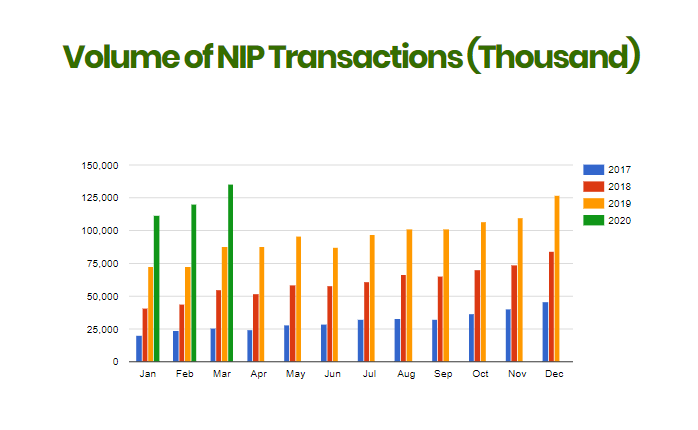

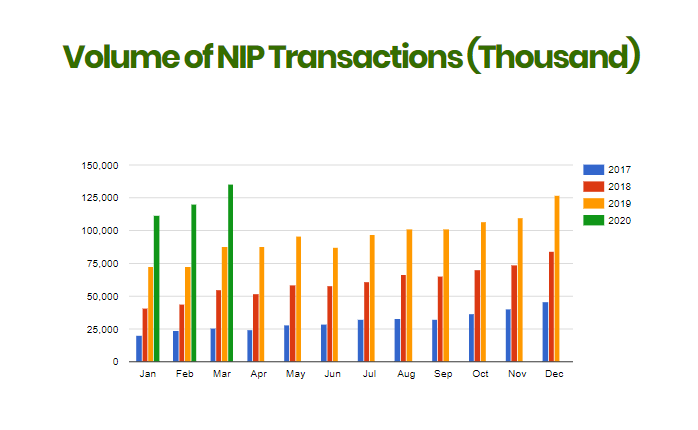

over 135 million NIP transactions

The number of transactions performed using NIBSS instant payment (NIP) was over 135 million in March. This is a 12.5% increase from the 120 million transactions recorded in the previous month.

NIP is an account number based online real-time interbank payment solution. This means that more than 135 million bank to bank transfers were completed in March.

The value of transactions performed using NIP also increased significantly. The value rose by about N1 trillion, jumping from N9.9 trillion in February to about N10.9 trillion in March. This indicates a reduction in the volume of cash to bank transfer.

In conclusion, NIBSS numbers show an all-round increase in the use of different digital banking solutions in the last month. The increase appears to have been caused majorly by the fact that millions of Nigerians who are stuck indoors are forced to leverage technology.

With the lockdown extended for another two weeks, many more Nigerians who are accustomed to cash transactions may be forced to turn towards digital banking.