The Central Bank of Nigeria (CBN) has announced that Nigerians will get N5 for every dollar they receive as remittance from abroad.

Dubbed the “Naira 4 Dollar” Scheme, the CBN explained that the new scheme is an incentive to encourage the inflow of diaspora remittance in the country.

This new scheme comes just months after the CBN stopped the collection to Naira remittances in its amended remittance law.

Funds sent from outside the country will no longer be received as Naira

Remittance in Nigeria

Bank and wire transfers are the most common ways of sending money to Nigeria. However, they are very slow (1-4 working days) and come with a high rate.

When sending money to Nigeria from the United States using bank account transfer you are paying for the outgoing fees, flat fees, currency exchange rate markup, and sometimes an additional incoming transfer fee.

This made online money transfer services and crypto exchanges which offer lower rates more attractive to Nigerians in the diaspora who wanted to send money into the country.

However, the new laws by the CBN have significantly adjusted foreign remittance in the country. The integrations and collaborations between mobile money operators, Switches, Payment Service Providers, and International Money Transfer Operators (“IMTOs”) have been banned.

This means that the online Wallet, Mobile money and other options that allowed for cheaper and faster diaspora remittance have been blocked.

Similarly, the CBN recently made a regulation banning the use of cryptocurrencies in the country thereby shutting down cryptos as a means of remittance.

This leaves the option of Nigerians receiving the funds as cash in foreign currency or having their domiciliary account credited. This means that only DMBs can pay beneficiaries of diaspora remittances.

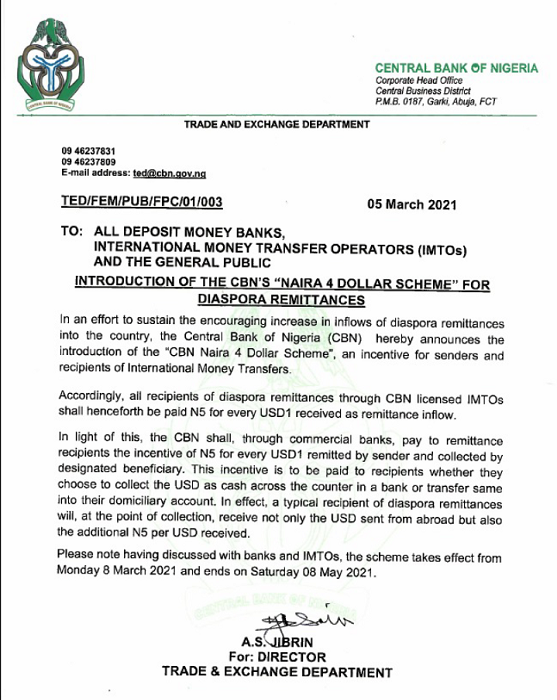

CBN New incentive

After thinning the means by which remittance is coming into the country, the CBN is looking at ways to encourage people to accept its selected means of collecting remittance.

According to the apex bank, all recipients of diaspora remittances through CBN licensed IMTOs shall henceforth be paid N5 for every $1 received as remittance inflow.

The CBN added that the payment will be made through commercial banks by the designated beneficiary.

Does CBN’s N5,000 for every $1,000 help?

Before now, IMTOs like Western Union and World Remit have been able to drop the cost of remittance by offering online wallet to replace banks. However, the ban has since taken that option away.

This means that remittance senders will have to pay more than they normally do to send money to Nigeria. CBN’s N5 appears as a means to reduce that but by how much?

Western Union charges between $0.99 to $45 for transfer to a bank account. In comparison, 1 dollar is currently about N411.54. This means that over $82 must be sent in remittance for CBN Naira 4 Dollar scheme can even have an effect on the high transfer rate.

This applies across the board as other IMTOs like Transferwise and World Remit charge between $3.09 to $37.44 and around $0.8 respectively for a transfer to a bank account.

In summary

Remittance inflow significantly affects the Nigerian economy, it influences the Nigerian exchange rate and strengthens the economy.

Nigeria’s current annual remittance inflow is about $24 billion but to the CBN Governor, Mr. Godwin Emefiele revealed that there has been a significant drop in inflows.

The latest incentive amongst others appears to be the CBN strategy to improve remittance inflows into the country.

56 million (56%) Nigerian adults are unbanked. With online wallets banned the percentage of the remittance they contribute would be lost.

However, with the incentive and remittance collection only available to domiciliary account holders, many banked and unbanked Nigerians may not be unable to receive remittance at all.

Notwithstanding, if the CBN scheme works and remittance increases. This could help in improving Nigeria’s balance of payment position and the foreign exchange rate; reducing dependence on external borrowing and mitigating the impact of COVID-19 on foreign exchange inflows into the country.

The scheme starts on Monday 8 March 2021 and ends on Saturday 08 May 2021.