Remittance is a major source of cash inflow for any country. Each year, over $30 billion in remittances is sent to sub-Saharan Africa by the million African migrants living overseas.

The cross-country transfer of funds not only help households pay for housing, healthcare and education, it also benefits developing countries like Nigeria by boosting foreign reserves, and GDP.

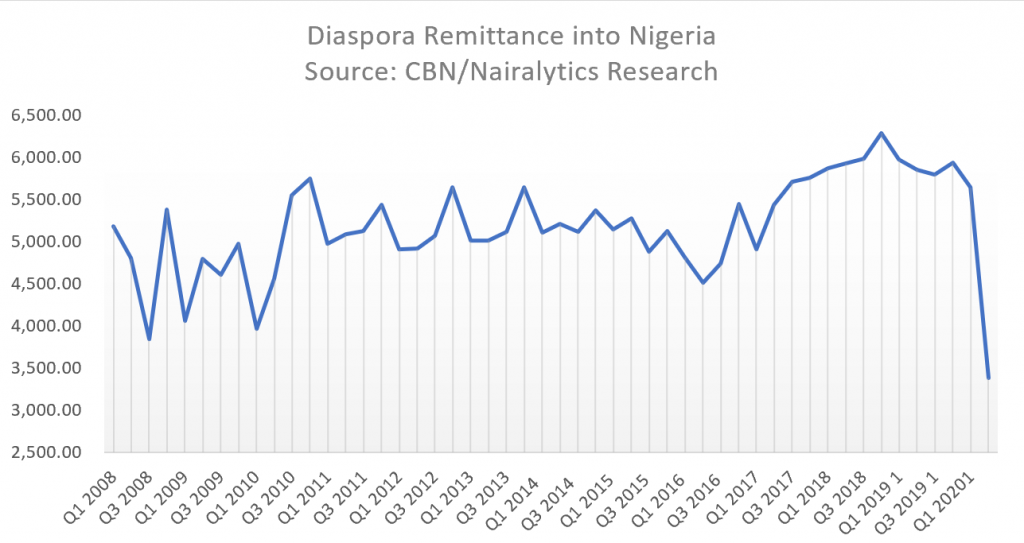

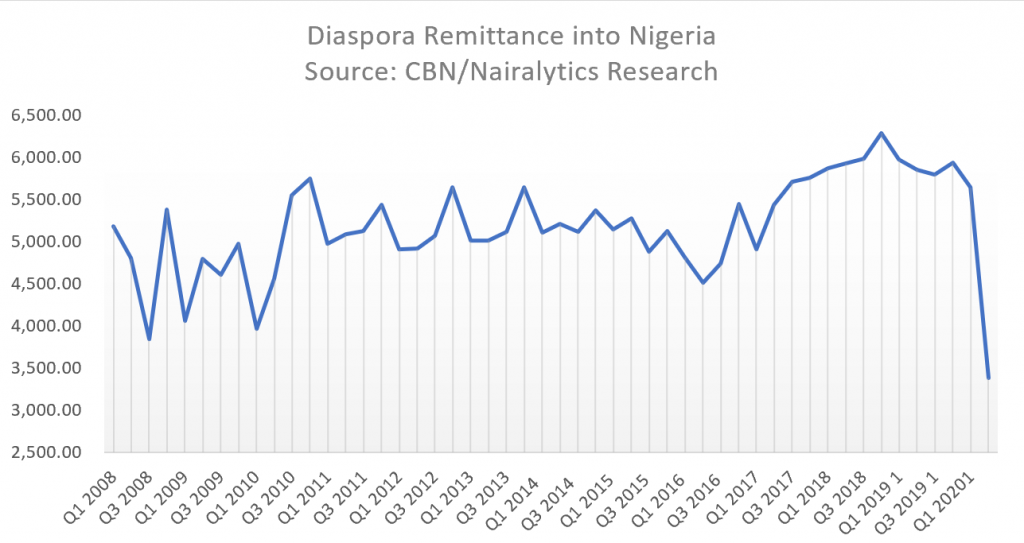

As the COVID-19 pandemic and resulting economic crisis continues to spread, new data has shown that remittance flow across the world has dropped significantly.

According to the World Bank, remittance flows to low and middle-income countries (LMICs) are projected to fall by 7%, to $508 billion in 2020, followed by a further decline of 7.5%, to $470 billion in 2021.

Nigeria was hit hard as remittance flow from abroad dropped to its record lowest since 2008. Stellar, an open-source and decentralized payment network is providing a platform to host fintech companies that can help increase remittance flow into the country.

Over the last 6 years, several companies and payment gateways have been hosted on the Stellar Network across 10 countries. And some of the companies on the network are now transacting hundreds of thousands of dollars.

Stellar Network

Apart from hosting fintech companies, Stellar has several features that can help remedy the issues plaguing remittances in Nigeria and around the world.

Lisa Nestor, Senior Strategist of Ecosystems at the Stellar Development Foundation in a chat with TechNext explained that Stellar removes the high cost of creating a remittance infrastructure.

She added that launching a remittance infrastructure on the network is free and super easy to use. This, according to her, helps companies focus their time and capital on building more localised products and experiences for their users.

To add to that, transaction on the network supports a variety of payments use cases like Bitcoin. It is also very fast and cost-effective, charging just a fraction of a cent.

The network supports businesses through the Stellar Development Foundation (SDF)

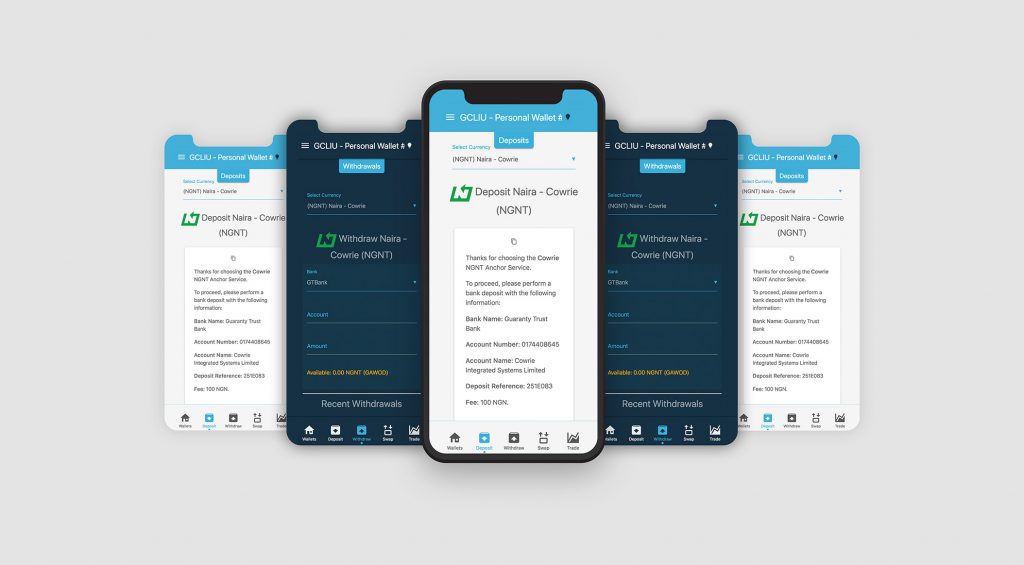

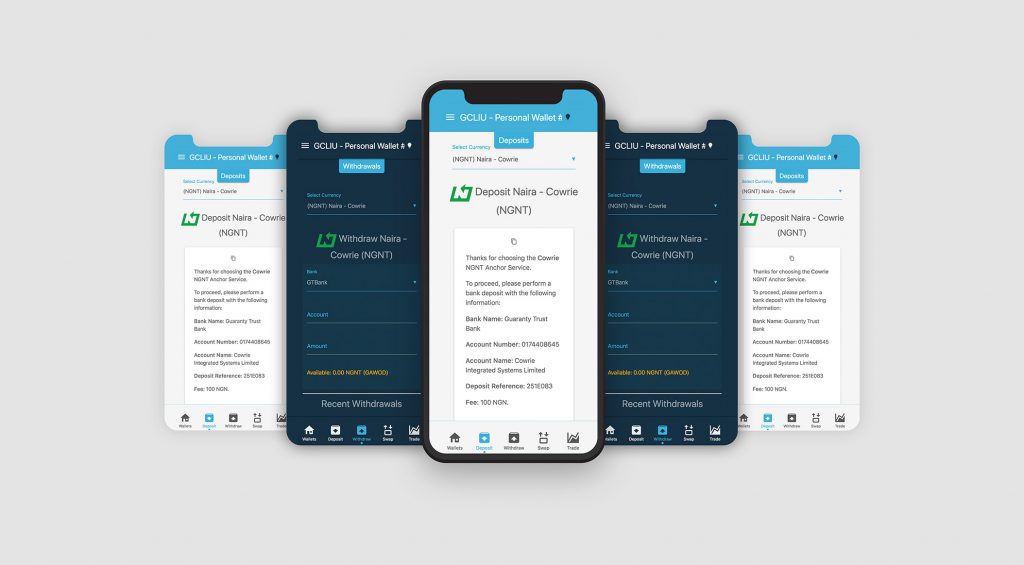

Cowrie Exchange Integration – Anchor

In Nigeria, there are several companies using Stellar’s Network. According to Lisa, the exact number of companies using it is unknown because the network is an open one.

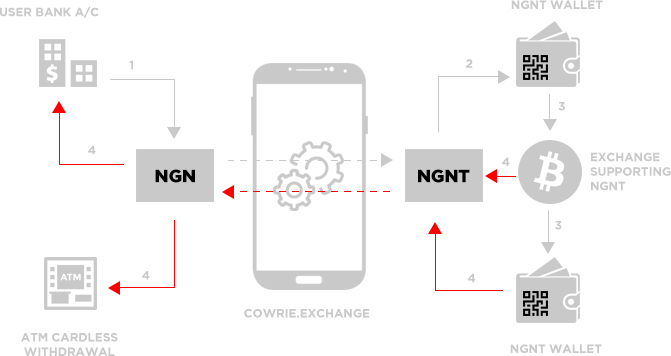

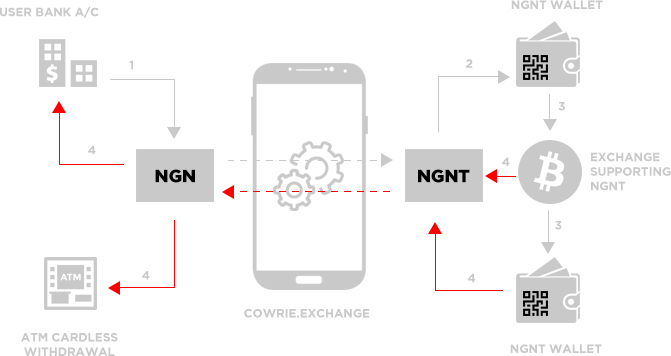

However, she listed Cowrie Exchange as a major Nigerian Fintech Company whose payment system is built on Stellar’s network. Lisa explained that Cowrie Exchange is an Anchor, a payment bridge that serves as a link between the Nigerian Inter-bank Service System (Nibss) and Stellar.

Using Cowrie integration, one can execute payment into and out of Nigeria

She further expatiated that the bridge – Cowrie Exchange integration is basically open-source so other companies can use the integration to facilitate transactions like cross-border payments or remittance in Nigeria.

There are at least 6 companies currently using cowry integrations on the Stellar network and some of them handle remittances from Europe, South Africa to Nigeria.

Compliance and interoperability are standards for companies that are using Stellar. This makes it easy for platforms using Stellar to send money to each other.

Lisa Nestor, Senior Strategist, Ecosystem at the Stellar Development Foundation

How Stellar Network Works

There can be several anchors in a country. Stellar’s decentralised exchange and built-in liquidity functionality make it possible for a company to select the integration of an anchor or become an anchor for payments.

Just like there are different banks, in the future, I believe there will be different anchor options.

Lisa Nestor, Senior Strategist, Ecosystem at the Stellar Development Foundation

For example, Hubu wallet helps African migrants to South Africa who have difficulty opening a bank account to bank using the Stella framework. This way, they can send remittance easily to Nigeria in minutes.

It also has a function where crypto users can use Stellar to execute a part payment to send Lumens which will be converted to NGN on the backend while the front-end gives a different user experience depending on the payment company used.

This works by using anchors as bridges between the indigenous payment system and the Stellar network. In a case where remittance is being sent from the US, the fund passes through the ACH to an anchor in the Stellar Network and from the Stellar into an anchor like Cowrywise in Nigeria before entering into a bank account (Nibss).

This way each anchor takes care of the compliance and regulations needed for payments and transaction in their country. This makes the transfer of remittance easy and fast.

This also translates to the fact that any company joining the Stellar network will not have to create a new system for new countries when they expand.

State of Remittance in Nigeria

The economic effect of the COVID-19 pandemic has been significant on the state of remittance in Africa especially Nigeria. According to Lisa, macroeconomics factors affecting countries like the US which is Nigeria’s number 1 remittance source has led to the major decline.

She explained that the pandemic generally affected the American Economy and caused unemployment to rise by 30% thereby affecting remittance flow.

Other notable factors that drove the decline include weak oil prices and depreciation of the currencies of remittance-source countries against the US dollar.

Despite the decline, there are some positives in the sector. Lisa revealed that Inter-Africa remittances are growing very fast. She added that Cameroun is the 3rd biggest remittance source for Nigeria.

According to her, the Inter-Africa remittances space presents a market opportunity for entrepreneurs as its still widely untapped. She added that entrepreneurs and innovators can take advantage of Stella network to tap into the market.

While remittance from the US is largely digital with the presence of big fintech like WorlRemit, transfer of remittance is mostly still analogue. Using digital payments of remittance through fintech can significantly help boost its flow

Security – Fraud protection

Stellar is not only fast, it is also a secure means of remittance. Lisa explained that because the platform leverages other platforms like Cowry or Finclusive – technically users go through licensed financial institutions to execute payments on the network.

She added that these financial institutions have added layers of security and also perform due diligence like a KYC – Know your customers and KYB – Know your business.

Also, the network is transparent which makes it possible for the ledger of payments to be easily seen and monitored to know when a transaction was made from beginning to the end

However, Lisa revealed that there are other forms of liabilities like credit card fraud that was still being worked around.

Borderless payments

The importance of borderless payment keeps growing by the day. With e-commerce, freelancing and remote work becoming more popular across the world, the need for easy and seamless payment across countries keeps growing.

Lisa attributed this to Society being more global now. She explained that having borderless payment will not only boost the economy it will also make the society stronger.

If money can move like e-mail society will be stronger and better able to respond to crisis and opportunity

Summary

With the effects of the pandemic still visible, total recovery of remittances in Nigeria may not be happening soon. The world bank has already forecasted that the decline will continue into next year.

However, Lisa believes that the best scenario for recovery can be sooner (1year) but ties her forecast to the availability of vaccine and recovery of the global economy.