South Africa’s financial regulator, the Financial Sector Conduct Authority (FSCA) is moving to exercise firm control over all crypto services in the country after an alleged $740 million scam involving Bitcoin exchange, Mirror Trading International (MTI) Ltd.

Investigations carried out by the FSCA revealed that MTI had allegedly been running a multi million-dollar Ponzi scheme under the guise of a legitimate crypto trading platform. The Bitcoin scam is reportedly the biggest ever in South Africa.

FSCA Divisional Executive for Investigations and Enforcement, Brandon Topham told reporters that the authority is speeding up plans to regulate the trading of cryptocurrencies such as Bitcoin, Ethereum and Litecoin to clamp down on crypto scammers in the country.

At the point something becomes a Ponzi scheme, we have lost our jurisdiction. We need the police and the prosecuting authority to work fast and put people in jail.

Brandon Topham

Last month, the under-fire MTI – which claimed to have up to 23,000 BTC worth $740 million in investments, was liquidated by the FSCA pending a full-scale probe. Traders have since been unable to withdraw funds, with many already counting their losses.

I am one of many individuals who invested their money & Bitcoin with Mirror Trading International. Over the past few weeks tried to withdraw my dollars, but system consistently gave message it was not processing withdrawals. Whom do we contact in the So? African govt?

KNerd on Twitter

In a Telegram post in December, MTI management said that they were misled and that the company’s CEO Johann Steynberg may have absconded to Brazil.

The MTI scandal is not good news for South Africa’s crypto space, and an imminent draconian regulation could spell doom for many lawful operators.

Severe Crypto Regulations Looming

With the FSCA more triggered than ever to crack down on counterfeit operators, enforced regulations could seriously restrict the scope of crypto trading and undo the background work of authentic operators in the country.

As crypto services have boomed in South Africa, so has associated fraud. South Africa ranks third in Africa in terms of Bitcoin trading volume and posted over $96 million in P2P in 2020, trailing only Nigeria and Kenya.

Bitcoin scammers have taken advantage of this to defraud unsuspecting people looking to leverage crypto offerings. In July last year, investors lost about $13 million to an alleged crypto scam masterminded by Willie Breedt, CEO of the now-defunct VaultAge Solutions.

Mandatory Licensing Or Shut Down

Prominent crypto exchanges such as Luno conduct the bulk of their operations in South Africa. Much of the growth in crypto adoption is due to its autonomous nature, and this would not be the case when operators are mandated to obtain a licence or otherwise shut down.

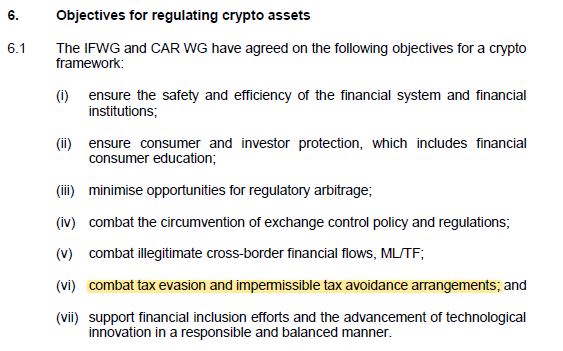

Under the proposed FSCAA regulation, crypto offerings are classified as “financial services”, meaning that issuers must obtain an FSP licence to operate legally within South Africa.

However, there is no assurance that a licence will be granted to operators even after the laborious process of applying and the payment of application fees. If the licence is granted, crypto exchanges may be compelled to increase commission charged on transactions such P2P trading and remittances.

Together with losing their autonomous business activity, higher charges could drive away a number of investors to unaffected foreign crypto platforms which will, in turn, cut down revenue.

Emerging Crypto Startups Less Likely to Survive

Early-stage crypto startups face the biggest risk amid pending stringent regulatory policies. The relatively low running cost for conducting crypto services would significantly shoot up when taxes, which could be burdensome for emerging legitimate exchanges, are factored in.

For emerging crypto startups that get through the licensing stage, the recurring taxes including income tax, capital gains tax and Value Added Tax (VAT) could disincentivise continued operations due to lower profitability levels.

Although operators could hike charges to recoup tax costs, this might end up being counter-productive in the long run.

In what appears to be a lose-lose situation for crypto players, South Africa’s scam-plagued yet fast-growing crypto space could crumble under harsh regulatory conditions.