In Nigeria, small businesses duly registered with the Corporate Affairs Commission are mandated to file and remit Value Added Tax (VAT) collected on sales of goods and services.

Value Added Tax is a federal tax administered by and payable to the Federal Inland Revenue Service (FIRS). The rate in Nigeria was increased on 1st February 2020 to 7.5% from a previous 5%.

Although the Value Added Tax is probably the most popular tax in Nigeria, it is only one of the taxes payable by small businesses in the country. Other taxes include Companies Income Tax, Stamp Duty Tax and Capital Gains Tax.

While the VAT is well-known, many Nigerian businesses and startups do not know how best to register and pay for it. As stipulated by the FIRS, the due date for filing Value Added Tax returns is the 21st day of the month following the month of transactions.

Failure to register for VAT in Nigeria attracts a fine of N10,000 for the first month and N5,000 for the subsequent months. If a business fails to register for the tax after a considerable period, the authorities will be obligated to seal up its premises.

Failure to remit taxes attracts a penalty of an amount which is equal to 5% of the tax payable in a year. The defaulting firm will also be required to pay interest on the sum owed. All payments must be made within 30 days of notification by the authorities or risk being sealed up.

Not registering and not remitting tax is clearly a serious offence. Thus without further ado, let’s tell you how to file for and remit your VAT to avoid the hammer.

How to File and Remit VAT

Here is a step-by-step guide on how to file and remit your VAT to the FIRS.

1. Audit Your Accounts

Before filing your VAT returns, your business’ financial accounts must be thoroughly audited for the accounting period under review. This will involve a detailed examination of financial documents – original bank statements, receipts, invoices, ledgers, checks and budget reports.

You may opt for an internal audit, which can be carried out by your company’s Chief Financial Officer (CFO). In the absence of a CFO, your business will require the services of an external auditor to conduct in-depth checks on your financials.

Data Analytics firms such as BFI Insights are well-equipped to carry out a successful audit of your financial records.

2. Fill the VAT Returns Form 002

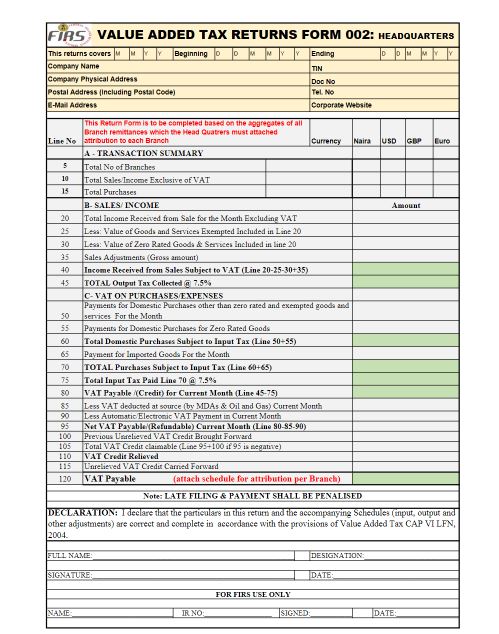

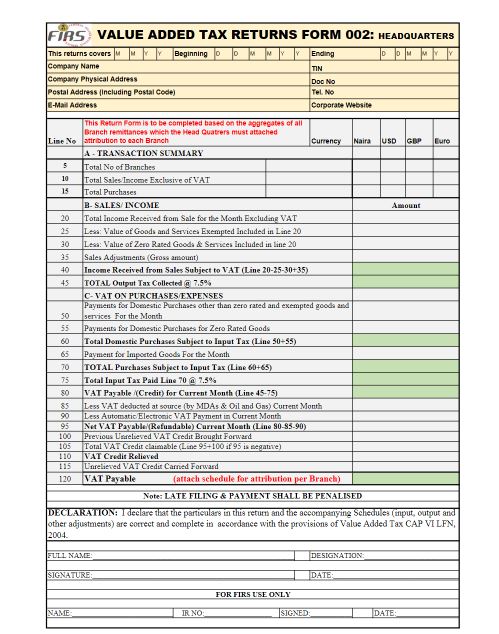

Proceed to the FIRS website and access the VAT Returns Form 002 here.

There are two Returns Forms – one for the business headquarters and another for each branch. If your company has no branch then it is the same as the headquarters and the data on the two forms will not be any different.

First, enter the date for your account reporting period then fill in your company’s name as well as the physical, postal and email addresses for your business.

Fill in your business’ 14-digit Tax Identification Number (TIN), 11-digit mobile number and corporate website. Input all required financial information based on expert auditors advise.

Print out original copies of the completed forms.

3. Remit VAT through the FIRS Payment Portal

Many business owners in Nigeria have found it very strenuous to pay for the VAT through banks. A big challenge with banks is the unavailability of their payment portal for long durations from time to time.

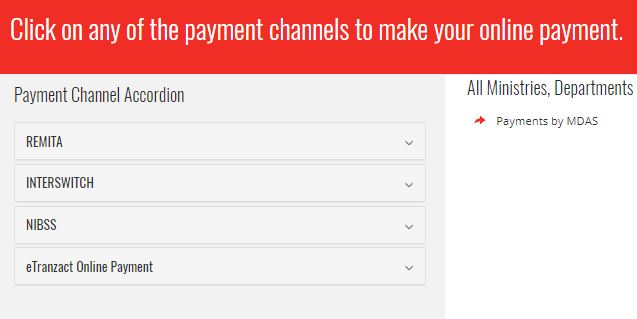

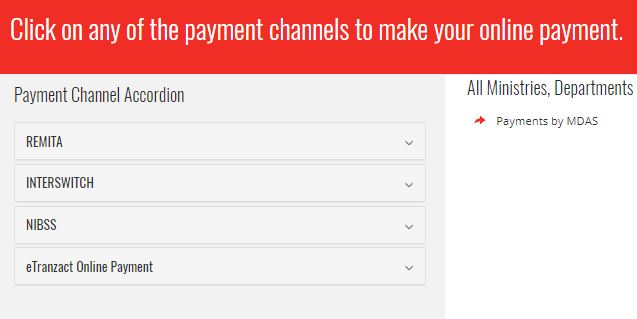

That said, the best way to pay for the VAT is through the FIRS payment portal.

A number of businesses prefer to process their remittance to the FIRS via “REMITA”, perhaps because it is the first payment option listed on the portal. However, you can also select from three other payment options – Interswitch, NIBSS or eTranzact online payment.

4. Proceed To VAT “Remita” Payment

The Remita option provides a fast and secure gateway for you to complete your VAT payment online without the stress of physically going to a bank.

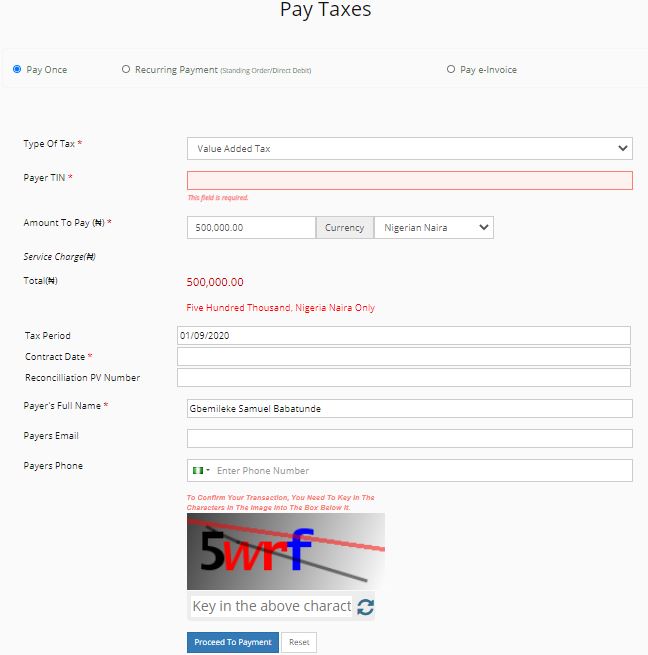

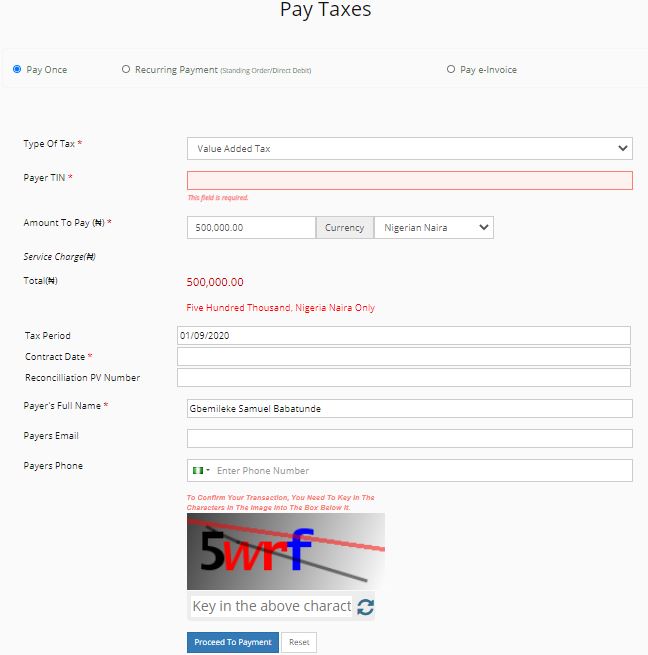

Click “Remita” then select Pay Online. You will be redirected to a “Pay Taxes” page. Select Pay Once. All asterisked (*) sections are required.

Select Value Added Tax as Type of Tax and enter your TIN. Fill in the payable VAT amount in Nigerian Naira, also input contract date and your full name.

Enter your email and phone number. Type in the case-sensitive image characters shown at the bottom of the page to confirm your transaction.

Click “Proceed To Payment” to complete VAT payment. Once your payment is approved as successful, a receipt of your transaction will be sent to your email. Print out an original copy of your receipt.

5. Submit VAT Forms & Receipt to FIRS Tax Office

After completing your VAT payment, go to your tax office along with original and photocopies of the completed VAT forms and receipt. The tax office will accept the original documents and stamp each of the copies presented.

Voila! You have successfully filed and remitted your Value Added Tax (VAT) to the FIRS.

If you don’t want to undertake this process yourself, you may decide to engage the services of a tax specialist.