M-PESA, Safaricom’s mobile money vertical, continues to dominate Kenya’s mobile money market. The company currently accounts for 98.8% of the 29.1 million registered mobile money subscriptions in the country.

According to the report by the Communications Authority of Kenya (CA), other players in the market have little presence with Airtel Money having just 1.1% and T-Kash at a 0.05% share.

M-PESA Leading Mobile Money Adoption In Africa

Since its launch in 2007, M-PESA has grown exponentially to become one of the largest mobile money services in Kenya and across Africa. Its service which offers mobile phone-based money transfer service and payments was an instant hit among the generally unbanked as it allowed them to send money as easily as a text.

M-Pesa services spread quickly, launching in Tanzania, Mozambique, DRC, Lesotho, Ghana, Egypt, Afghanistan, South Africa, India, Romania, and Albania. By 2011, it had become the most successful mobile-phone-based financial service in the developing world, having more than 17 million subscribers in Kenya alone. By 2017, the number of transactions processed on M-PESA yearly was over $1.7 billion.

In 2018, the number of MPESA agents across Kenya rose above 120,000 and Google Play store started taking payments for apps via its service. Today, its services remain impressively popular and robust with the company gaining popular partnerships with global fintech companies like Visa and Paypal.

Driving Financial inclusion with Mobile Money

M-PESA has been very successful in driving financial inclusion in Kenya due to various services that have been directed more towards the financially excluded.

By pioneering the repurposing of SIM cards and phone accounts into bank accounts for virtual currency, M-PESA single-handedly drove Kenya’s financial inclusion from 27% in 2007 to its current 82%.

Apart from allowing users to send money and make transactions through their feature phones, M-PESA had initiated several programmes that provided the low and small income earner access to phones that let them join the network.

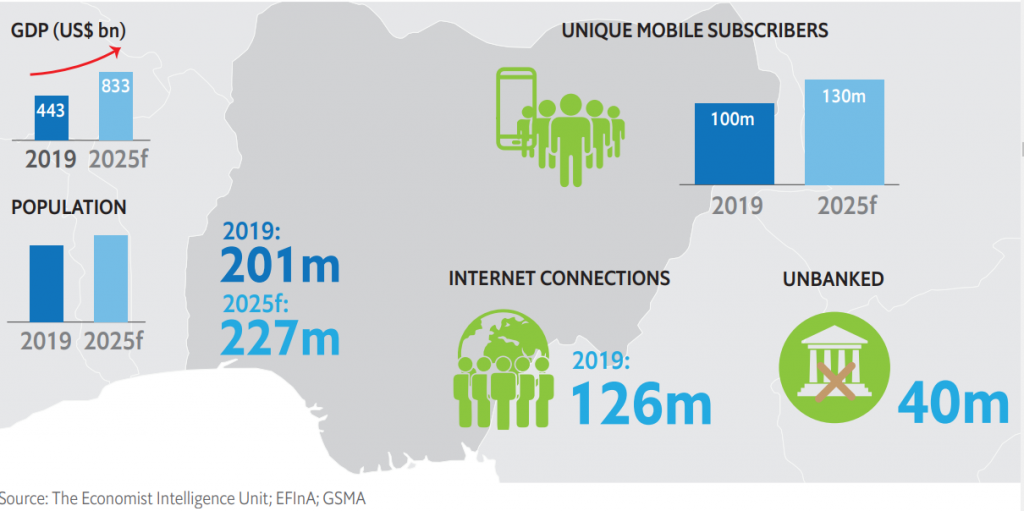

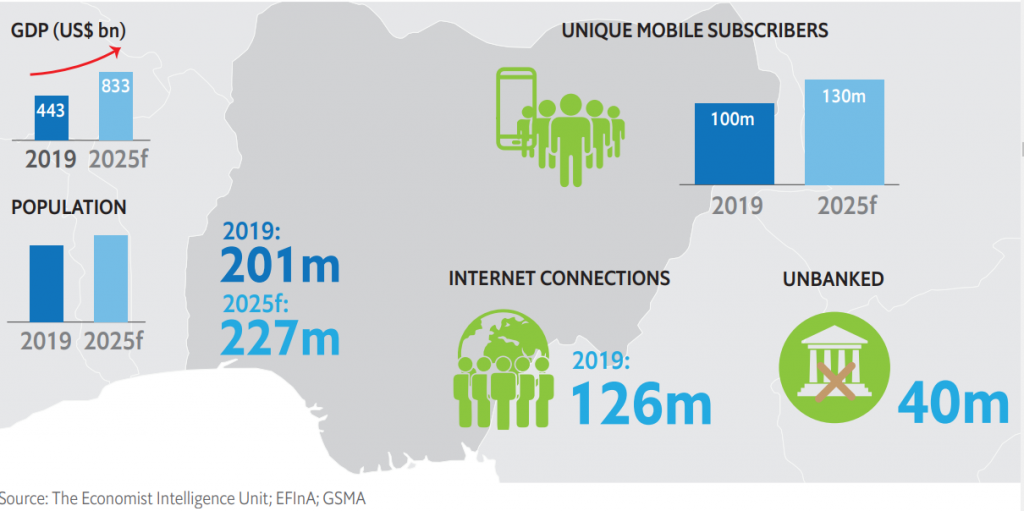

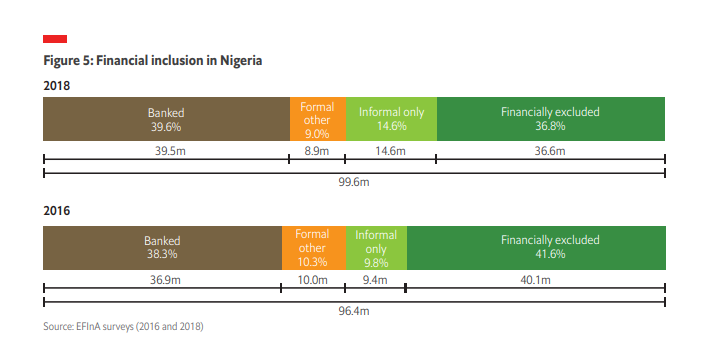

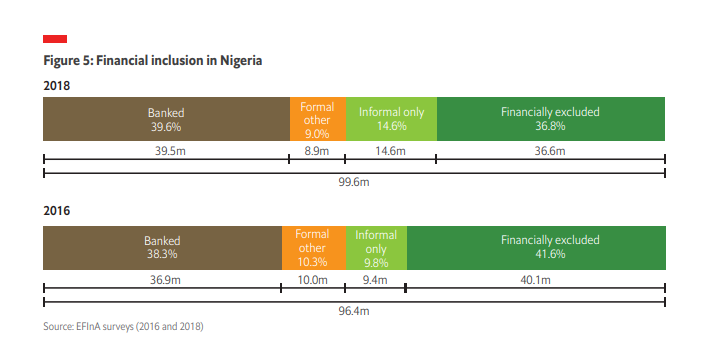

Although mobile money is growing in Nigeria, it does not have as much impact on the financially excluded in the country when compared to M-PESA impact in Kenya.

Mobile payments in Nigeria has increased by 391% since May 2019.

This is because mobile money services have not been championed among the majority of unbanked in Nigeria. Instead, it has become a major extension for banking services among the already banked population in the country.

73.2 million adults representing 41.6% of the adult population in Nigeria are financially excluded

Notwithstanding, Mobile Money still holds the secret to hastening financial inclusion in the country with the volume of transactions performed increasing gradually. In January 2020, the volume of mobile payments topped 7.4 million transactions, up from just 724,803 in January 2019.

Also, Nigerian mobile money services, OPay and Paga both reported huge growths, with OPay claiming it grew from 100,000 users in early 2019 to about 5 million in 2020.

With the current pandemic, mobile money is poised to keep rising in popularity as the uptick in transaction activity shows greater adoption of payments using mobile phones.

This growth could translate to significant financial inclusion in the coming months if mobile money services focus their efforts on the financially excluded regions in the north instead of the megacities like Lagos and Abuja.