The Nigerian fintech sector is thriving, both in the area of developing solutions and raising of investments. This was the general consensus during the soft launch of an Economist Intelligence Unit (EIU) Research on Fintech in Nigeria with the support of Mastercard and MTN.

The report tagged “State of Play: FinTech in Nigeria”, was presented during a webinar hosted by Camelia Oros. Camelia is Managing Director at CT production, an agent for the economist in West Africa.

The webinar was a forerunner to the main event which was supposed to hold March 26, in Lagos but was postponed due to coronavirus pandemic.

According to Irene Mia, Global Editorial Director, Thought Leadership, the report combines extensive desk research and insights from interviews with regulators like CBN’s Director of Payment System Management, Musa Jimoh, industry experts and CEO of fintech firms like Ham Serunjogi, co-founder and CEO, Chipper Cash.

FinTech in Nigeria

Giving an introduction into the research, Melanie Noronha, Senior Editor of Thought Leadership, EMEA highlighted the significant impact digital innovation has on the finance industry and the range of opportunities it creates for both people and businesses.

“Digital innovation is disrupting the finance industry in the world, in an unprecedented way and pace. Mobile money, Online lending platforms, Cryptocurrency and blockchain a new range of products and players are creating a range an opportunities to better sell to consumers and enable SMEs and Forums to operate better”

Melanie Noronha, Senior Editor, Thought Leadership, EMEA

She also noted the major role fintech can play in driving financial inclusion among the 66% of the unbanked population on the continent. She referenced the impact Mobile money – Mpesa had in driving Kenya’s financial inclusion from 27% in 2007 to its current 82%.

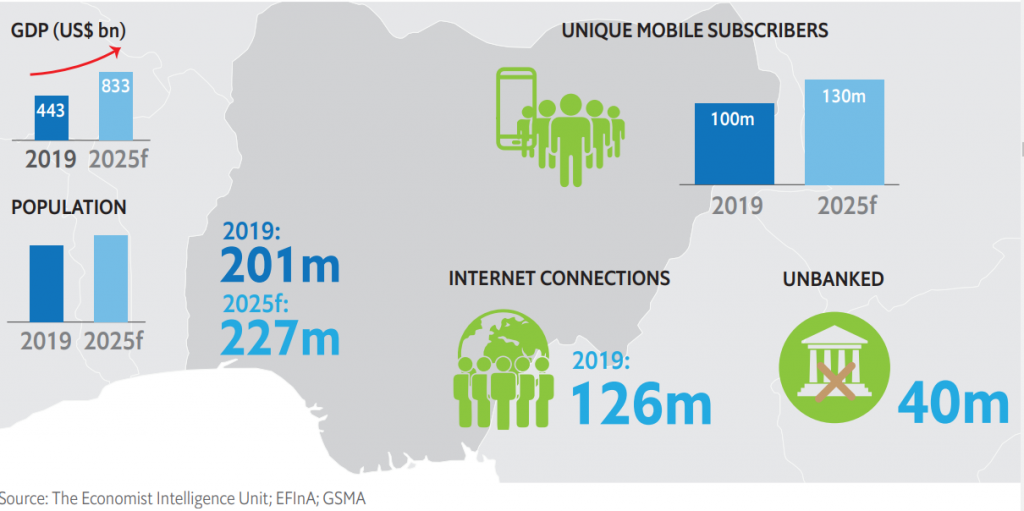

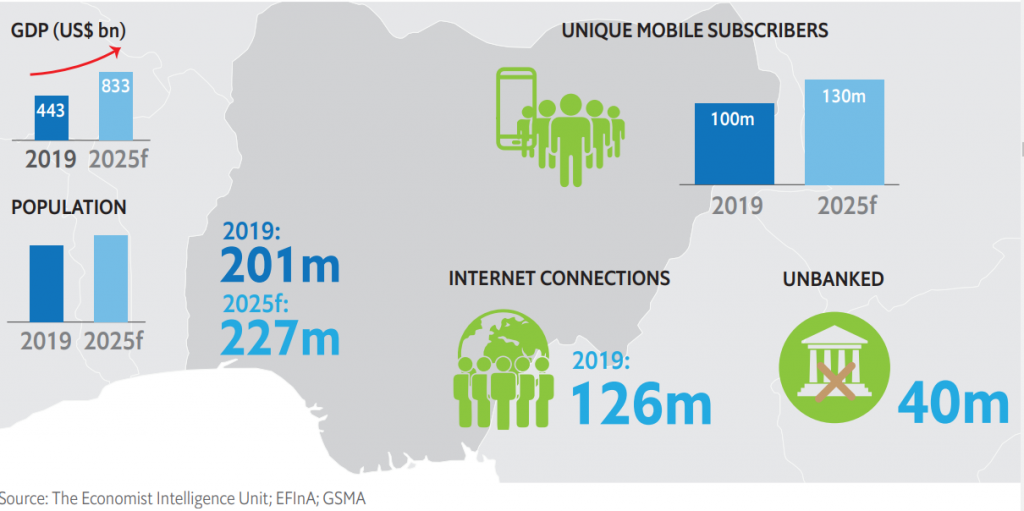

Shedding light on the fintech sector in Nigeria, Melanie explained that the country’s large population together with its increasing mobile and internet access makes opportunities for fintech endless.

“If you look at the data in terms of mobile access and internet access. You see that currently in Nigeria here are 100 million unique mobile subscribers, which are projected to increase 130 million by 2025 also there are about 126 million internet subscribers. So really it is a big sector” Melanie said

Strong forecast for Fintech revenue growth

On her part, Irene Mia revealed that there is a strong forecast for fintech revenue in the country as it is expected to reach an estimated $543m by 2022.

This represents a significant increase from the $153m recorded in 2017.

Financial Inclusion

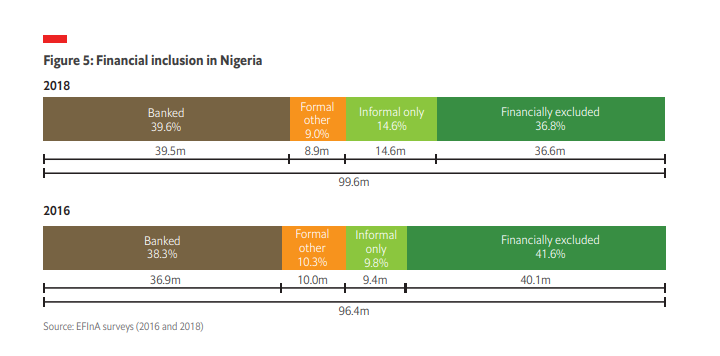

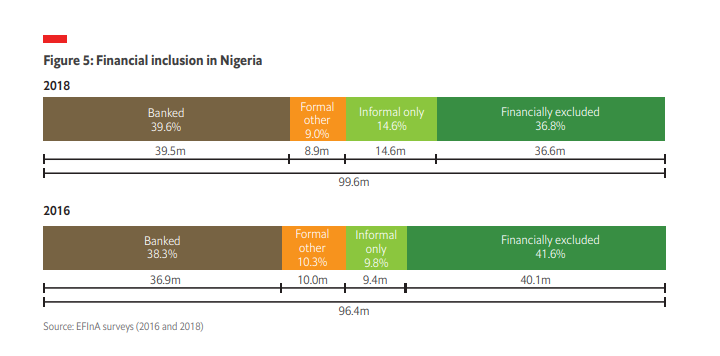

The largely unbanked population in Nigeria is about 40 million. According to surveys, conducted the percentage of financially excluded adults in Nigeria has actually reduced from above 42% in 2016 to about 37% in 2018.

Speaking on financial inclusion, Irene pegged infrastructure deficits like insufficient bank branches, ATMs and difficulties with securing biometric verification numbers and high service fees as some of the major problems.

Commenting on lack of banking infrastructure, Usoro A. Usoro, General Manager, Mobile Financial Services, MTN said that stakeholders need to look at no cost models to ensure that the country can deliver Financial Services to the underserved.

Africa recorded an annual growth rate of 24% in fintech from 2009 to 2019 – fueled by Nigeria, Kenya and South Africa

Irene, however, added that anecdotal evidence from one of the CEOs interviewed shows that fintech was making good progress in driving financial inclusion in Nigeria

“So one CEO that we interviewed which offers agent banking and payment services actually told us that they have created accounts for over 750,000 adults who were previously unbanked and their target over the next few years is to reach about 3 million more people,” Irene said

More men than women are banked in Nigeria. According to the World Bank data which Irene shared, just over a quarter of women have a bank account compared to more than half of men who have.

Smart Regulation

Talking about possible challenges in the sector, Melanie expressed that regulation is always catching up with innovation, which always causes disruption. Therefore it’s important to develop the right regulatory ecosystem.

She advised that smart regulation with flexible equations that are transformative can adapt to the different disruptions in the sector.

However, she said there is a risk associated with data privacy and ownership. She also pointed out that there is a risk when fintech and financial inclusion doesn’t go hand-in-hand with financial literacy and education.

Local Investors playing a small role in Fintech

Nigeria’s fintech sector has seen very impressive growth in terms of investment activity. However, most of the investments have come from foreign investors.

Irene, however, highlighted that there are some emerging signs that indicate some change in the approach of investors. Nigerian Stock Exchange recently launched a fintech growth fund.

Global Investment activity in fintech which includes Venture capital, private equity, merger and acquisition reached $ 120 billion in 2018 up from $51 billion 2017

The skills gap in Business Management, Marketing and Corporate governance

As the fintech ecosystem expands core skill gaps are emerging from outside of programming and product development. According to Irene, skill gaps in areas like marketing, communications, corporate governance and business development have been created following the growth and expansion of fintech in Nigeria.

Speaking on the efforts Mastercard has made towards helping fintech grow in Nigeria, Ebehijie Momoh, Senior Vice President, General Manager West Africa, noted that with many countries across the globe still under lockdown, there is a dire need to strengthen financial institutions and develop robust payment systems now more than ever.

He applauded the fact that Nigerian Fintechs are expanding their businesses from payments into lending, micro-investment, wealth management, peer-to-peer transfers and insurance etc. He acknowledged the role of the regulators in balancing innovation and customer protection while insisting they must continually evolve to respond to market dynamics.

He also pointed out that to develop and flourish, Nigerian fintech needs to address shortcomings in the broader ecosystem.

While venture capital investment is forthcoming, the majority comes from abroad with Nigerian investors currently playing a small role. As the sector matures, skills gaps are emerging outside of product development in areas such as business management and marketing. Given the challenges that fintechs in all markets are facing in terms of profitability, expertise in business management and corporate governance is needed.

Ebehijie Momoh, Senior Vice President, General Manager West Africa of Mastercard

Mr Momoh especially challenged Nigerian fintech to truly measure up and solve problems in the area of truly reaching the financially under-served against easing transaction for those already in the system. He expressed Mastercard’s belief that fintech can drive growth and prosperity while reiterating the company’s resolve to bring a total of 1 billion people and 50 million micro and small businesses across the globe into the digital economy by 2025.

Mastercard intends to achieve this through programs like the Mastercard Acceleration Program, Mastercard Fintech Express, Mastercard Engage, Mastercard Start Path and Mastercard Developers.

In conclusion, Irene noted that if challenges discovered in the Nigerian fintech sector were overcome it would help set up the next wave of growth. She added that domestic success stories created will only inspire a new wave of fintech ideas in Nigeria and hopefully move the needle on financial inclusion.