Kippa, a Nigerian firm that uses its money management software to enhance the life cycle of small enterprises, has acquired $3.2 million in pre-seed capital.

The startup’s fresh funding round was led by Target Global, a Berlin-based venture capital firm. Other VCs that took part are Entrée Capital, Alter Global, and Rally Cap Ventures.

Kuda CEO Babs Ogundeyi; Sriram Krishnan, a Khatabook investor; Raffael Johnen, Auxmoney CEO; Chris Bouwer; Kyane Kassiri; Edward Suh of Goodwater Capital; and Sajid Rahman were among the angel investors that invested in the firm.

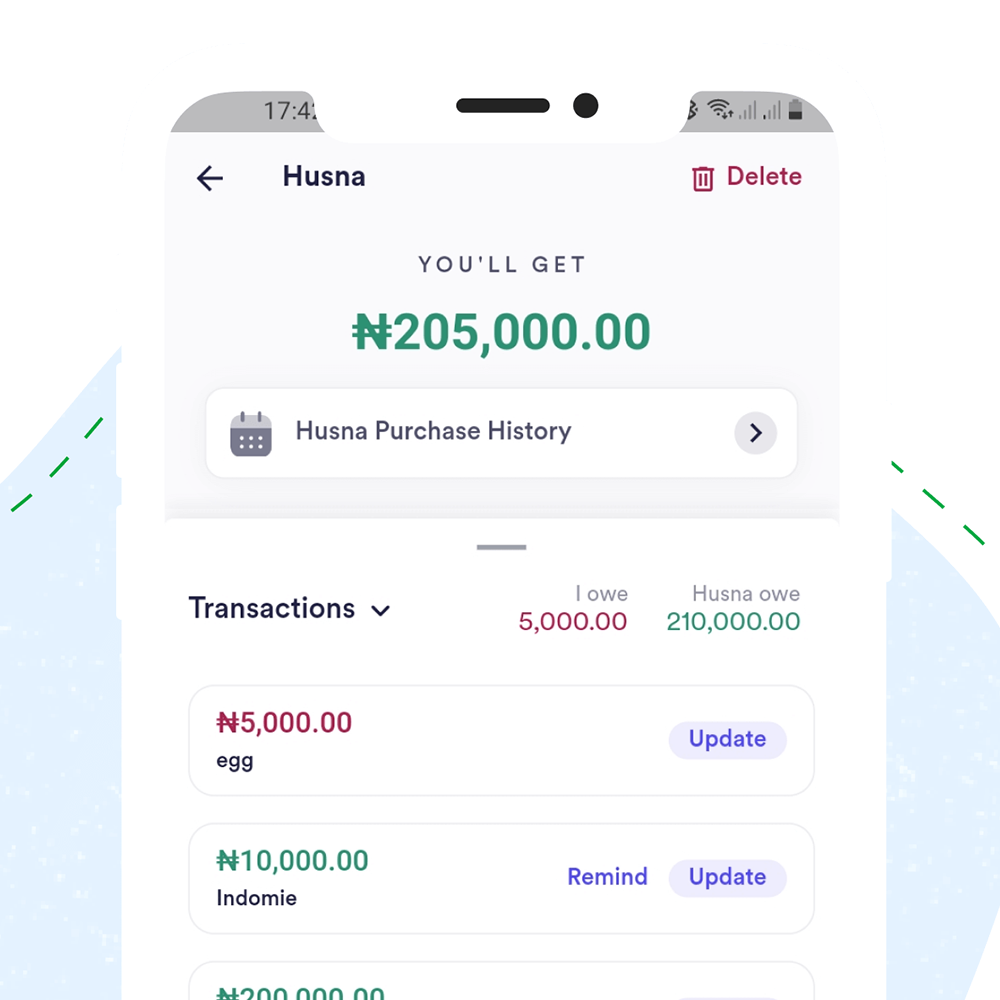

Kippa is a simple tool that allows small company owners to keep track of their daily revenue and spending transactions, make invoices and receipts, manage inventory, and see how their companies fluctuate over time.

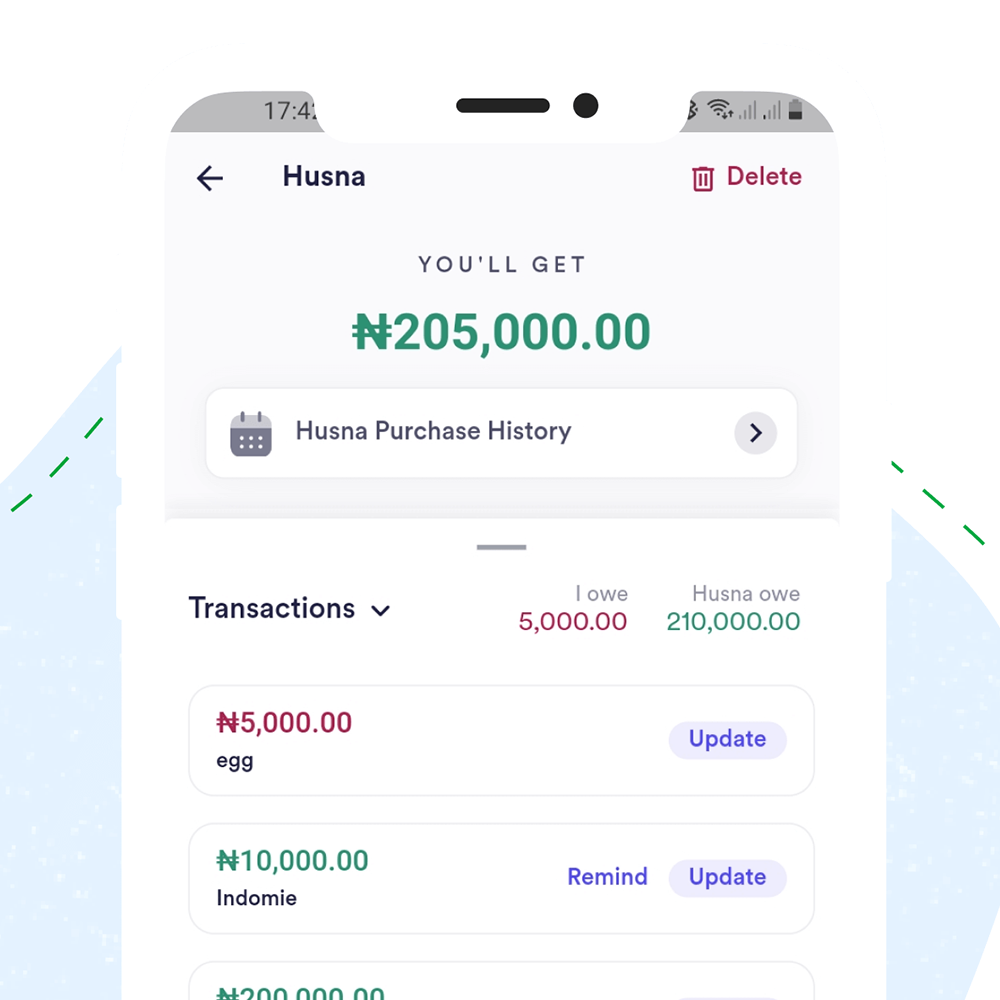

According to the company, one of the most essential aspects of the software is that it assists merchants in keeping track of debtors and sending automatic reminders to them. Merchants that utilize Kippa in this fashion, according to the business, “recover debts 3x faster.”

“For us, what we do is that we have such a unique opportunity to provide financial services to users. For most of them, Kippa is the first B2B SaaS app that they’re using,”

Kippa

$300m in sales in less than 5 months

Kippa was founded in February 2021 by CEO Kennedy Ekezie, along with co-founders Duke Ekezie and Jephthah Uche. Prior to founding the startup, the three co-founded Africave, a software talent matchmaking portal that shut down last year.

They left Africave after realizing impending supply limits that would limit the company’s expansion, according to Ekezie.

Presently, Kippa says its accounting and financial software has grown at a monthly rate of 126 per cent on average since its inception in June.

The company also claims to have logged more than $300 million in sales in the last five months, with over 130,000 active companies ranging from small kiosks and street corner stores to high-end retailers utilizing the app.

According to CEO Ekezie, what distinguished the firm from prior players was “choosing to be digitally native” rather than pursuing the digitalization of analogue processes as prior players have done.

“The majority of other features are aimed at bringing a diverse variety of Nigerian businesses onto the platform. However, the plan is to provide them with loans and other financial services.”

Kippa is currently free to use for businesses, but with the addition of credit and other financial services, the firm will be able to generate money by charging commission fees or interest on loans or working capital.

According to lead investor Target Global, Kippa has shown favourable numbers and there’s a substantial need for the product in the Nigerian market.

“Our investment in Kippa will help it to develop and become the first-choice financial management solution for small businesses in Africa,”

Lina Chong, Target Global investment director.