Individuals and businesses adversely affected by the COVID-19 pandemic can apply for the Central Bank of Nigeria’s N50 billion Targeted Credit Facility (TCF).

The apex bank has introduced the scheme as a stimulus package to support households and Micro, Small and Medium Enterprises (MSMEs) which have been severely impacted post-COVID-19.

The CBN loan facility will run for a maximum of 3 years and repayment will be made on an instalment basis according to the nature of the enterprise. Households will be able to access loans between N1 million and N3 million while MSMEs can obtain loans ranging from N3 million to N25 million.

Interest rate varies between 5% and 9% depending on loan purpose.

Read: Covid-19 Update: States Finally Get Vaccines, Lagos Seals 11 Clubs and Arrests 113 Clubgoers

Eligibility

To qualify for the N50 billion TCF, all applicants should possess a valid means of identification such as a national ID, driver’s license, voter’s card or international passport, as well as a valid BVN.

MSMEs and households must agree to allow the NIRSAL Microfinance Bank (NMFB) Credit Unit assess their financial records and estimate the impact of COVID-19 on their level of sales proceeds. Applicants must also present evidence of opportunity cost and justify their numbers.

Terms and Conditions

- Flexible and movable collateral options shall be admitted and registered under the Collateral Registry Bureau.

- Forfeiture Undertaking and Power of Attorney agreement to be signed by customer, giving NMFB rights to take over pledged assets in instance of loan default.

- Insurance cover on the asset financed or asset availed as flexible collateral, with the NMFB noted as the first loss payee.

- Loan amount must match loan repayment plan and loan purpose.

- Domiciliation of proceeds with NIRSAL Microfinance Bank.

- Customer must have a verifiable supplier/s who he/she must have had a business relationship with for a minimum of 6 months (for MSMEs).

How to Apply

All applications for the TCF should be made through the NFMB loan application portal. Households can apply here.

For MSMEs, log on to the portal to begin your application. All asterisked (*) sections are required.

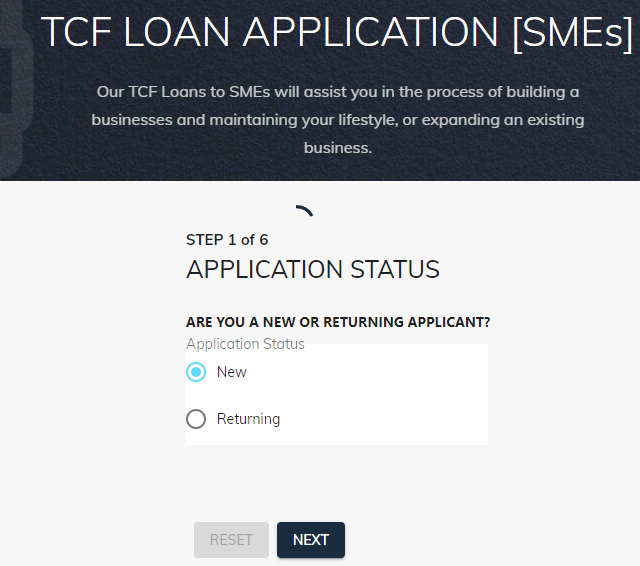

Step 1: Select Application Status

Once you login to the portal, select New to start your application and note down the reference number assigned to you by the system. Click Next to proceed.

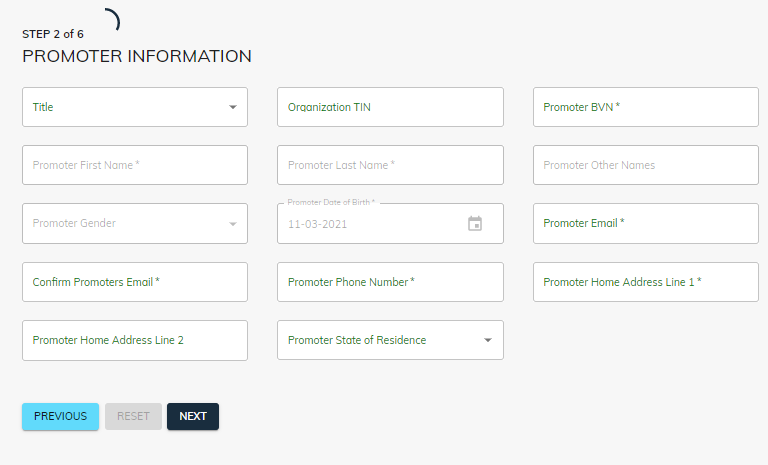

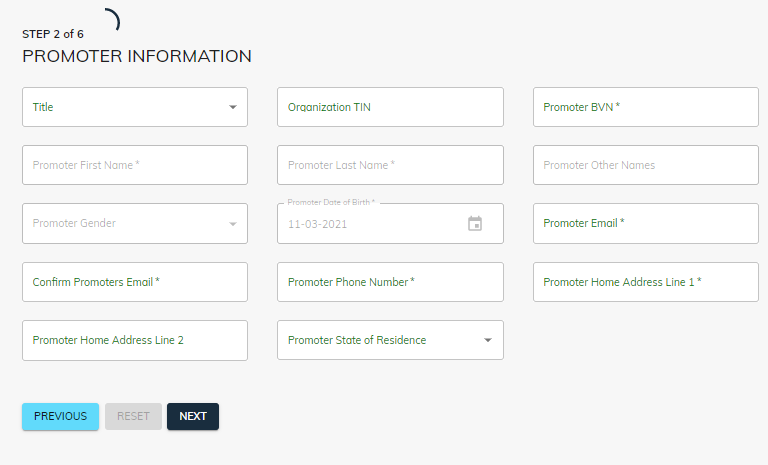

Step 2: Enter Personal Details

Input necessary information about yourself including your full names, gender, date of birth, phone number, email address and 11-digit BVN. You may choose to fill in your Tax Identification Number, although this is optional.

Click Next to proceed.

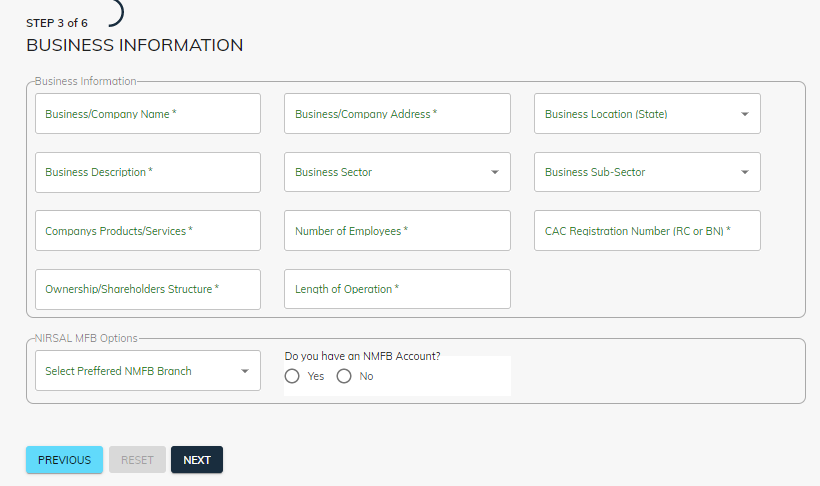

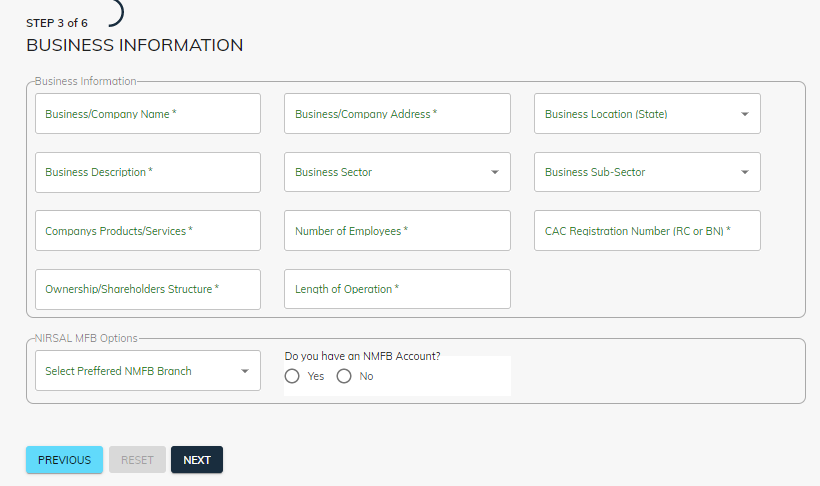

Step 3: Provide Business Information

Here, enter company name, address, location, products and CAC registration number. Ensure you select the business sector your organisation falls under – Agriculture, Education, Transportation, Manufacturing, among others.

Also, select your preferred NMFB branch and tap Yes if you have an NFMB account. Click Next to continue.

Step 4,5: Enter Revenue and Loan Information

For steps 4 and 5, supply the details on your organisation’s annual revenue and indicate the loan range you want to apply for – N3 – 10 million, N10 – 15 million or N15 – 25 million. Then fill in your bank account details as required.

Step 6: Accept Declaration and Submit

This is the final stage of your application where you accept the loan declaration by ticking the checkbox.

Click Submit to complete your application.

What Next?

Candidates’ applications will be reviewed and forwarded to the CBN for final approval for the disbursement of loans to successful applicants through the NFMB.