Fintech solutions are some of the most sought after solutions. This is because they deal with the all-important subject of money, especially how to make more of it and how to transfer it from one point to another at the user’s own leisure. Basically, they have made banking possible without having to visit a physical bank.

While secure payments can now be carried out on mobile devices thanks to mobile payment apps, there are however serious limitations as only smartphone users can access these solutions. There are about 170 million mobile phone users in Nigeria but only 20% of them use smartphones. This means about 136 million mobile phone users can’t access these financial products. Most of them are in low-income areas.

The USSD option has helped to bridge the gap for those without smartphones but USSD transactions and mobile platforms are quite limited and only serve people with bank accounts while entirely leaving out the unbanked.

See also: e-Payment fraud and inflation saw value of PoS transactions in Nigeria drop by N49.8bn in August

According to the Nigeria Inter-Bank Settlement System (NIBSS), only 43.6 million Nigerian adults have a BVN, a very low number when juxtaposed with data from the World Population Review which puts the Nigerian adult population at almost 100 million. This means about half the adult population don’t have bank accounts and are therefore unbanked.

Chipper Cash is trying to solve this problem with its app that allows users to send money using their mobile phone numbers. Founded in 2018 by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled, the app can be used for money transfers in 7 African countries Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya and the UK.

It can also be used to pay utility bills like the purchase of airtime, electricity, cable tv and data.

How does the app work?

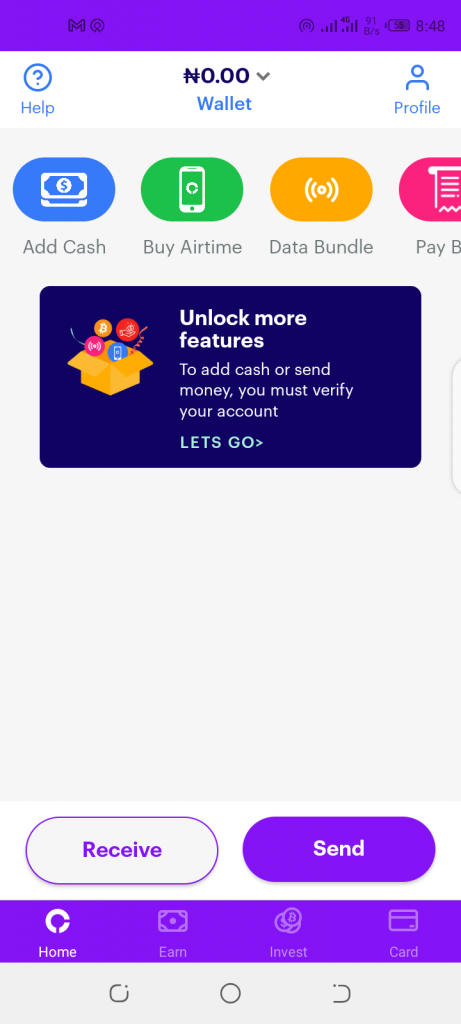

Chipper Cash app has over 1 million downloads on Google Play and an average rating of 4 stars. The version under review is 1.9.11. The highlight of the app is that it allows users to send funds to their contacts using only their mobile numbers. The app is easy to use and users of the app enjoy free transactions.

Upon installation, you are to enter your personal details such as name, email address, phone number, address, etc. You are also to choose a tag, like a username after which you will get a notification that your account has been successfully created. Finally, you are required to select a pin to secure your account. This pin is needed whenever you are inactive on the app and also to make transactions.

You can now use the basic features like buying airtime where you get 2% off data and cable tv subscriptions.

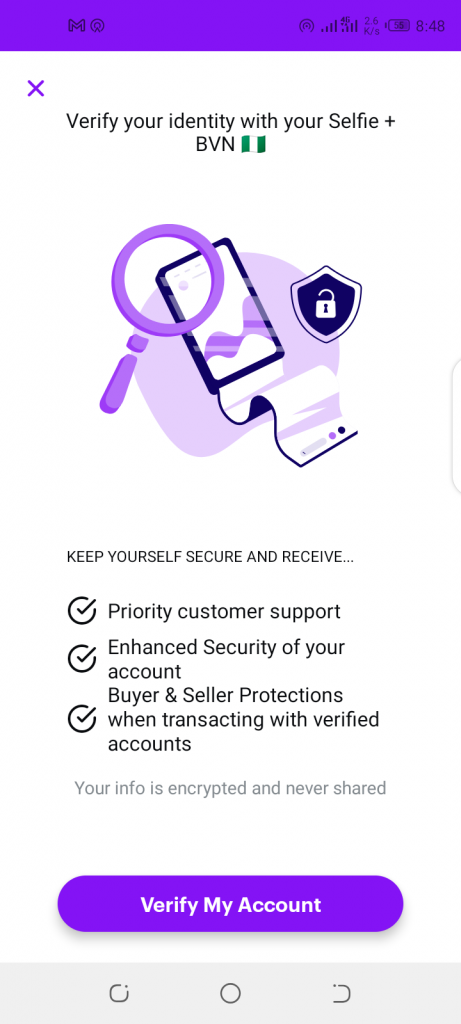

In order to access the transfer of cash options, your account has to be verified by entering your Bank Verification Number (BVN). You’ll also be required to take a live picture.

As an unverified user, you can only send N42,000 daily and withdraw N50,000 daily. To increase this limit, your account has to be verified. As a verified user, you can send N3,750,000 and withdraw N500,000 daily.

Like other fintechs such as Alat and Kuda Bank, Chipper Cash has a virtual card that can be used for online payments. It is free and acceptable globally.

You can send money to your contacts even if they do not have the app. However, they have to install the app and open an account using the mobile number that you sent money to in order to access the money.

Chipper Cash money transfer process is the same whether the recipient has the app or not. You also get a referral bonus whenever anyone opens an account, verifies it and sends money via the app using your link.

There is an investment feature on the app where you can buy stock of foreign corporations but this is currently unavailable in Nigeria.

Pricing

Transfers are free on the chipper app regardless of the amount or the location you are sending to. In instances where the payment is across borders with different currencies, live and current exchange rates are used to process the transfers. The app shows the exchange rates and does not include any commissions to their exchange rates.

What users are saying

The reviews on Google play store are mostly positive. Olushike Bamgbose describes it as an amazing app especially for the digital visa card that can be used to buy anything online. Sunday Ibrahim says it is a great platform to save, receive and make money transactions at ease.

“I really love chipper cash. But I will love you to increase your networks to more European countries so we can receive money from our friends and family members abroad,” Sunday concluded.

Serene Elmarkson described the app as amazing and said everything about it was top-notch including the connection, exchange rate, speed, partnership, etc.

However, some users were left unsatisfied with the app. A user, Vianel IshaSeptember said the app was quite slow and referrals don’t work. Another user, Victoria Joshua said she hasn’t been able to verify her account since coming onboard. She also complained about having to answer the registration questions all over again whenever she tries to log back in.

While commending the ‘great service’, Samson Mukisa however noted that during verification the video selfie process hardly works and even when it does, the cashout process never works most of the time.

The Customer care service politely addresses the negative reviews though by asking for their chipper tags so that individual concerns could be addressed. Chipper Cash is good for the financial scene.

As per serving the unbanked and underbanked, to the extent to which users can use their mobile phones as bank accounts, it actually offers something unique. It also provides free financial services that would otherwise be paid for which means it tries to solve the problem of the underserved.

However, users ultimately need to use its app to access their cash. This eventually requires a smartphone which many people don’t have.