Chipper Cash, an Africa focused cross-border money transfer platform, has closed a $30 million Series B funding. The round was led by Ribbit Capital with the participation of Bezos Expeditions — the personal VC fund of Amazon CEO Jeff Bezos.

According to Techcrunch, the startup plans to expand its products and geographic scope following the Series B raise. This entails offering more business payment solutions, crypto-currency trading options, and investment services.

Chipper Cash also plans to use its Series B financing for additional country expansion, which the company will announce by the end of 2021.

Funding History

This follows a $13.8 million Series A funding round 5 months ago and a $6 million in a seed funding round in December 2019 plus a $2.3 million raised earlier in May. This brings its total funding to about $52 million in about two years.

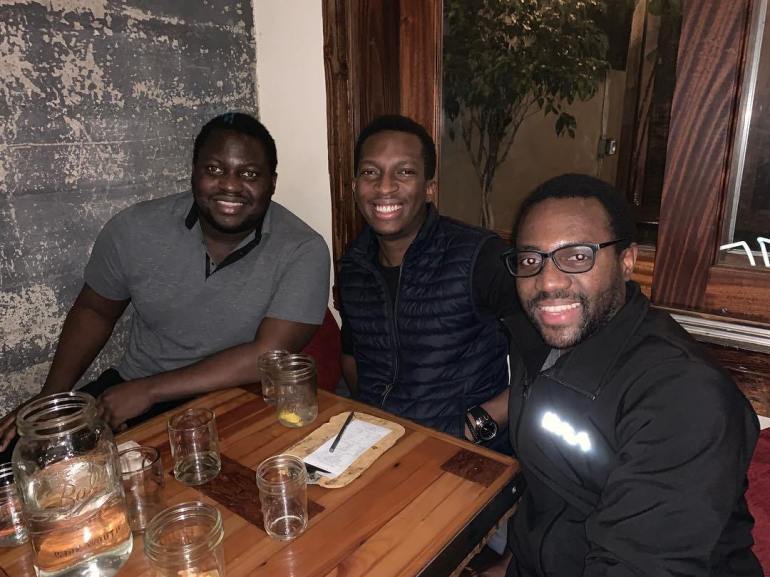

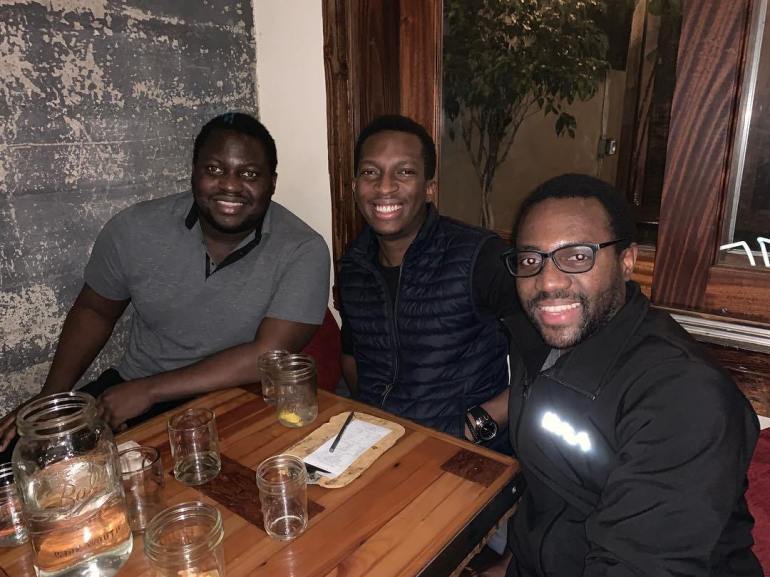

Founded by Ham Serunjogi and Maijid Moujaled in 2018, the startup offers cross-border payment services in seven countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya.

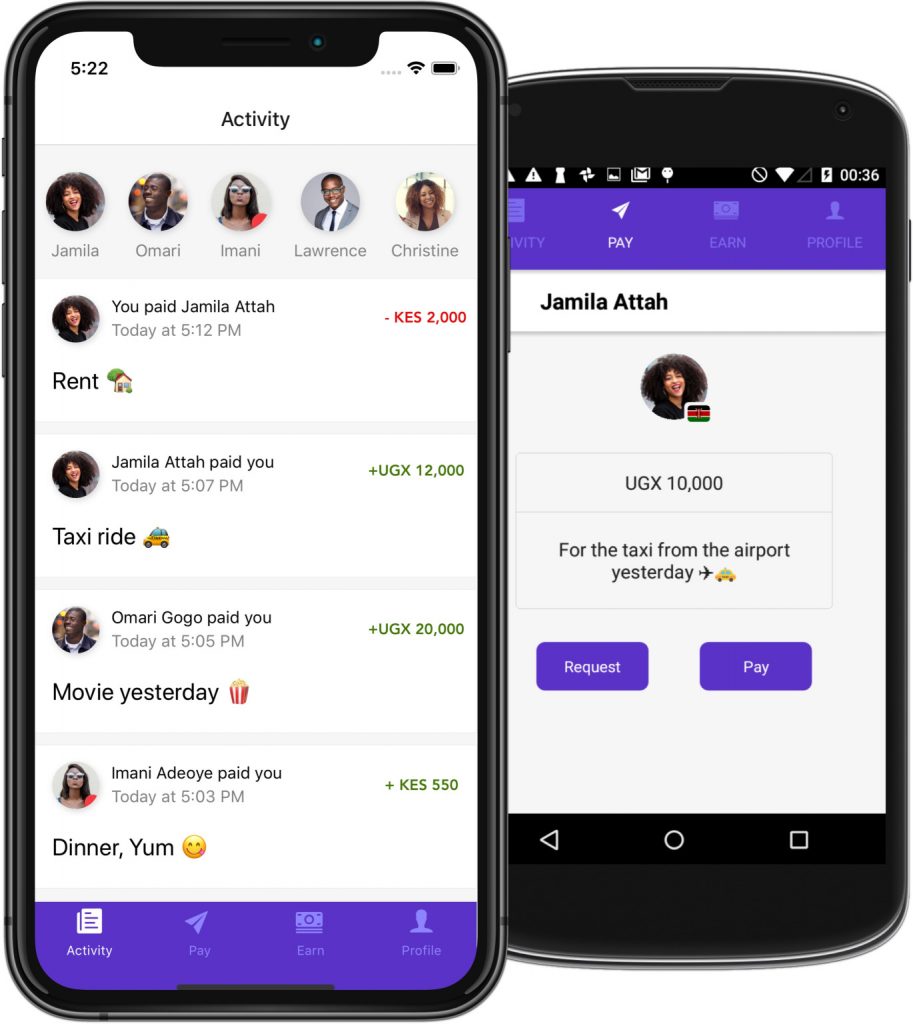

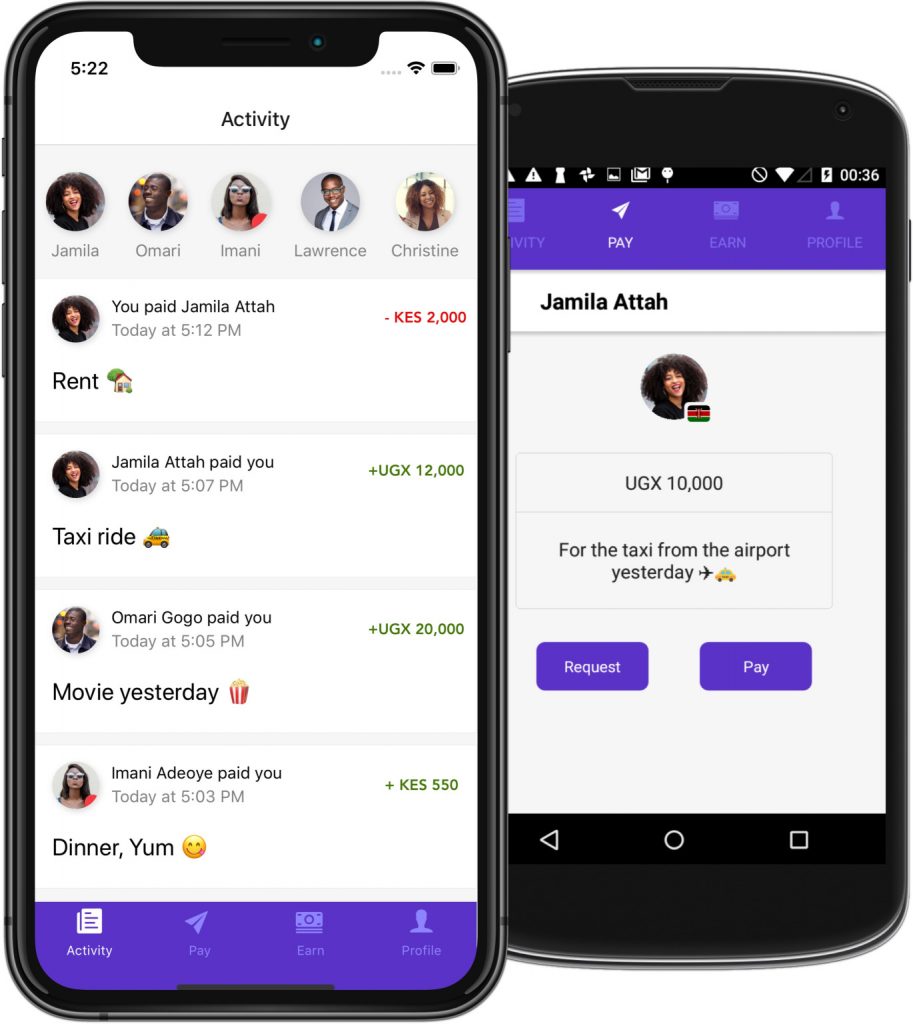

The company has scaled to 3 million users on its platform and processes an average of 80,000 transactions daily. In June 2020, Chipper Cash reached the value of a monthly payment of $100 million, CEO Ham Serunjogi told Techcrunch.

He believes that the investment in his company by a notable tech figure, such as Jeff Bezos (the world’s richest person), has benefits beyond his venture.

“It’s a big deal when a world-class investor like Bezos or Ribbit goes out of their sweet spot to a new area where they previously haven’t done investments. Ultimately, the winner of those things happening in the African tech ecosystem overall, as it will bring more investment from firms of that calibre to African startups,” he said.

New Offerings

Chipper Cash has added beta dropdowns on its website and app to buy and sell Bitcoin and invest in U.S. stocks from Africa — the latter through a partnership with U.S. financial services company DriveWealth.

“We’ll launch [the stock product] in Nigeria first so Nigerians have the option to buy fractional stocks — Tesla shares, Apple shares or Amazon shares and others — through our app. We’ll expand into other countries thereafter,” said Serunjogi.

The startup expanded into Nigeria and Southern Africa in 2019 and entered a payments partnership with Visa in April.