Overall revenue generated by Econet, NetOne and Telecel in Zimbabwe reached $151.8 million in Q4 2020. This is according to the sector performance report released by the Postal and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ).

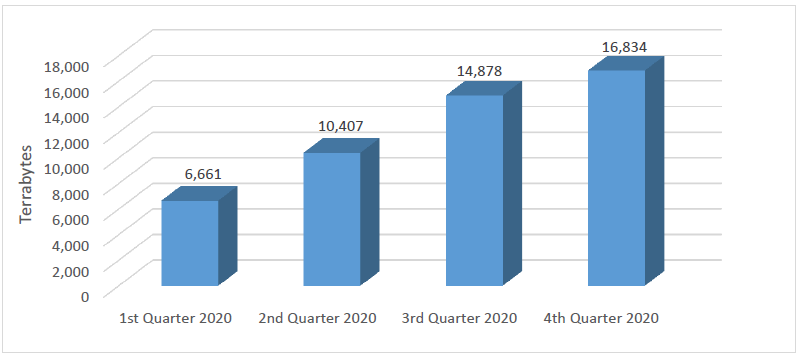

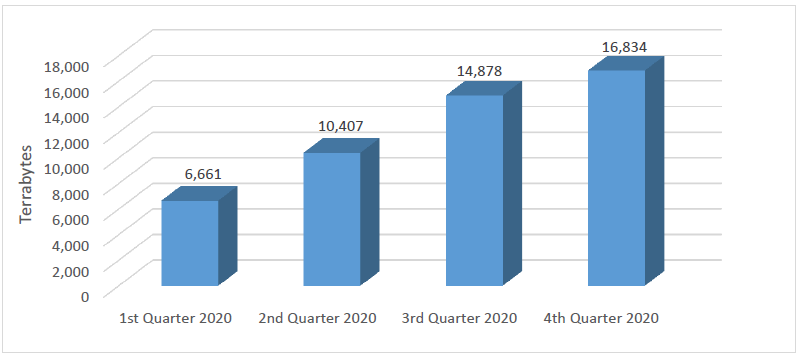

Higher internet activity during the quarter led to subscribers consuming up to 16,834 Terabytes (16.8 million gigabytes) of data.

Total mobile subscriptions for telecom operators increased by 3.2% from 12.8 million in Q3 to 13.2 million in Q4 2020. NetOne gained the highest number of subscribers (236,000) in the fourth quarter.

In terms of market share, Econet leads with 66.5% (8.77 million) of mobile subscribers, followed by NetOne (28%) and Telecel (5.5%).

Peak Data Usage Drives Revenue Growth

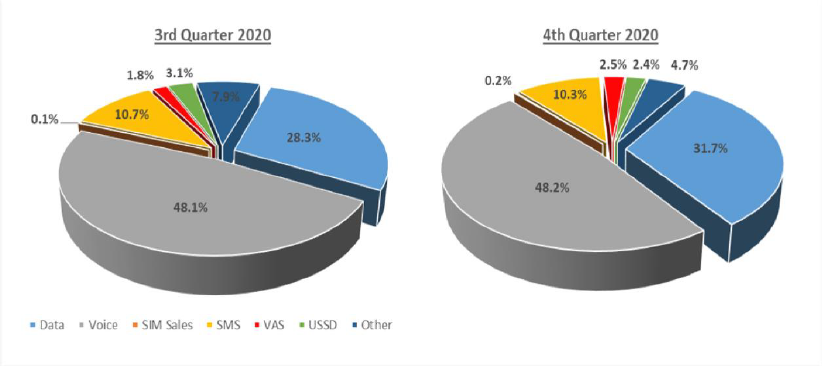

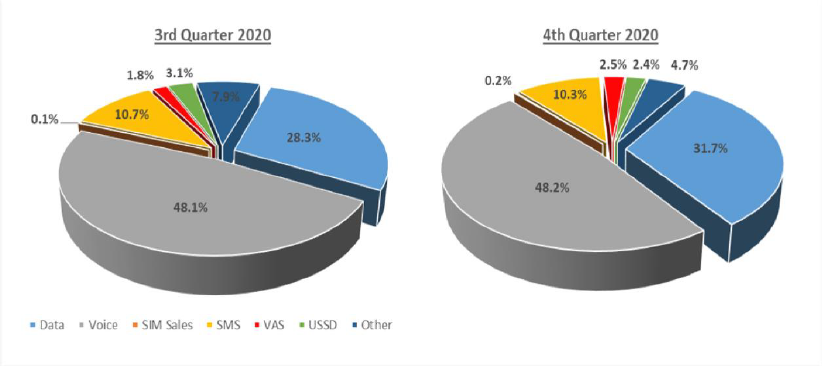

According to the POTRAZ report, mobile data usage among internet subscribers increased by 1,956 Tb to account for 32% of the $151.8 million telco revenue in Q4. The spike in data consumption could be attributed to the higher adoption of digital technologies post-COVID-19 which has shot up internet activity.

Internet users expended a peak 16,834 Tb of data in Q4 2020, representing a 13.1% increase from 14,878 Tb consumed in the previous quarter. This spurred a surge in revenue by $41.4 million QoQ to $151.8 million in Q4 2020.

In 2020, Zimbabweans spent up to 48,780 Tb (48.8 million gb) of data, which pales in comparison to the 80 million gb data used per month in Nigeria.

During the quarter, mobile data contribution to telco revenue increased by 3.4%, the highest of all service segments. While voice remains the cash cow for operators, its revenue contribution only rose by a tiny 0.1%.

Econet retained the lion share (78.4%) of mobile data traffic in Q4.

Mobile Money Revenue Suffers Decline

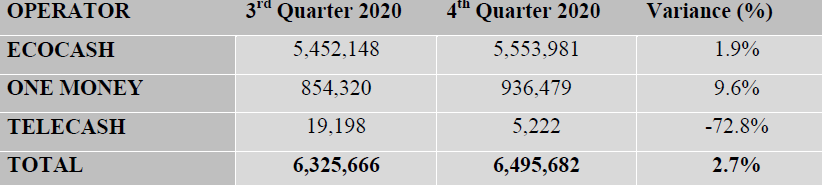

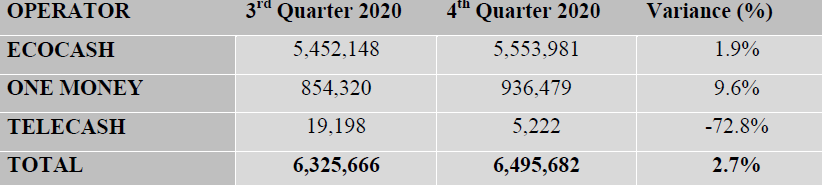

Mobile network operators recorded a lowly 2.7% increase in number of mobile money subscribers, and this was not enough to drive growth in the segment’s revenue contribution for Q4 2020.

Mobile money as part of Value Added Services accounted for just 10.3% ($15.6 million) of operators’ Q4 revenue, representing a 0.4% decline QoQ.

The total number of active mobile money subscriptions in Q4 2020 reached 6.5 million, an improvement from the 6.3 million recorded in the previous quarter.

However, mobile money subscriptions reduced by a significant 11% through the whole year. Active subscriptions fell from 7.3 million in Q1 to 6.5 million in Q4 2020.

Mobile money regulations enforced by the Reserve Bank of Zimbabwe (RBZ) have expectedly led to a decrease in mobile money activity and adoption.

Going Forward

The revenue surge for telecom operators in Q4 2020 might not be quite replicated in subsequent quarters.

All operators recently hiked tariff rates in line with the POTRAZ directive given in August 2020 to combat increased operating costs and foreign exchange losses.

Econet and other MNOs have upwardly reviewed their voice, data and SMS bundle tariffs. For instance, Econet’s 1.2gb data is now priced at $6.67 from a previous $5.56.

The service tariffs’ increase across all three MNOs (Econet, NetOne and Telecel) poses the question of affordability to subscribers. Data plans are now more expensive, and logically this could force a number of internet users to go for cheaper plans or opt out entirely.

That said, lower internet activity would mean that operators will perhaps not see the spike in data usage which boosted revenues in Q4 2020.