Earlier this month, the Central Bank of Nigeria (CBN) surprised many Nigerians by ordering banks and other financial institutions in the country to close accounts transacting or operating cryptocurrency exchanges within their system.

While this is not the first time the apex bank has spoken against cryptocurrency, the new directive takes a different turn that could cripple the crypto industry in the country.

In a chat with TechNext, Danny Oyekan, CEO of Dan Holdings and Founder of Coins App said that the CBN’s restriction on crypto transactions is really wrong.

He explained that an outright ban is detrimental to the economy itself because cryptocurrencies are going to be the norm in the long run. Danny cautioned that if Nigeria is left out of that norm, it’s going to take a long time to get back in.

CBN banned crypto to reduce capital flight, not fight money laundry

The CBN in its defence had earlier revealed that it banned cryptocurrencies because it’s increasingly being used for criminal activities like money laundry, tax evasion among other things.

However, Danny believes otherwise. According to the crypto expert, the main reason why the Central bank decided to ban banks from dealing with crypto companies was due to Capital Flight.

Capital flight is a large-scale exodus of financial assets and capital from a nation due to events such as political or economic instability, currency devaluation or, in this case, cryptocurrency boom.

He explained that the deduction of crypto being used for illicit purposes like money laundry is not true. He added that even fiat currencies like the Naira are being used for nefarious purposes more than digital currencies.

Speaking on the CBN’s claim that the anonymous nature of cryptos made them shady, Danny clarified that they are only pseudonymous and not exactly anonymous. He added that digital currencies are immutable and are stored on a transaction ledger so you can actually see who did the transaction.

CBN will be the biggest loser

Over the last year, cryptocurrency has witnessed a tremendous boom. Bitcoin, the worlds most popular digital coin has especially been on a bullish run, rising up to $48,000 from below $10,000 in 2020.

Looking at the growth of the sector, Danny cautions that if the government doesn’t start to be proactive in this new industry they are going to be left out.

I have been in this industry for about 9 to 10 years and the way this industry works is that if you don’t adapt you are going to be left out. I believe that if both the government and CBN are proactive, we are going to have a lot of progress.

He explained that he understood the CBN’s concerns but what they should have done was to speak and engage industry stakeholders. This way they could have found out how the exchanges actually deal with KYC laws and figure out how to regulate the industry instead of shutting it down.

Danny advised that the apex bank of Africa’s largest economy should look at what other countries are doing and tailor their regulations towards that.

According to him, the first step is to create a regulatory licensing scheme. he gave the example of the United Arab Emirates (UAE), where the regulator brought out regulation and set out guidelines on how crypto assets are going to be regulated.

Everyone will move to p2p

Following the CBN ban, some banks like Access Bank have reportedly frozen accounts of users suspected of trading cryptocurrencies. Similarly, most crypto exchanges in the country have disabled withdrawal on their platforms.

Speaking on the effect of the ban, Danny says everyone is going to move towards peer-to-peer.

Once people realize that the CBN is not in favour of the crypto industry, people are going to move underground and start peer-2-peer.

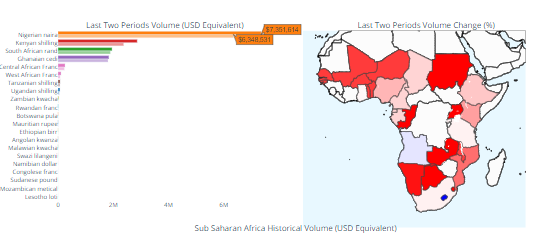

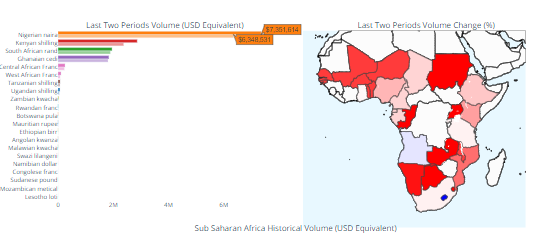

According to data from Usefultulips, Bitcoin’s P2P trading volume in the country has increased by about 16% barely a week after the CBN order.

Nigeria posted $7.35 million in P2P trading volume, representing a $1 million increase from the $6.35 million processed prior to the ban.

According, the Coins App CEO the CBN literarily shot itself in the foot with the ban as the move to P2P will further deter any plans to regulate the sector. He explained that there are no regulatory oversights as KYC laws will not be implementable once people move to peer-to-peer.

He added that “It will be impossible to know who is actually buying crypto from his friend or who is selling crypto once everyone moves to P2P. it’s way harder to track transactions than if people are dealing with crypto wallets, crypto exchanges or social payment apps.”

Volume may reduce but will return long term

With people abandoning crypto exchanges for P2P exchanges, Danny says there is a possibility that the volume of crypto transactions will drop. However, he says that does not mean that people will abandon cryptocurrency.

Last year, Nigeria traded more than $400m worth of crypto on local crypto exchange platforms.

According to the Coins App boss, the volume will come back on the long term even if it drops because of the ban.

He also added that the ban will have a funny effect on the economy because it’s going to bring that awareness that the crypto industry didn’t really have in the Nigerian economy.

Dangers of P2P

When asked about the possible dangers of the growing P2P crypto trading, the CEO acknowledged that there are some inherent dangers especially those posed by scammers. However, he explained that this will be reduced with the help of escrow services.

With escrow services, funds are not released to the other party on P2P exchanges if the funds are not even there. This according to Danny, means that fraud is rather minimal to nonexistent rather than rampant.

He also pointed out that a lot of P2P exchanges still have KYC for their users But noted that most are registered outside of the country.

Other ways to still trade in cryptocurrency

Besides P2P there are other ways to trade and transact in crypto. According to Coins App CEO, There are over-the-counter (OTC) desks which are basically desks that trade cryptocurrencies.

Over-the-counter (OTC) Desks are mostly trading for companies not listed on a formal exchange. With regard to the cryptocurrency industry, OTC desks have gained popularity among those who are willing to sell large amounts of coins, like miners or high-profile investors — willing to buy crypto without resorting to major exchanges.

Danny explained that they are basically registered companies trading cryptocurrencies, have stocks and sell directly to clients. He added that all this is done outside the banking system. However, they are mainly for large transactions.

According to some estimates, crypto OTC trading companies sometimes have larger daily volumes than the major exchanges. For example, Digital Assets Research firm, the TABB Group reported that the OTC market facilitated $250 million to $30 billion in trades per day in April 2018.

Crypto startups need to persevere

The new CBN directive has most crypto startups searching for a workaround to keep their startup alive. Danny advises that startups in the crypto space need to persevere and come together as a community.

He also added that it is key for them to find alternative solutions.

I see some companies are already offering peer-to-peer to their customers while others like us are already working on stable coins. I think that’s the route in the medium term.

In addition to that, the Coins App boss advised engaging and educating the regulators to understand what their actions could bring. He added that although they have the final decision, educating them will go a long way in helping the ecosystem.

What kind of regulation the CBN should put in place.

Speaking on the recent summoning of the CBN governor, Godwin Emefiele to appear before the Senate on the matter, Danny acknowledged the development was a good one.

According to him, the summon shows that the Nigerian senate has actually paid attention to the issue and seen that it’s something worth thinking about and deliberating on.

I think that a lot of senators and house of representative member already know about digital currencies, how they operate and how they work.

On the suggestion of possible regulations CBN could adopt, Danny offered several options. According to him, if the CBN’s major concern is capital control they can be limits to how much users can purchase using exchanges or OTC Desks.

Another is to strengthen KYC laws and regulation. The effect of KYC has been far reaching in stopping crime relating to cryptocurrency and Danny believes it will have the same desired effects in Nigeria.

Summary

Despite the ban, Danny believes that the CBN will one day have to put Bitcoin as one of its Foreign reserves. He explained that other countries and big companies are already considering it so why not Nigeria?

You can see Tesla the other day amassing 1.5 billion in Bitcoin, you can see Twitter CFO thinking about investing in Bitcoin, you could see today bank of New York thinking of investing in Bitcoin. If the Central Bank can be one of the early adopters, they can have part of their balance sheet in Bitcoin.

Danny Oyekan

He added that this is the right time for the Nigerian government and CBN to take advantage of this new ecosystem by looking favourably towards cryptocurrency and not against it.