Several Guaranty Trust Bank (GT Bank) customers across social media have berated the bank over surcharges collected for SMS alerts.

One GT Bank customer and Twitter user, Korede Lucas shared a post showing the various SMS charges that had been deducted from his account balance on Monday. The screenshot included “SMS alert VAT” as part of the debit charges.

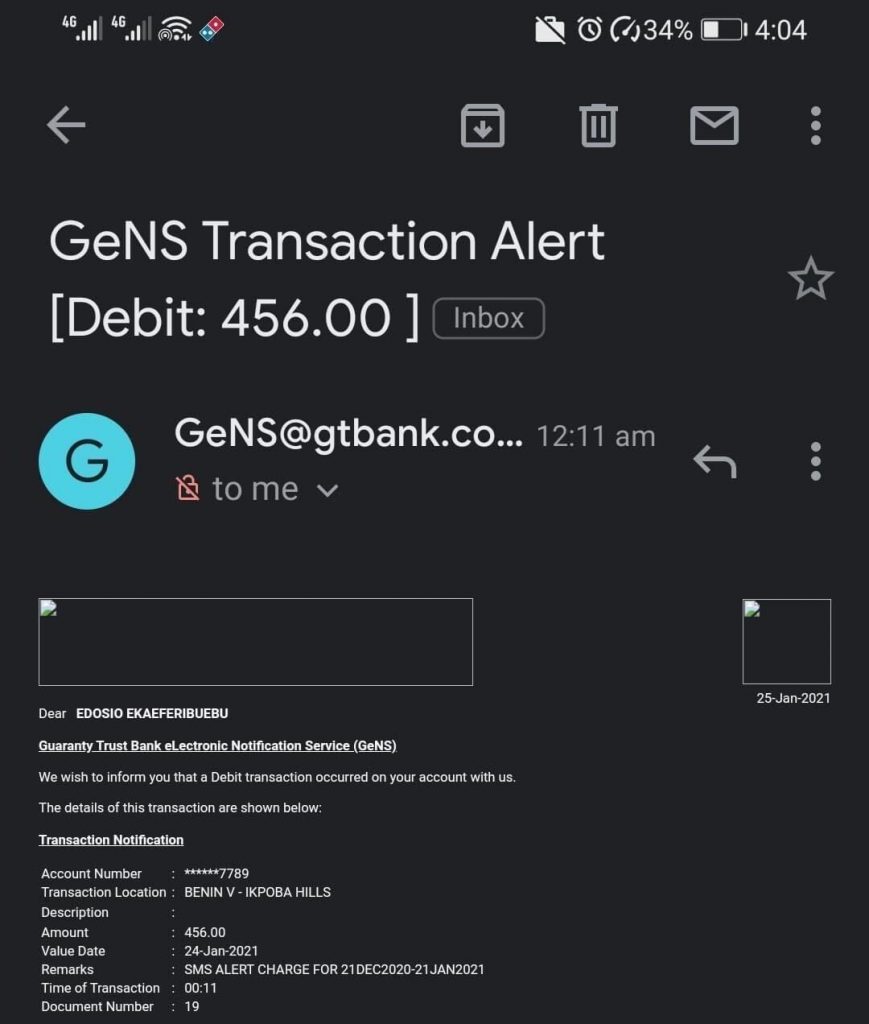

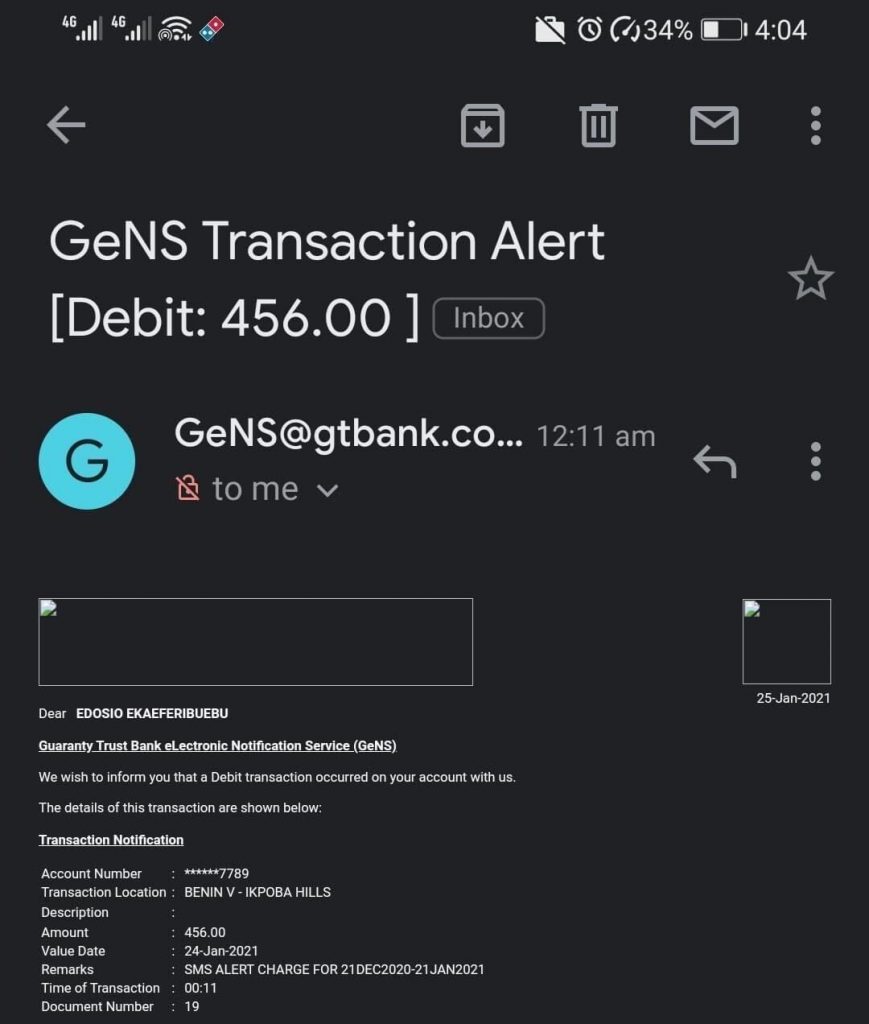

Another GT Bank customer, Femi shared a screenshot of his transaction history which displayed similar SMS charges to Korede’s, including the “SMS Alert VAT”.

Several other GT Bank customers in the country have complained about the high amount being charged for SMS alerts, insisting that the charges didn’t correspond with their transactions. They also accused the bank of collecting value-added tax (VAT) on SMS alert fees.

Reports from many GT Bank users suggest that many customers believe that they are being subtly extorted by the bank as they do not understand why the bank is charging VAT on SMS alerts.

Recall that the Nigerian Senate had in October last year pushed for the Central Bank of Nigeria (CBN) to probe banks over surcharges on ATM withdrawals, e-transfer, card maintenance, among others.

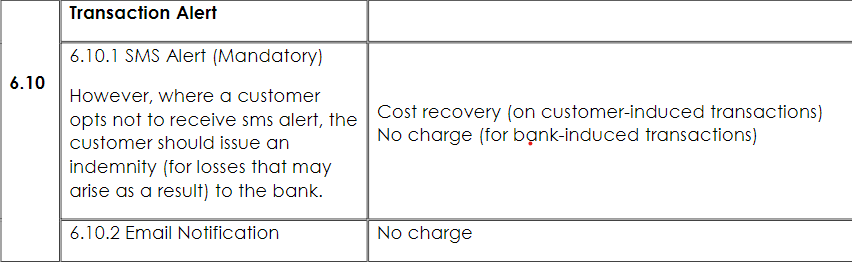

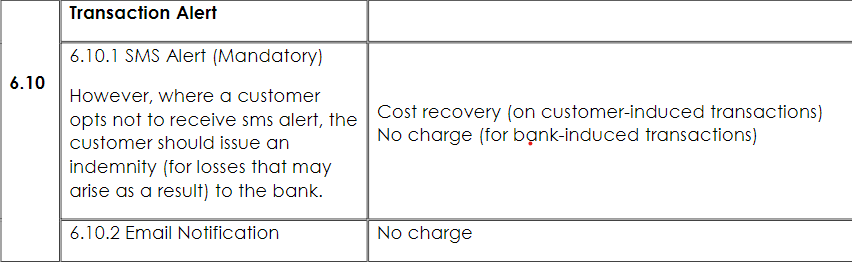

CBN Guideline on SMS Charges

At N4 per alert, banks generate billions of naira in SMS alerts as millions of customers are subscribed to the service to monitor cash transfers, debit and credit transactions. According to the CBN directive, the fee for SMS mandatory alert will be on cost recovery from the previous maximum charge of N4.

What this means is that the N4 SMS charges are still in permitted, but will be levied based on the expenses incurred by the banks. This is as long as the transaction is customer-induced or initiated by the customer. For transactions or SMS alerts not induced by the customer but rather initiated by the bank, there ought to be no charge.

At the cost of N4 per SMS, it means the last complainant above initiated transactions a whopping 91 times in the one month under review. For the next customer below, it was more. He would have initiated transactions 114 times.

Furthermore, the CBN guideline makes absolutely no mention of an SMS alert VAT. Moreover, regular SMS charges are supposed to include VAT. This somewhat validating the backlash against GT Bank by customers over the SMS alert VAT.

Other key reviews in the guide include the reduction in transfer fees, slashing of ATM withdrawal charges from other banks to N35 after the third transaction and scrapping of card maintenance fees (CAMF) for current accounts.

Therefore, how exactly GT Bank came about the VAT on SMS alert fees is unclear. The downward review of many other transaction charges has led to huge revenue loss for banks.

If this is a breach of the CBN guideline, then GT Bank would be culpable to pay a fine of N2 million, according to the stipulated sanctions for non-compliant banks.

Technext has reached out to GT Bank for comments, but no response has been received as at the time of this writing.