E-commerce giant, Jumia generated a gross profit of N10.44 billion in the third quarter of 2020. This is the first time the company has reported a positive gross after Fulfillment & Advertising expenses since it listed last year.

According to the report, the company’s gross profit after Fulfillment expense reached N2.97 when compared to a loss of N765.38 million (USD 2 Mn) in the third quarter of 2019.

The positive return represents Jumia’s first major step towards profitability as gross profit after expenses moved clear of the red zone for the first time. The company also reported that it broke even in the majority of countries where it has operations in Q3 2020.

Speaking on the results, Co-Chief Executive Officers, Jeremy Hodara and Sacha Poignonnec affirmed that the company is moving towards profitability

“We are making significant progress on our path to profitability with Adjusted EBITDA loss in the third quarter of 2020 decreasing by 50 per cent year-over-year.”

Jumia co-CEOs

They also mentioned that the business mix rebalancing initiated late last year has increased Jumia’s exposure to everyday product categories and, combined with enhanced promotional discipline, supported unit economics.

Suggested read: Former Jumia Investor, Rocket Internet is Delisting From the Stock Market to Pursue Other Long-Term Prospects

49% Decrease in Operation Loss

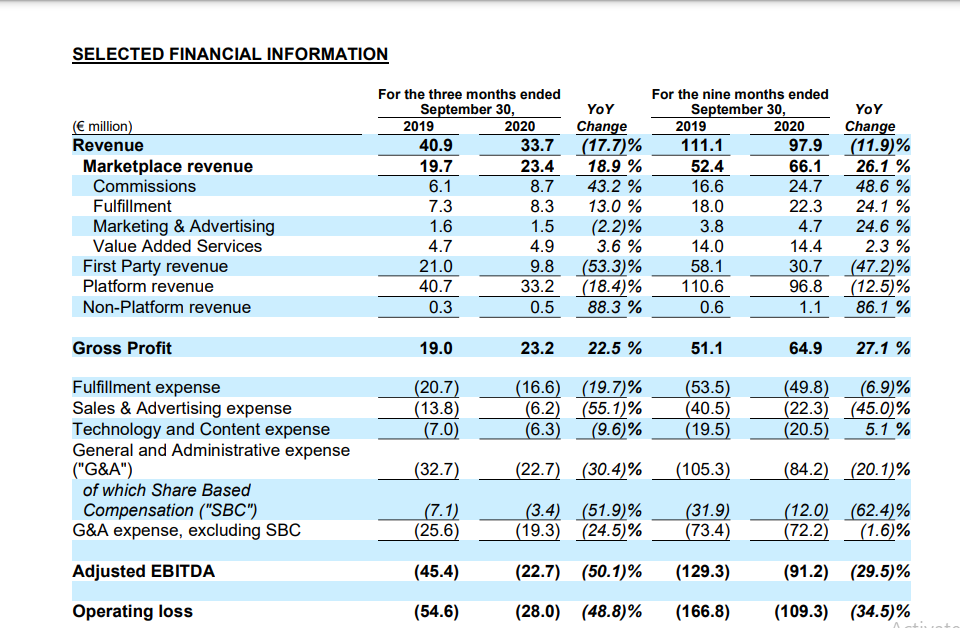

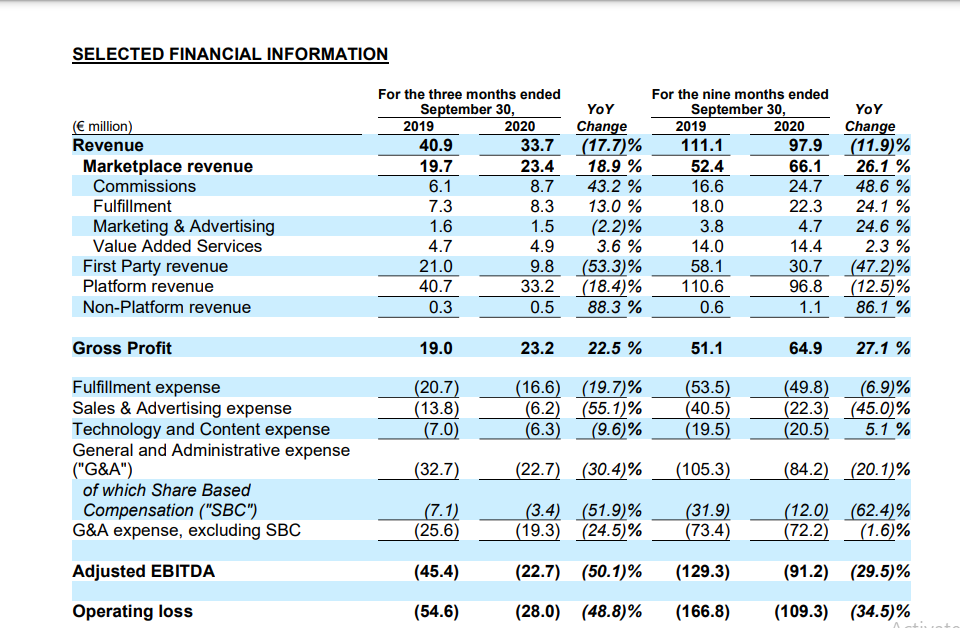

In terms of revenue, Jumia generated N15.15 billion (€33.7 million) in the third quarter of 2020, a 17.7% drop from the sum generated during the same period last year. However, Marketplace revenue reached N10.53 billion (€23.4 million) during the quarter, up 19% compared to the Q3 2019.

According to the report, the growth was mostly driven by an increase in Commissions and Fulfillment revenue, which increased by 43% and 13% year-over-year respectively.

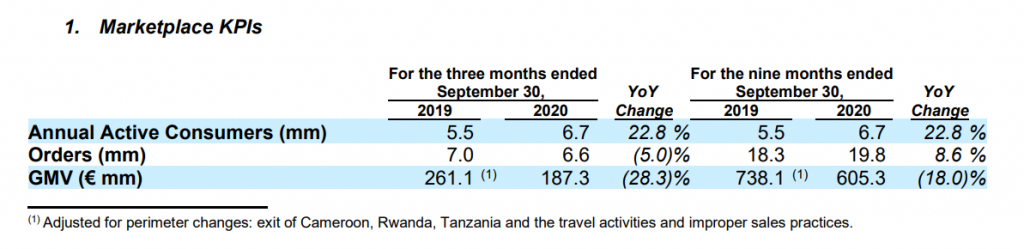

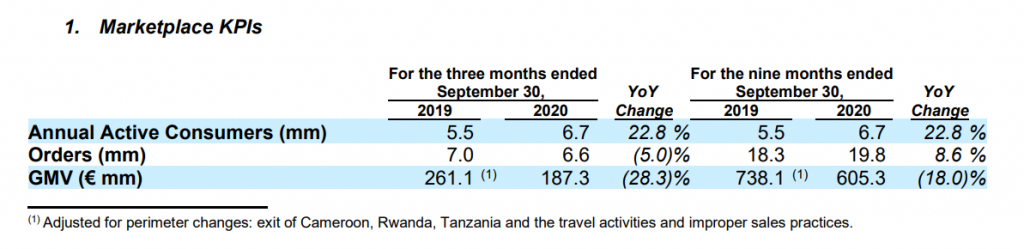

In total, over 6.6 million orders were made during the quarter from an active customer base of about 6.7 million. The orders fell by about 5% year-over-year on the back of a 20% decrease in digital services transactions on the JumiaPay app.

Although revenue dropped, the e-Commerce was able to reduce its operating cost during the quarter to a three year low. The company recorded a loss of N12.60 billion (€28.0 million), a 48.8% decrease from the €54.6 million loss last year.

Similarly, sales & advertising expense was N2.79 billion (€6.2 million), the lowest quarterly amount since 2017 and a YoY decrease of 55%. Jumia explained that was owing to the increasing marketing efficiency as Sales & Advertising expense per Order decreased by 53%.

Jumia co-CEOs claim that the company has made multiple enhancements across its logistics and marketing operations that led to a decrease in fulfilment and marketing expenses for the third quarter of 2020.

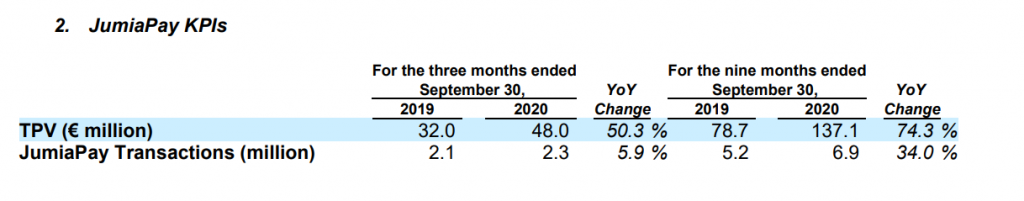

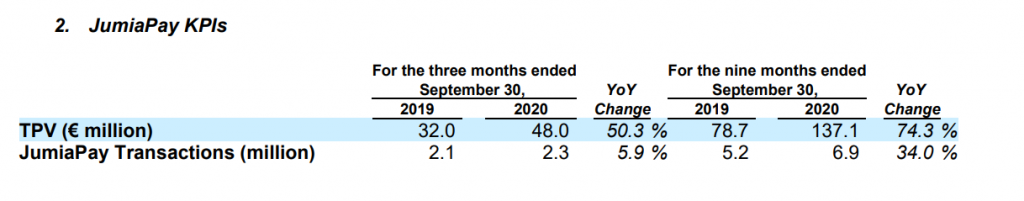

JumiaPay grows by 50%

Jumia’s payment platform, JumiaPay, continued its stellar growth recording a total payment value (TPV) of N21.61 billion (USD 56.6 Mn) during the quarter. this is almost double the amount transacted during the same period a year before.

In general, the platform’s volume of transactions increased by 6% from 2.1 million in the third quarter of 2019 to 2.3 million in Q3 2020.

To further boost growth, Jumia has revealed plans to launch the pilot of Jumia Games on the JumiaPay app across five countries. This will be in partnership with Mondia. The new game is a subscription-based service offering unlimited access to over 500 games, including in-app purchases.

Similarly, Jumia Food platforms also saw major growth, rising by almost 90% over the same period. Overall, 34.1% of Orders placed on the Jumia platform were paid for using JumiaPay, compared to 30.6% in the third quarter of 2019.

In summary

Despite the drop in revenue during the quarter, the numbers show that Jumia is on track to full recovery.

Its shares currently sell as $12.96.

However, shares went down 19.6% to $12.86 early Tuesday following the release of the earnings report. This shows that Jumia will have to show higher growth if they wish to fully recover investor confidence.