Kwaba is a mobile app that offers services related to mortgage and housing to city dwellers, especially Lagos. It is developed and maintained by Kwaba_ng, a startup that provides flexible rent-payment options to the low and middle-income earners.

Overview

Finding a suitable house to rent in Lagos can be a stressful experience. Even after finding the house, making the payment can be another challenge because houses are expensive and the good ones are even more expensive.

Real estate analysis in 2019 showed that Lagos is the most expensive city in Africa with apartment prices in some areas almost tripling that of other states in Nigeria. Abuja is rapidly trailing Lagos in the cost of rents as well. The cost of housing has continued to rise as the population in these states increase and they attract more economic activity.

For low and middle-income earners, this sometimes means that the amount they earn in salary cannot cover the immediate yearly payment of rent. This challenge is sometimes solved by two or more people sharing an apartment and splitting the bill. Some other people choose to borrow the money or save up and rent at a later date.

Kwaba_ng has created a solution that allows people to rent apartments for a year and pay back over a couple of months. Kwaba pays the yearly rent to the landlord or house agent while the tenant pays Kwaba back on a monthly basis.

Features of the Kwaba mobile app

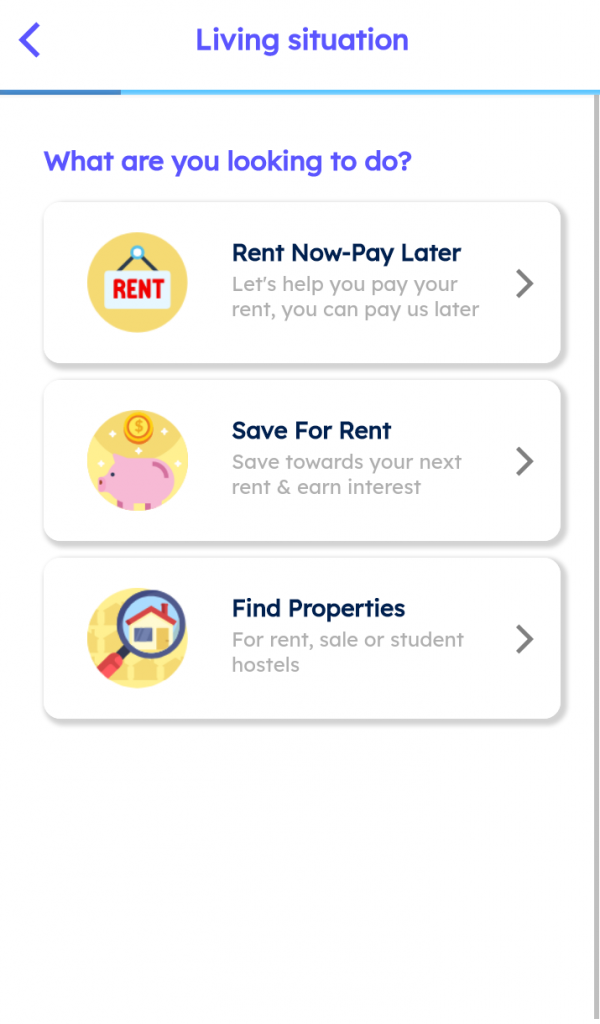

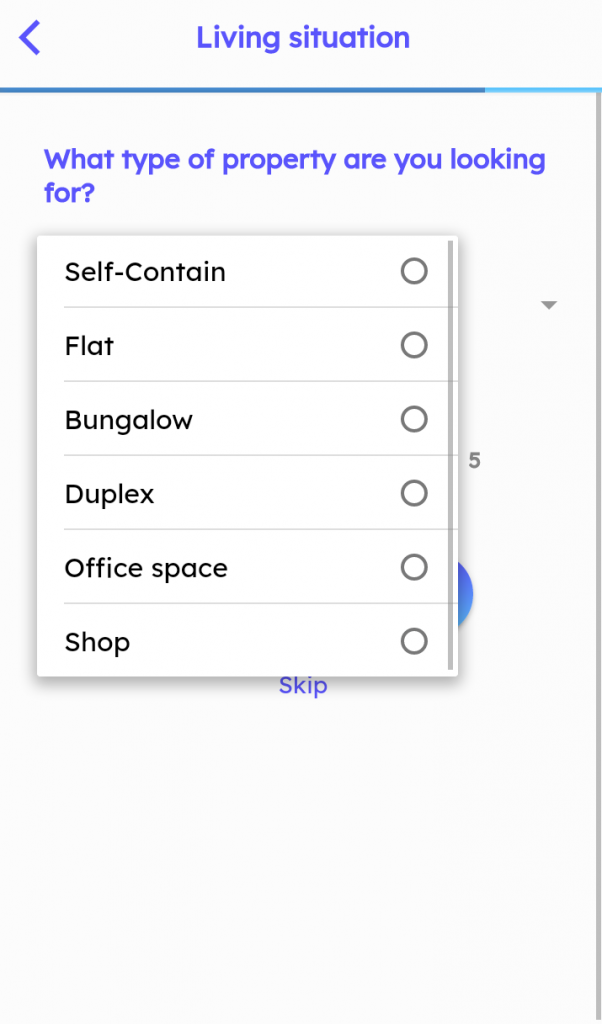

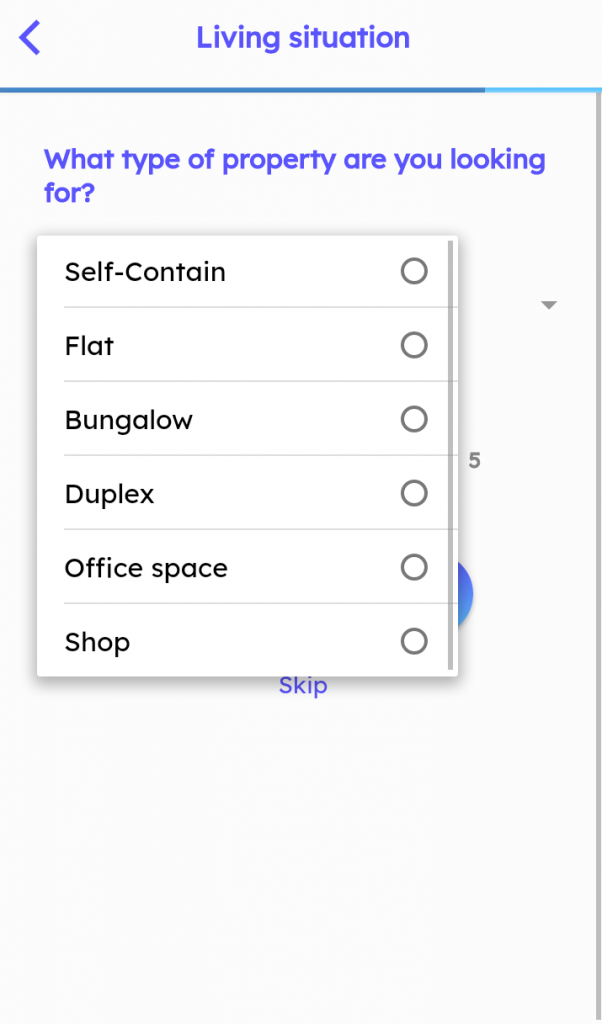

I installed version 1.5 of Kwaba and set up my profile with name, email and phone number. There are three main functions that can be carried out on the app. You can either search for a property to rent, ask Kwaba to foot your payment upfront while you pay later, or save towards a later rent.

I tried out all three functions on the app and found the app easy to navigate. By clicking the search for a place option and specifying a location, the app curates a list of places that are available within the area as well as their prices. I searched for available buildings in Ikeja and got results.

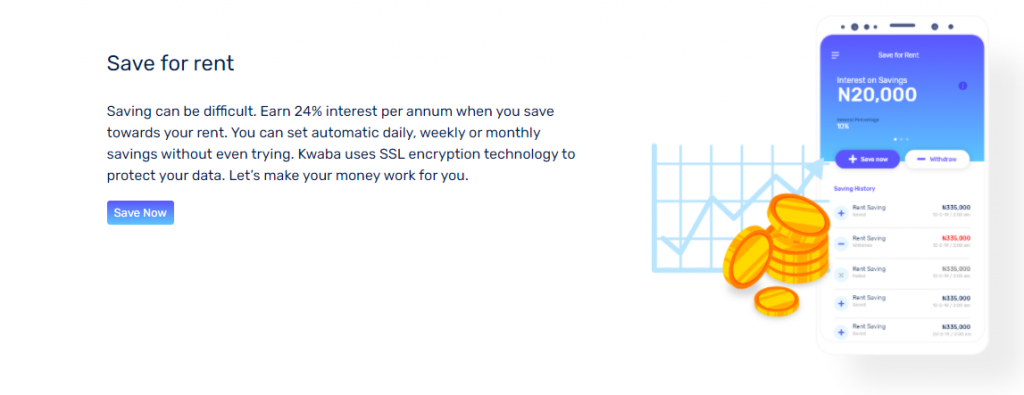

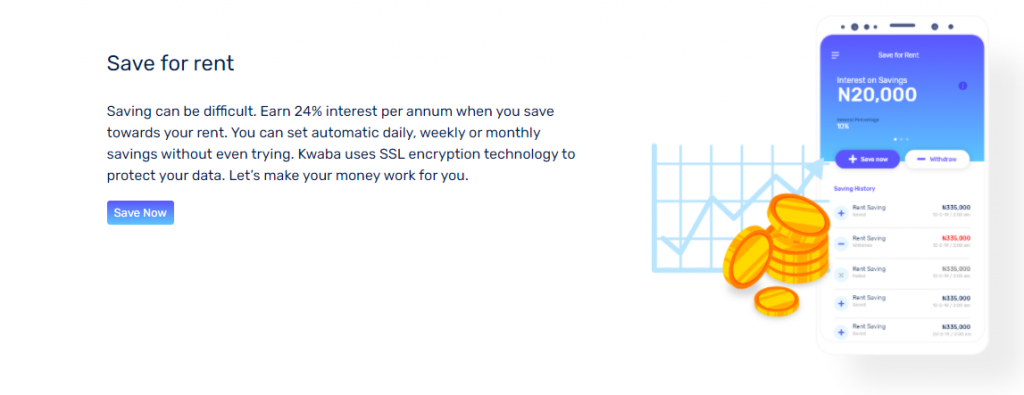

Saving through the app is easy and requires your bank details including BVN, the amount that you want to save and the frequency at which you want to save. However, there are inconsistencies in the interest rates that were promised.

In one section of its website, the company says the interest rate on savings is 24% per annum while in another section it says the same interest rate is over 10% in another section. We reached out to the company with questions about the interest rate on savings and will update the post as soon as we get a response.

A user, Ejetavwo also noted the inconsistency in the interest rates and tweeted, “In one breath, you promise 24% interest p.a but along the line, it changes to 10% p.a for save a rent. Haba kwaba.”

Requesting for an upfront rent payment is Kwaba’s main offering. This feature is only available in Abuja and Lagos states and only to salary earners who earn above N80,000 monthly.

Suggested Read: How PayMyRent is Helping Users Sort out Their House Rent Issues

If Kwaba pays the yearly rent upfront, the user can pay back in monthly instalments at an agreed interest rate. To use this feature, details of the user’s employer, bank account as well as the landlord or house agent will be required.

The interest rate for this service vary and can be as high as 50% depending on the repayment time as well as the amount borrowed. Reacting to the interest rate on rent of N450,000, @lancelotgreene replied on Twitter, “On a 450,000 rent, 12 months repayment plan you guys charge 693,000? I’ll pass.”

We reached out to Kwaba for clarifications on the interest rate structure for rents that are paid upfront and why the rates climb as high as 50% or more. We will update the post as soon as they respond.

What do users say?

Users have shared their experience on the Kwaba app. While some of the reviews are good, some are not so good.

Reacting to the stress caused by the inefficient ‘back’ button mentioned earlier, a user, Yimika Ilori, while admitting that the general interface is cool, said the back button experience is terrible.

Another user, @@lancelotgreene (mentioned earlier) complained about the interest rate over a rent upfront payment of N450,000 by Kwaba.

Another user, Kolawole Salami, tweeted that he was not okay with the idea of paying rent monthly because of the pressure that comes when a new month rolls in. He said, “I am not okay with paying rent monthly, it is not a good idea and it can be tiresome. You find yourself thinking of paying rent every given month. Count me out of this”

Another user, @SavioYourfav felt that Kwaba’s service would make him indebted to the company and could end badly.

User experience on the Kwaba app

The app has a nice-looking interface and the prompts are easy to follow from signing up to applying for loans and others. The ‘back’ option does not work efficiently across the app, however.

In some cases, when you click the ‘back’ arrow on your phone, the app closes instead of retracing its steps to the previous interface. When this happens, you have to relaunch the app again, and this makes the experience a bit more stressful than one might like.

In summary

Kwaba eliminates the need for gathering money in bulk for yearly rent payments and makes it possible to pay monthly in states like Lagos where the rent is high and the landlords do not smile at the idea of monthly payments.

However, job security is a must for users who choose to go the Kwaba way for upfront payment as there must be a guaranteed source of income every month with which the user pays back.

The other service of saving towards rents would have been outstanding if it indeed offers 24% interest rate per annum. Alternatives like Piggyvest offer 10% interest rate per annum on savings as well, therefore Kwaba’s offering is not special in this regard unless the interest rate per annum is higher.

Nevertheless, if you need to search for apartments or houses to rent or need any of Kwaba’s services, you can check them out here.