January and September are some of the most pensive months for parents. This is so because they just have to pay children’s school fees. In such situations, many parents are often left stranded and often in need of loans targeted at educational needs? While there are many edtech solutions developed by Nigerian startups, there are very few that solve this problem like Schoolable.

Schoolable is a solution developed by AllPro, an edtech startup founded by Henry Nnalue (CEO) and Angela Essien (COO). While the solution is targeted at the educational sector, the problem it solves is financial. So, it will not be out of place to think of it as a fin-ed-tech solution.

Schoolable

“We believe that access to affordable finance is the greatest barrier to quality education in Africa. As such we have built Schoolable to make affordable finance available to all players in the education value chain.”

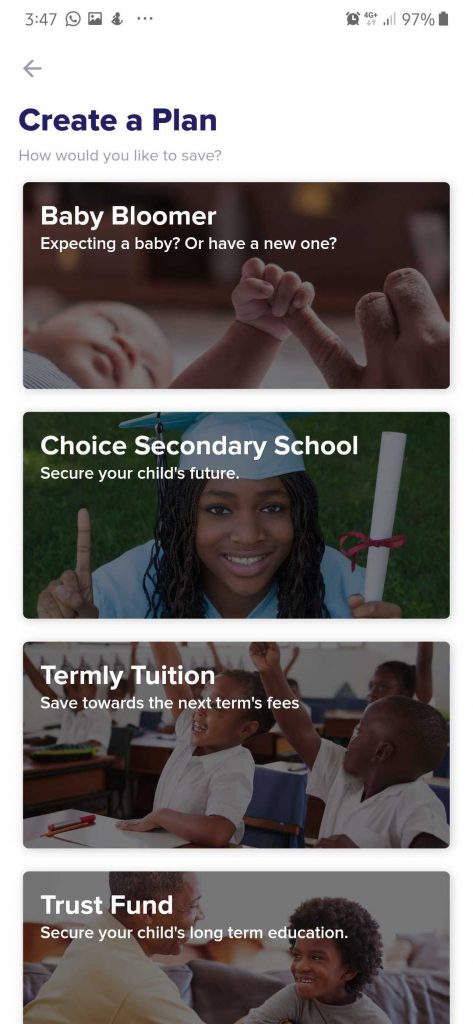

Schoolable’s angle is that it allows users (parents, students, and others) to save towards an educational or more general target. The target could be tuition fee for primary or secondary school, or other goals. Schoolable helps people plan, set aside a portion of their income for tuition fees, and track tuition payments.

It further breaks educational goals into achievable chunks for its users. The Schoolable service can be accessed by downloading the android or iOS app on Playstore and Appstore respectively. It can also be accessed on the website.

How does Schoolable work?

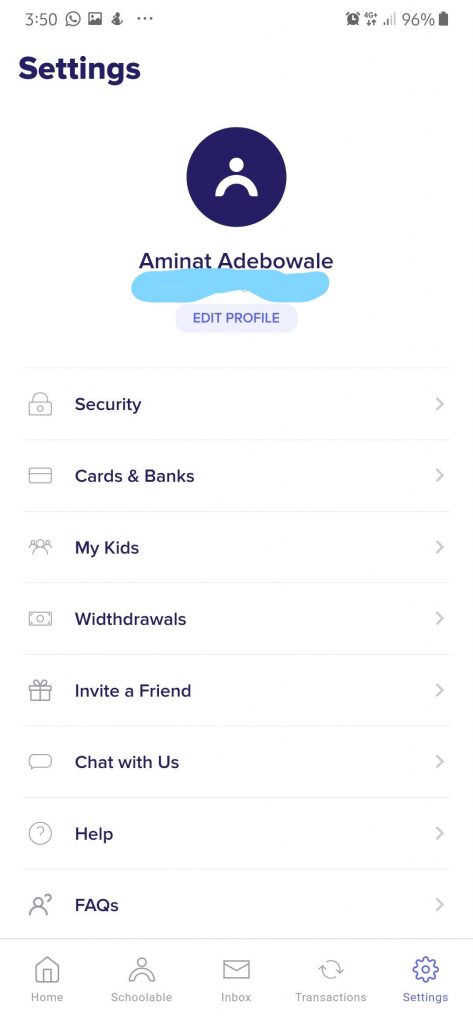

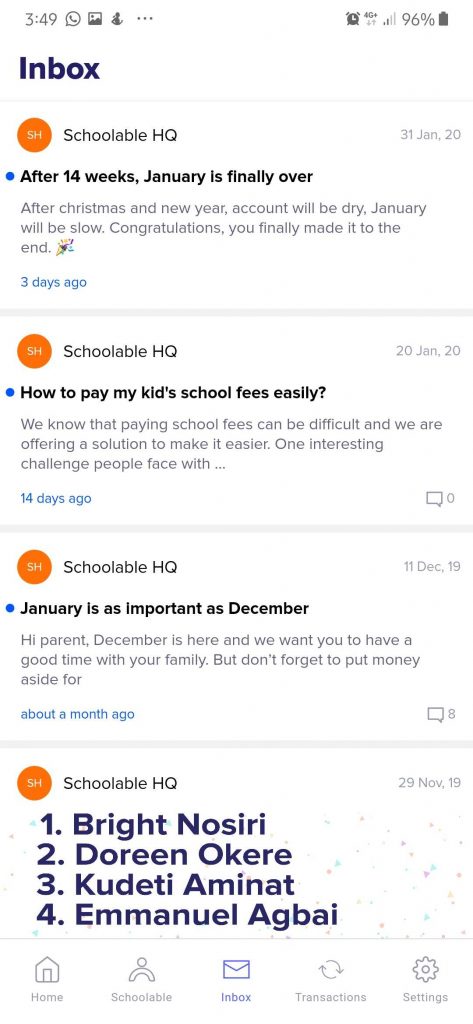

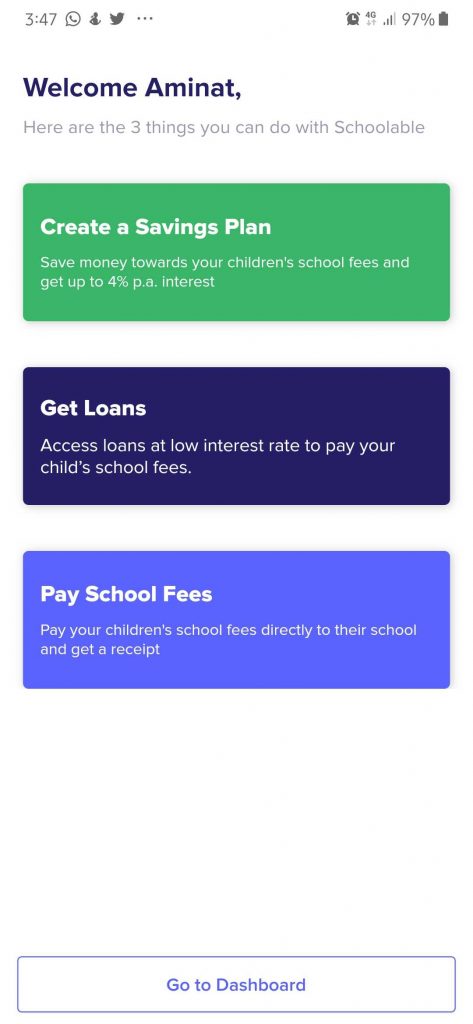

To access this product, I launched the Schoolable mobile app and signed up as a new user. It opened a dashboard for me and showed the various things I could do with the app.

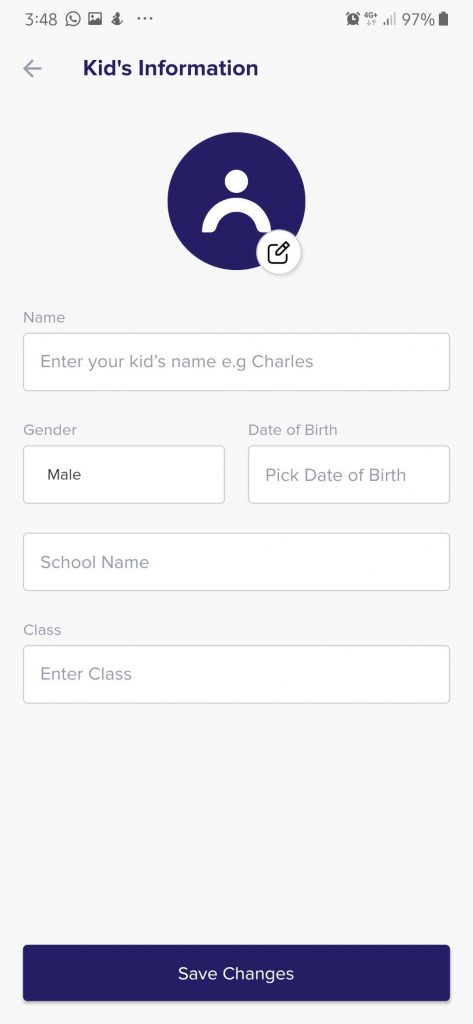

From the dashboard, it seems users can save money, obtain loans or make payments for tuition fees. There are certain fields that need to be filled however and Schoolable requires parents to fill in the details of their children/wards whose fees will be paid.

The details should correspond with the records of the child’s school.

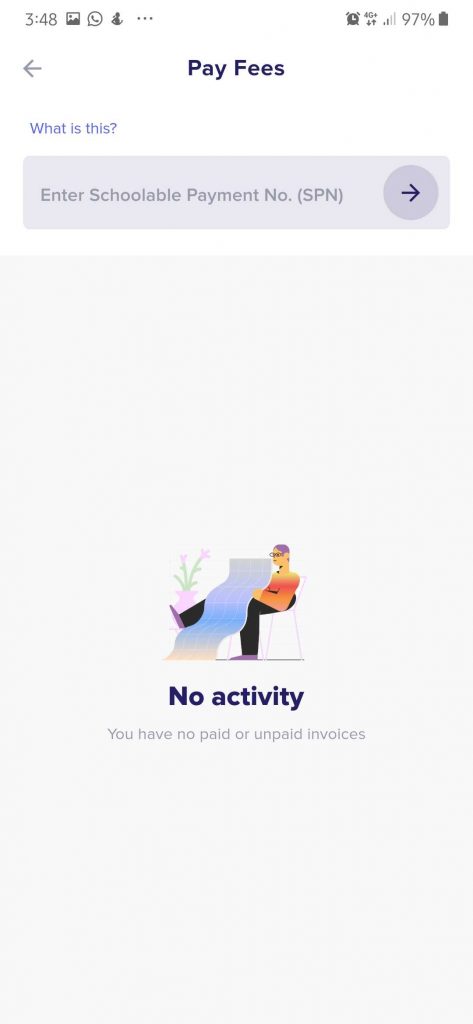

To make payments to schools, the schools will be required to have an account with Schoolable, it is to this account that payments for the schools are remitted.

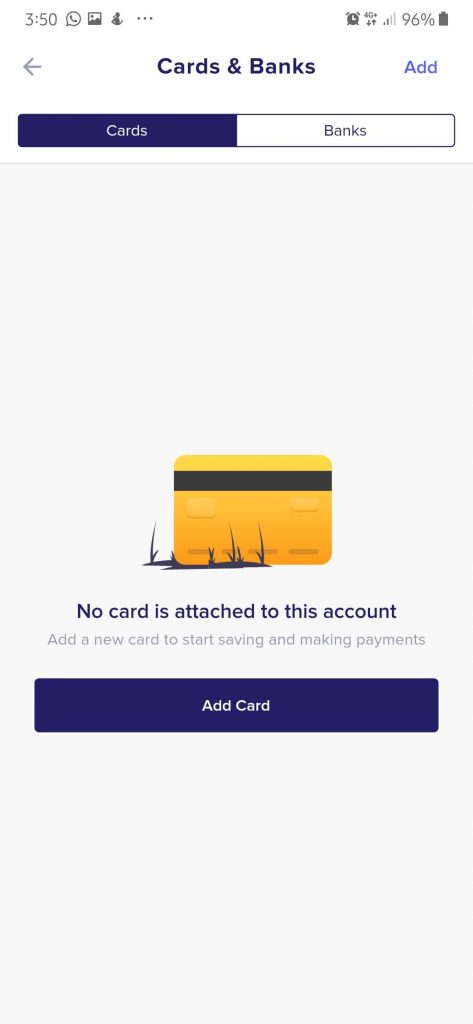

Once the required information is set, users are required to provide their bank/card details before subscribing to a savings plan. Users can also apply for loans if they need it, but provision of the loan is subject to the credit-worthiness of the user, and may or may not be approved.

However, for certain schools, Schoolable provides a better option.

Schoolable trust fund and how it works

In a chat with a Schoolable CEO, Henry Nnalue, the edtech service provider explained to us that trust funds are a better alternative to obtaining loans for fees. The trust fund service is only available to users in institutions that accept tuition fees through its platform.

“Presently, Schoolable is used by 350 schools across Nigeria. Out of those schools, the Trust Fund is currently available to 7 schools, all of which are on the Lagos Island.”

Henry Nnalue, Schoolable CEO

To use the trust fund, a user has to lock up 33% of its annual tuition fee in the fund, like a deposit. When the time for tuition payment arrives, Schoolable pays the lump sum and allows the user to pay back at an agreed monthly rate.

According to Henry, the initial amount put in the trust fund is invested and may be withdrawn by the user afterwards, if the payment has been completed.

After the deposit has been made into the trust fund, the platform pays the tuition to the child/ward’s school when it is due while the user can pay back on an agreed monthly basis. Currently, only pre-tertiary schools and parents whose wards are in that segment can make use of Schoolable.

The Schoolable solution is great for parents and other users. However, to fully enjoy all the services provided, schools have to embrace the service. Users can only pay to schools that are registered on the platform and the trust fund can only be used in schools that are registered with Schoolable.