Following complaints from mobile money users over restricted spending, the Reserve Bank of Zimbabwe (RBZ) has increased the daily spending limit on all mobile money platforms across the country.

The decision was taken as part of a review to the RBZ Monetary Policy after a committee meeting in early October.

Before now, the RBZ had pegged a daily spending limit of ZW$5,000 on all mobile money services after it banned all mobile money agents from handling cash transactions.

Suggested read: Zimbabwe Central Bank Permanently Bans Mobile Money Operators Over Allegations of Money Laundering

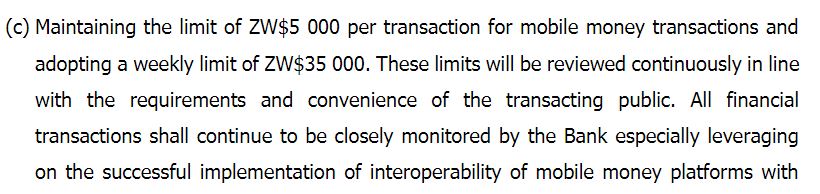

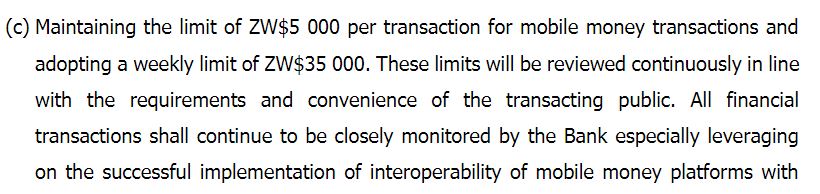

According to the Monetary Policy statement released by RBZ, the spending limit has been reviewed from ZW$5,000 per day to ZW$5,000 per transaction.

Higher Daily Spending Limit for Dissatisfied Mobile Money Users

With the new spending limit of $5,000 per transaction, mobile money users can now spend up to $35,000 in a day. Although the weekly limit remains at the same $35,000, the per transaction limit means that people are able to spend more money daily without having to wait till the next day to complete a payment above $5,000 or forfeit the transaction entirely.

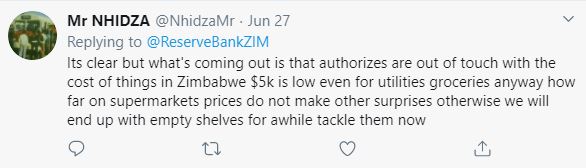

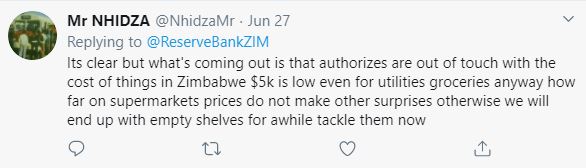

When the RBZ effected the $5,000 daily spending limit, it drew a lot of criticism from mobile money users in Zimbabwe. People condemned the directive, stating that it restricted the amount of money available for them to spend on person-to-person transfers, payments for merchant goods and services as well as the settlement of bills and airtime purchase.

Users also mentioned that the ban of all secondary mobile money wallets meant that they had only a single primary wallet to complete all financial transactions.

Suggested read: EcoCash Users in Zimbabwe Decry Ban of Secondary Mobile Money Wallets

Mobile money is predominantly used to complete transactions in Zimbabwe, with 7.5 million (50.4%) of the 14.86 million people in Zimbabwe actively subscribed to at least one mobile money platform, mainly Ecocash.

This is due to the shortage of cash in the country brought about by constantly fluctuating foreign exchange rates.

Govt Controlling Cash flow through ZimSwitch

All mobile money operators in Zimbabwe are now connected to national payments platform, ZimSwitch. ZimSwitch was set up by banks in Zimbabwe and is designated by RBZ as the sole platform for processing cash transactions in the country.

Although the RBZ directive banning mobile money agents was reportedly aimed at taking down money laundering operations, the integration of ZimSwitch into all mobile money platforms means that the government now entirely oversees all cash transactions in Zimbabwe.

Before ZimSwitch was introduced, people hardly processed any transactions through banks, preferring to use mobile money platforms and patronise mobile money agents for cash withdrawals.

The move by RBZ effectively forces people to process mobile money transactions through banks and patronise banks when they need cash in the absence of any other alternative.

By controlling cash flow, the government perhaps intends to stabilise the unpredictable foreign exchange market in Zimbabwe and overcome cash shortages.