Kudi is a fintech app that helps people provide agent banking services to others within their community. It was developed and is maintained by Kudi, a startup founded by Yinka Adewale and Pelumi Aboluwarin in 2016.

Overview

Paying bills, sending money and renewing subscription for services, are regular aspects of daily living. Finding a very easy and relatable yet tech-enhanced way to do that has been a challenge in Nigeria considering that not everyone is banked in the country.

As of 2019, 80% of the country’s population was still being paid in cash. This means that financial solutions that are being developed have to take the people’s high dependency on cash into consideration.

This is the reason why Kudi developed a financial product that connects people who want to pay in cash to people who have bank accounts and can serve as agents using an app that facilitates payment for different services.

For this review of the app, I used the version 2.2.2. Kudi has more than 50,000 downloads on the Android playstore. This article reviews it based on its functionality regarding the services it offers, ease of use/feedback structure for people and the simplicity of its layout.

Kudi’s services

As earlier mentioned, the app allows people to become agents that can facilitate payments for others through it. It is essentially for agents.

I installed the app and set up an account with my details. It requires your name, BVN and the phone number associated with it. After that process is completed, the app takes your picture through a camera feature built into it.

The process of capturing the picture is an unpleasant one because of the flash that compulsorily comes on. Also, depending on the type of phone that you use, it is possible that the picture comes out longish or slightly distorted.

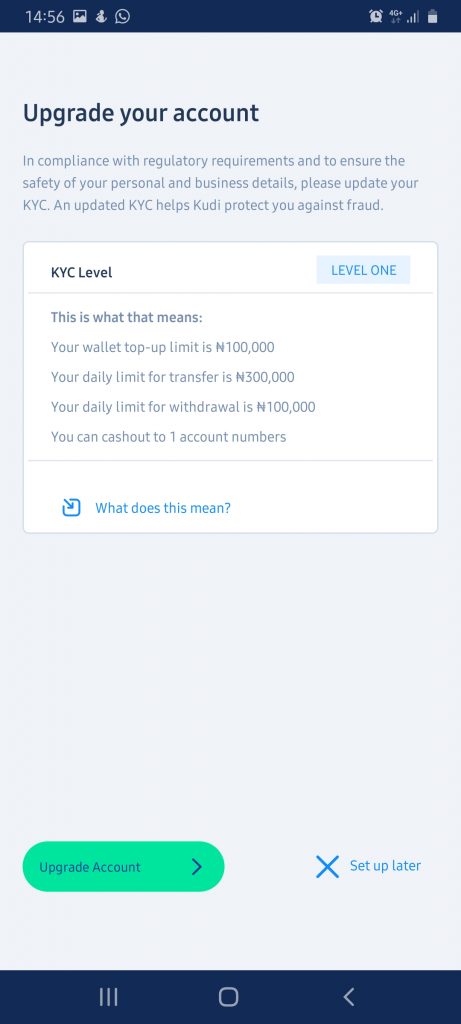

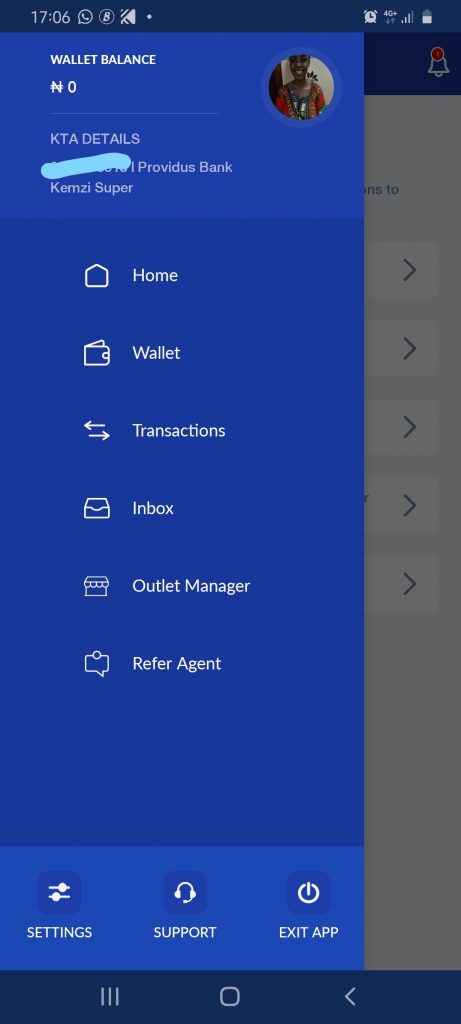

Once your basic profile is set up, you can start making transactions for people after setting up your bank account and funding your wallet.

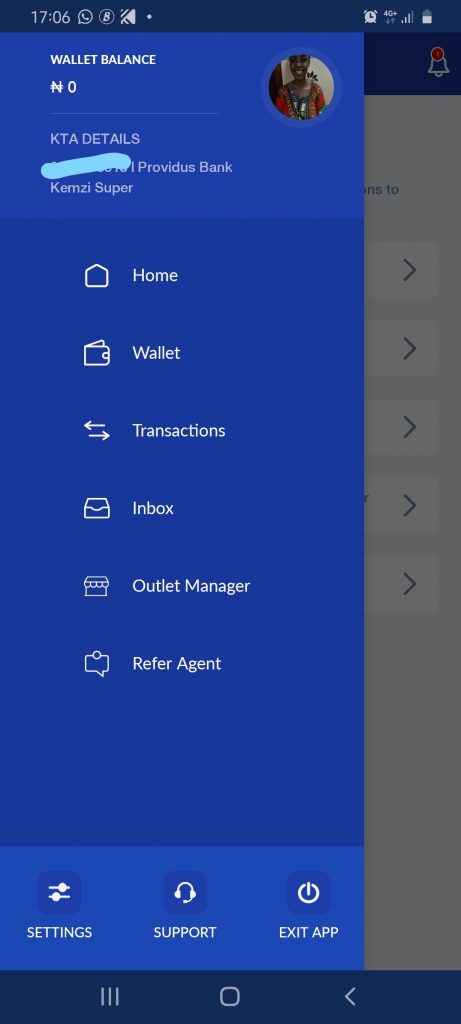

Each agent has a unique Providus bank account that is used as a virtual wallet to store money. It is from the wallet that agents make their transactions for various services.

Once the wallet is funded, you can start functioning as an agent. The services agents perform include money transfer, cable TV subscriptions and utility bills payment.

Banking the unbanked

As of 2019, there are roughly 60 million unbanked Nigerians according to the Central Bank. This means nearly 40% of the population remain largely unbanked. Thus, the Kudi app, through its network of agents, appears to be solving the problem of banking these unbanked populations.

While a considerable number of the unbanked are in the countries cities and urban areas, the bulk of this population is expected to be found in rural areas. It remains to be seen how widely distributed Kudi agents are. With its app depending majorly on good internet to function, penetrating into rural areas might be a problem. Thus a bulk of its agents might be located around urban centres.

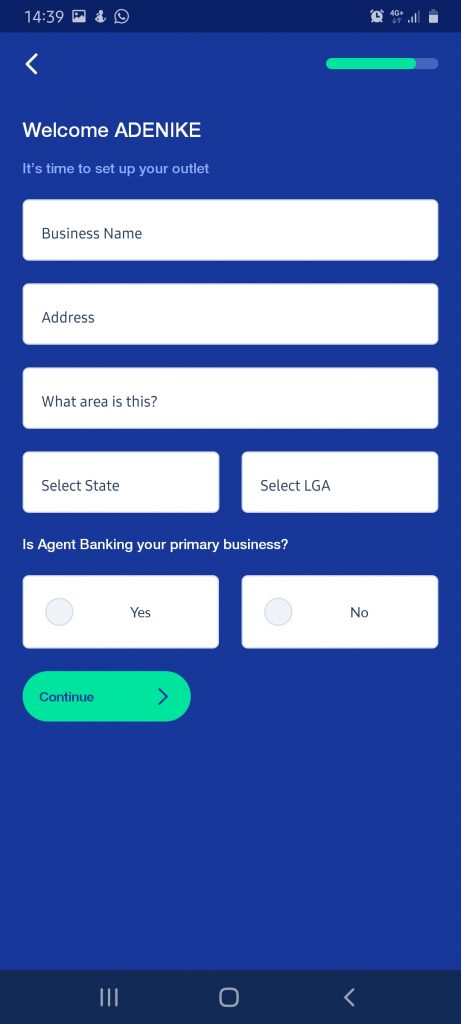

The app delivers on its expected functionalities and recently added a feature that allows a user to manage more than one Kudi agent account. Reviews by other users on the Playstore also show that people are able to serve as agents using the app. I was able to set up a payment outlet which I named Kemzi Super just for fun.

Feedback structure for user complaints

Within the app, the support provided is a FAQ section which is supposed to address all complaints. While using the app, I did not have any need to seek help outside of the FAQ. However, other users have dropped complaints and negative reviews on the Playstore based on glitches that they experienced and would have preferred to report in the app.

As Patricia Agbonkhese said, the app should “include live chat with a customer service representative. And again your customer service representative does not take calls and will disconnect you suddenly.”

Previous versions of the Kudi app had a feature called ‘other complaint’ which, according to another Playstore reviewer, Guess Vaughn, helped to “express my complaint and usually get faster resolution than the FAQ”.

Simplicity/technicality of the app

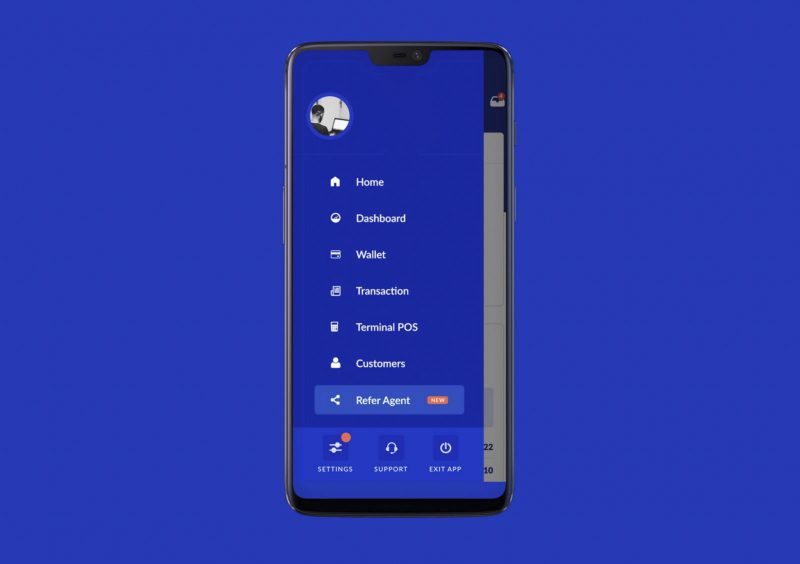

The app layout makes it easy to follow processes and carry out actions on it. It has a moderate mix of colours, prominent of which are green, blue and white. The dashboard includes just the three features which the app designers anticipated would be the most required by the users.

The processes flow into each other in an intuitive manner. The design thinking and easy-to-navigate format of the app make it simple to use even for first-timers.

In summary

The app makes it easy for agents to help customers carry out financial transactions. But it could do a lot much more to make the the experience more pleasant by adding proper feedback channels that can provide a more effective support for the agents in the case of back-end glitches during financial transactions.