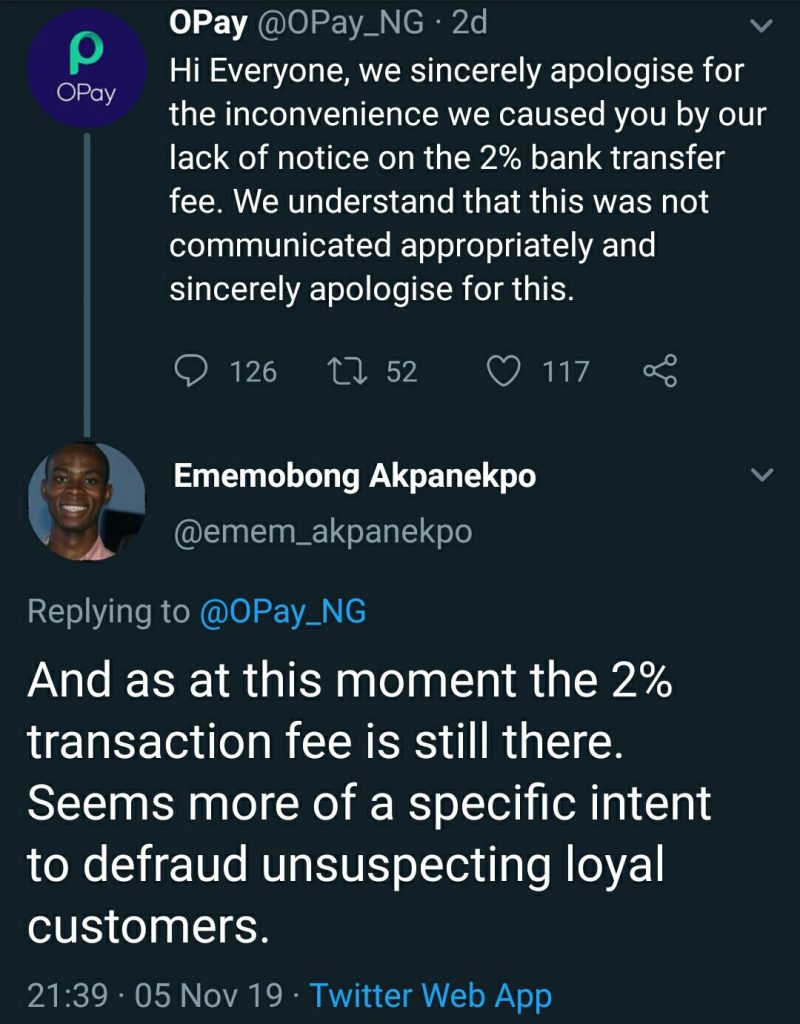

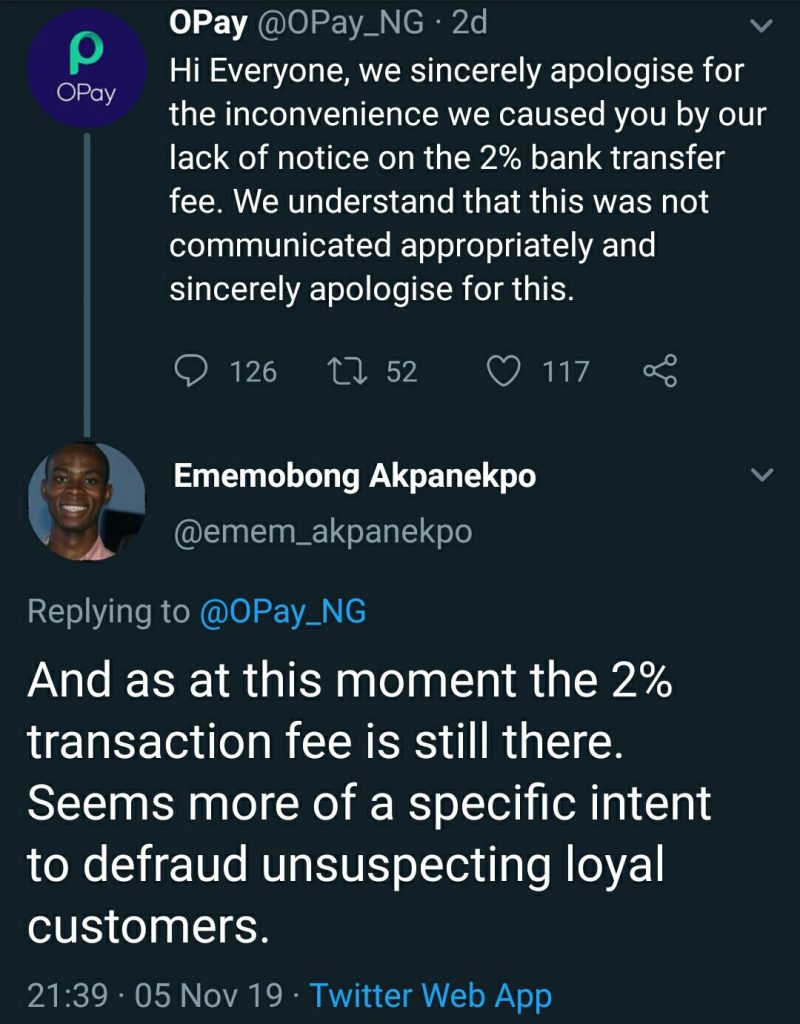

Users of mobile money platform, Opay, were this week greeted with a rude shock after operators of the Super app suddenly, and without notice, increased their service charge.

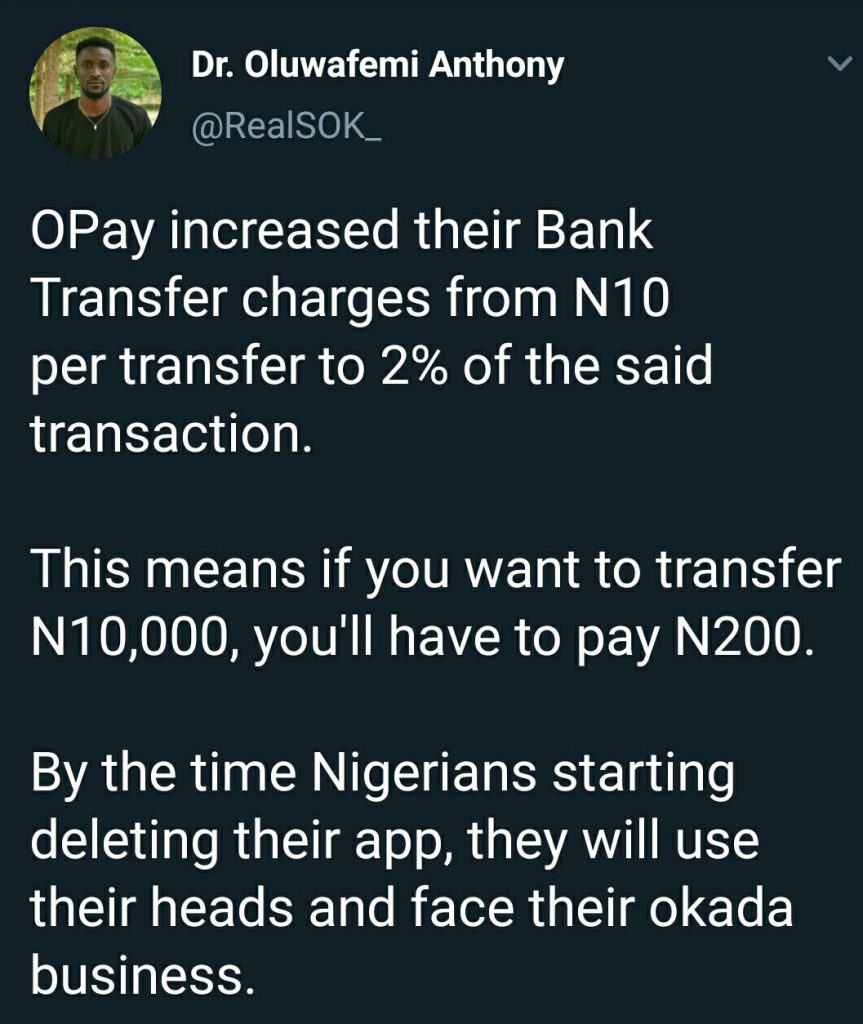

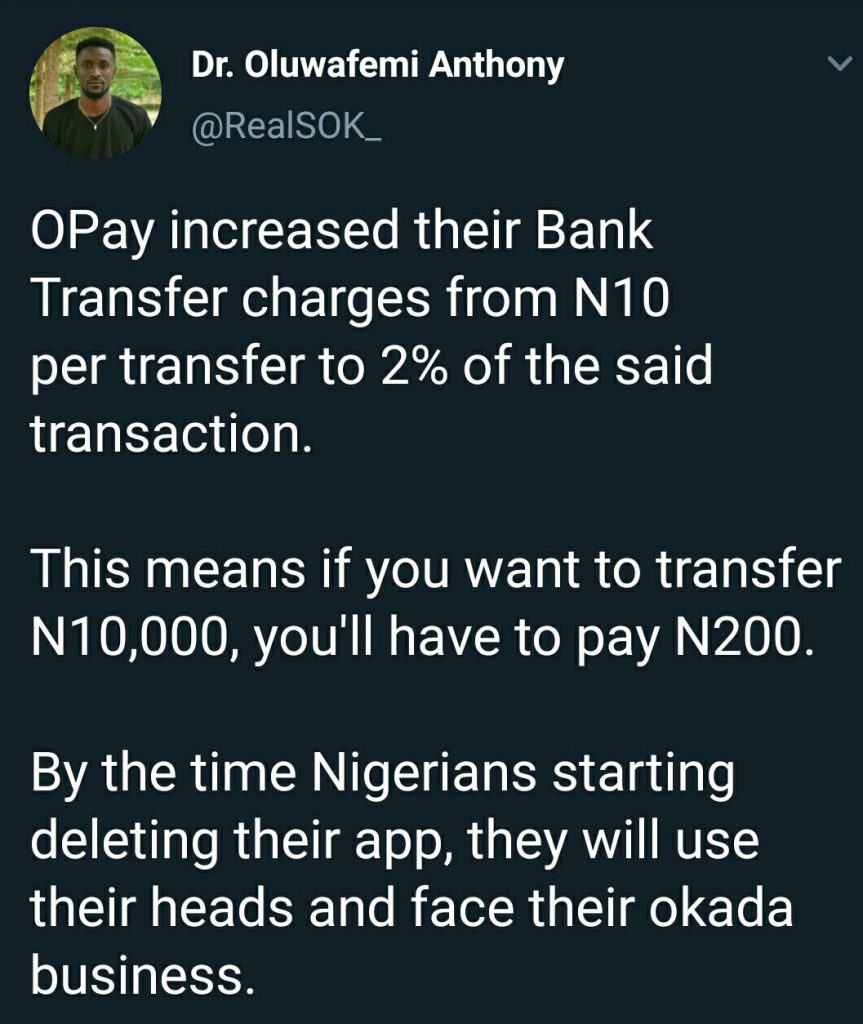

Initially pegged at 10 Naira per transaction, users practically woke up one morning to discover it has been increased to 2% of the worth of any transaction. According to some users, this also includes the transaction of funding your wallet.

While Opay claimed the fee is just 1% after an initial N45 for the first transaction, users however insist they are still been charged 2%. To put it in context, if you want to initiate a transaction worth N50,000, your fee would be a whopping N1,000. This basically makes OPay the most expensive mobile money app in Nigeria by far.

But trust Nigerians to not hang around such an unfriendly platform much longer. In a business where serious competition is forcing charges down, skyrocketing charges is bad business for OPay. The honeymoon is obviously over and users are saying goodbye.

With this in mind, I have come up with a list of lesser known mobile money apps which reviews have shown to offer excellent services and whose rates are quite business friendly.

Kudi

Kudi is basically a mobile money agent banking app which encourages users to become agents. Rated an impressive 4.1 Stars, users say it offers a smooth customer experience, is easy to use and transactions are fast and secure.

Kudi charges 0.7% on POS withdrawals and a flat rate of N45 on all transfers. To use the platform, you have to download the Kudi app, log in, and fill in your personal details, phone number and bank details. You can then proceed to fund your wallet and start making transactions.

Fortis mobile money

Fortis is another cool mobile money agent app that a lot of people aren’t conversant with. Licensed in 2009 with operational debut in 2010, the app is rated 4.4 Stars on Play Store. There’s hardly a single complain by users and the platform is being touted as one of the best out there.

With Fortis Mobile money, your phone number could also serve as your account number. This enables users to send money directly to people living in rural areas with no Internet. Fortis charges N100 for transfers below N100,000 and N150 for transfers above N100,000. For POS withdrawals, Fortis charges 0.6% of the amount withdrawn. As an agent Fortis lets you keep 40% of the proceeds.

PalmPay

PalmPay is another not-very-popular mobile money platform out there. Operated by Transsnet Financial, the app boasts a rating of 4.1 Stars with reviewers describing it as instantaneous, fast, reliable, and generally giving it a thumbs up.

PalmPay currently charges a flat rate of N10 for transfers while deposits and withdrawals are totally free. There’s also a 10% cashback when you buy airtime or data via this app as well as a 5% cashback when you pay bills via the app.

Tingg

Tingg is one mobile money app that has been around for a while. Operated by Cellulant Finance, on Play Store the app enjoys an approval rating of 3.9 stars. Tingg currently charges a fee of as low as N6 for every transaction. That’s incredibly cheap.

To become a Tingg agent/neighbourhood banker, you need to already own a small business or a kiosk from where you can be reached. You must also have a valid means of identification like national ID, drivers licence, voters card, passport etc. You must also present one passport photograph. These are the requirements for becoming an agent.

ReadyCash

ReadyCash is one mobile money app that has largely been overlooked even though users testify that it guarantees seamless transactions. Operated by Parkway Projects, the app has a rating of 3.9 Stars on Google Play store.

It’s users, many of them mobile banking agents, testify that the service they get on the app is excellent. Complaints are majorly from first timers finding it difficult to register or logging. But as for the service itself, there are hardly any complaints. I however couldn’t confirm its charges as every attempt to speak with a representative proved abortive.

To use its service you need to download the Readycash application, launch it, register with some basic bio data which includes phone number and BVN, then input the verification code sent to your phone via SMS to create your wallet. After this you’ll have to generate a pin, and choose a secret word. Then you’re good to go.

Competition is a very good thing. Not only does it give you options, it also helps improve the quality of services as providers are always in a bid to outdo each other. Competition also affects prices and fees and the mobile money industry isn’t left out. There are quite a number of options, you just have to choose one that suits you.