Video streaming giant Netflix has announced its second-quarter earnings for the year 2020. The figures fell shorter than predicted by analysts in terms of earnings per share (EPS). Netflix EPS in Q2 is $1.59, which is lower than the $1.81 predicted for the quarter by Refinitiv survey of analysts.

The brand, however, surpassed analysts predictions in terms of revenue. For the quarter in view, the revenue was $6.15 billion, which is higher than the $6.08 billion that analysts predicted for the quarter, according to FactSet.

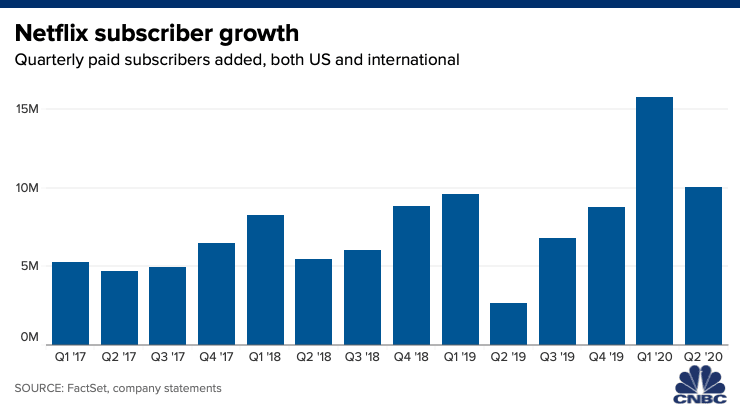

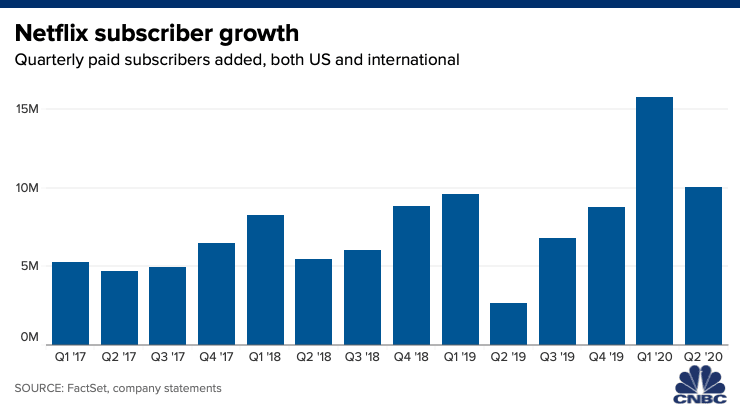

The number of subscribers gained over the quarter increased beyond what was predicted. 10.09 million net paid subscribers were gained globally, compared to the 8.26 million that was expected.

Netflix projected growth for Q3 2020

Netflix has witnessed a decline in its new subscriber base since its first-quarter reports. In Q1 2020, it gained about 15.77 million new users, which was more than double the 7 million net subscribers that was predicted. The net subscriber gain for Q2 however dropped to 10.09 million, which was still higher than the 8.26 million predicted.

The gain in Q1 and Q2 were largely due to the effects of the COVID-19 on people. Projecting a drop in subscribe gain, Netflix said, “growth is slowing as consumers get through the initial shock of Covid and social restrictions.

“Our paid net additions for the month of June also included the subscriptions we cancelled for the small percentage of members who had not used the service recently.”

Suggested read: Owners of Forgotten Accounts to Save Money as Netflix Plans to Remove Inactive Users

For the third quarter of the year, Netflix expects to have 2.5 million net subscriber additions. This is less than half of the 5.27 million subscribers that analysts are expecting from Netflix for the same quarter.

The company’s revenue predictions are lower than what analysts predicted. According to Refinitiv, Netflix is expected to turn up a revenue estimate of $6.40 billion, however, the company’s revenue guidance gives a lower value of $6.33 billion for the quarter. It expects third-quarter earnings of $2.09 per share, above the $2.01 estimated by analysts.

After announcing its revenue guidance which was lower than what analysts predicted, Netflix shares dropped by almost 9%.

Moving forward, Netflix Chief Content Officer, Ted Sarandos, has been promoted to co-CEO while Reed Hastings remains the current CEO. Sarandos will still continue in his role as chief content officer, while Chief Product Officer Greg Peters will take on the added position of chief operating officer.

Netflix vs TikTok and other competitors

The streaming giant alluded to TikTok as being another addition to its list of competitors. “TikTok’s growth is astounding, showing the fluidity of internet entertainment,” it said.

But instead of worrying about its competitors, Netflix says it will continue to stick to its strategy of trying to improve on service and content every quarter faster than its peers.

“Our continued strong growth is a testament to this approach and the size of the entertainment market.”

The company says unpredictability in the trend of COVID-19 infections is a cause of concern for the production of some of its movies in certain parts of Latin America, India, and the US, the company says.

Some of Netflix content that did really well in the quarter include Never Have I, Spike Lee’s Da 5 Bloods, and documentaries including 13th and American Son and Dear White People, all from its Black Lives Matter collection.

“In Q2, we notched successes in many of our key content verticals. In English scripted TV, Never Have I Ever, a fun, young adult dramedy from Mindy Kaling, broke through with 40m households choosing to watch this show in its first four weeks, and 40m households for our new comedy Space Force (starring Steve Carell). On the heels of Love is Blind, Too Hot to Handle and Floor is Lava are the latest in our line of buzzy unscripted shows (51m and a projected 37m households, respectively, in the first four weeks).”

Netflix

Find the full report here.

Netflix is proceeding to the next quarter with lesser expectations than are being predicted by analysts. It is also banking on hit series for the Q3 to bring in significant views from households. As it has predicted, consumer behaviour as they come out of the COVID-19 situation will have an impact on its Q3 earnings report. But is not predictable yet whether it will be positive or negative.