Nigeria’s Paystack is the only African startup shortlisted in the 2019 edition of the Fintech100 report compiled by KPMG and H2 Ventures.

The report which was unveiled recently represents the sixth annual Fintech100 report by the auditing and business advisory company. The list comprises the best fintech innovators from around the world.

The Fintech100 highlights truly innovative companies creating products and services at the juncture of technology and financial services

The companies selected were determined based on extensive global research and analysis of data across a range of dimensions including the core five factors.

The core five factors ar, average annual capital raised; the rate of recent capital increases; geographic diversity; sectorial diversity; and the XFactor, which focuses on the degree of product, service and business model/innovation of newer companies.

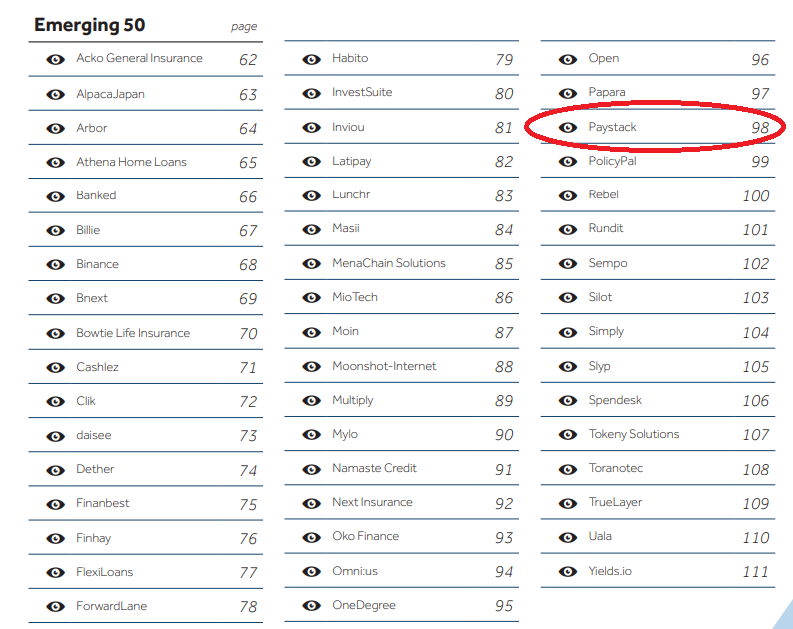

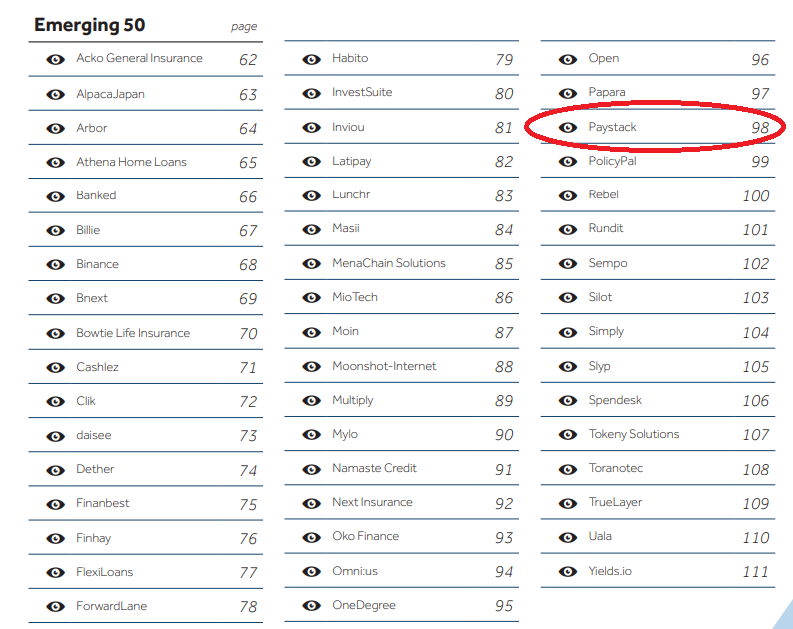

The #Fintech100 list is divided into parts. The first part called the ‘Leading 50′, comprises a list of 50 established fintech companies. The second part is the ‘Emerging 50′ which is a list of newer fintech startups across the world that are showing important potential.

China’s dominance shrinks

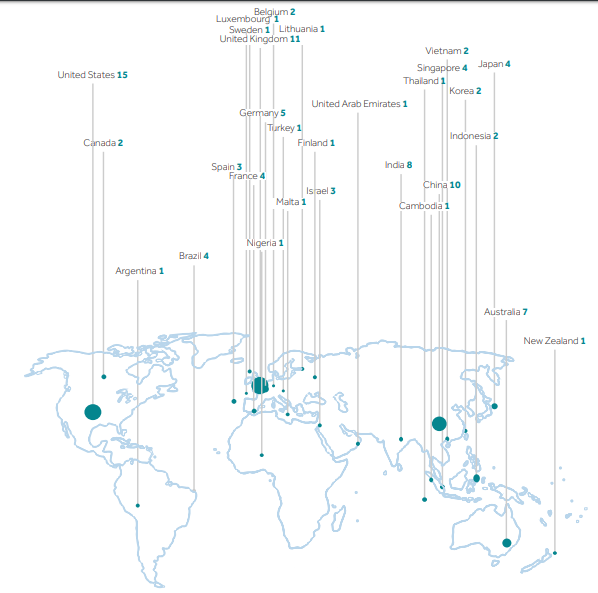

This year’s list featured Fintech companies from 29 countries. This consist of 36 companies from the UK and EMEA (Europe, the Middle East and Africa), 22 companies from the Americas (North and South America) and 42 companies from Asia (including Australia and New Zealand).

Compared to the previous year (4), China’s dominance in the top 10 (3) was taped with the emergence of India as a fintech force, taking out 2 top 10 positions. Ant Financial retained its top spot on the list but Grab overtook JD Digits to become second most innovative fintech company in the world.

Although no African Startup made it into the top 50, fintech startups like Transferwise (#28) with significant presence on the continent made the top half of the ranking.

The list was further categorized into 8 different sectors, comprising of 27 payments and transactions companies, 19 wealth companies, 17 insurance companies, 15 lending companies, 9 neo/challenger banks, and 13 companies that operate across multiple fintech sectors.

Like last year, there were no startups from the blockchain and cryptocurrency sector

Paystack represents Africa

The Emerging 50 list changes each year as the publishers aim to spotlight new fintech across the globe. In 2018, WalletNG and the two other African startups made the Emerging 50 list. This year, Paystack was the only African startup highlighted on the list.

Paystack was listed as an emerging fintech startup under Payments category

Founded in 2016 by Shola Akinlade and Ezra Olubi, Paystack is a modern online and offline payments platform that helps African businesses accept payments from anyone, anywhere in the world.

The fintech startup has attracted investment from global companies like Visa, Stripe, Y Combinator, Tencent Holdings, Google Launchpad Accelerator and Tokyo Founders Fund.

Over $70 Billion Capital Raised

In terms of funding, the top 100 fintech in 2019 collectively raised over $70 billion in venture capital since they launched. This is a 35% increase from the over $50 billion raised by the Fintech100 companies last year.

In the last 12 months, the 100 companies on the list raised over $18 billion, which is far below the over $27 billion raised by the 2018 Fintech, but way higher than the 5.5 billion raised by the 2017 nominees.

In summary, the publishers highlighted that the flow of capital continues to fuel financial services industry innovation. It added that open banking was leading the forefront of the evolution in the financial services industry and also highlighted that traditional industry boundaries were blurring around the customer as network operators are entering into fintech with mobile money and other financial services.

you can get access to the full list of the fintech100 here.