The increasing adoption of technology in banking is proving very effective in driving financial inclusion in Nigeria. This is especially so with access to mobile broadband connections now at about 39% and growing.

Sparkle, a new entrant into the fintech space wants to increase the pace of financial inclusion in the country by leveraging technology in providing, not only financial services, but also lifestyle and business support services to Nigerians.

The startup officially launched its app on 3rd June and announced that it has an official banking license from the Central Bank of Nigeria (CBN). It also revealed that Nigerians can open an account in minutes from anywhere in the world with just their Bank Verification Number (BVN), email address and phone number.

With the promise of swift opening of bank accounts and simple digital banking services among others, we reviewed the Sparkle app.

Sparkle app

Searching for the Sparkle app on Playstore came with a surprise, as I discovered a social media app with the same name and even a similar logo. However, I was able to easily find the app by searching for Sparkle bank instead.

At 18 MB the sparkle app was fast and easy to download. The app has a 4.8-star rating from about 13 reviews and over 5 thousand downloads.

After downloading, you can create a bank account by clicking ‘I am new to Sparkle’ then entering your email. The account is created after you confirm your email in the mail sent to you. However, if you are under 18, you will need a parent’s or legal guardian’s consent to access the platform.

Once confirmed, you will have to enter your full name and phone number in the ‘about you’ page and take a profile picture. Then, you will have to enter a personal OTP sent to your phone followed by your selected sparkle pin for your account to be fully ready.

The whole personal account creation process was easy but wasn’t really fast as I had to wait for several minutes for the confirmation mail.

Sparkle Services

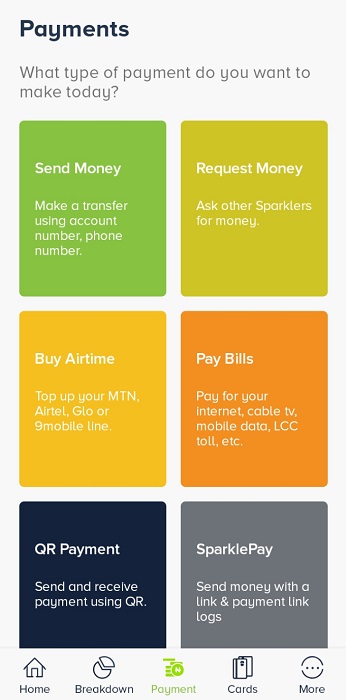

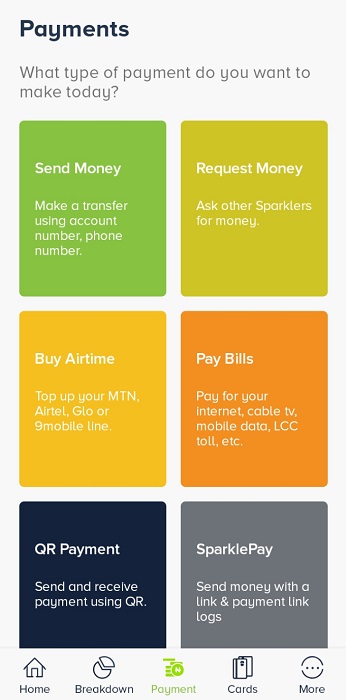

Your Sparkle account offers a variety of services from sending and requesting money to managing stashes and chatting with Indy, its customer services chatbot.

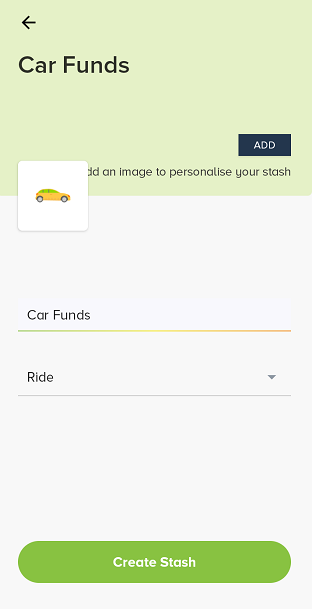

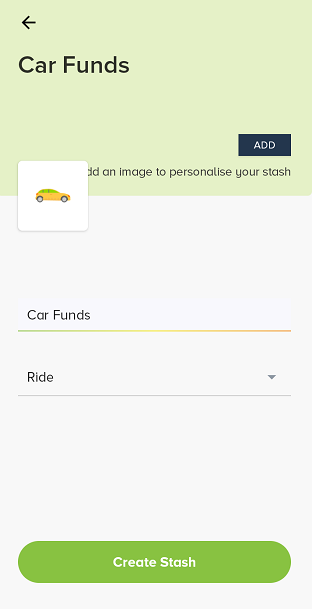

To create a personal stash on the app, you click the manage my stash tile and enter the amount followed by the name and category of the stash. you can also add a picture to personalize your stash.

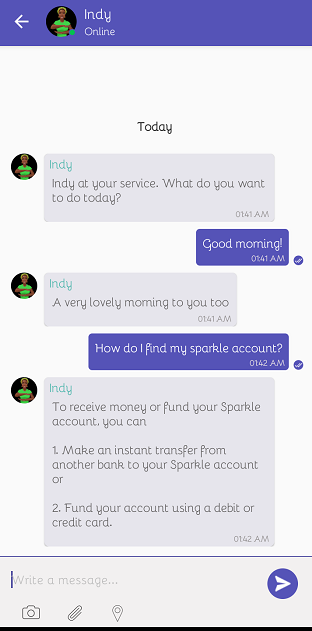

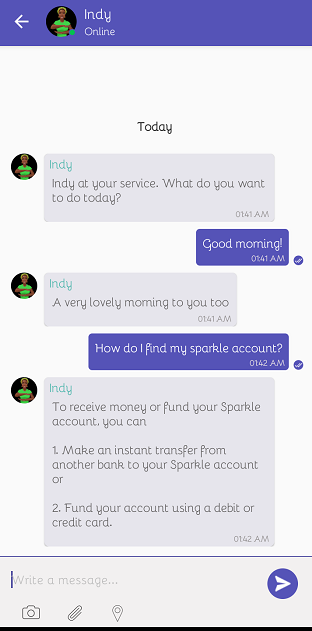

If you have inquiries, Indy, the apps intelligent chatbot is available 24/7 to answer questions. Chating with Indy was easy as she answered the few questions I asked correctly.

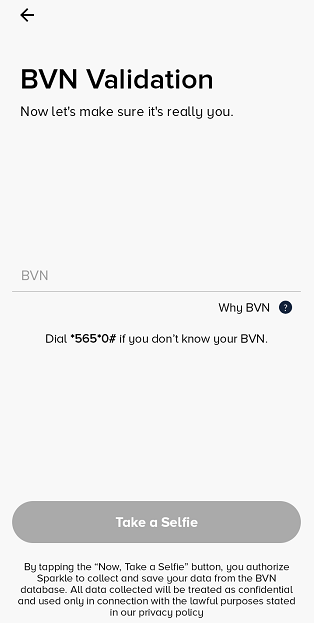

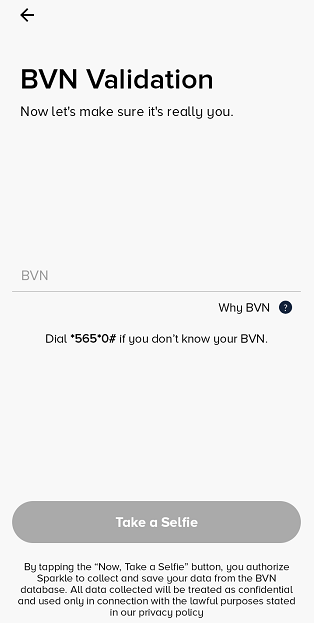

To fund your account you can easily enter amount and enter an atm card to facilitate the transaction. However, if you want to send or request money on the app, you will have to add your BVN.

After inputting BVN, you will need to take a selfie. The app uses the picture and the BVN to confirm your identity by checking it against your BVN data in the NIBBS database.

Once the BVN is verified you can start sending money. To request money you have to have other Sparkle users on your contact list. Note that the app asks for permission to access your contacts, location and pictures so if you are privacy-conscious you may want to think twice before ticking all the boxes.

As at the time of the review, other features like Buy Airtime, Pay Bills, QR payment and Sparkle Cards was not available. However, the app has an activities log and breakdown features that can help you effectively manage and track your money.

Summary

With its innovative and easy to use bank app, Sparkle is making customer banking more transparent, simple and personalised. It could also help accelerate the transition to more digitally enabled lifestyles especially at a time when the effect of COVID-19 pandemic is being felt across the globe.