Banking with a digital bank is on the rise in Nigeria. Thanks to a young internet-savvy population and increased mobile penetration, digital banks have brought a whole new world of opportunity in the financial space.

The ease of being able to open and operate an account in minutes from any location, compared to the number of processes needed in traditional banks have also opened up the space. As a result, there has been a rise in digital-only banks using digital innovation to solve financial issues. Retail banks have also caught on, with banks like Wema deploying standalone digital-only banking platform, Alat.

Choosing among these digital banks should be delicate considering the fact that it will involve your finances. In this post, we will be looking at 3 of the available digital-only platforms out there – Alat, Vbank and Kuda and my experiences using them.

Suggested Read: Great Features but Several Downsides, The V App is Adequate When it Could Have Been More

Getting Registered

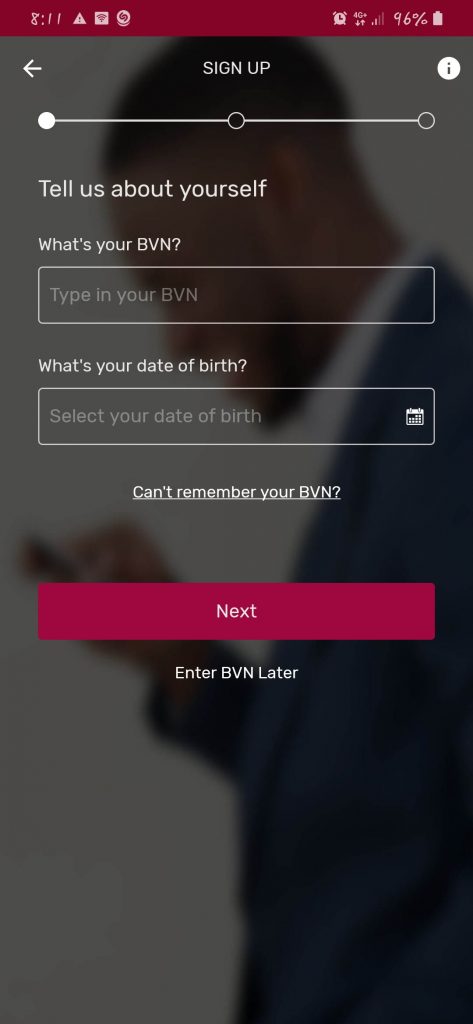

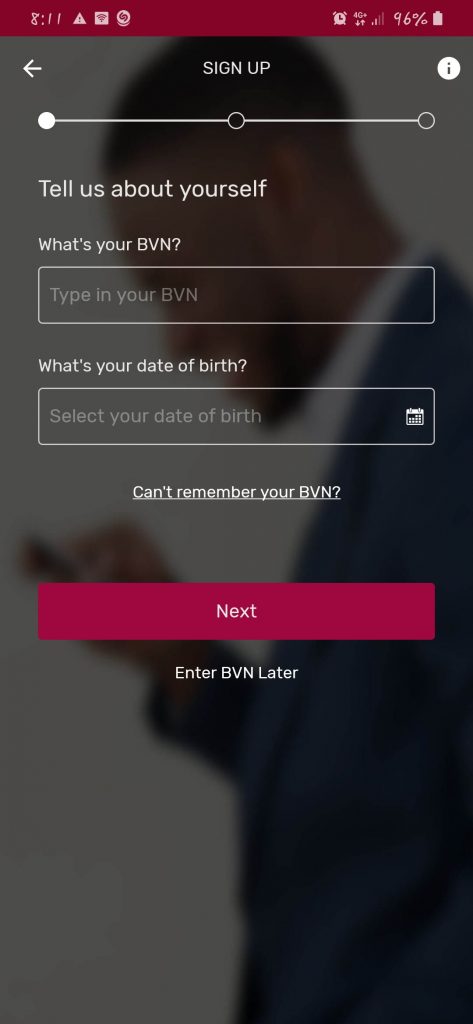

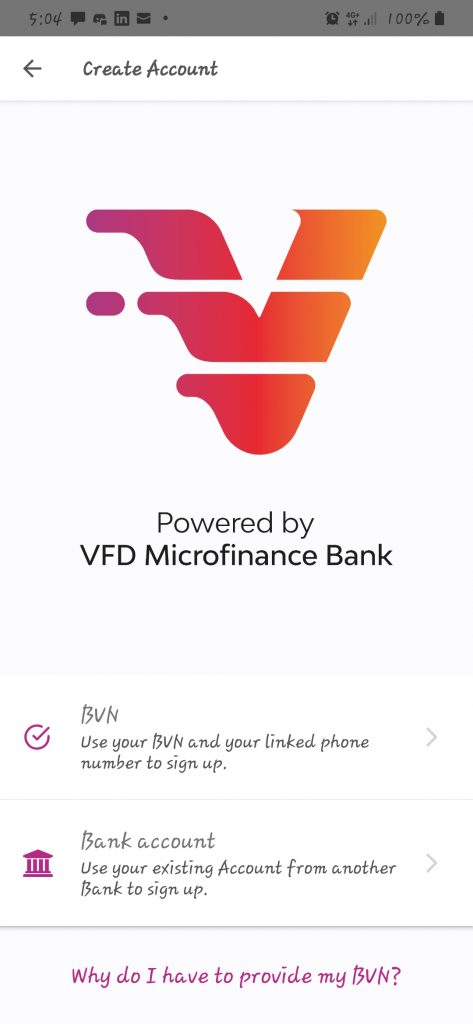

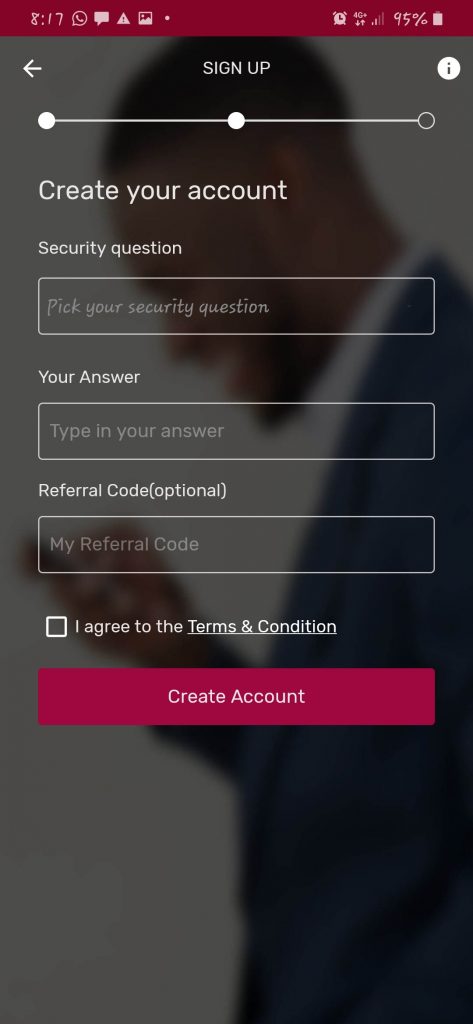

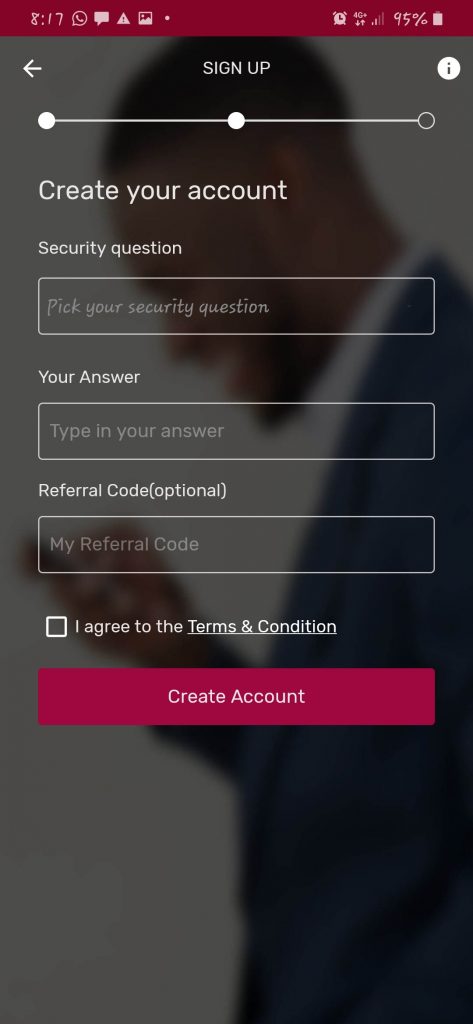

First of all, it is good to note that all three platforms are free. They all also have Android and iOS Apps. Registration on all three platforms is quite similar save a few differences. Across the board, requirements like phone number, birthdate, BVN are the preliminary requests.

Users also receive an OTP to continue the process of registration.

On Alat, there’s a video tutorial for first-time users to ease them through the registration process. Also, basic details like your name are automatically filled from the BVN entered. On Vbank and Kuda, however, you will need to enter your details manually.

Email address and password are also requested by all the platforms. The User’s picture is also requested at the point of registration. For Vbank you can select from your gallery, while Kuda and Alat will need you to take a picture using your phone’s camera.

For Vbank and Alat, your signature is required. Vbank lets you do it digitally with your phone while on Alat you will need to grab a pen and paper, sign, and take a picture of it.

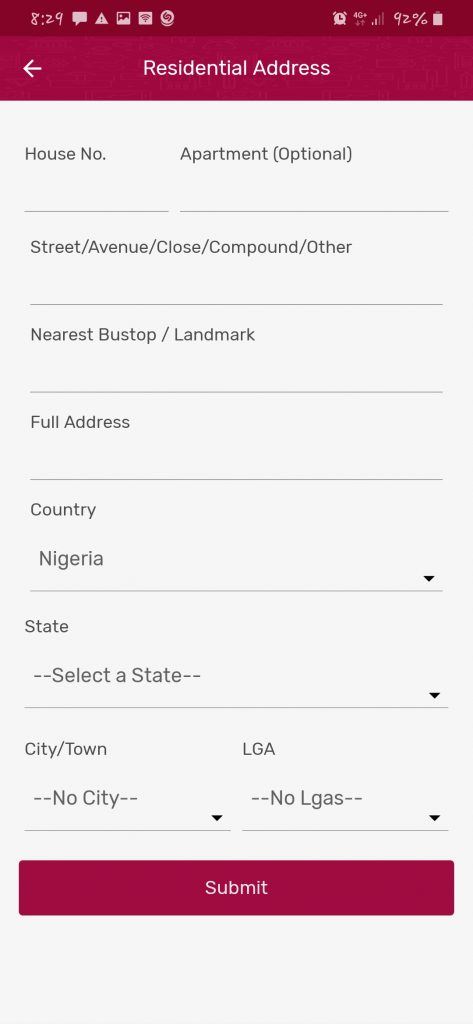

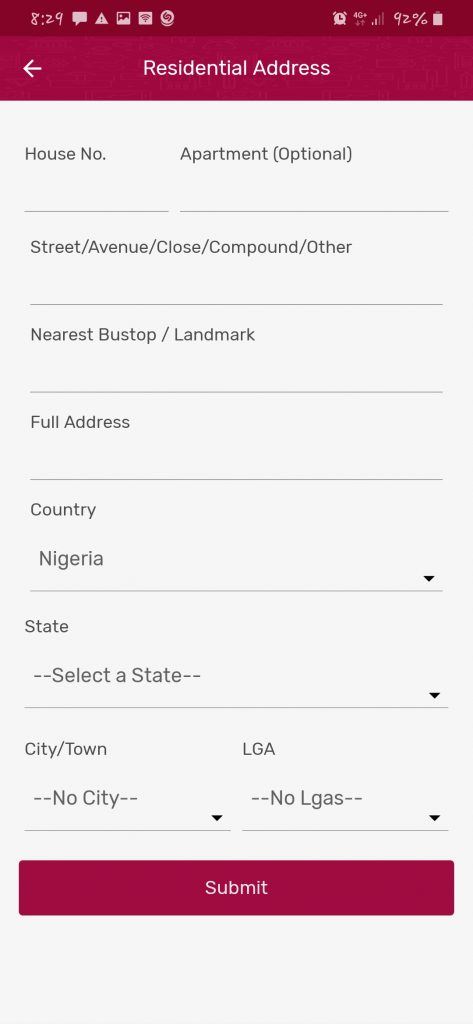

Kudabank requires you to fill in your address details during your registration, while for Alat you will be allowed to fill it after initial registration.

Overall registration on all the platforms takes between 7-10 minutes once you have all.

Key Features

Beyond the ease of getting on board, what the ‘digital bank’ offers is very crucial to making a decision. For starters, once registered the offerings on all the platforms are limited until you verify your account. As a government rule, you will need to add a government-issued ID – passport, National ID or Driver’s licence. For Alat, you will also need to fill in details of your Next of Kin to get fully verified.

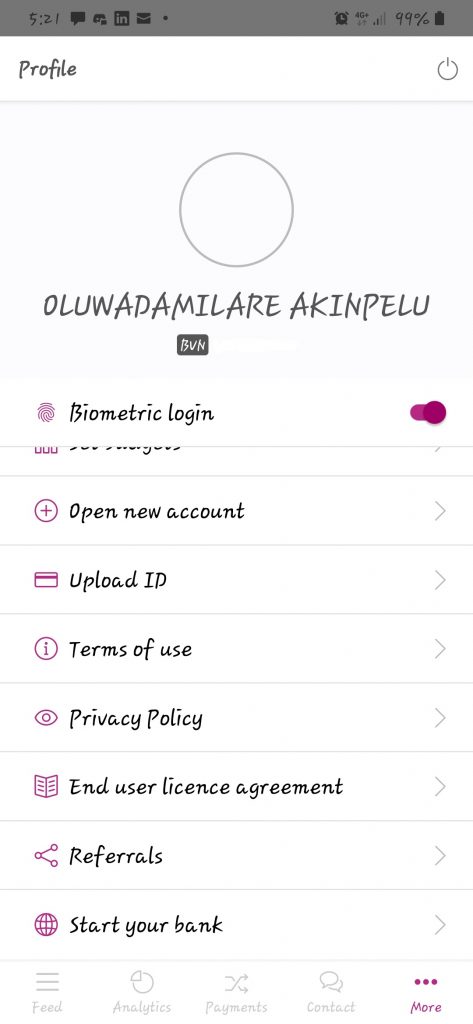

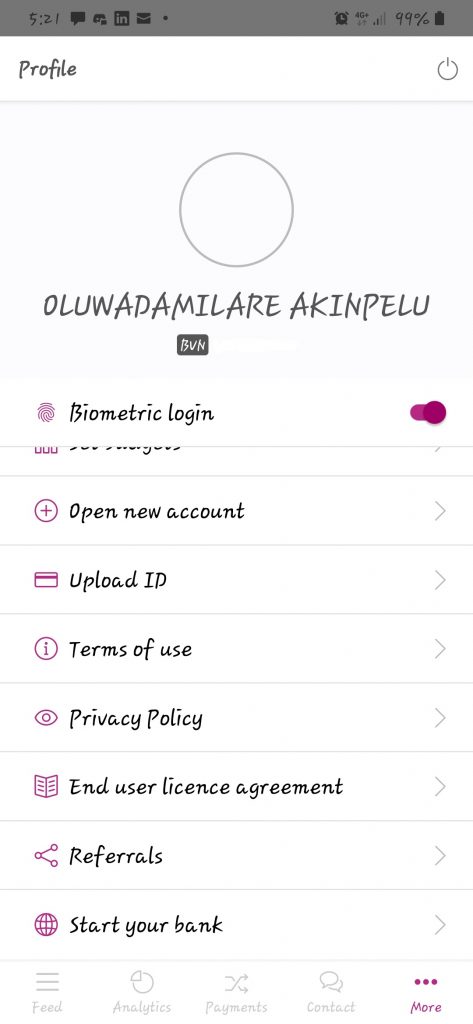

On the Kuda app, features are well categorized. So you have your home page, payments page, budget page, cards page and more page – where you have the saved cards, customer care chat, security settings, referrals, account limits, legal and sign out.

The home page gives you a brief rundown of transactions you have done so far as well as your balance. The payments page lets you send money, pay bills, pay a bill, cardless withdrawal and payment link. The budget section lets you create a budget, card page lets you request for a card which is delivered for free. Heads up the delivery might take quite a while.

The platform also has a savings feature and a loan option – which is not available yet.

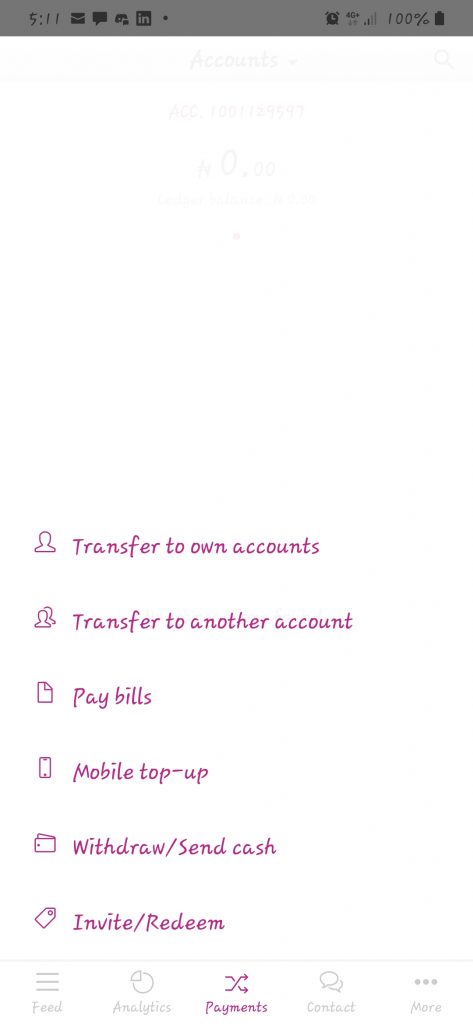

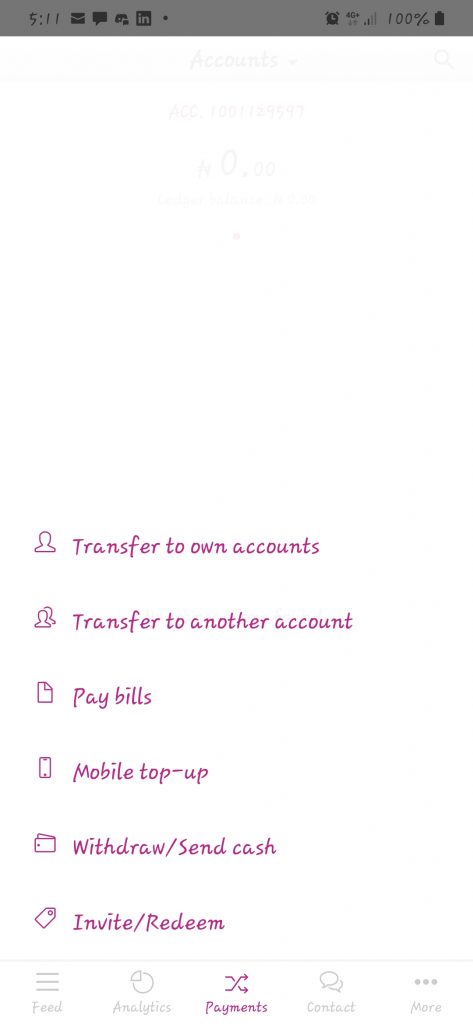

The V App also has a feed page, analytics page, payments page, contact and more page. Similar to the Kuda app, the feed page shows your account balance, account number, and most recent transactions. The next page shows the analytics of your entire transactions and cash inflow and outflow. The payments page has the options to transfer to other banks, pay bills, top-up your mobile phone, withdraw/send cash, invite/redeem friends etc.

You can also set a budget for your spending monthly to help you track how you spend your money.

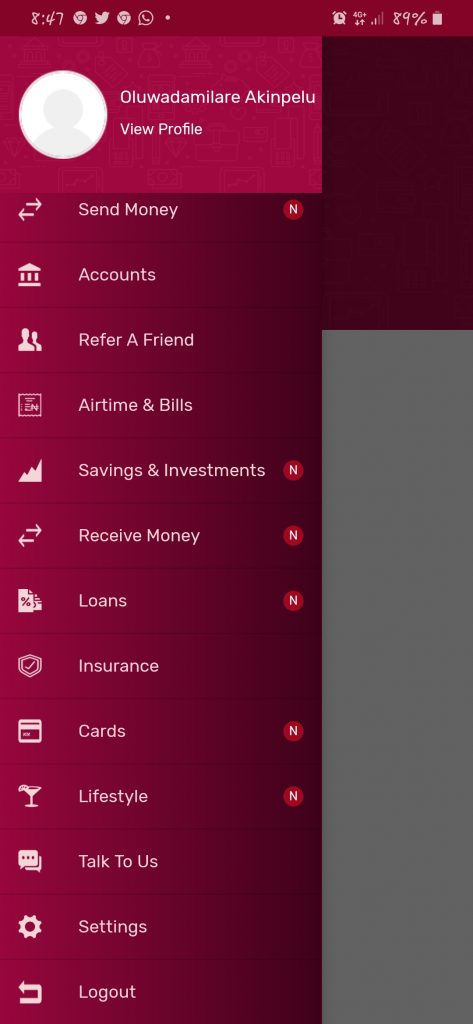

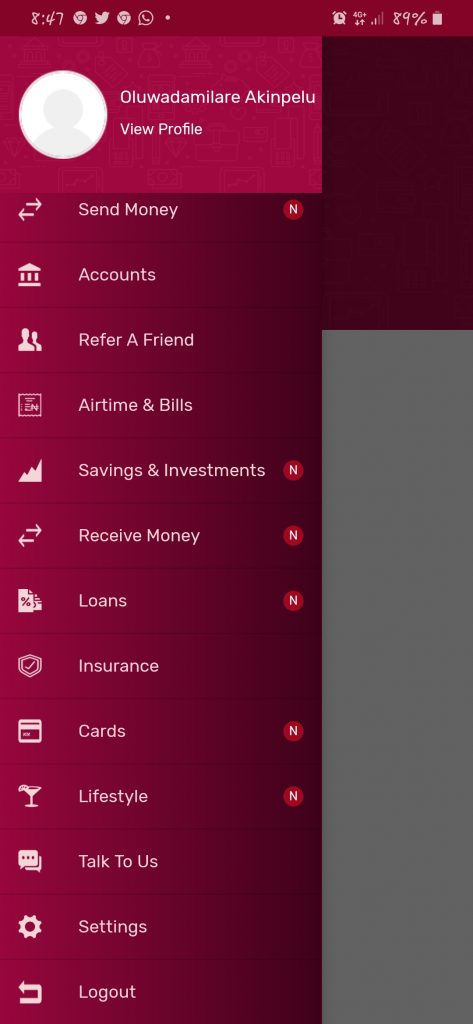

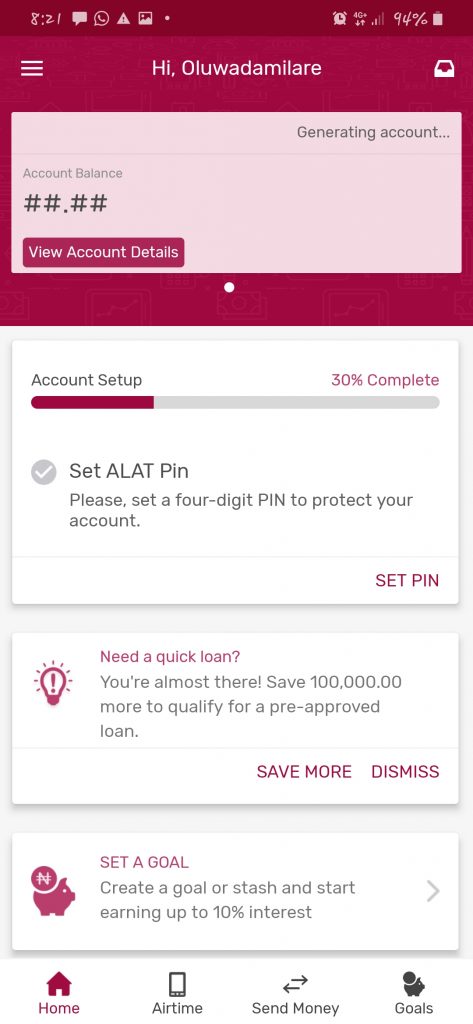

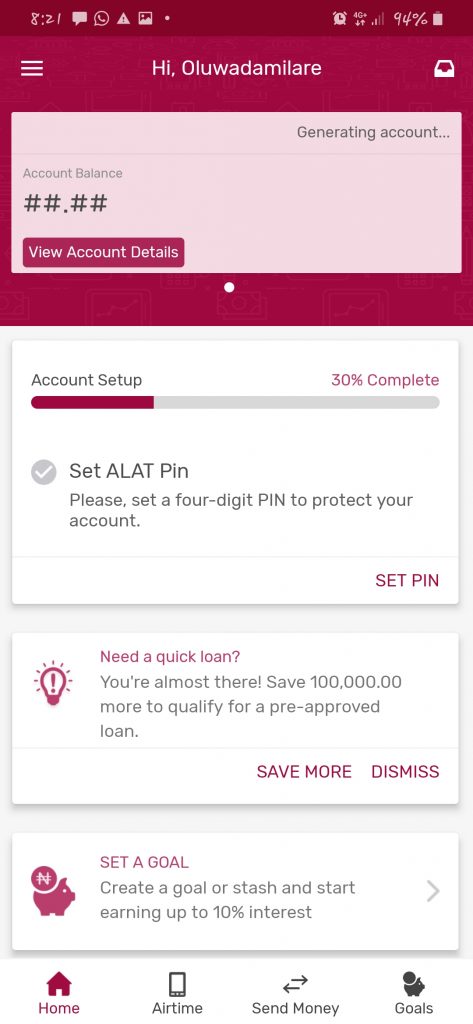

The Alat app is a better-packed platform compared to the former two. In addition to sending and receiving money, payments of bills and purchase of airtime/data, the platform allows for several other functions.

With the Alat app, users can save and invest (a competition for PiggyVest and Cowrywise), buy insurance policies, request for loans, pay for lifestyle activities – movies, events, travel and other activities you have listed as preferences.

As such, Alat trumps the others in terms of offerings.

User Experience Banking on the Apps

Moving around on the apps is quite seamless. All three have their features clearly spelt out and users will have little or no issue manoeuvring them.

Carrying out transactions on Kuda and Vbank was also smooth enough. On Vbank, however, you can’t add a 3rd party card to top up your account. You will need to carry out a transfer from another bank platform to your Vbank account. Kuda, on the other hand, allows you to add a bank card which makes topping up super smooth and fast.

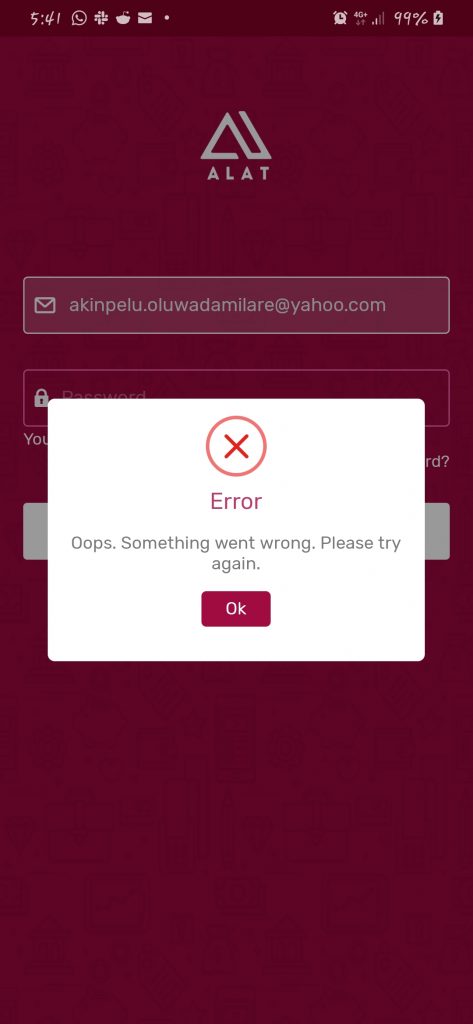

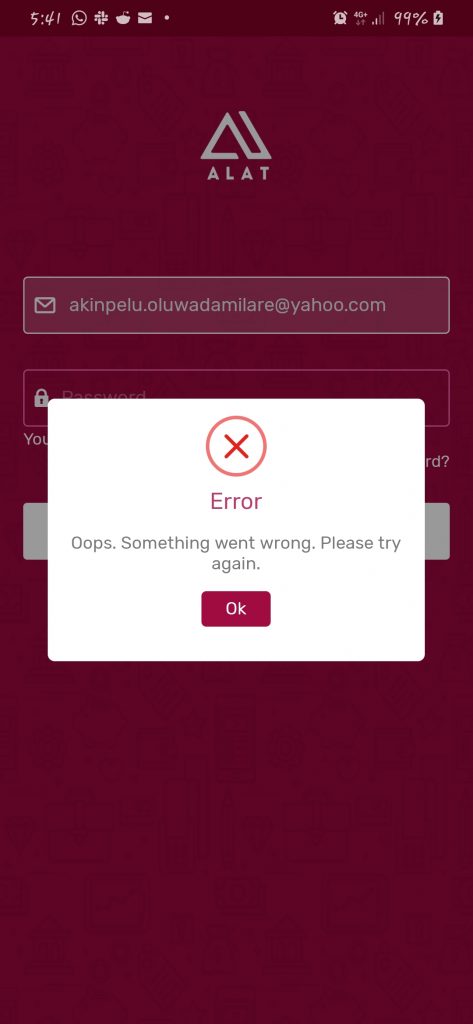

On Alat, I had several issues checking out the app. Logging in atimes can be tedious as I kept getting an error message despite enabling fingerprint login. While trying to perform some operations I kept getting the ‘something went wrong, please try again’ prompt. To top it all, I couldn’t fund my account using my debit card – which it is supposed to allow. I kept getting a blank page as a reply.

A quick check of the reviews on Playstore showed that these issues were not peculiar to me. About 7 of the first 10 reviews had a similar experience with mine, with some dating as far back as April. These negative reviews were not replied to by the Alat team and the last update on the app was done in March. A bug? one might never know till the next update.

Suggested Read: Why is Wema Bank’s ALAT Getting a Lot of Negative Reviews From Users?

Alat and Kuda give users a debit card for free. On Alat however, you need to have at least N2,000 to be able to request. Kuda allows up to 25 free transfers monthly, Vbank allowed my transfers to go through for free. I can’t say for Alat since I couldn’t even carry out any.

In Conclusion

All three, Kuda, Alat, and Vbank, offer basic financial transactions and are all great products. Kuda and Alat feel more flexible though with their offerings and interface. It is also good to know that Alat is better packed compared to the other two – which is not so surprising as it was launched earlier in 2017 compared to Kuda in 2019 and Vbank in February 2020.

It is important to note that these banks are not entirely independent of other retail banks. For instance they require BVN for verification and you need a bank account to have registered for the BVN.

Note: Screenshots of Kuda Bank App were not included in this post as it is against the app’s security policies.