Digital banks are quickly becoming the rave in the fintech space in Nigeria. Following the introduction of Alat, the space has seen the entry of many players like Rubies, Kuda, Globus bank and others. But now, V Digital Bank is joining the fray.

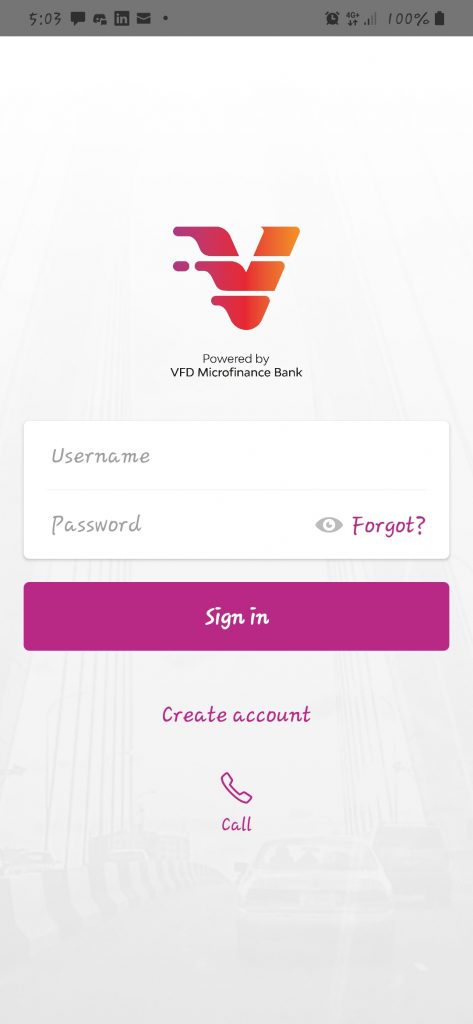

The latest entry in the space, V Digital Bank is a virtual banking platform by VFD Microfinance Bank. The platform which was launched in February has been gaining prominence on social media thanks to giveaways and freebies to new users by Nigerian music producer, Don Jazzy. And since everyone seems to be using the app now, we decided to check it out.

Getting Started

Like every other digital banking platform, V promises to allow users to open a bank account within 2 minutes. The app is available on both the Google Play Store and Apple store, with over 100,000 downloads on Play Store.

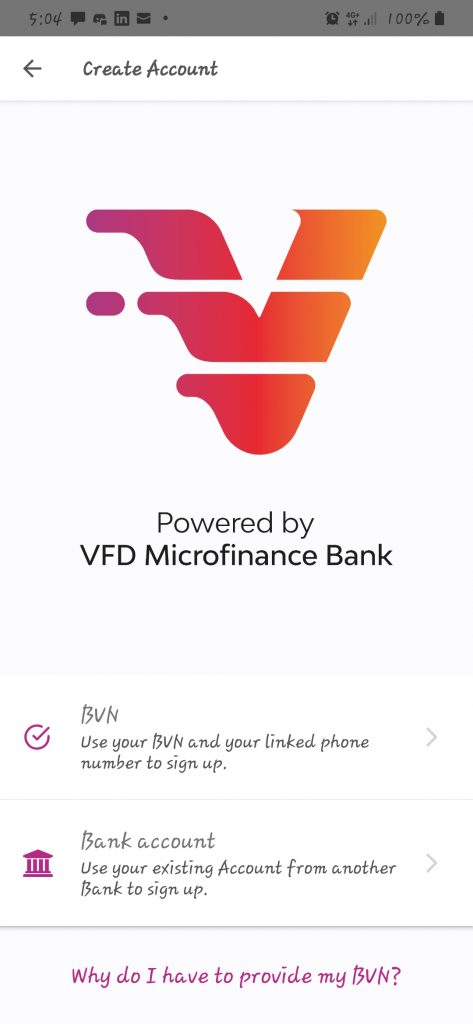

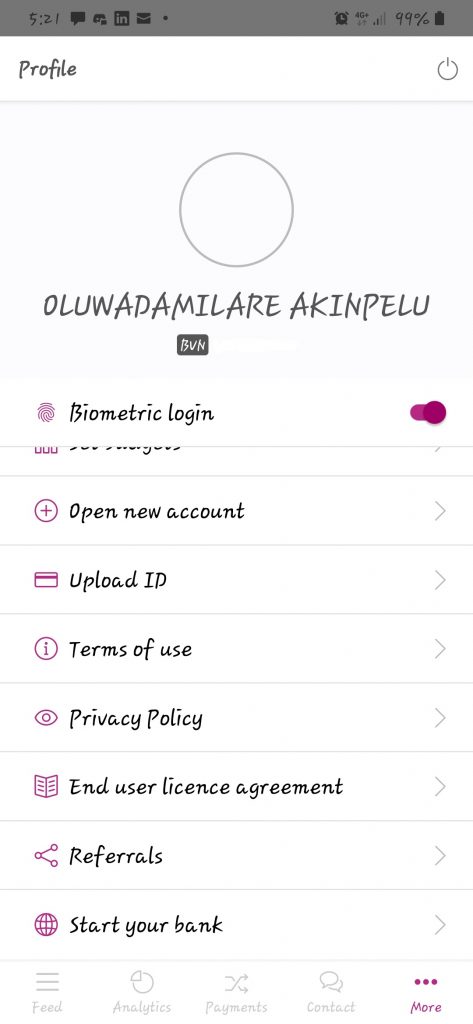

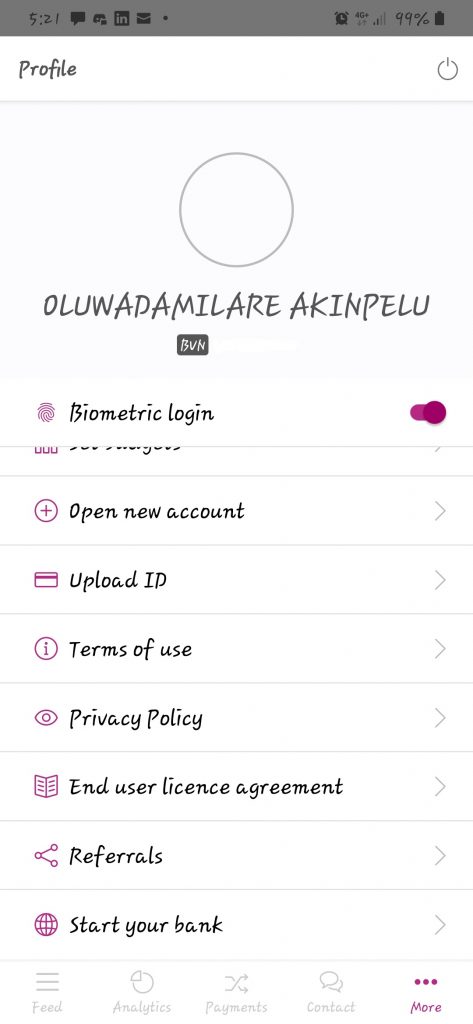

To register on the V app, you need to register with your phone number and your birthdate. After which you can use your Bank Verification Number (BVN) or Bank account to proceed with the registration. Whichever option you choose an OTP, is sent to the phone number linked with your BVN, after which other details like password and email are required.

The app requires you to validate your signature using your phone screen. I personally feel this is not needed. Already when registering for BVN, the signatures are already provided. As such, the addition of this to the registration process only stretches what should have been a short process.

After the signature validation, you will be required to further verify your identity with any of the government-issued ID (Passport, National ID, Driver’s License, Utility Bill). However, you can skip this stage until later.

While the registration might not be completed in 2 minutes, it shouldn’t take more than 7 minutes if you have every requirement ready.

Banking with the V App

The V app has a plain user interface, which is easy to use. If you are looking out for special UI designs, you might not really be impressed by the interface which is plain. Navigating the app, on the other hand, is quite easy to get used to.

Logging into the app automatically directs you to your feed which shows your account balance, account number, and most recent transactions. The next page shows the analytics of your entire transactions and cash inflow and outflow. You can set the duration for the analytics you want to see, say from February to April.

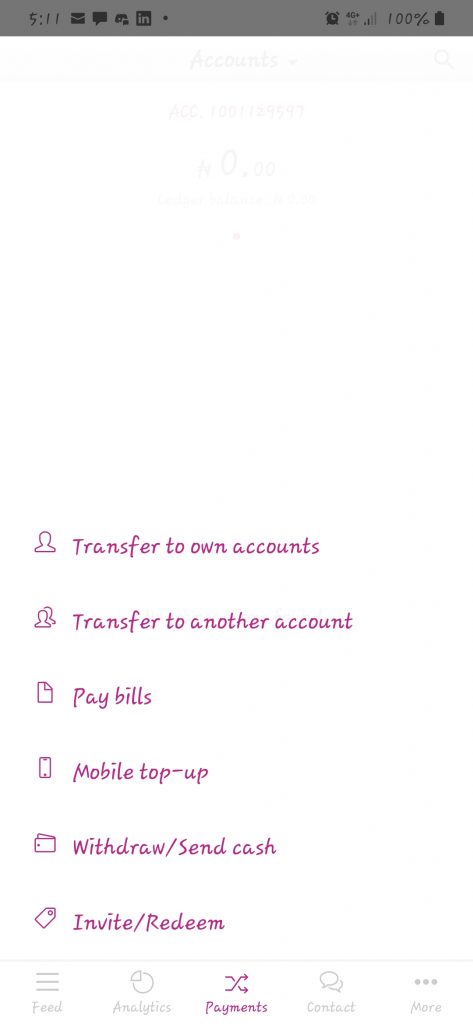

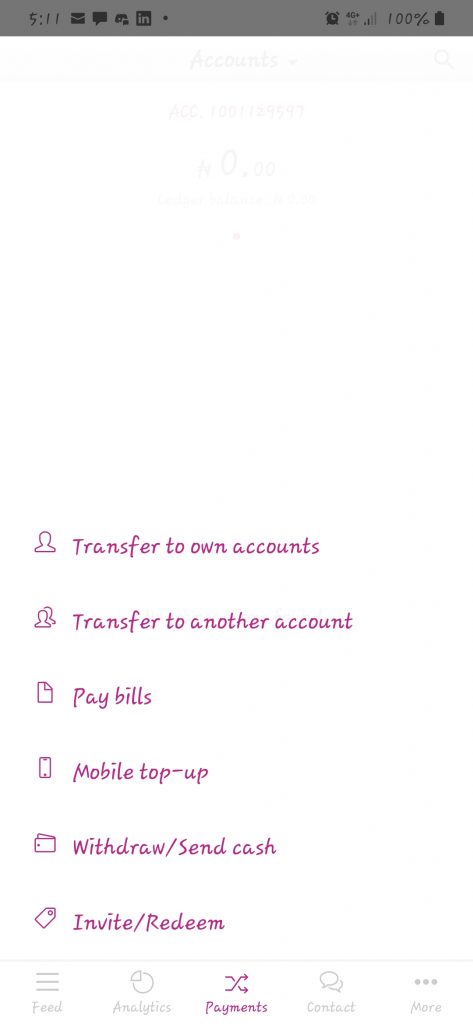

The next page is the payments section where you can find every transaction you can carry out with the app in one place.

The app allows you to create a target savings account and fixed deposit account in-app, so you can transfer from your pre-opened savings account to any other of your accounts within the app.

You can also transfer to other banks, pay bills, top-up your mobile phone, withdraw/send cash, invite/redeem friends. You can also set a budget for your spending monthly to help you track how you spend your money.

While V doesn’t give you debit cards like Kuda and Alat, you can carry out cardless withdrawals from your account. However, I tried the feature but was told it was unavailable at the moment.

Transfer to other banks and mobile top-up worked very well, and I was impressed by the speed of transacting via the app. Also, my 2 transfers were at no charge. However, I can’t confirm if this is currently a first-time bonus and if the free transfers have a cap like Kuda which allows up to 25 free transfers monthly.

There’s another downside. The app does not have an option for adding money to your account through debit cards. So, to add money to your V app, you need to transfer from another financial app. This is a huge turn off for me, as I have to shuffle between transferring from my bank app to the V app when I could have added cash with just a click in the app.

Final thoughts…

The V app has a fair UI and is easy to use. For the basic financial transactions, it serves its purpose as I was able to carry them out without hitches, save the cardless withdrawal.

However, it might not be a full-blown digital bank yet as users still need an existing account as one of the registration requirements. Also, while there’s no option to add a card, there’s also no way to create a virtual card to carry out transactions yet.

So outside the app, I can’t use my V account to make any payment except I transfer. Nevertheless, the V app is a good addition for carrying out financial transactions digitally.