Fintech has become an important sector of our daily lives as it has created more options for people to have access to financial services. And as fintech continues to grow globally, with more startups and entrepreneurs making giant strides, hubs and ecosystems are also being created.

A recent report on the Global Fintech Index City Rankings 2020 released by Findexable, provides an overview of fintech clusters around the world, sampling over 230 cities across 65 countries. It ranks them based on the quantity and quality of startups in the area as well as the environment around which the startups are in.

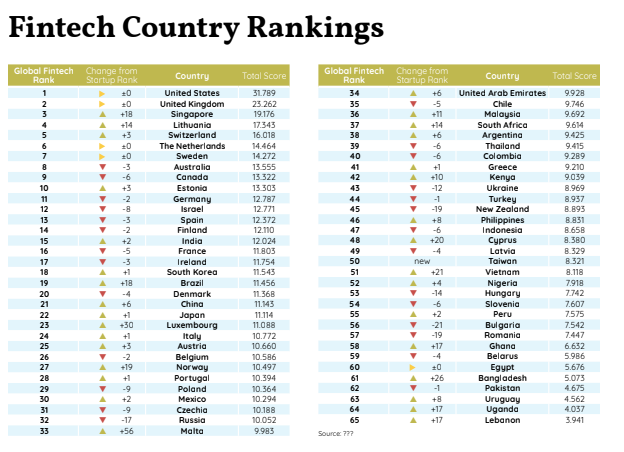

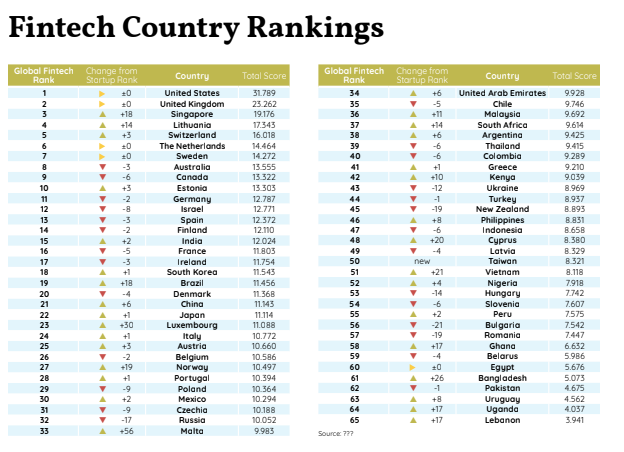

USA, United Kingdom, Singapore, Lithuania, and Switzerland are the top five fintech countries. The top 5 countries are followed by Netherlands, Sweden, Australia, Canada and Estonia.

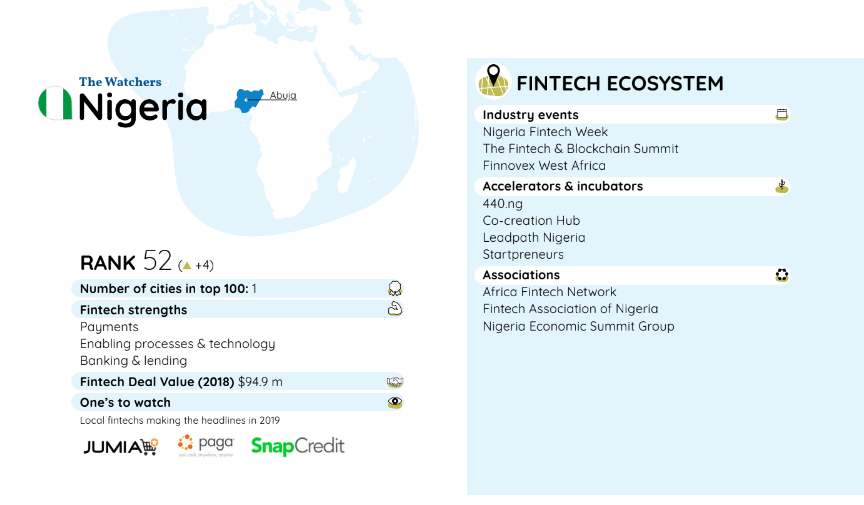

Africa’s largest economy, Nigeria is placed at 52, behind 2 other African countries – South Africa at 37 and Kenya at 42.

Other ranked African countries like Ghana and Egypt and Uganda come at 58, 60, and 64 positions respectively.

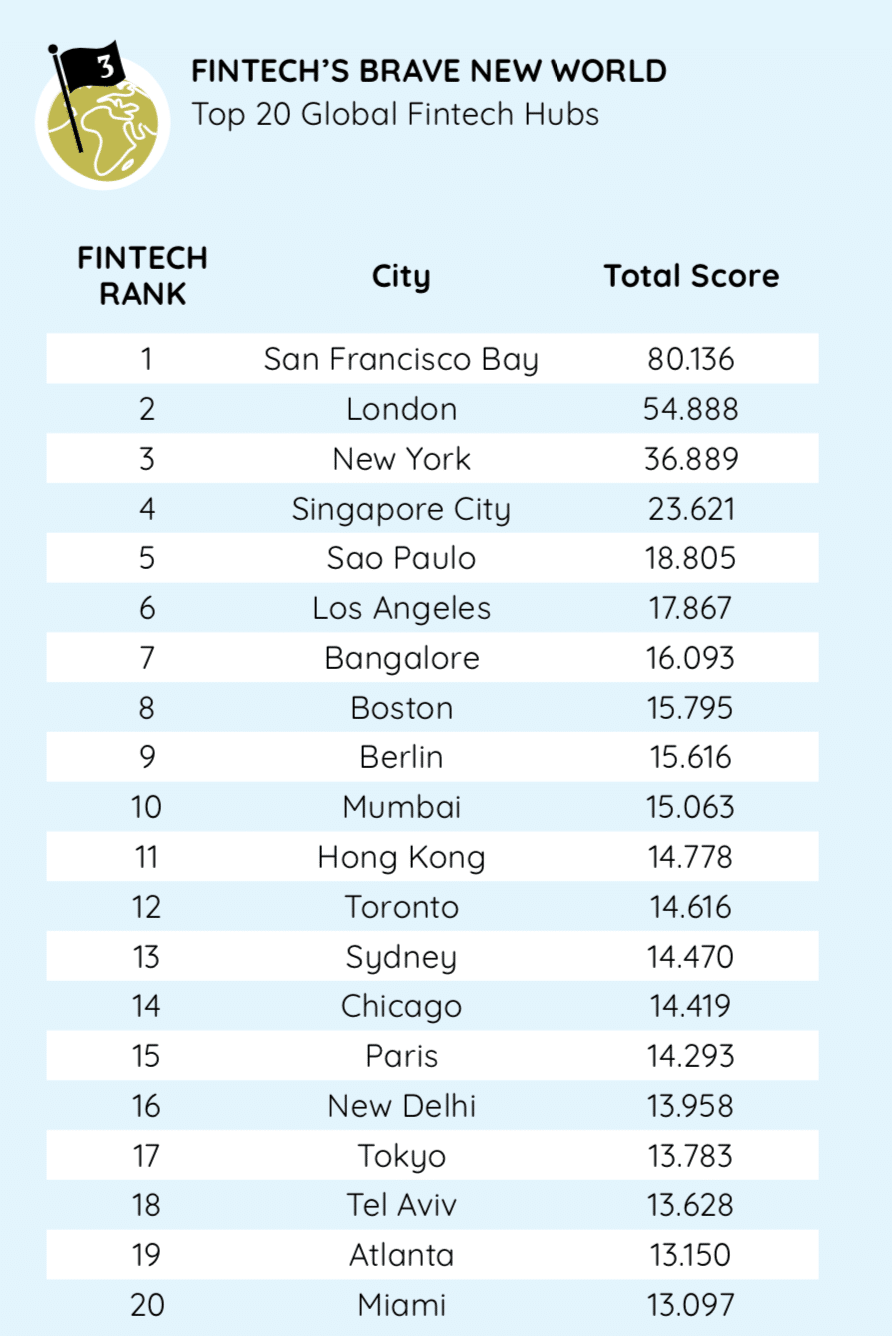

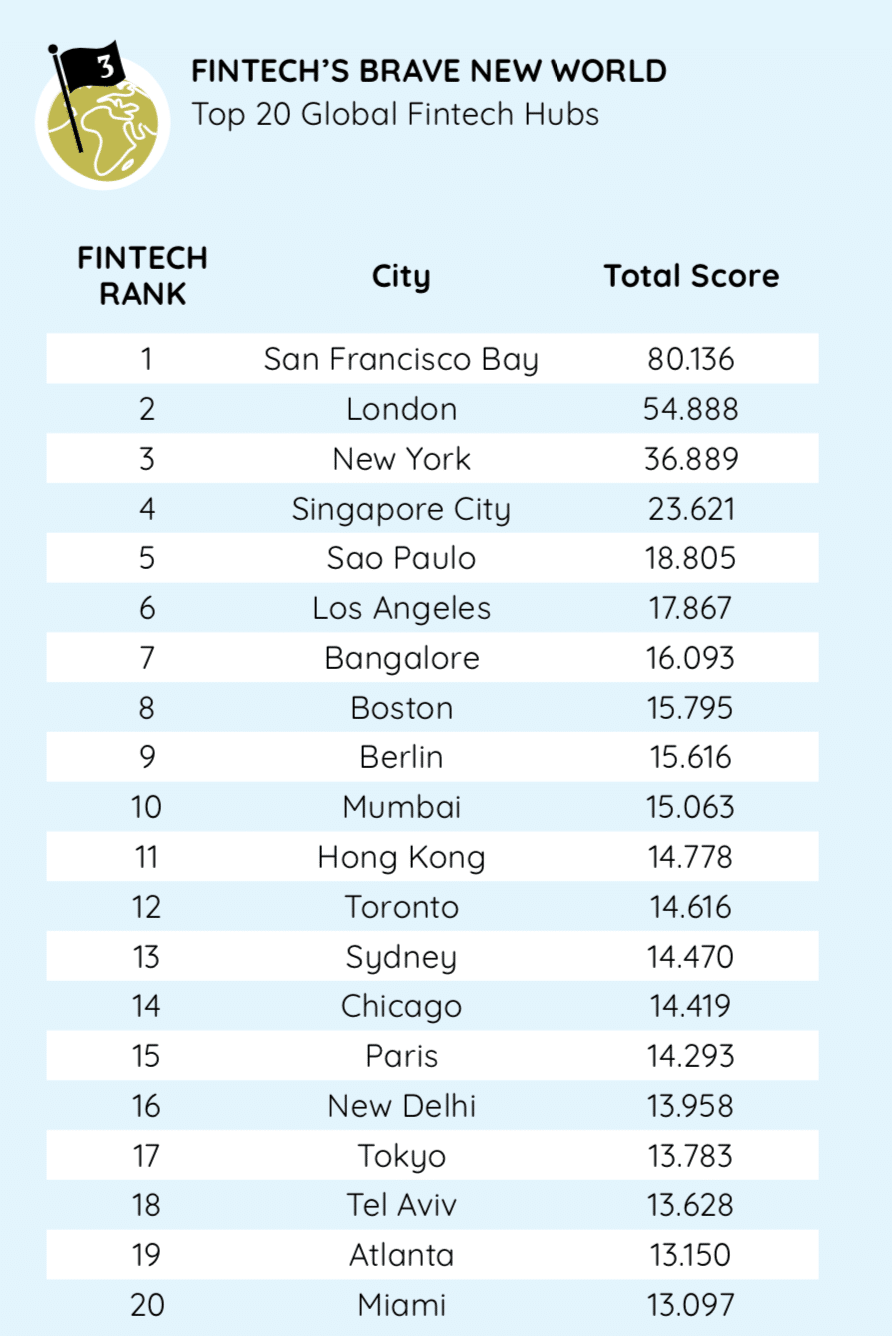

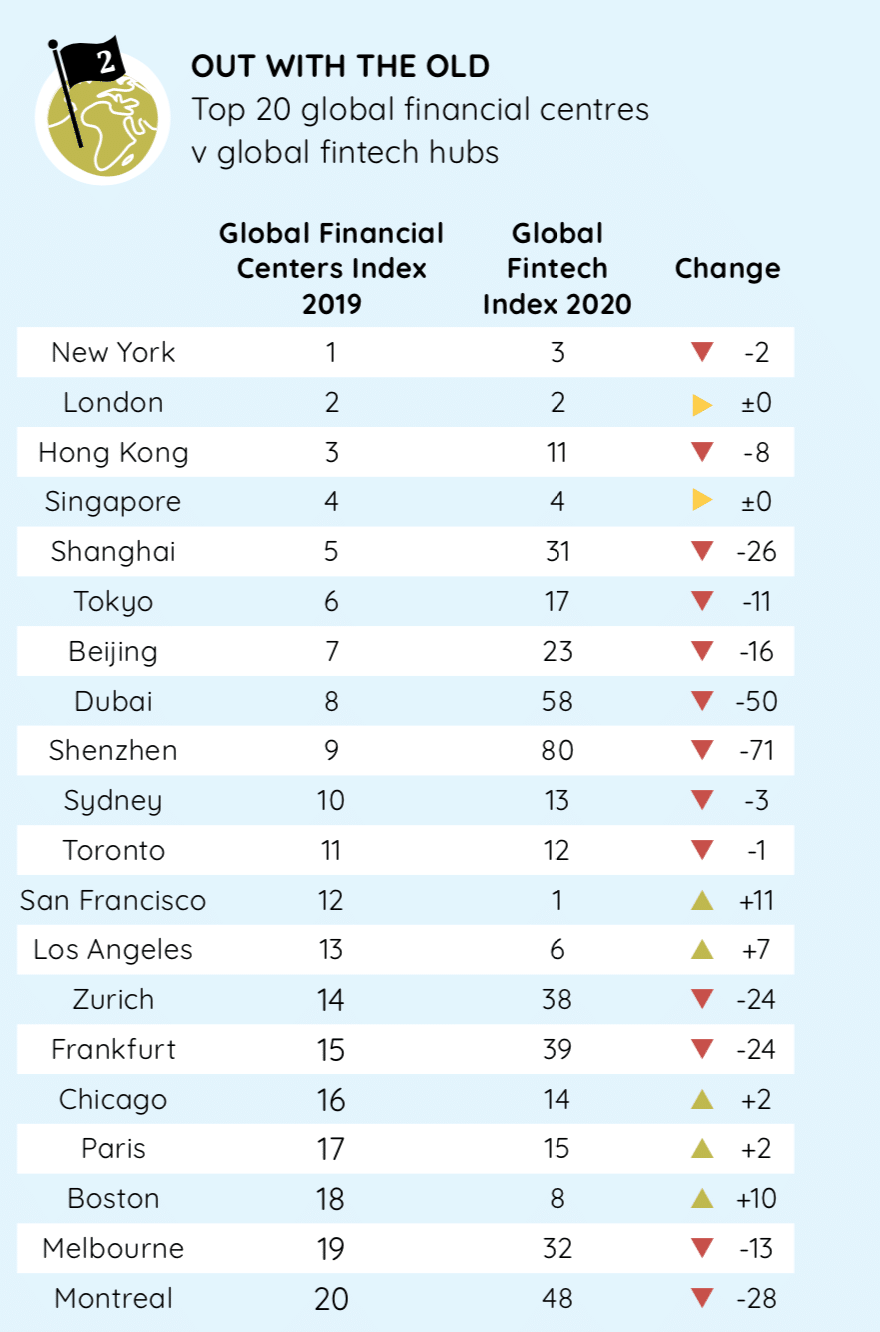

The report also ranks Fintech by cities/hubs, 238 in number, and the San Francisco Bay Area, London, New York, Singapore City, and Sao Paulo make the top 5.

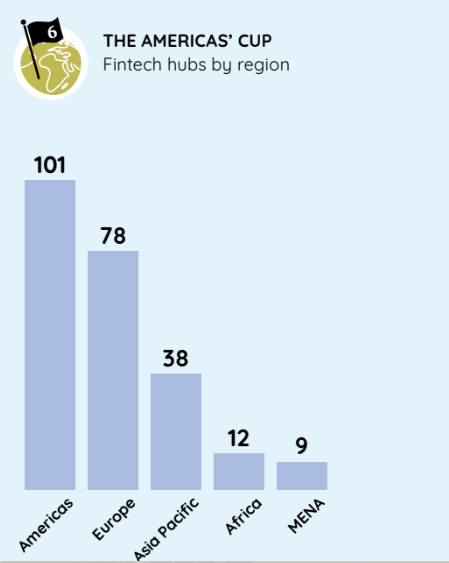

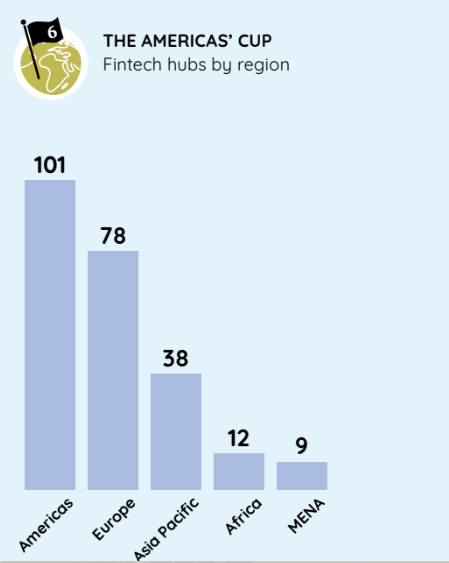

Of the 238 sampled hubs/cities, the Americas account for a majority of them – 101 fintech hubs. This is no surprise as the region has some of the world’s most dynamic emerging hubs with the USA as a country being the biggest single country for fintech activity.

Europe has 78 fintech hubs, Asia Pacific has 38, Africa with 12 and the Middle East and North Africa (MENA) accounts for 9.

Nigeria as a country has two hubs listed, Lagos and Lekki. Lagos (probably referring to the mainland – Yabacon) is the only one to make the top 100, standing at 71 and Lekki makes an entry at 177.

With just about 20 fintech cities in Africa, it’s a meager number when you consider the fact that the region is one with the greatest need – having more than half of its population with no access to traditional financial services. While the report argues that this lack is what will spur fintech’s future in the region, there is still a need for progressive regulations and a culture of innovation to grow more fintech hubs around the continent and scale the available ones.

Which is why the report listed 10 countries across Africa, Asia and Middle East among countries to ‘watch’ across the globe. These countries include Kenya, The Philippines, Cyprus, Vietnam, Nigeria, Peru, Ghana, Bangladesh, Uganda, Lebanon.

In Nigeria fintech strengths are highlighted to be in payments, enabling processes and technology, and banking and lending. And startups like Jumia, Paga and Snapcredit are said by the report to be ones to watch.

Lagos was also highlighted in the report as a growth hub – fintech ecosystems that are rapidly emerging as alternative fintech destinations matching talent and innovation with a fintech friendly business environment and a vibrant startup scene. Fintech startups like Kudi, OneFi, Lidya, paystack, Piggybank.ng and TeamApt are highlighted as startups to watch.

Other growth hubs listed include Hamburg, Tallinn, Copenhagen, Istanbul, Dubai, Johannesburg, Nairobi, and Zug.

Other Facts

Countries that are leading traditionally financial centres such as Frankfurt, Shanghai, and Zurich have been replaced on the list of top 20 centres for fintech by cities like Sao Paulo, Bangalore, Mumbai, and New Delhi.

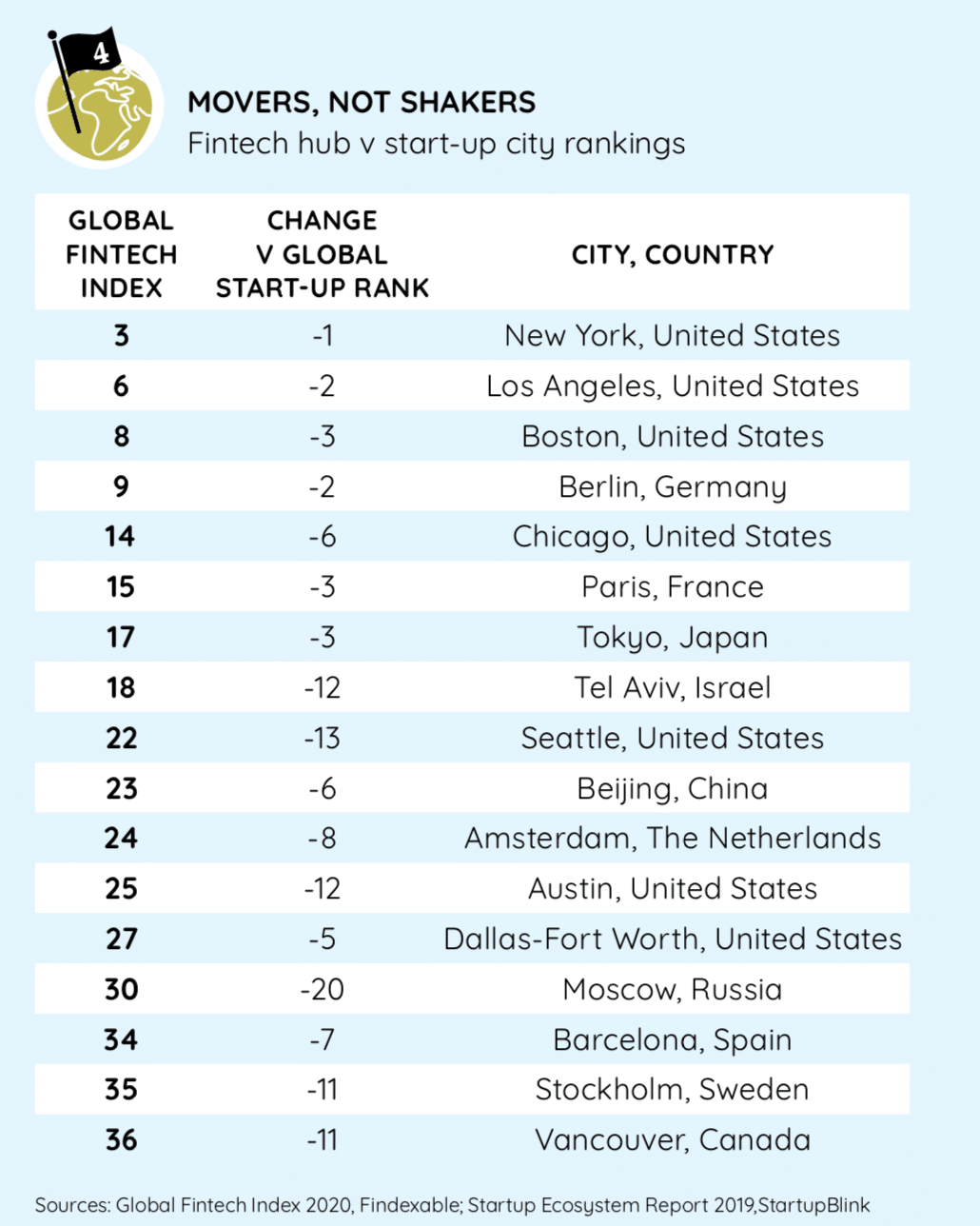

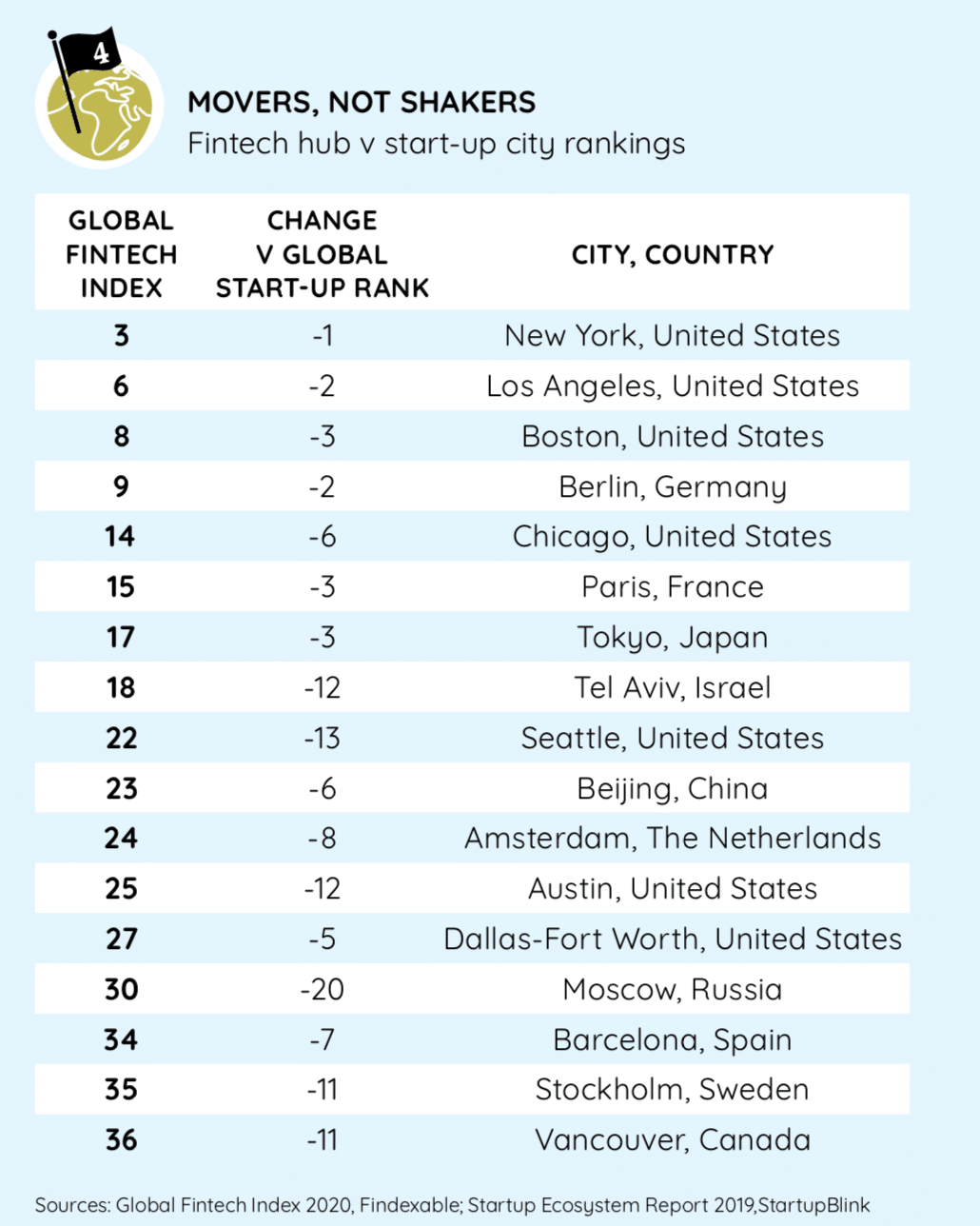

Another interesting takeaways from the report is the fact that being a startup city is different from its position as a global fintech hub. A startup city’s status only shows the strength of its fintech community. Nigeria for example was ranked 52nd on the Fintech country rankings but is ranked 56th on startup rankings.

The report also shows that there is still a long way to go as regards equality in the fintech world. Less than a third of fintech staffs are female and while male fintech founders are 88%, female founders account for just 12%.

In Summary

Africa is highlighted to be the next fintech boom, and while there’s no magic trick to make this work overnight, fintech players and stakeholder should be looking at these two areas.

- Regulations: Fintech-friendly regulations should be put in place to spur innovations from entrepreneurs and to encourage investment from VCs.

- A strong talent pool is also key to fintech success as well as an ecosystem that is built with a global vibe.