The FT Partners Fintech Industry Research has indicated that over 70% of the world’s global mobile money transactions in 2018 emanating from Sub-Saharan Africa.

According to the report which provides insight into the performance of financial technology (Fintech) in Africa, about half of the world’s mobile money population is based in Africa.

This is one of the many pointers that Fintech is rapidly growing in Africa with financial services rapidly scaling despite the underdeveloped traditional financial services ecosystem – reason for this being the growing mobile and internet penetration.

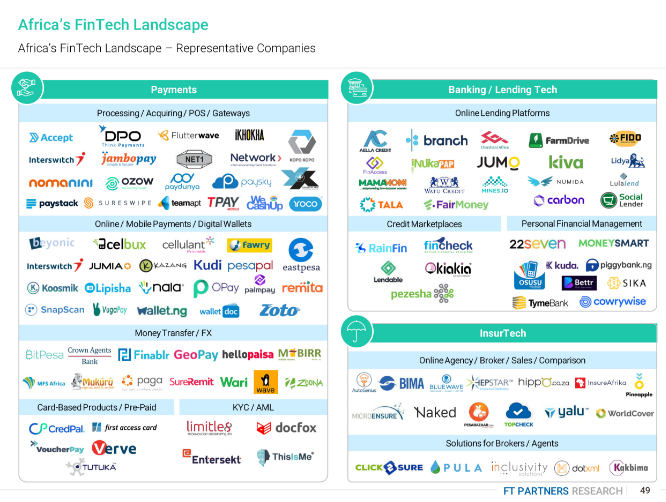

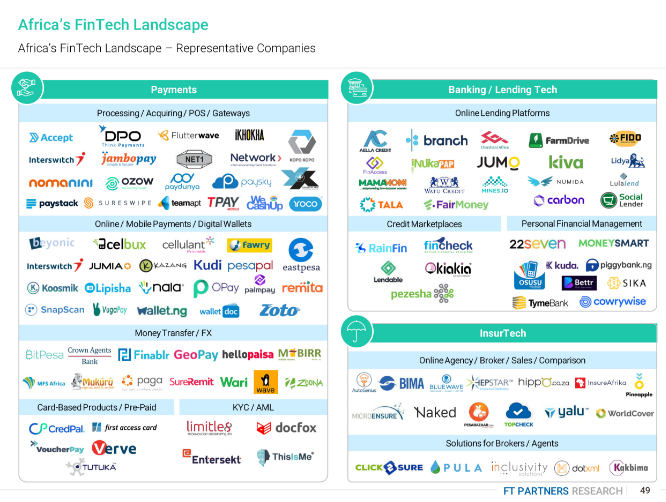

Here are some other details of the report:

Financial Services in Africa Leapfrogging

According to the report, there are 4.5 bank branches per 100,000 people in Sub-Saharan Africa. Comparing this with developed economies like the US where there are 31.5 bank branches per 100,000 people with about 93% banked population highlight a large gap.

This gap has left millions of Africans in SSA, about 66% unable to access core financial services which are very important.

But technology is about to close the gap. Whilst traditional banking has had its growth stunted, mobile proliferation and internet penetration has continued to accelerate.

For example in Nigeria, while its banked population is down low at 39%, 75% of its population have mobile phones and 56% have access to the internet.

This widespread of mobile technology has allowed financial services in Africa to leapfrog traditional banking infrastructure for tech-enabled solutions like mobile payments/banking and digital lending – spurring Fintech innovation on the continent.

Other Drivers for Fintech Adoption in Africa

Beyond a growing mobile-focused population and poor traditional financial infrastructure –

- a growing youthful population (65% of Africa’s population are youths under 35) that tends to be more tech-savvy is also important.

- increasing urbanization which is expected to double in Africa over the next 25 years is leading to migration and as such driving substantial growth in remittances.

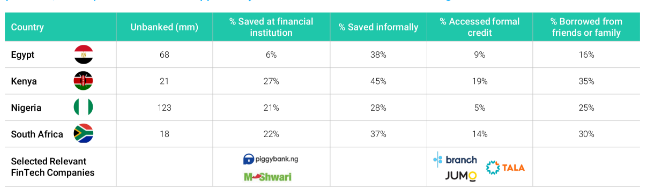

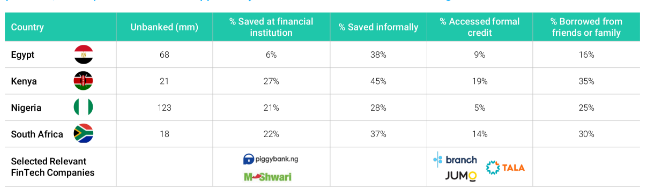

- Access to credit for individuals and SMEs at traditional banks is very low because of no available credit history. This is hereby seeing users turn to digital lending startups who determine creditworthiness with various digital financial data. In Nigeria, only 5% of the unbanked get access to formal credit with 25% of them getting loans from friends and family.

- An increase in peer-2-peer transactions on the continent has driven Fintech to expand to new places, and in turn reducing the cost of remittances. In 2018, $46 billion remittances flowed into SSA, showing the ease of cross-border payments.

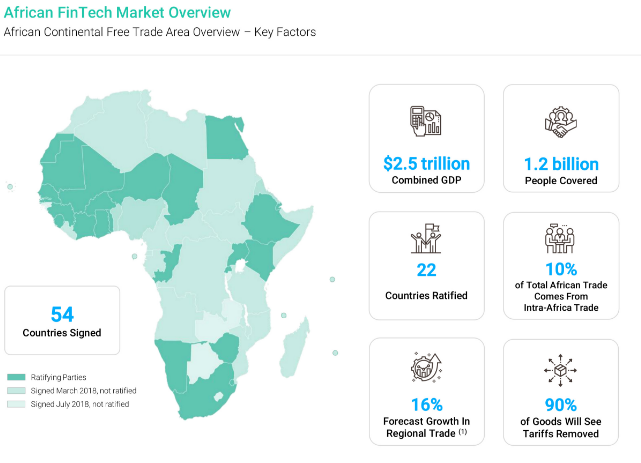

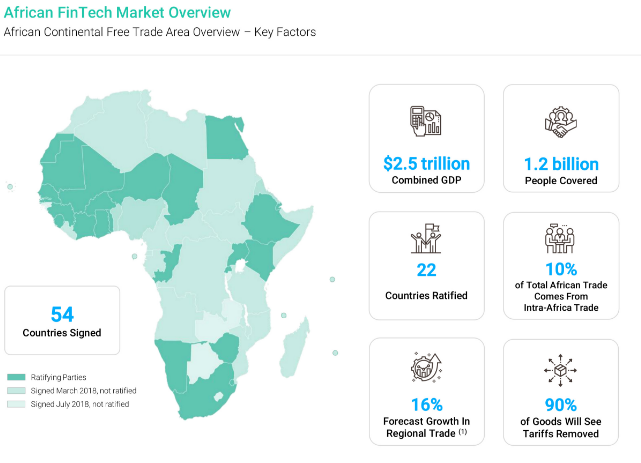

AFCFTA Will Benefit the Fintech Ecosystem a Lot

The African Continental Free Trade Area (AFCFTA) sees 55 countries come together to create a single African market largely free of tariffs and open to all.

With a growing Fintech ecosystem, the AFCFTA will provide a boost, making it easier for cross border payments and commerce, interregional switching and a common ground for regulations.

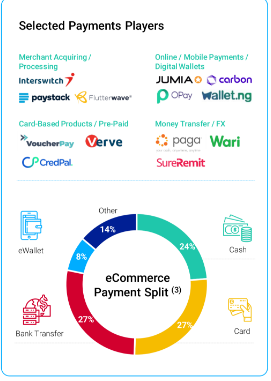

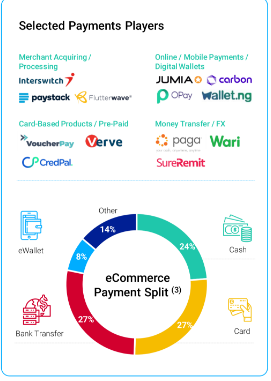

Mobile Money Very Important to Payments in Africa

Africa is the global leader in mobile money, a service which has become vital to the continent’s financial services space.

80% of MSMEs in Africa have a mobile money account which is double the rate of banking population and more than 20% of adults across Sub-Saharan Africa have a mobile money account.

And following the success of M-Pesa, more Mobile network operators (MNOs) have come into space and have dominated mobile money services in Africa for the past decade because of their widespread of agents.

Remittance is Still Expensive in Africa But Increasing

It costs $18.8 (9.4%) to send $200 in Africa. This is very much expensive compared to other areas where it cost lesser to send the same amount – 7.6% in East Asia, 6.7% in EU and Central Asia, and 5.9% in Latin America.

This is due to the high use of cash on the continent, poor financial infrastructure and bank operability and lack of competition to drive down costs.

However, remittances continue to grow on the continent, 10% in 2018, with Egypt leading in remittance payment inflows, $29 billion, however majorly in cash.

Nigeria follows with $24 billion, which is higher than the $20 billion oil revenues contributed to the economy in 2017.

Kenya records $3 billion mostly in mobile payments and South Africa, $1 billion.

Nigeria: A Market Primed for Fintech Disruption

With its large population, Nigeria has a massive market opportunity for Fintech to thrive.

However, the financial gap is still high. Between 2014 and 2016, while formal financial accounts grew by 1.5 million, the financially excluded grew by 2.1 million and now stand at 123 million.

But recent flexibility in regulations has now made it easy for emerging Fintech to innovate within the payments space and aid financial inclusion. And this can be seen with the number of Fintech startups springing up in the country with many of them going on to gain traction and raise funding.

Other Facts

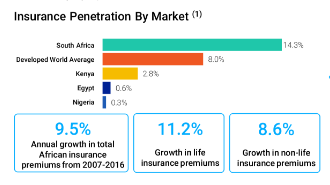

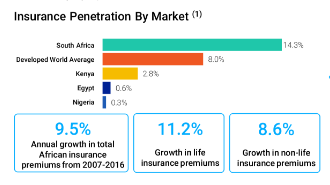

South Africa accounts for 70% of all insurance premiums in Sub-Saharan Africa, although it is mostly concentrated among the wealthy. And as a country it has the biggest insurance penetration by market, 14.3%, compared to that of developed worlds 8.0% (average).

Nigeria only has 0.3% insurance penetration and this is owing to the fact that many Africans don’t fully understand insurance yet.

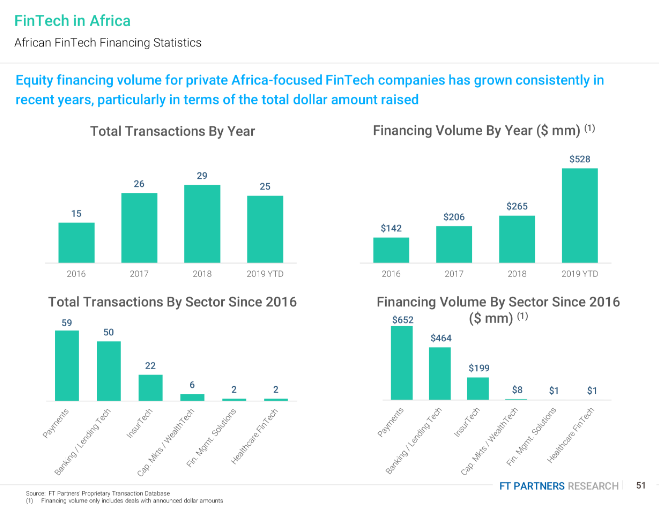

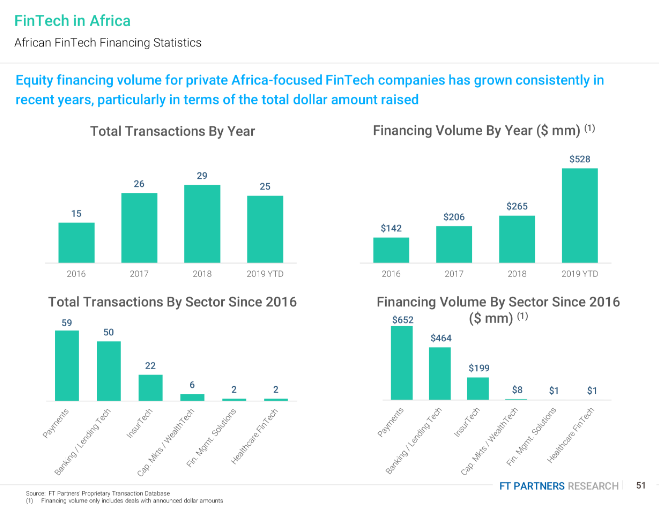

African focused Fintech startups have also raised $528 million so far this year, almost times 2 of the amount raised last year, with the highest being Opera’s OPay.

Fintech startups in Africa have also carried out 25 million transactions this year, which is less than the 29 million transactions recorded last year.

In Sum

One thing is sure, mobile and internet penetration will continue to increase on the continent. And as such Fintechs will continue to have an environment for them to innovate solutions to bank the unbanked African population.

However, African governments will need to offer the needed regulatory measures that will aid the growth of startups and spur competition which will lead to startups offering more innovative solutions at lesser fees.

Some African countries are already championing this, others should follow suit too.