2017 was a relatively good year for the Nigerian tech industry. By the third quarter of 2017 (Q3), quarterly contribution of the Information and Communications Technology (ICT) sector to the Gross Domestic Product (GDP) increased to N1.6 trillion. While major events such as the $547m Etisalat (now 9mobile) debt impasse headlined the news, the sector enjoyed some other promising prospects.

In this piece, I have highlighted a number of trends in the ICT sector that are worthy of the attention of all in the year 2018. These trends will dominate the headlines and affect lives and living.

The Sales of 9mobile and Market Dynamics

The news had it that Bharti Airtel, Globacom, Dangote’s Alheri Engineering were among the 5 major investors struggling to acquire 9mobile (which was formerly known as Etisalat Nigeria). Although the NCC sale deadline of December 31 has been missed, there are strong indications that the conclusion of the sales exercise and the handover of 9mobile to the successful bidder is underway.

9mobile: What More Do We Expect?

Details 👉 https://t.co/2RpFNzIBt0 pic.twitter.com/TaX2UMjtVu

— Technext (@technextdotng) January 13, 2018

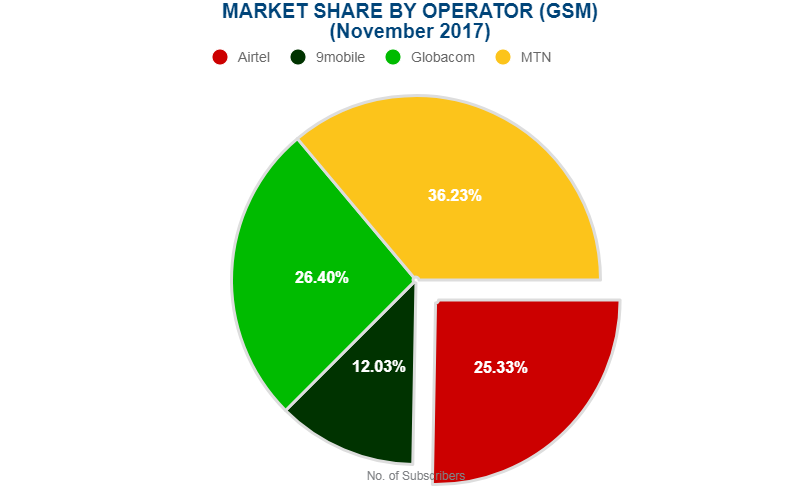

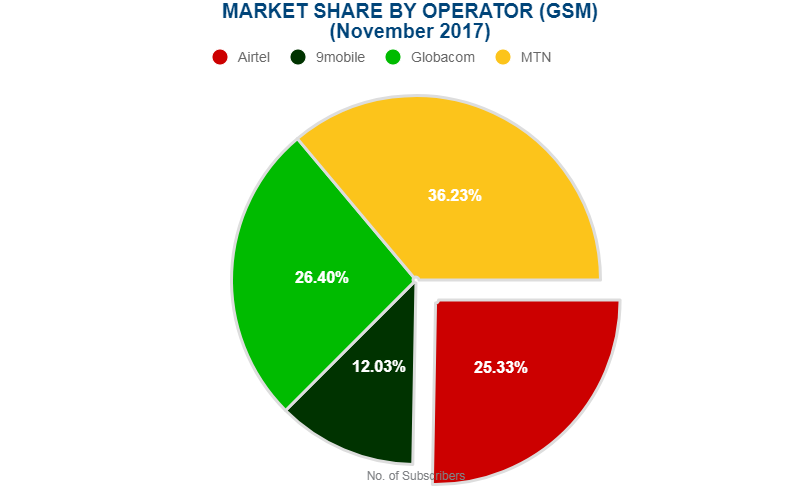

As predicted here, experts project that Globacom is most likely to win the bid. If this eventually happens, it will translate to a tectonic shift in the $70 billion telecom industry in Nigeria. this is because Globacom is on its way to becoming the largest mobile operator in Nigeria, ahead of the perennial leader, MTN Nigeria.

According to the October 2017 data by the NCC, MTN Nigeria is leading the industry with a total of 50,720,702 subscribers (36.14%). Globacom trails with 37,418,933 (26.6%) and 9mobile has a total of 17,121,058 (12.20%). You can do the maths.

The industry under the leadership of Globacom will portend new realities and pose new questions. Will Globacom be able to hold the lead? Will they continue with the data price war? 2018 is bound to be interesting for users.

Crowdfunding in Agritech

One of the big stories of 2017 is the announcement that Farmcrowdy, Nigeria’s first digital agriculture platform, has raised $1m (one million dollars) in a round of funding from investors including Techstars, Cox Ventures and Social Capital.

Farmcrowdy connects investors to farmers through sponsorship packages to fund higher yields for a share of the returns. While farming is ongoing, the farm sponsors are able to keep track of the full-cycle by getting updates in text, pictures and videos.

#FarmInMyPocket: @FarmCrowdy Launches Mobile App for Agritech at 1st Anniversary

Details 👉 https://t.co/tNh6bawpgc#Apapa #Argentina

— Technext (@technextdotng) November 16, 2017

Crowdfunding has always been with us, for a long time. Effectively implementing it as an agritech model is what is a bit novel. Since the launch of its website over 12 months ago, Farmcrowdy has recorded close to 1,000 unique farm sponsors, aggregated a combined 4,000 acres of farmland in Nigeria for farming purpose and grown over 150,000 organic chickens to date.

If you have the interest to invest in the tech space in 2018, investing in aggregated funds for Agriculture is the way to go.

Fintech is the way

2017 was an impressive year for Nigerian Fintechs. First, two Nigerian startups, Flutterwave, a payments company and Riby, a financial management app made the list of the annual Fintech 100 (a list of the most innovative Fintech companies across the globe) report compiled by KPMG and H2 Ventures.

Interesting Details About 2017 Fintech100 as Flutterwave, Riby, Grassroots Bima Make List – https://t.co/S3aEyM8hNx pic.twitter.com/5ZKkisDQP0

— Technext (@technextdotng) December 6, 2017

On individual notes, the big players have attained notable milestones in the year. Flutterwave secured a funding of over $10 million in a Series A round of Venture Capital funding from Greycroft Partners and Green Visor. Flutterwave also struck a partnership arrangement with TransferWise that will enable Nigerians in diaspora send money into any verified Nigerian bank account.

The players in the fintech space have shown the capacity to provide a viable alternative to the traditional banks in the country as well as help with bringing banking services to the unbanked. 2018 will surely be the year of the fintech.

Ecommerce: Dying or dead?

One of the downsides of 2017 is the announcement by Techpoint that Konga has reportedly laid off over 60% of its workforce and made a move to drastically reduce operational costs by totally cancelling Payment on Delivery (PoD).

Breaking News: Konga Sacks Many Workers, Stops POD Services https://t.co/FCpmoky5tN pic.twitter.com/eY96WVKabxhttps://t.co/eqRMAJ4Obh

— MoHaMMaD NaEeM (@Naeemchoohan) December 2, 2017

While this shocking reality poses a serious question about the future of the ecommerce industry in Nigeria, Konga led the way in the adoption of a payment system that is requisite for a trust-challenged society such as ours. This is not unique to the ecommerce sector. Every industry that has survived in Nigeria has adopted the prepay model: food ordering, recharge card, prepaid meters. This way you can avoid issues such incessant order cancellations or the safety of your workers.

2018 will put this infant model to adequate test.

Bitcoin and Cryptocurrency

2018 will be deciding the year in the battle for the recognition of bitcoin as a legitimate currency. Although there are indications that the British, Australian and United States governments are taking Bitcoin a bit seriously by increasing regulations, the global acceptance rate is still paltry.

https://twitter.com/EndDeepState/status/938903740719009793

The price of the coin has increased by up to 1,000 percent owing to increased demands. This has made the prospect for investment by many (Nigerians inclusive) very enticing. In the midst of all the uncertainties, one can only hope that Nigerians do not fall prey in 2018.