Kwara, a Kenyan fintech digitizing credit union, has announced that it has raised $3 million in seed funding, alongside a deal to acquire IRNET, the software subsidiary of the National Union of all savings and credit cooperative societies in Kenya.

It has also signed an exclusive distribution deal for digital solutions with the Kenya Union of Savings and Credit Cooperatives (KUSCCO), the national umbrella body for SACCOs in Kenya.

The seed funding round was led by some existing investors, DOB Equity, Globivest, and Willard Ahdritz, the founder of Kobalt Music. New investors that also joined the round included One Day Yes, Base Capital, and fintech executive Mikko Salovaara, the CFO of Revolut.

This raises the startup’s total seed funding raised to $7 million. With this new funding, Kwara hopes to double its client base and focus on regional growth expansion.

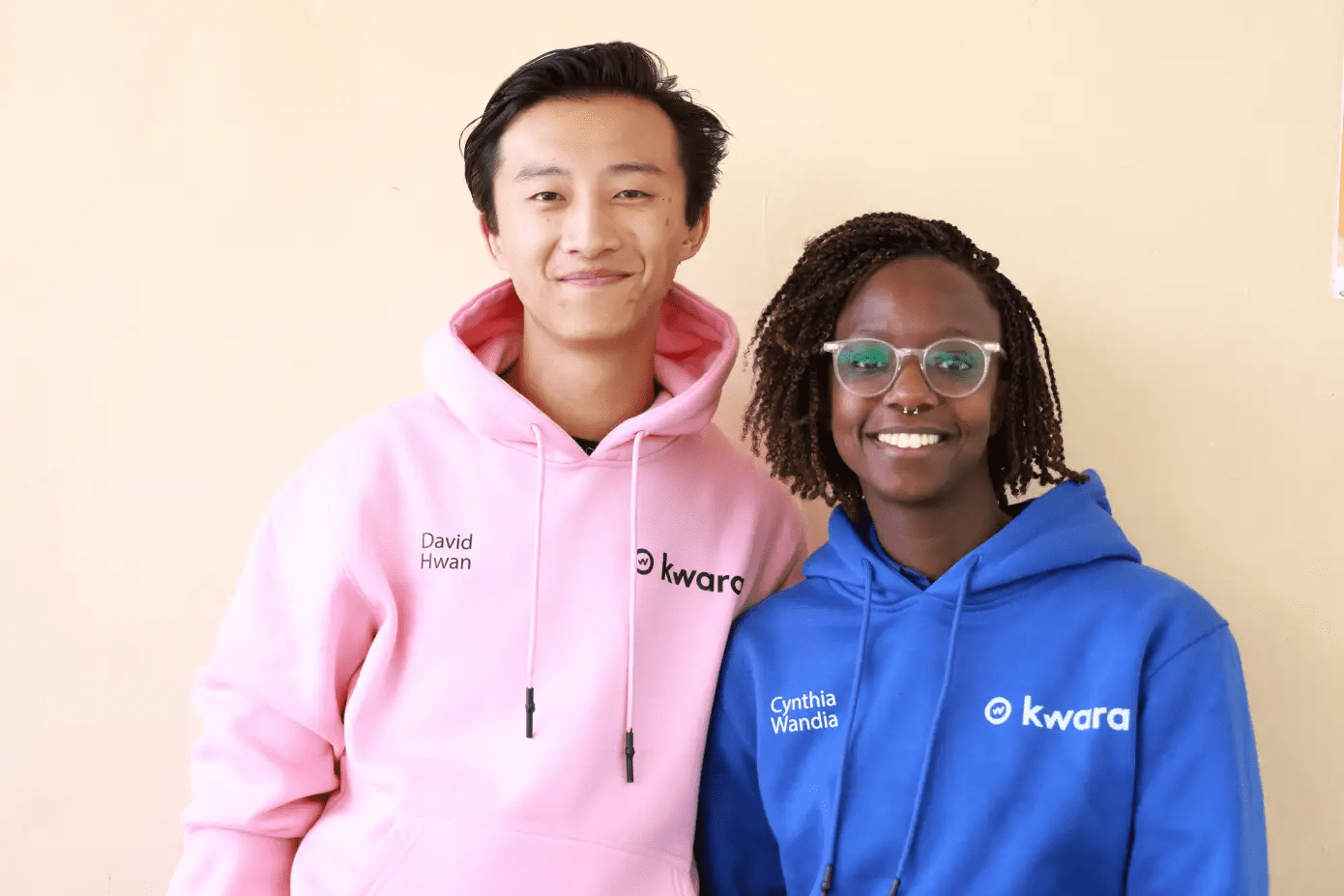

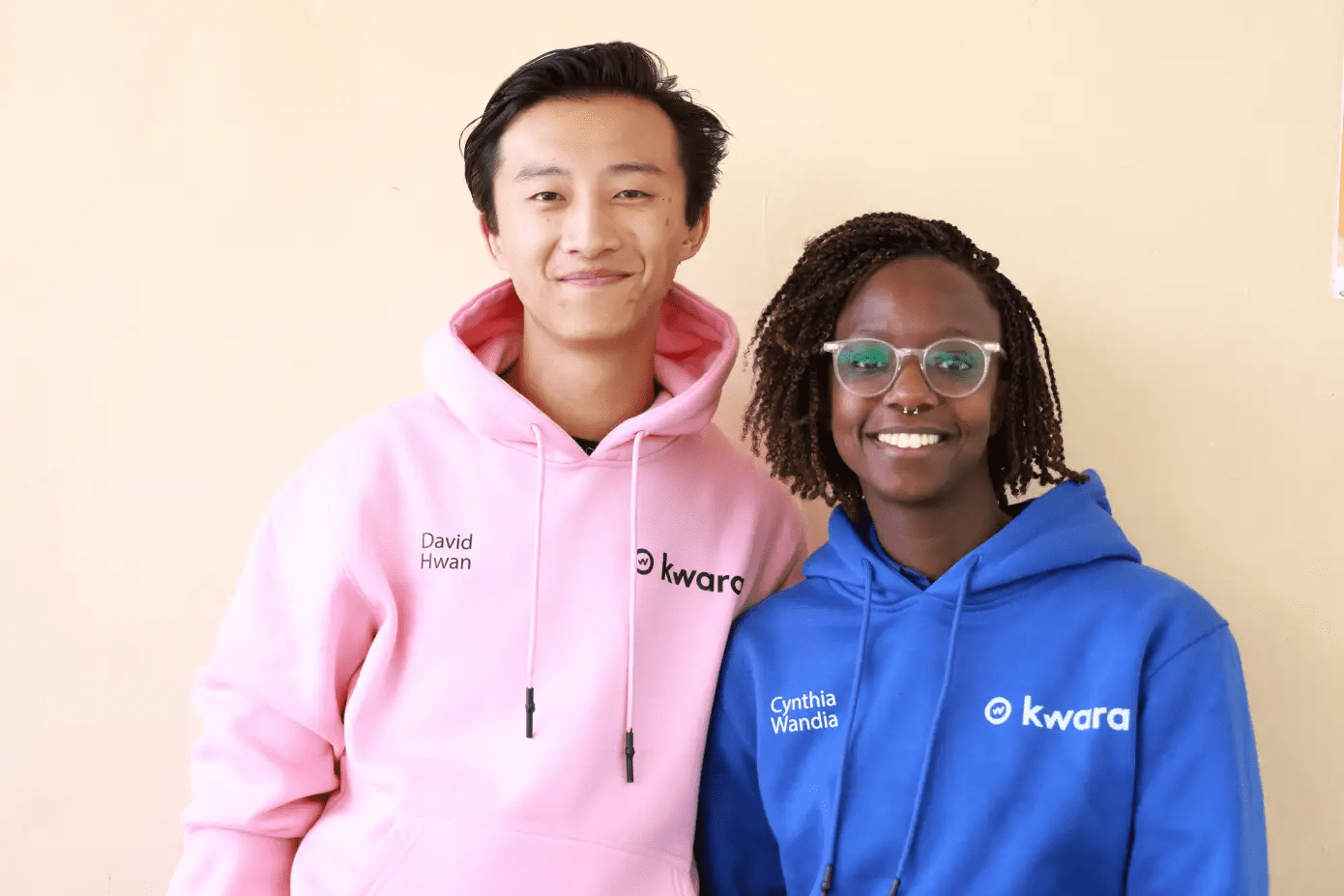

Speaking on the funds raised, Cynthia Wandia, the CEO and co-founder of Kwara, explained how the funds would be used. She said,

We think we’ve barely scratched the surface in the Kenyan market. And so, we are just going to be really investing in products and services that deepen our relationship here.

Kwara co-founder and CEO, Cynthia Wandia told TechCrunch.

Given that KUSCCO has fostered the credit union movement in Kenya for decades and serves as the largest body of credit unions and that IRNET has offered crucial technical services to hundreds of SACCOs in Kenya, this acquisition will represent a significant step forward for all parties involved.

According to the Kwara CEO, this exclusive partnership guarantees that no other tech company can market with KUSCCO. She further said,

They are staking their bets on us but we have been able to prove that we can do it as we continue to grow.

Following the KUSCCO partnership, Kwara said it had gained connections to a pool of over 4,000 SACCOs for its banking-as-a-service offering.

Read Also: Here is all you need to know about Union54, chargeback fraud and the USD virtual card palava

About Kwara

Founded in 2018 by Cynthia Wandia and David Hwan, Kwara is on a mission to bring savings and credit cooperatives into the twenty-first century. By offering a shared financial platform, shared digital channels, and credit scoring as a service, it is also committed to assisting individuals in realizing their full digital potential.

According to Techcrunch, the firm is in South Africa and the Philippines. It increased its clientele base from 50 to 120 in 2021 while maintaining 100% customer retention.

With Kwara’s solution, it upgrades the process of the credit union, providing an opportunity to move away from cumbersome paper-based procedures and physical branches, creating new opportunities for member recruitment and the development of innovative products.

The fintech business also offers members of partner credit unions access to additional services, including fast loans and third-party services like insurance through its next-generation neobank app. The startup is also looking to expand its services to serve the SACCOs better.

Read Also: 5 major trends that will define the African tech space in 2023

Digitizing Africa and promoting credit unions

The pace of financial digitization in Africa has accelerated recently. It is already transforming the continent’s economies, revolutionizing retail payment systems, saving businesses and consumers billions in transaction costs, and promoting financial inclusion.

In Africa, credit unions are very popular, especially in developing nations since they offer loans with lower interest rates and more convenient credit access than traditional banks. According to Statista, Africa has about 40,570 credit unions as of 2020, more than any other continent outside of Asia.

The industry, however, is already embracing digital solutions to fuel its next phase of expansion and increase financial inclusion on the continent. Africa’s savings and credit cooperative organizations (SACCO) are also rapidly digitizing to deliver financial inclusion to all Sacco members, from table banking to credit unions.