It is another Friday. And we know you’re pumped up to step back from work and get some good rest.

As you prepare, we believe it’s important to share Global Roundup with you. Because we understand you’re busy, we’re bringing back exciting global updates you missed during the week.

This week, Amazon, the world’s largest online retailer, became the first public company to lose $1 trillion in market value; layoffs in big tech continued as Meta became the latest tech giant to sack staff after Twitter. In other news, the dramatic Elon Musk continued with his cuts, as Twitter’s West African office was shut.

These and more you will find in this edition of this Friday’s global roundup. Let’s get to it.

Summary of the Bulletin

- Amazon becomes the world’s first public company to lose $1 trillion in market value.

- Meta continues a trend of layoffs by tech companies

- Elon Musk shuts down Twitter’s new West African office

- Google enters into a partnership with Renault to develop a ‘software-defined’ vehicle

- David Wadhwani is poised to become new Adobe’s CEO

Read also: Verified Twitter users to pay $8 monthly subscription, AWS launches Lagos office

Amazon loses big

This week, Amazon got its fair share of losses from the biting inflation, low revenues, and unstable macroeconomic environment that have become a reality for many companies.

According to Bloomberg, Amazon became the first public company to lose $1 trillion in market value amid a tech stock rout. This drop in Amazon stock is the biggest dip in US history. That’s almost like losing Google parent Alphabet’s worth of market value, which is now around $1.13 trillion.

The world’s largest online retailer’s share price closed 4.3% lower at $86.14 on Wednesday, taking its market capitalization to about $879 billion.

The Amazon stock has lost around 48% of its value this year alone and is a far cry from July 2021, when the company’s market cap almost touched $1.9 trillion, per Bloomberg.

It’s not just Amazon that’s losing money. The top five US tech businesses by revenue have already lost about $4 trillion in market value this year due to growing inflation and macroeconomic headwinds.

According to Reuters, in a call with reporters on October 27, Amazon CFO Brian Olsavsky said:

“We are seeing signs all around that, again, people’s budgets are tight, inflation is still high, and energy costs are an extra layer on top of that driven by other issues.” “Like most businesses, we are preparing for what may be a slower growth era.”

The dip in Amazon’s share price has also hit Amazon founder Jeff Bezos’ net worth. According to the Bloomberg Billionaires Index, the world’s fourth richest person is now worth $113 billion after starting the year at $192.5 billion.

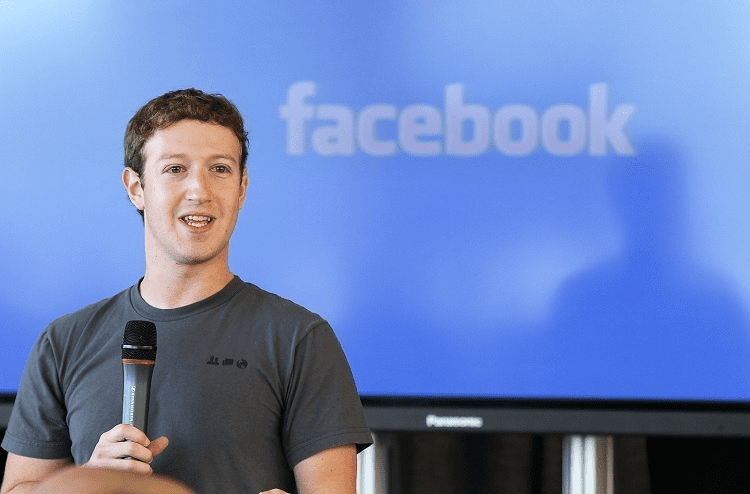

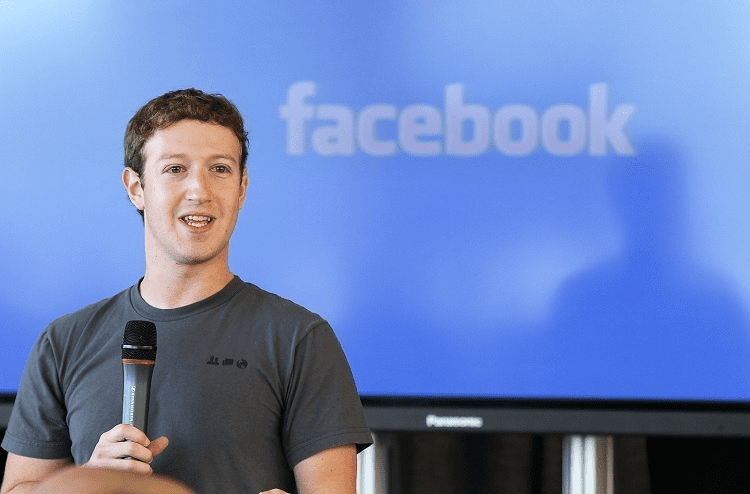

Meta lays off 11,000, and Mark apologizes

It appears the season of lay-offs isn’t coming to an end soon, or perhaps, the hope of 2022 being the Post-Pandemic year of Recovery was all a myth, as mass layoffs continually hit the tech ecosystem.

Last week, in an outlined strategy to cut costs and make the platform profitable, Elon Musk laid off over 3,000 Twitter employees. This week, it became the turn of Meta, the parent company of WhatsApp, Instagram and Facebook.

Meta’s CEO, Mark Zuckerberg, shared a Facebook post after the earnings call on 26 October 2022 hinting at an impending cut. The company this week finally cut its employee payroll by 13%, which is the largest in its history.

In the blog post, the CEO, Mark Zuckerberg, expressed remorse for making this difficult decision. He said,

We’ve cut costs across our business, including scaling back budgets, reducing perks, and shrinking our real estate footprint. We’re restructuring teams to increase our efficiency. But these measures alone won’t bring our expenses in line with our revenue growth, so I’ve also made the hard decision to let people go.

Meta CEO, Mark Zuckerberg

He further explained the major reason behind the layoffs, citing the expansion made during the COVID-19 pandemic.

“At the start of Covid, the world rapidly moved online, and the surge of e-commerce led to outsized revenue growth. Many people predicted this would be a permanent acceleration that would continue even after the pandemic ended”…

I got this wrong, and I take responsibility for that.

Mark Zuckerberg, CEO Meta explaining the mass layoff

Read also: Mark Zuckerberg explains why Meta sacked over 11000 employees

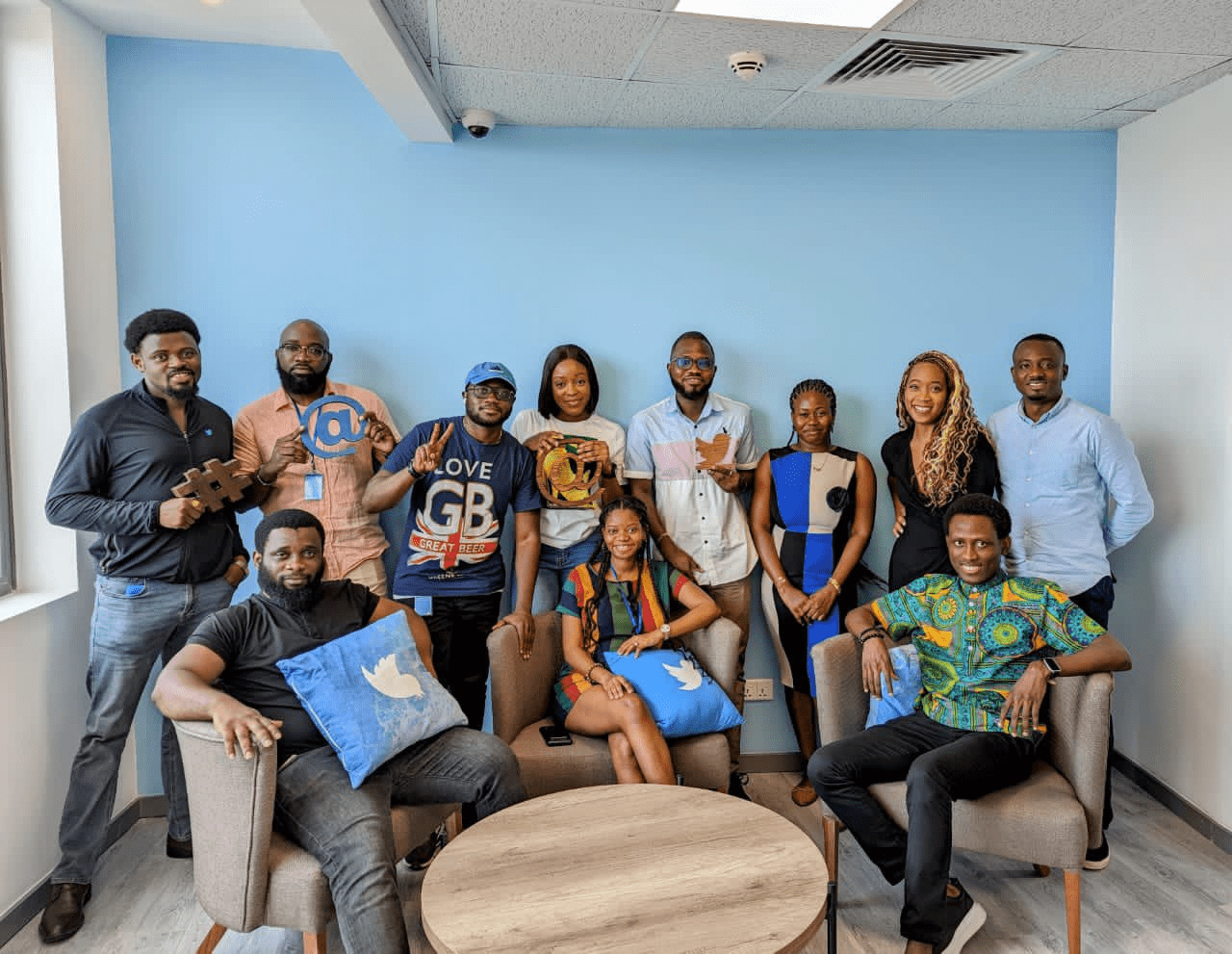

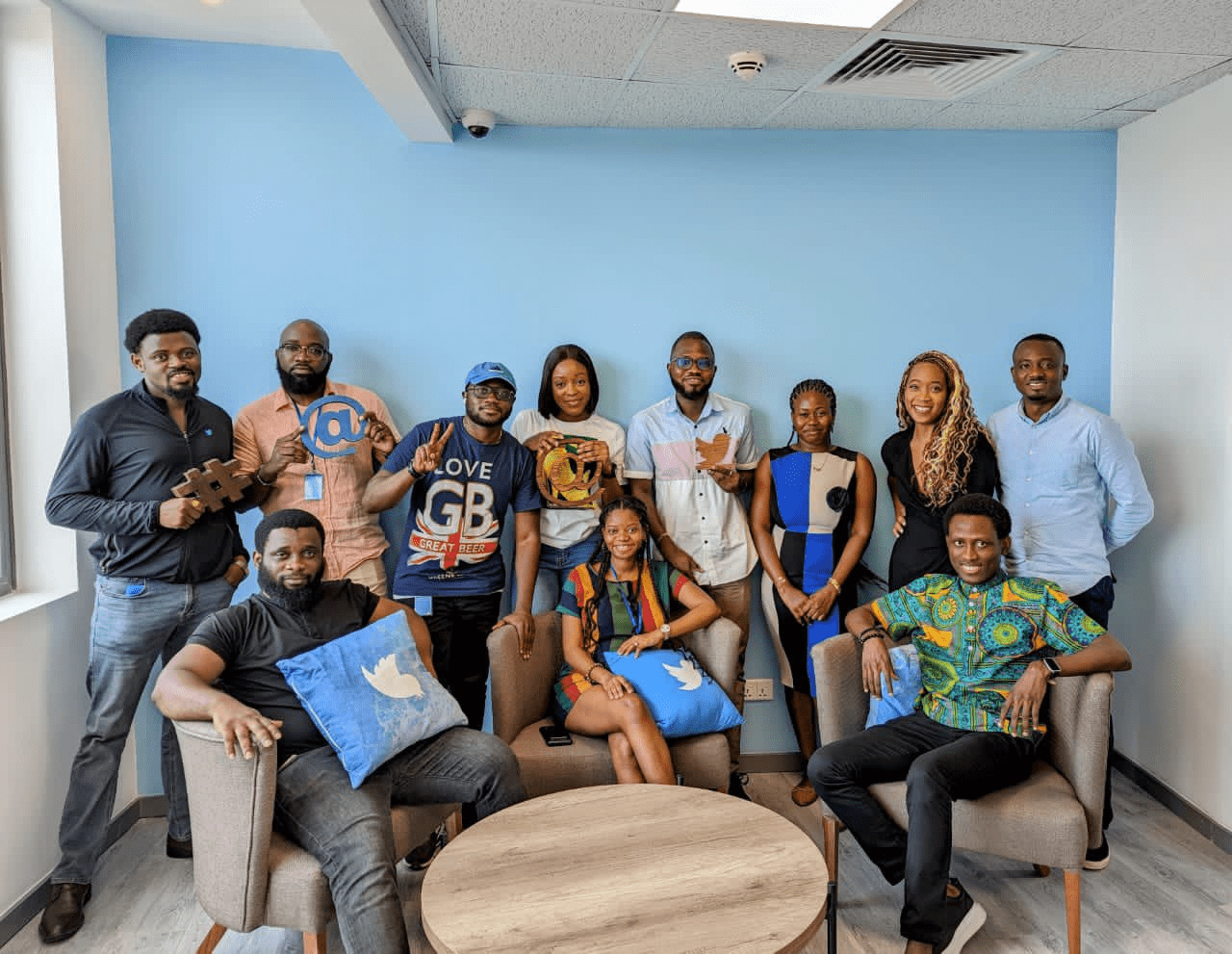

Twitter’s new West African office shut

At this point, I’m guessing you are tired of hearing about the melodramatic Tesla founder or perhaps not. However, the tech billionaire might not be leaving headlines soon.

This week, in continuance of his planned restructuring of the platform to place it on a “healthy path”, the new Twitter CEO has shut down the newly opened West African office in Ghana. Mind you, the Ghana office was only opened some days ago, after months of recruitment and remote work.

Members of that team have now all been laid off. An email from Twitter to employees reads in part:

In an effort to place Twitter on a healthy path, we will go through the difficult process of reducing our global workforce. We recognize that this will impact a number of individuals who have made valuable contributions to Twitter, but this action is unfortunately necessary to ensure the company’s success moving forward.

Meanwhile, Musk has also informed social media company employees that remote work will no longer be allowed, as they are expected to show up in the office for at least 40 hours per week.

Bloomberg reports that the self-styled “Chief Twit” made this known in an email to employees in the late hours of Wednesday, urging them to prepare for “difficult times ahead”.

In the said email, Musk noted that there was “no way to sugarcoat the message” about the economic outlook of the microblogging platform, which he had earlier attributed to his decision to introduce a monthly subscription for Twitter verification pegged at $8.

Google partners with Renault for ‘software-defined’ vehicle

In a space where others are laying off staff to sustain their productivity, Google is establishing more partnerships to bring newer innovations that would enhance the future of mobility.

In the latest move, French automaker Renault is partnering with Google to develop its cars like a tech company makes software, according to a report by CNBC.

The pact, which expands on a previous collaboration between the two firms, will see Renault commit to making what it calls a “software-defined” vehicle using technology from Google’s cloud division.

According to the companies, the agreement will assist Renault in creating new on- and off-road applications. Renault will customise users’ experiences to adapt to frequently visited locations, such as electric vehicle charging stations, and utilize data analytics to identify and fix malfunctions in how the vehicle operates.

Commenting on the partnership Tuesday, Google CEO Sundar Pichai said it would “help accelerate Renault Group’s digital transformation by bringing together our expertise in the cloud, AI, and Android to provide for a secure, highly-personalized experience that meets customers’ evolving expectations.”

David Wadhwani to become the new Adobe CEO

Last month, Adobe agreed to pay $20 billion for Figma, the largest takeover of a private software company and a sum more than four times greater than what Adobe had ever spent in an acquisition.

Although still the CEO of Adobe, Shantanu Narayen wasn’t the one who pushed for that deal. According to persons familiar with the transaction who declined to be identified because the information was private, David Wadhwani, the head of Adobe’s enormous digital media division, is the rightful owner of that distinction, CNBC reports.

Wadhwani, 51, has spent more than a decade at Adobe over two separate stints, rejoining the company in mid-2021 after six years in other Silicon Valley executive and investing roles.

After Narayen, 59, and finance chief Dan Durn, Wadhwani is Adobe’s third highest-paid executive, and the Figma transaction has reportedly boosted his position as the company’s next CEO. Everyone is interested in learning when Wadhwani will receive the promotion, a former executive told CNBC.