Two weeks ago, Kenya’s largest telecommunications operator Safaricom rolled out the fifth generation (5G) mobile network for the first time in the East Africa region in a move the company said will “herald an era of intelligent connectivity”.

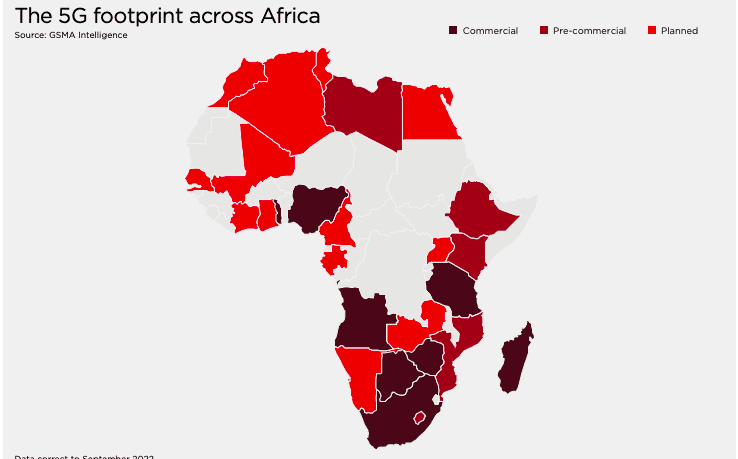

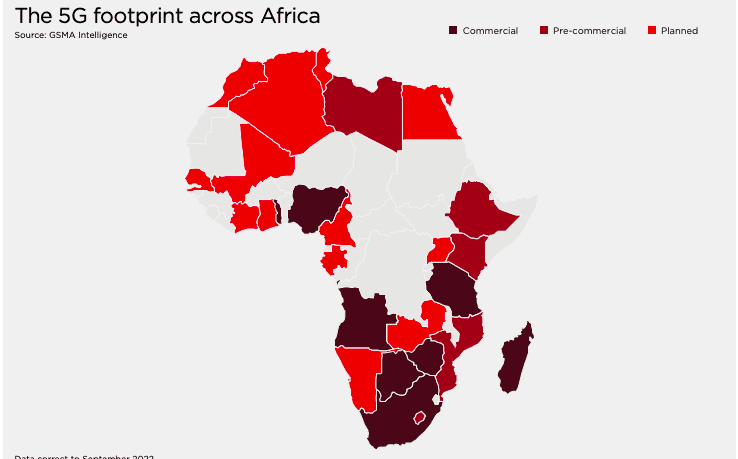

Undoubtedly, the launch of the trending high-speed technology in Kenya reflects a growing adoption of 5G across Africa. Since South Africa spearheaded its journey on the continent, other countries have followed suit. Fourteen African nations were actively testing 5G networks as of May this year.

Analysts predict that 5G service will add $2.2 trillion to Africa’s economy by 2034.

This pinpoints a fact: the fast mobile network, described as the “future of mobile communication”, is gradually becoming a thing on the continent, albeit with a rough beginning due to certain challenges.

By 2025, 5G will account for 4% of total connections in Sub-Saharan Africa, according to The Mobile Economy Sub-Saharan Africa 2022 report released by GSM Association (GSMA) last month.

That’s not a lot compared to the global average of 25%.

Read also: NCC says it will auction 2 additional 5G licenses by December 2022.

Why is 5G struggling in Africa?

The reasons aren’t far-fetched. First, Africa has the lowest number of internet connections in the world. For context, while mobile networks cover about 83% of Africa’s population, only about 22% have internet access, as GSMA disclosed in its The State of Mobile Internet Connectivity 2022 report.

After many years, Africa is still lagging behind in the 4G adoption. In 2020, only 7% of Africa’s 774 million mobile connections were 4G, way lower than the 44% global average. According to the biannual report by Stockholm-headquartered telecommunications company Ericsson, the number of 4G subscriptions grew by 26 % in 2021.

By the end of Q1 2022, less than 30% of mobile broadband subscriptions in Africa were 4G, while over 70% of subscriptions were 2G/3G. According to the GSMA report on the mobile economy in Sub-Saharan Africa, 4G will only overtake 2G in 2023, after 3G adoption has reached its peak in 2022.

It is estimated that it will take until 2027 for 4G mobile subscriptions to overtake other mobile internet subscriptions in Sub-Saharan Africa, while 4G subscriptions will account for just under 50%, and 5G subscriptions will still be less than 4%, according to Dataxis.

We recently reported that despite the latest rollout, data shows 70% of Africans only have access to 2G/3G networks. Little wonder internet speed in Africa is way below the global average, according to the 2022 Speedtest Global Index published by US-based analytics firm Ookla.

For instance, South Africa, which boasts the highest internet speed on the continent, has an average mobile internet download speed of 68.9 megabits per second (MBps), compared with the global average mobile download speed of 77.7 Mbps.

In its recently published report, GSMA says the greatest potential obstacle to consumer adoption and usage of 5G in Africa is device cost and availability. When Safaricom launched the latest mobile network in Kenya last month, the company’s CEO Peter Ndegwa admitted that “the adoption of 5G smartphones remains low, largely due to the high cost of the devices”.

In context, it will cost a Kenyan $609 to buy a suitable smartphone and set up 5G broadband. The country’s minimum wage is just $130.

The Kenyan example reflects the bigger picture: Africans can’t afford it. The continent is currently experiencing its highest levels of poverty in recent years. By 2030, an estimated 479 million Africans (28.1% of the population) will be living in extreme poverty, according to a recent report.

But 5G isn’t only expensive to the users. Telecommunications companies spend a fortune to put up the infrastructure. For instance, Nigeria’s reserve price (RP) bid at the 5G auction was pegged at $194.7 million, one of the costliest in the world. This report predicts that companies globally will spend over $1 trillion in the next three years to upgrade.

5G is here. What next?

Despite these seeming challenges, telcos in Africa appear unmoved as they continue to push out capital to explore the potential in the 5G spectrum.

Well, they have their reasons.

Between now and 2030, the spectrum is expected to contribute around $26 billion to Africa’s economy, according to the GSMA 5G in Africa report.

“Africa’s retail, financial services, agriculture, extractive, and manufacturing industries present clear opportunities for 5G to enable digital transformation, which will avert the risk of exacerbating the digital divide with the rest of the world.

Furthermore, Africa’s vibrant tech startup ecosystem is well placed to leverage the capabilities of 5G to develop innovative solutions to address local challenges,” Angela Wamola, Head of Sub-Saharan Africa, GSMA, added in the report.

Mobile operators in Africa are encouraged to ramp up investments in cost-effective networks to accelerate 5G adoption on the continent. According to the report, telcos should also “work collaboratively with various stakeholders to develop innovative use cases specifically for local markets in the region.”